17+ Eu money laundering directive 6 information

Home » about money loundering Info » 17+ Eu money laundering directive 6 informationYour Eu money laundering directive 6 images are available. Eu money laundering directive 6 are a topic that is being searched for and liked by netizens today. You can Get the Eu money laundering directive 6 files here. Get all royalty-free images.

If you’re searching for eu money laundering directive 6 images information linked to the eu money laundering directive 6 interest, you have pay a visit to the ideal blog. Our website frequently gives you hints for seeing the maximum quality video and image content, please kindly search and find more informative video content and graphics that match your interests.

Eu Money Laundering Directive 6. Text of the proposal for a 6 th directive on AMLCFT. 6 th Directive on AMLCFT AMLD 6 The directive will replace the existing Directive 2015849EU containing provisions that will be transposed into national law such as rules on national supervisors and financial intelligence units in Member States. Regulated entities operating in the union will need to be compliant by June 3 2021. The 6 th money laundering 6AMLD directive has already been in effect in EU member states since the 3 rd of December 2020 however financial institutions are mandated to implement it by the 3 rd of June 2021.

6amld 4 Things You Need To Know 2021 Update From lavenpartners.com

6amld 4 Things You Need To Know 2021 Update From lavenpartners.com

A new Directive complementing and reinforcing the Fourth and the Fifth Anti-Money Laundering Directives 4AMLD and 5AMLD was adopted on 23 October 2018. The 6AMLD brings clarity to specific regulatory details to close loopholes toughen penalties and encourage greater cooperation. Following 5AMLD which broadly strengthened existing AMLCFT provisions the sixth anti-money laundering directive aims to empower financial institutions and. 6 th Directive on AMLCFT AMLD 6 The directive will replace the existing Directive 2015849EU containing provisions that will be transposed into national law such as rules on national supervisors and financial intelligence units in Member States. Text of the proposal for a 6 th directive on AMLCFT. Directive EU 20181673 of the European Parliament and of the Council of 23 October 2018 on combating money laundering by criminal law PE302018REV1 OJ L 284 12112018 p.

One primary focus in 2021 for regulated firms is planning for compliance in line with the EUs 6th Anti-Money Laundering Directive 6AMLD which clarifies the definition of money laundering offences and establishes minimum rules on criminal liability for money laundering.

The 6 th Anti Money Laundering Directive 6AMLD is the European Unions most stringent anti money laundering measure to date. Following 5AMLD which broadly strengthened existing AMLCFT provisions the sixth anti-money laundering directive aims to empower financial institutions and. The 6 th Anti Money Laundering Directive 6AMLD is the European Unions most stringent anti money laundering measure to date. The Sixth EU Anti-Money Laundering Directive 6AMLD came into force at the EU level on 2 December 2018 and EU member states are required to implement it by 3 December 2020. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. Regulated entities operating in the union will need to be compliant by June 3 2021.

Source: portal.ieu-monitoring.com

Source: portal.ieu-monitoring.com

3 June 2021 The most important modifications made through the adoption of the Sixth Money Laundering Directive 6AMLD affect the areas of harmonization regulatory scope criminal liability tougher punishment and member state cooperation along with other noteworthy alterations. Identify and verify the identity of clients monitor transactions and report suspicious transactions. 6AMLD builds on the foundations established in the 5AMLD and represents a significant development in certain areas of the legislation. A new Directive complementing and reinforcing the Fourth and the Fifth Anti-Money Laundering Directives 4AMLD and 5AMLD was adopted on 23 October 2018. Like its predecessor this new directive is aimed to strengthen anti-money laundering.

Source: researchgate.net

Source: researchgate.net

As of December 3rd 2020 the European Unions Sixth Anti-Money Laundering Directive AMLD6 is in effect for all member states. Revision of the 2015 Regulation on Transfers of Funds. Directive EU 20181673 of the European Parliament and of the Council of 23 October 2018 on combating money laundering by criminal law PE302018REV1 OJ L 284 12112018 p. 6AMLD builds on the foundations established in the 5AMLD and represents a significant development in certain areas of the legislation. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie.

Source: youtube.com

Source: youtube.com

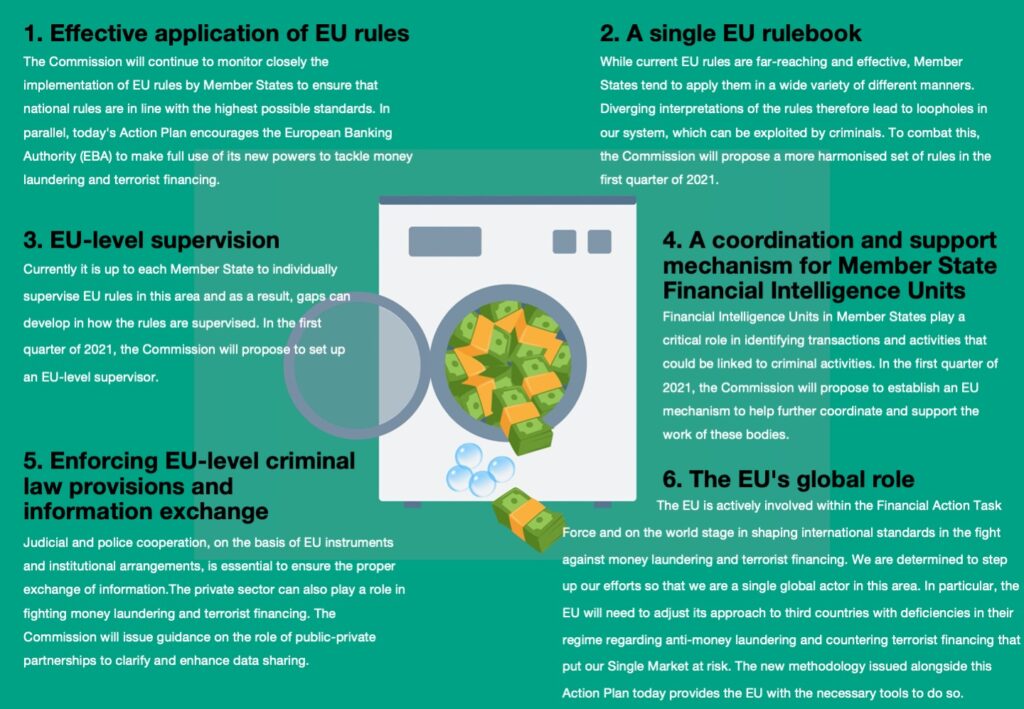

Anti-money-laundering Directive to a regulation thereby directly applicable in the Member States ii an EU level supervision with an EU -wide anti-money-laundering supervisory system and iii a coordination and support mechanism for Member States Financial Intelligence Units. As of December 3rd 2020 the European Unions Sixth Anti-Money Laundering Directive AMLD6 is in effect for all member states. Directive EU 20181673 of the European Parliament and of the Council of 23 October 2018 on combating money laundering by criminal law PE302018REV1 OJ L 284 12112018 p. Text of the proposal for a 6 th directive on AMLCFT. 6 th Directive on AMLCFT AMLD 6 The directive will replace the existing Directive 2015849EU containing provisions that will be transposed into national law such as rules on national supervisors and financial intelligence units in Member States.

Source: saktiryan.wordpress.com

Source: saktiryan.wordpress.com

Directive EU 20181673 of the European Parliament and of the Council of 23 October 2018 on combating money laundering by criminal law PE302018REV1 OJ L 284 12112018 p. The newly adopted Directive has already been dubbed as the 6AMLD due to its paramount. Despite the ongoing pandemic and Brexit negotiations the European Unions EU 6th Money Laundering Directive 6AMLD comes into effect on the 3rd December 2020. As of December 3rd 2020 the European Unions Sixth Anti-Money Laundering Directive AMLD6 is in effect for all member states. Identify and verify the identity of clients monitor transactions and report suspicious transactions.

EUs 6th Anti-Money Laundering Directive. On November 12 2018 approximately 6 months after the adoption of the 5th EU Money Laundering Directive the European Parliament published further guidelines to strengthen the fight against money laundering through Directive EU 20181673 6th EU Money Laundering Directive. It focuses on standardising the approach of EU member. The European Unions Sixth Anti-Money Laundering Directive 6AMLD came into effect for member states on 3 December 2020 and must be implemented by financial institutions by 3 June 2021. The Sixth Money Laundering Directive Implementation date.

Source: planetcompliance.com

Source: planetcompliance.com

Directive EU 20181673 of the European Parliament and of the Council of 23 October 2018 on combating money laundering by criminal law PE302018REV1 OJ L 284 12112018 p. The Sixth Money Laundering Directive Implementation date. 3 June 2021 The most important modifications made through the adoption of the Sixth Money Laundering Directive 6AMLD affect the areas of harmonization regulatory scope criminal liability tougher punishment and member state cooperation along with other noteworthy alterations. The European Unions Sixth Anti-Money Laundering Directive 6AMLD came into effect for member states on 3 December 2020 and must be implemented by financial institutions by 3 June 2021. Following 5AMLD which broadly strengthened existing AMLCFT provisions the sixth anti-money laundering directive aims to empower financial institutions and.

Source: tookitaki.ai

Source: tookitaki.ai

The Sixth EU Anti-Money Laundering Directive 6AMLD came into force at the EU level on 2 December 2018 and EU member states are required to implement it by 3 December 2020. EUs 6th Anti-Money Laundering Directive. The 6AMLD brings clarity to specific regulatory details to close loopholes toughen penalties and encourage greater cooperation. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. Despite the ongoing pandemic and Brexit negotiations the European Unions EU 6th Money Laundering Directive 6AMLD comes into effect on the 3rd December 2020.

Source: lavenpartners.com

Source: lavenpartners.com

Anti-money-laundering Directive to a regulation thereby directly applicable in the Member States ii an EU level supervision with an EU -wide anti-money-laundering supervisory system and iii a coordination and support mechanism for Member States Financial Intelligence Units. Regulated entities operating in the union will need to be compliant by June 3 2021. As of December 3rd 2020 the European Unions Sixth Anti-Money Laundering Directive AMLD6 is in effect for all member states. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. The new directive is designed to invigorate the anti-money laundering efforts of financial institutions by incentivising good practice throughout sectors open to abuse by money launderers.

Source: shuftipro.com

Source: shuftipro.com

Like its predecessor this new directive is aimed to strengthen anti-money laundering. A new Directive complementing and reinforcing the Fourth and the Fifth Anti-Money Laundering Directives 4AMLD and 5AMLD was adopted on 23 October 2018. The 6 th Anti Money Laundering Directive 6AMLD is the European Unions most stringent anti money laundering measure to date. The newly adopted Directive has already been dubbed as the 6AMLD due to its paramount. 6thAnti-Money Laundering Directive 6AMLD.

Source: camsafroza.com

Source: camsafroza.com

It focuses on standardising the approach of EU member. It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. 6 th Directive on AMLCFT AMLD 6 The directive will replace the existing Directive 2015849EU containing provisions that will be transposed into national law such as rules on national supervisors and financial intelligence units in Member States. The European Unions Sixth Anti-Money Laundering Directive 6AMLD came into effect for member states on 3 December 2020 and must be implemented by financial institutions by 3 June 2021. The 6 th Anti Money Laundering Directive 6AMLD is the European Unions most stringent anti money laundering measure to date.

Source: smart-oversight.com

Source: smart-oversight.com

3 June 2021 The most important modifications made through the adoption of the Sixth Money Laundering Directive 6AMLD affect the areas of harmonization regulatory scope criminal liability tougher punishment and member state cooperation along with other noteworthy alterations. Like its predecessor this new directive is aimed to strengthen anti-money laundering. The 6AMLD brings clarity to specific regulatory details to close loopholes toughen penalties and encourage greater cooperation. Identify and verify the identity of clients monitor transactions and report suspicious transactions. 6AMLD builds on the foundations established in the 5AMLD and represents a significant development in certain areas of the legislation.

Source: bankinghub.eu

Source: bankinghub.eu

The Sixth Money Laundering Directive Implementation date. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. EUs 6th Anti-Money Laundering Directive. With a deadline of 3 December 2020 many Member States have begun to incorporate 6AMLD into national frameworks. The Sixth EU Anti-Money Laundering Directive 6AMLD came into force at the EU level on 2 December 2018 and EU member states are required to implement it by 3 December 2020.

Source: skillcast.com

Source: skillcast.com

2230 BG ES CS DA DE ET EL EN FR GA HR IT LV LT HU MT NL PL PT RO SK SL FI. The 6AMLD brings clarity to specific regulatory details to close loopholes toughen penalties and encourage greater cooperation. Identify and verify the identity of clients monitor transactions and report suspicious transactions. EUs 6th Anti-Money Laundering Directive. It focuses on standardising the approach of EU member.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title eu money laundering directive 6 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas