11++ Enterprise customer risk rating ideas in 2021

Home » about money loundering idea » 11++ Enterprise customer risk rating ideas in 2021Your Enterprise customer risk rating images are available. Enterprise customer risk rating are a topic that is being searched for and liked by netizens today. You can Find and Download the Enterprise customer risk rating files here. Get all royalty-free photos.

If you’re looking for enterprise customer risk rating images information related to the enterprise customer risk rating topic, you have pay a visit to the right blog. Our website always provides you with suggestions for viewing the highest quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

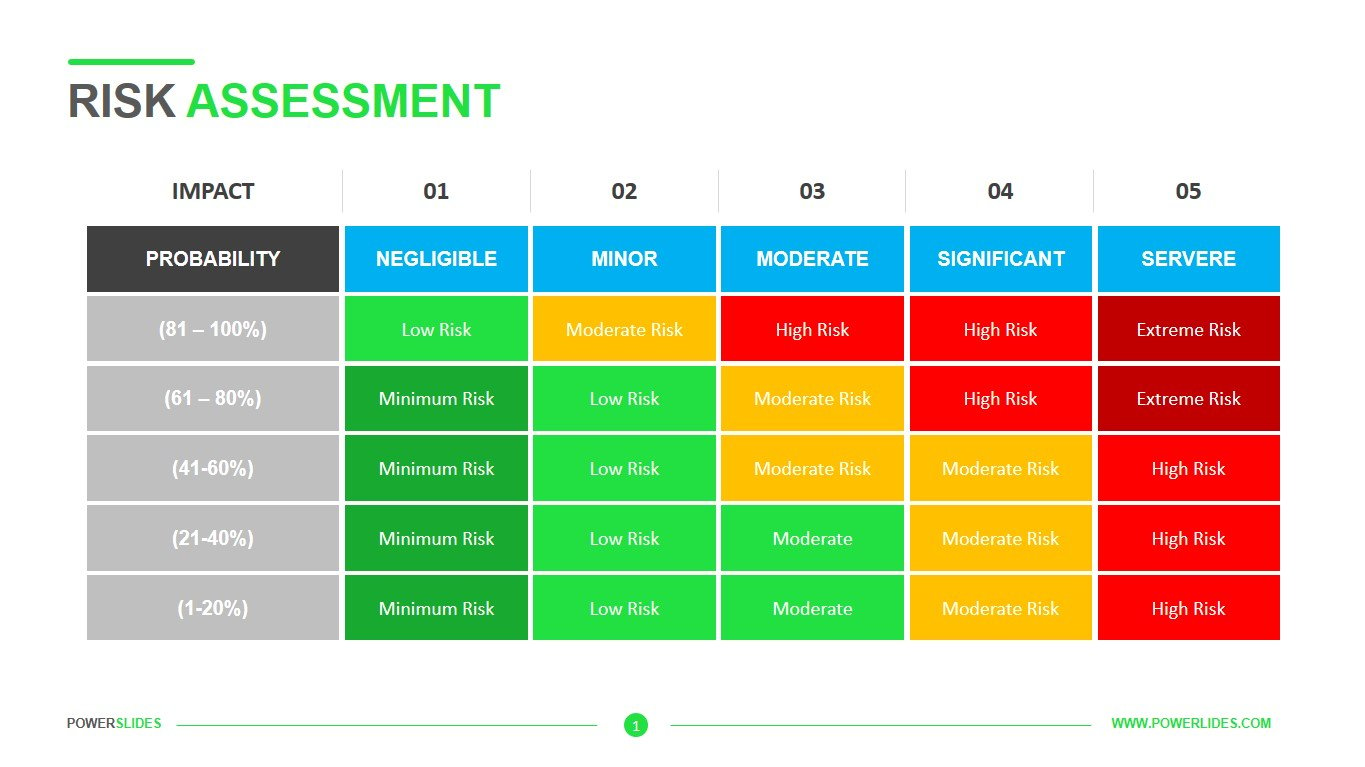

Enterprise Customer Risk Rating. This case study illustrates a methodology to rate the risk arising from client. Risk Factor Rating Score Economic activity or business of the customer is considered high risk H 3 Economic activity or business of the customer is NOT considered high risk L 0 Copyright -This document is the property of the CFATF Secretariat. Functions of a Credit Risk Rating System. The approach to risk assessment will need to utilise a risk-based approach at the enterprise level enterprise-wide risk assessment EWRA.

Risk Assessment Seek To Improve The Four Pear Elements Download Scientific Diagram From researchgate.net

Risk Assessment Seek To Improve The Four Pear Elements Download Scientific Diagram From researchgate.net

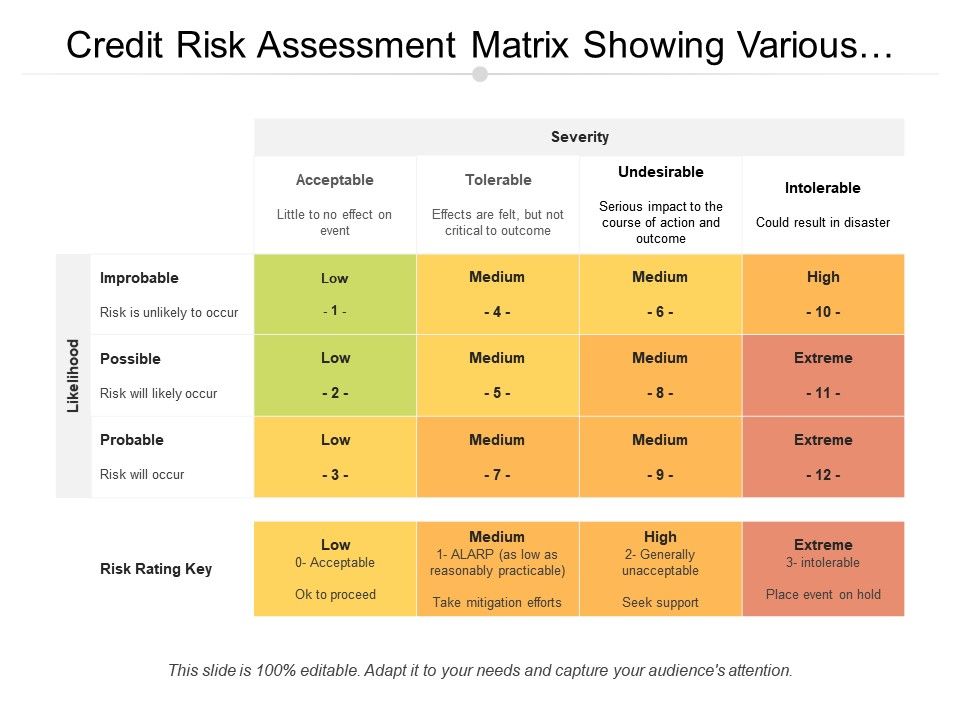

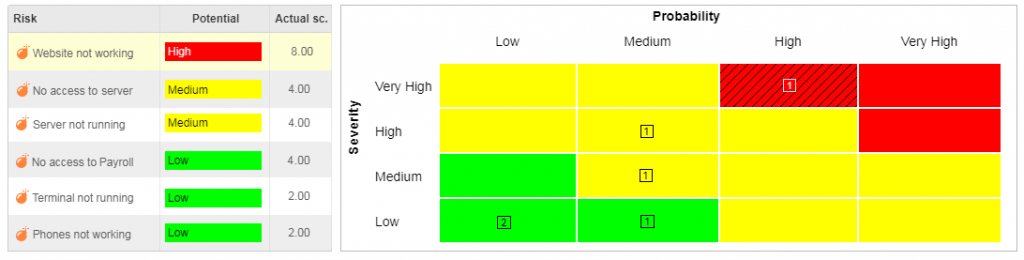

This allows bank management and examiners to monitor changes and trends. To determine a customers overall risk rating a select list of variables are assessed and each one is rated as low medium or high risk. In its assessment of inherent AML risk at the enterprise level an FI should evaluate AML and OFAC risk inherent in its customers geographies products services channels and transactions. Functions of a Credit Risk Rating System. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. Geographical Risk to be tackled separately.

The approach to risk assessment will need to utilise a risk-based approach at the enterprise level enterprise-wide risk assessment EWRA.

Therefore your risk assessments must take into account the following risk categories. Certain types of customers may pose heightened risk. Enterprise risk management ERM is a holistic top-down approach. The approach to risk assessment will need to utilise a risk-based approach at the enterprise level enterprise-wide risk assessment EWRA. Based on the customers risk score the KYC system determines the next review date. Each line in the chart uses the Vulnerability Last Observed filter to allow the analysts to observe changes.

Source: pinterest.com

Source: pinterest.com

In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. As 20 101 x 100 198 the rating for segment B 0 to 20 new clients will always be low. It assesses how risks affect not just specific siloed units but also how risks develop across units and operations of an. An assessment helps businesses to adapt their approach of managing risks to meet the demands of the evolving financial. The reproduction or modification is prohibited.

Source: id.pinterest.com

Source: id.pinterest.com

Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. At this stage a wide net is cast to understand the universe of risks making up the enterprises risk profile. In its assessment of inherent AML risk at the enterprise level an FI should evaluate AML and OFAC risk inherent in its customers geographies products services channels and transactions. This helps identify potential risk and determine an appropriate level of monitoring. Some firms only have low and high risk classification.

Source: researchgate.net

Source: researchgate.net

In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. At a practical level this means that there will be more factors relevant to risk assessment. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. At this stage a wide net is cast to understand the universe of risks making up the enterprises risk profile. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account.

Source: powerslides.com

Source: powerslides.com

The reproduction or modification is prohibited. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. The identification appraisal and supervision of risks of an entity. Enterprise risk management ERM is a holistic top-down approach. This case study illustrates a methodology to rate the risk arising from client.

Source: slideteam.net

Source: slideteam.net

Certain types of customers may pose heightened risk. Therefore your risk assessments must take into account the following risk categories. At a practical level this means that there will be more factors relevant to risk assessment. Based on the customers risk score the KYC system determines the next review date. Product Service and Transaction Risk.

Source: pinterest.com

Source: pinterest.com

Geographical Risk to be tackled separately. At a practical level this means that there will be more factors relevant to risk assessment. Well-managed credit risk rating systems promote bank safety and soundness by facilitating informed decision making. This helps identify potential risk and determine an appropriate level of monitoring. Certain types of customers may pose heightened risk.

Source: pinterest.com

Source: pinterest.com

This case study illustrates a methodology to rate the risk arising from client. Where flaws are identified in the design of the EWRA rating methodologies banks should. This allows bank management and examiners to monitor changes and trends. Based on the customers risk score the KYC system determines the next review date. Some firms only have low and high risk classification.

Source: pinterest.com

Source: pinterest.com

Particular customer types geographic locations products services channels and transactions generally pose a higher risk of money laundering and terrorism financing due to their vulnerability. Functions of a Credit Risk Rating System. Each line in the chart uses the Vulnerability Last Observed filter to allow the analysts to observe changes. Risk Factor Rating Score Economic activity or business of the customer is considered high risk H 3 Economic activity or business of the customer is NOT considered high risk L 0 Copyright -This document is the property of the CFATF Secretariat. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account.

It assesses how risks affect not just specific siloed units but also how risks develop across units and operations of an. This component contains a trend analysis for each of the VPR levels. This allows bank management and examiners to monitor changes and trends. Functions of a Credit Risk Rating System. Enterprise risk management ERM is a holistic top-down approach.

Source: pinterest.com

Source: pinterest.com

This component contains a trend analysis for each of the VPR levels. Delivery Channels Risk or Interface Risk. This helps identify potential risk and determine an appropriate level of monitoring. This component contains a trend analysis for each of the VPR levels. Each line in the chart uses the Vulnerability Last Observed filter to allow the analysts to observe changes.

Source: pinterest.com

Source: pinterest.com

Customer and entity risk is extremely complex. An assessment helps businesses to adapt their approach of managing risks to meet the demands of the evolving financial. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Customer and entity risk is extremely complex. While each risk captured may be important to management.

Source: blog.softexpert.com

Source: blog.softexpert.com

As 20 101 x 100 198 the rating for segment B 0 to 20 new clients will always be low. This component contains a trend analysis for each of the VPR levels. Where flaws are identified in the design of the EWRA rating methodologies banks should. While each risk captured may be important to management. Through customer due diligence CDD a financial institution gains an understanding of the types of transactions in which a customer is likely to engage.

Source: id.pinterest.com

Source: id.pinterest.com

Particular customer types geographic locations products services channels and transactions generally pose a higher risk of money laundering and terrorism financing due to their vulnerability. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. Through customer due diligence CDD a financial institution gains an understanding of the types of transactions in which a customer is likely to engage. This helps identify potential risk and determine an appropriate level of monitoring. At a practical level this means that there will be more factors relevant to risk assessment.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title enterprise customer risk rating by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information