13+ Enigma customer risk rating information

Home » about money loundering idea » 13+ Enigma customer risk rating informationYour Enigma customer risk rating images are ready. Enigma customer risk rating are a topic that is being searched for and liked by netizens today. You can Download the Enigma customer risk rating files here. Download all free photos.

If you’re looking for enigma customer risk rating pictures information related to the enigma customer risk rating keyword, you have come to the right site. Our site always provides you with suggestions for seeing the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

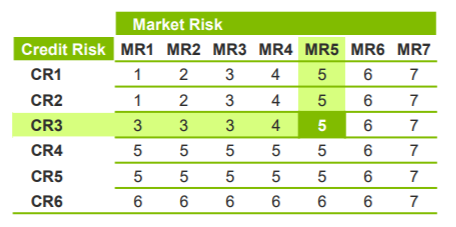

Enigma Customer Risk Rating. However financial institutions on the basis of risk may choose to review customer information on a regular or periodic basis. These scales comprise rating levels and definitions that foster consistent interpretation and application by different constituencies. Once the portfolio is completed they closely analyse the information that they have obtained and they determine the KYC risk rating of that specific client. In 2016 a school in Brentwood England pleaded guilty after failing to comply with health and safety regulations.

Iso 45001 6 1 2 Hazard Identification And Assessment Of Risks And Opportunities Youtube Hazard Identification Assessment Risk From pinterest.com

Iso 45001 6 1 2 Hazard Identification And Assessment Of Risks And Opportunities Youtube Hazard Identification Assessment Risk From pinterest.com

Benefits of a Risk Assessment. Take back control of your portfolio with Enigmas leading risk indicators about your small and medium business customers. Classification of the customers is done under three risk categories viz. In 2016 a school in Brentwood England pleaded guilty after failing to comply with health and safety regulations. Enigma helps risk teams make lending decisions quickly and confidently with accurate small business data and transparent customer scoring. Reassess the customer risk profilerating and follow established financial institutions policies procedures and processes for maintaining or changing the customer risk profilerating.

If the risk rating is low the client.

Conducting a risk assessment has moral legal and financial benefits. Any customer account may be used for illicit purposes including money laundering or terrorist financing. Enigma Businesses provides the most accurate and reliable information on small and medium businesses in real-time. In 2016 a school in Brentwood England pleaded guilty after failing to comply with health and safety regulations. 82 - 100 U ndoubted 2. If the risk rating is high that client will be consistently and closely monitored.

Source:

The more descriptive the scales the more consistent their. Low medium and high. The bank should have an understanding of the money laundering and terrorist financing risks of its customers referred to in the rule as the customer risk profile. Enigmas algorithms identify screen and analyze customers and transactions for better matching with no increased risk. Compare and aggregate risks across the organization.

Source: pinterest.com

Source: pinterest.com

Classification of the customers is done under three risk categories viz. The bank should have an understanding of the money laundering and terrorist financing risks of its customers referred to in the rule as the customer risk profile. 43 - 61 M oderate 4. Identify and engage top prospects with up-to-date intelligence about business revenue and growth. Low medium and high.

Source:

43 - 61 M oderate 4. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating. Enigma Businesses provides the most accurate and reliable information on small and medium businesses in real-time. Based on the customers risk score the KYC system determines the next review date. Compare and aggregate risks across the organization.

Source:

Identify and engage top prospects with up-to-date intelligence about business revenue and growth. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. If the risk rating is high that client will be consistently and closely monitored. Based on the customers risk score the KYC system determines the next review date. Our technology powers compliance programs at leading financial instiuttions.

Source: researchgate.net

Source: researchgate.net

The bank should have an understanding of the money laundering and terrorist financing risks of its customers referred to in the rule as the customer risk profile. Functions of a Credit Risk Rating System. Low medium and high. Weiss Research an investment research firm that rates cryptocurrencies has given Enigma an overall rating of E a technology and adoption rating of E and a market performance rating. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating.

Source: researchgate.net

Source: researchgate.net

Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. The business credit score is a measure of a companys financial stability and can predict how likely they are to pay you on time. 82 - 100 U ndoubted 2.

Source: pinterest.com

Source: pinterest.com

Further a spectrum of risks may be identifiable even within the same category of customers. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. Low medium and high. Customer relationship pose money laundering and terrorist financing risk before the regulated financial institutions. Most organizations define scales for rating risks in terms of impact likelihood and other dimensions.

Source: researchgate.net

Source: researchgate.net

From evaluating insurance risk to fraud prevention Enigma helps businesses better serve their SMB customers. Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. A 63-year-old employee was working on the roof when his foot got caught causing him to fall nearly 10 feet. The bank should have an understanding of the money laundering and terrorist financing risks of its customers referred to in the rule as the customer risk profile. Customer relationship pose money laundering and terrorist financing risk before the regulated financial institutions.

Source: researchgate.net

Source: researchgate.net

A 63-year-old employee was working on the roof when his foot got caught causing him to fall nearly 10 feet. For example an overall score between 62 and 81 provides a low risk rating while a score between 27 and 42 results in a cautionary risk rating. Reassess the customer risk profilerating and follow established financial institutions policies procedures and processes for maintaining or changing the customer risk profilerating. Low medium and high. Most organizations define scales for rating risks in terms of impact likelihood and other dimensions.

Source: risksystem.com

Source: risksystem.com

A 63-year-old employee was working on the roof when his foot got caught causing him to fall nearly 10 feet. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. Identify and engage top prospects with up-to-date intelligence about business revenue and growth. Functions of a Credit Risk Rating System. This allows bank management and examiners to monitor changes and trends.

Source: risksystem.com

Source: risksystem.com

Reassess the customer risk profilerating and follow established financial institutions policies procedures and processes for maintaining or changing the customer risk profilerating. Risk classification is an important parameter of the risk based kyc approach. This allows bank management and examiners to monitor changes and trends. Enigmas algorithms identify screen and analyze customers and transactions for better matching with no increased risk. Low medium and high.

Source: researchgate.net

Source: researchgate.net

Rating systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. Any customer account may be used for illicit purposes including money laundering or terrorist financing. Weiss Research an investment research firm that rates cryptocurrencies has given Enigma an overall rating of E a technology and adoption rating of E and a market performance rating. Further a spectrum of risks may be identifiable even within the same category of customers. This allows bank management and examiners to monitor changes and trends.

Source: enigmaconsulting.nl

Source: enigmaconsulting.nl

A 63-year-old employee was working on the roof when his foot got caught causing him to fall nearly 10 feet. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. Reassess the customer risk profilerating and follow established financial institutions policies procedures and processes for maintaining or changing the customer risk profilerating. From evaluating insurance risk to fraud prevention Enigma helps businesses better serve their SMB customers. 82 - 100 U ndoubted 2.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title enigma customer risk rating by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information