11++ Example of laundering money using the insurance industry information

Home » about money loundering idea » 11++ Example of laundering money using the insurance industry informationYour Example of laundering money using the insurance industry images are available in this site. Example of laundering money using the insurance industry are a topic that is being searched for and liked by netizens today. You can Download the Example of laundering money using the insurance industry files here. Download all royalty-free images.

If you’re looking for example of laundering money using the insurance industry images information related to the example of laundering money using the insurance industry keyword, you have come to the ideal blog. Our site frequently provides you with hints for viewing the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that match your interests.

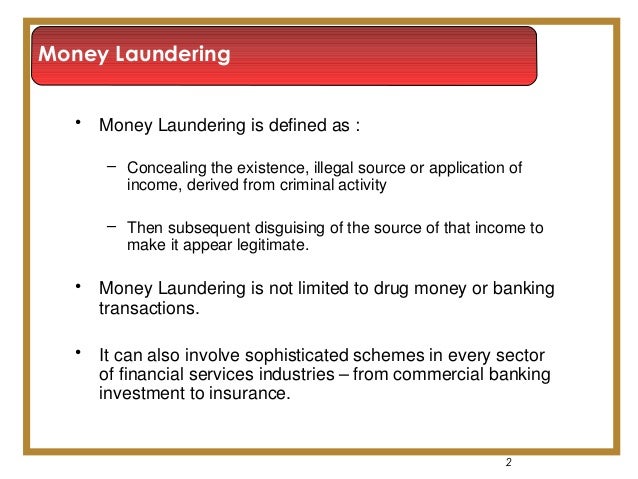

Example Of Laundering Money Using The Insurance Industry. 1 case involved US370m. The reasoning behind this is due to the fact that banks must report large or suspicious transactions to the IRS. Such as an insurance policy bank deposit casino cheque or even real estate. What is Money Laundering.

Dennis M Lormel S Statement Before The U S Senate Banking Subcommittee On National Security International Trade And Finance Hearing Acams Today From acamstoday.org

Dennis M Lormel S Statement Before The U S Senate Banking Subcommittee On National Security International Trade And Finance Hearing Acams Today From acamstoday.org

Some common methods of laundering are. 1 case involved US370m. As a result AML regulations are evolving. But Office Space creator Mike Judges farcical setup does underscore an important point. Investing in other legitimate business interests. The course describes the specific measures that insurance companies must take to detect and prevent money laundering including why and when SAR-IC reports must be filed and devote a chapter to producer responsibilities.

Sometimes they take advantage of insurance products structured as investments such as variable annuities and certain life insurance policies.

According to the FinCEN the most significant money laundering and terrorist financial risks in the insurance industry are found in life insurance and annuity products because such products allow a customer to place large amounts of funds into the financial system and seamlessly transfer such funds to disguise their true origin. If you need to look up money laundering in the dictionary before setting your plan in motion youre not off to a good start. According to the FinCEN the most significant money laundering and terrorist financial risks in the insurance industry are found in life insurance and annuity products because such products allow a customer to place large amounts of funds into the financial system and seamlessly transfer such funds to disguise their true origin. A Textbook Money Laundering Example. Some common methods of laundering are. Insurance industry doubled from just over 4000 to just over 8000 from 2003 to 20065.

Source: jagranjosh.com

Source: jagranjosh.com

Conceptually money laundering is pretty easy to understand. Process of Money Laundering. The Shady Pizza Parlor. Reselling high-value goods such as artwork or any type of stored-value product such as jewelry or prepaid cards. The Placement Stage Filtering.

Source: fincen.gov

Source: fincen.gov

Ad Unlimited access to Insurance market reports on 180 countries. Instant industry overview Market sizing forecast key players trends. The Shady Pizza Parlor. The course describes the specific measures that insurance companies must take to detect and prevent money laundering including why and when SAR-IC reports must be filed and devote a chapter to producer responsibilities. Some common methods of laundering are.

Source: acamstoday.org

Source: acamstoday.org

However insurance products particularly life insurance do provide opportunities to launder money given the significant flow of funds. Instant industry overview Market sizing forecast key players trends. Insurance firms operating in the US that issue or underwrite covered products which may pose a higher risk of money laundering for example must comply with Bank Secrecy Actanti-money laundering BSAAML programme. For example a life insurance policy that can be cashed in is an attractive money laundering vehicle because it allows criminals to put dirty money in and take clean money out in the form of an insurance company check. Ad Unlimited access to Insurance market reports on 180 countries.

What is Money Laundering. Given the growing size of the insurance industry in Canada and the focus placed on life insurance products as a conduit for money laundering by authoritative international bodies one might wonder why is the suspicious transaction reporting levels. What is Money Laundering. The above reinforces the suspicion that the number of actual money laundering cases related to life assurance is low when compared to the actual size of the life insurance market and the number of STRs submitted from other financial sectors. Reselling high-value goods such as artwork or any type of stored-value product such as jewelry or prepaid cards.

Source: acamstoday.org

Source: acamstoday.org

Money laundering is a federal crime in which large sums of dirty currency earned from illegal activity such as drug or sex crimes is cleaned and deposited into a legally sanctioned banking institutions. Sometimes they take advantage of insurance products structured as investments such as variable annuities and certain life insurance policies. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. Process of Money Laundering. Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply.

Source: compliancealert.org

Source: compliancealert.org

Investing in real estate. He paid large premiums on the policy and suborned the 2 FATF Report on Money Laundering and Terrorist Financing Typologies 2003 2004. For example a life insurance policy that can be cashed in is an attractive money laundering vehicle because it allows criminals to put dirty money in and take clean money out in the form of an insurance company check. The money laundering process is divided into 3 segments. The insurance industry is generally susceptible to money laundering.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

Sometimes they take advantage of insurance products structured as investments such as variable annuities and certain life insurance policies. A Textbook Money Laundering Example. Investing in other legitimate business interests. He paid large premiums on the policy and suborned the 2 FATF Report on Money Laundering and Terrorist Financing Typologies 2003 2004. If you need to look up money laundering in the dictionary before setting your plan in motion youre not off to a good start.

Source: slideshare.net

Source: slideshare.net

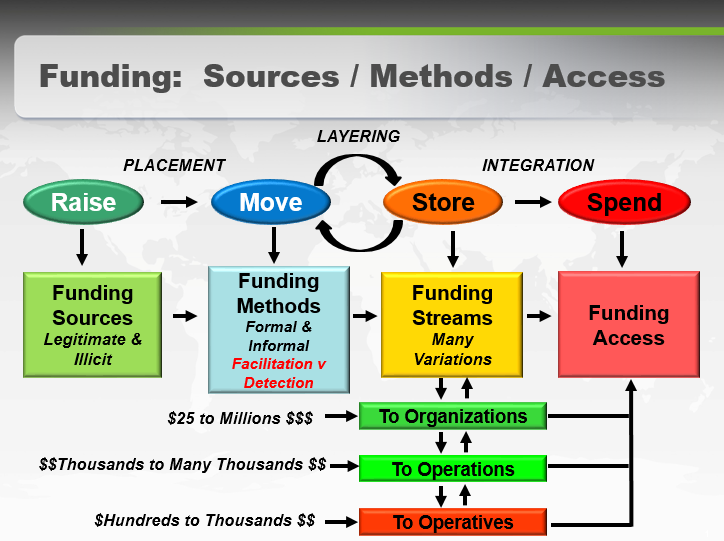

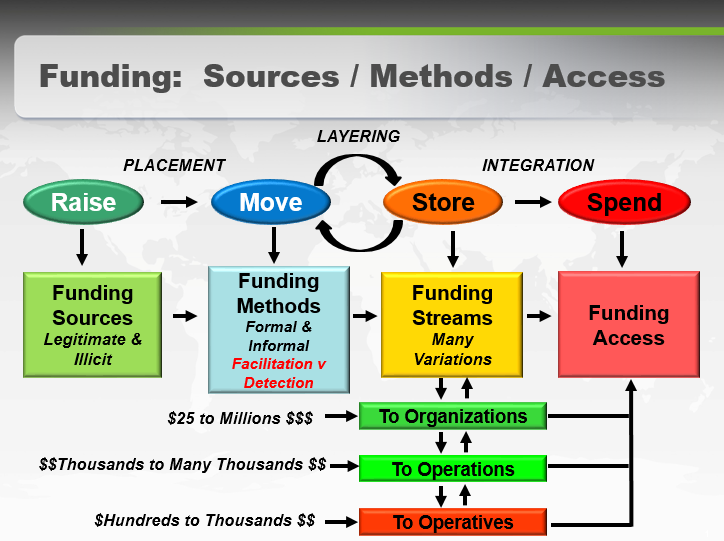

What is Money Laundering. The Shady Pizza Parlor. Investing in real estate. Suspected funds totalled approx. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration.

Source: eimf.eu

Source: eimf.eu

Criminals use insurance companies for money laundering primarily by buying insurance and then submitting claims to retrieve their funds. With around 62 of firms reporting exposure to financial crime money laundering in the insurance sector is a growing global problem. The course describes the specific measures that insurance companies must take to detect and prevent money laundering including why and when SAR-IC reports must be filed and devote a chapter to producer responsibilities. Four methods of money launderingcash smuggling casinos and other gambling venues insurance policies and securitiesare described below in. Ad Unlimited access to Insurance market reports on 180 countries.

Source: researchgate.net

Source: researchgate.net

The Placement Stage Filtering. Insurance firms operating in the US that issue or underwrite covered products which may pose a higher risk of money laundering for example must comply with Bank Secrecy Actanti-money laundering BSAAML programme. As a result AML regulations are evolving. Such as an insurance policy bank deposit casino cheque or even real estate. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into.

The course describes the specific measures that insurance companies must take to detect and prevent money laundering including why and when SAR-IC reports must be filed and devote a chapter to producer responsibilities. Life insurance firms are at particular risk of money laundering because of the massive flows of funds into and out of their businesses. What is Money Laundering. Given the growing size of the insurance industry in Canada and the focus placed on life insurance products as a conduit for money laundering by authoritative international bodies one might wonder why is the suspicious transaction reporting levels. As a result AML regulations are evolving.

Source: jagranjosh.com

Source: jagranjosh.com

The above reinforces the suspicion that the number of actual money laundering cases related to life assurance is low when compared to the actual size of the life insurance market and the number of STRs submitted from other financial sectors. However insurance products particularly life insurance do provide opportunities to launder money given the significant flow of funds. Using case studies and real-life examples the course explores how life insurance products can be used in money laundering activities and explain how the AML rules apply. Sometimes they take advantage of insurance products structured as investments such as variable annuities and certain life insurance policies. The insurance industry is generally susceptible to money laundering.

Source:

For example a life insurance policy that can be cashed in is an attractive money laundering vehicle because it allows criminals to put dirty money in and take clean money out in the form of an insurance company check. Instant industry overview Market sizing forecast key players trends. Ad Unlimited access to Insurance market reports on 180 countries. Setting up or using shell companies to move illegal funds and obscure ultimate beneficial ownership and assets. Suspected funds totalled approx.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title example of laundering money using the insurance industry by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information