19++ Example of structuring in money laundering ideas in 2021

Home » about money loundering idea » 19++ Example of structuring in money laundering ideas in 2021Your Example of structuring in money laundering images are available in this site. Example of structuring in money laundering are a topic that is being searched for and liked by netizens now. You can Get the Example of structuring in money laundering files here. Download all free photos.

If you’re looking for example of structuring in money laundering images information related to the example of structuring in money laundering interest, you have visit the ideal site. Our site frequently gives you hints for downloading the maximum quality video and picture content, please kindly hunt and find more informative video content and graphics that fit your interests.

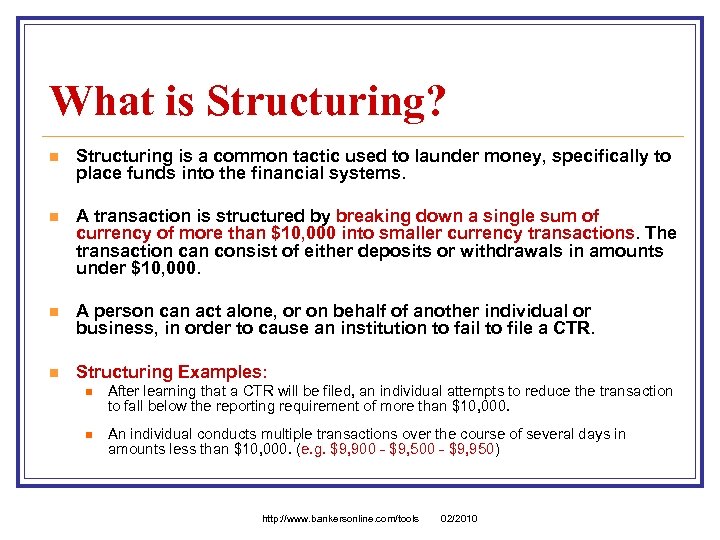

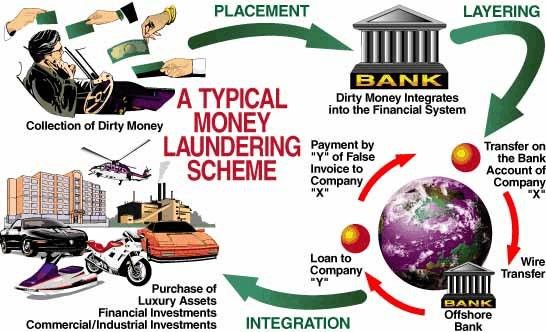

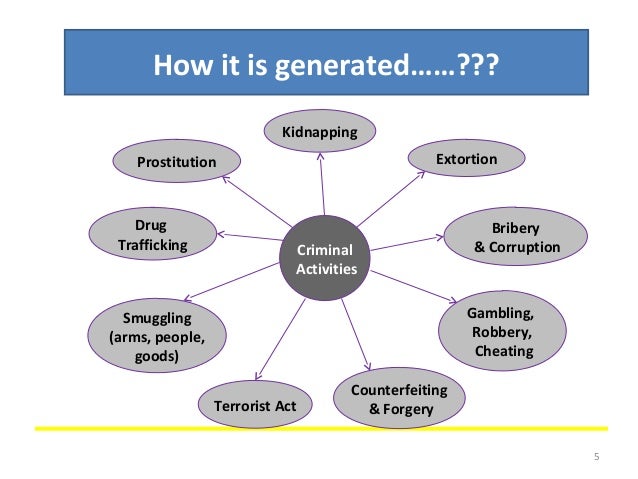

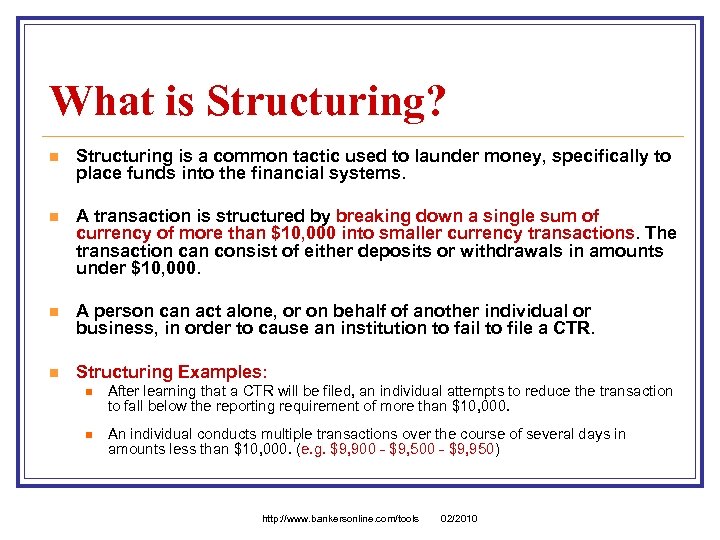

Example Of Structuring In Money Laundering. After placement comes the layering stage sometimes referred to as structuring. For example such international watchdogs as the Financial Action Task Force FATF evolved out of these discussions. An example of structuring would be a business with cash of 17000 to deposit breaking it into two deposits one of 9000 and the other of 8000 with specific intent to evade the banks. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers From present5.com

Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers From present5.com

This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. John Smith sells a car and goes to the bank with 14000 in cash to deposit. Each cash withdrawal will be in 100 bills and in an amount too small to trigger the reporting threshold. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the. Final integration is when the money is freely used legally without the necessity to conceal it any further. Person and doesnt want to have to report the income on.

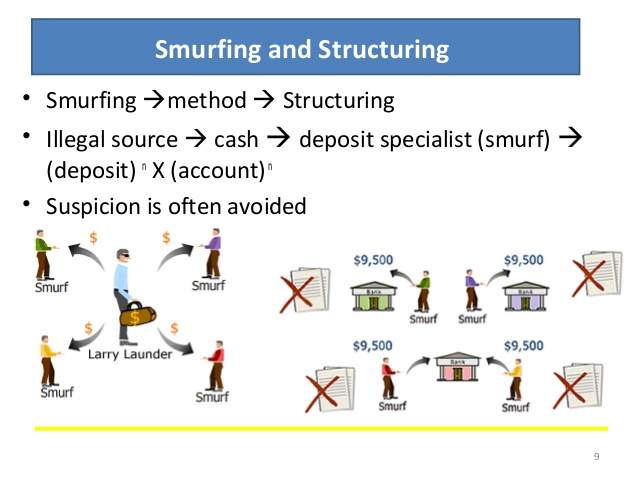

Aka Structuring Gargamel is a US.

Aka Structuring Gargamel is a US. Structuring is unlawful whether or not it occurs in conjunction with any other legal offense as opposed to being motivated by say a desire to keep a low profile in general or. Structuring involves splitting transactions into separate amounts under AUD10000 to avoid the transaction reporting requirements of the FTR Act and AMLCTF Act. The Placement Stage Filtering. A drug dealer purchases a new Yukon Denali for 60000. Some common methods of laundering are.

Source: bankofcyprus.com.cy

Source: bankofcyprus.com.cy

Other examples of structuring are below. He fills out a deposit slip and goes to the teller. Each cash withdrawal will be in 100 bills and in an amount too small to trigger the reporting threshold. An Example of Smurfing. The layering stage is the most complex and often entails the international movement of.

Structuring is unlawful whether or not it occurs in conjunction with any other legal offense as opposed to being motivated by say a desire to keep a low profile in general or. Structuring can take two basic forms. Use currency to purchase official bank checks money orders or travelers checks with currency in amounts less than 10000 and possibly in amounts less than the 3000 recordkeeping threshold for the currency. He fills out a deposit slip and goes to the teller. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

Source: slideshare.net

Source: slideshare.net

Process of Money Laundering. Money Laundering Example One of the most commonly used and simpler methods of washing money is by funneling it through a restaurant or other business where there are a. The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as. So SMURFING is the act of using runners to perform multiple financial transactions to avoid the currency reporting requirements. After placement comes the layering stage sometimes referred to as structuring.

Source: prezi.com

Source: prezi.com

An Example of Smurfing. According to Hughes structuring is the money laundering process by which individuals or criminal syndicates are able to bypass this recognition of money transfers by breaking up cash amounts into sums lower than the threshold so that theyre not picked up by banks and therefore reported. First a customer might deposit currency on multiple days in amounts under 10000 eg 990000 for the intended purpose of circumventing a financial institutions obligation to report any cash deposit over 10000 on a currency transaction report as described in 31 CFR. Structuring involves splitting transactions into separate amounts under AUD10000 to avoid the transaction reporting requirements of the FTR Act and AMLCTF Act. Many money launderers rely on this placement technique because numerous deposits.

Source: present5.com

Source: present5.com

For example a customer may structure currency deposit or withdrawal transactions so that each is less than the 10000 CTR filing threshold. Structuring is a Well-Known Money Laundering Method Structuring by smurfs is such a well known method that all national laws in respect of money laundering take that into account by requiring that banks look at placements over a rolling 24-hour period specifically to capture smurfs smurfing the system with proceeds of crime. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. The layering stage is the most complex and often entails the international movement of. He fills out a deposit slip and goes to the teller.

Source: theofy.world

Source: theofy.world

So SMURFING is the act of using runners to perform multiple financial transactions to avoid the currency reporting requirements. He fills out a deposit slip and goes to the teller. Each cash withdrawal will be in 100 bills and in an amount too small to trigger the reporting threshold. The money laundering process is divided into 3 segments. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the.

Source: calert.info

Source: calert.info

For example a customer may structure currency deposit or withdrawal transactions so that each is less than the 10000 CTR filing threshold. An Example of Smurfing. Structuring can take two basic forms. For example a customer may structure currency deposit or withdrawal transactions so that each is less than the 10000 CTR filing threshold. Other examples of structuring are below.

Source: allbankingalerts.com

Source: allbankingalerts.com

He fills out a deposit slip and goes to the teller. Person and doesnt want to have to report the income on. Structuring is unlawful whether or not it occurs in conjunction with any other legal offense as opposed to being motivated by say a desire to keep a low profile in general or. He would like to deposit into different banks to avoid reporting. The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as.

Source: blog.ipleaders.in

Source: blog.ipleaders.in

A drug dealer purchases a new Yukon Denali for 60000. The final example of money laundering techniques is the integration of the money back into the economy in such a way as to make it look like a legitimate business transaction with an audit trail. For example a customer may structure currency deposit or withdrawal transactions so that each is less than the 10000 CTR filing threshold. According to Hughes structuring is the money laundering process by which individuals or criminal syndicates are able to bypass this recognition of money transfers by breaking up cash amounts into sums lower than the threshold so that theyre not picked up by banks and therefore reported. He pays cash and registers the car in his girlfriends name.

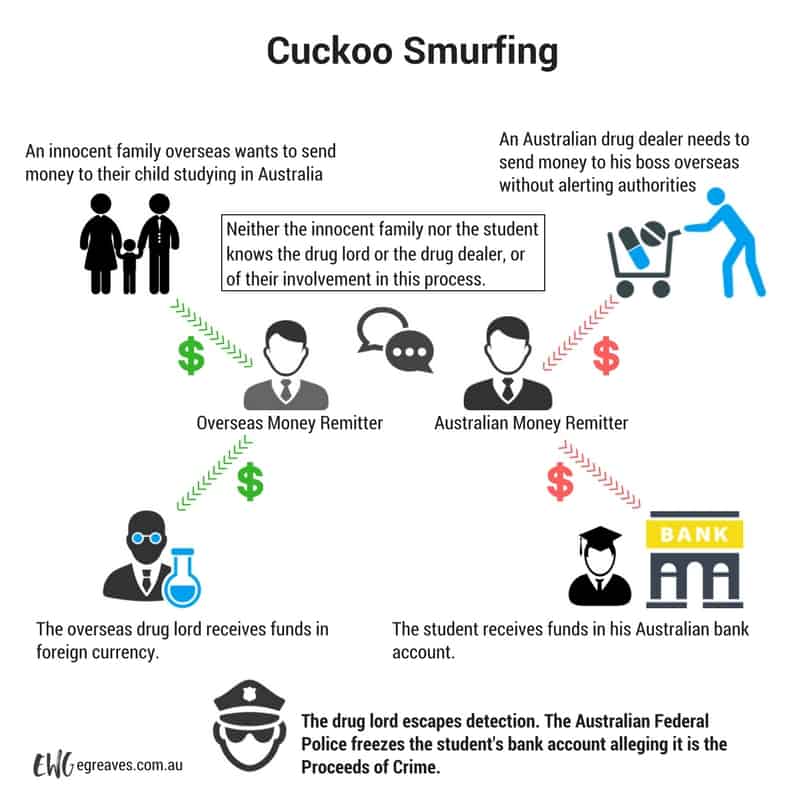

Source: egreaves.com.au

Source: egreaves.com.au

An example of structuring would be a business with cash of 17000 to deposit breaking it into two deposits one of 9000 and the other of 8000 with specific intent to evade the banks. He pays cash and registers the car in his girlfriends name. He would like to deposit into different banks to avoid reporting. California Man Sentenced for Structuring Cash Deposits On July 21 2014 in Bakersfield California Miguel Antonio Ruiz Jaramillo was sentenced to 12 months in prison and ordered to pay 91527 in unpaid federal taxes. The final example of money laundering techniques is the integration of the money back into the economy in such a way as to make it look like a legitimate business transaction with an audit trail.

Source: goldinglawyers.com

Source: goldinglawyers.com

Many money launderers rely on this placement technique because numerous deposits. Structuring as readers may recall is the federal criminal offense of splitting up bank deposits so as to keep them under a threshold such as 10000 above which banks have to report transactions to the government. An Example of Smurfing. Gargamel has about 500000 of cash that he received in legally sourced money. An example of structuring would be a business with cash of 17000 to deposit breaking it into two deposits one of 9000 and the other of 8000 with specific intent to evade the banks.

Source: aml-assassin.com

Source: aml-assassin.com

After placement comes the layering stage sometimes referred to as structuring. As mentioned these laws are intended to restrict the activities of criminals. Aka Structuring Gargamel is a US. There are numerous examples of money launderinga simple example is this. According to Hughes structuring is the money laundering process by which individuals or criminal syndicates are able to bypass this recognition of money transfers by breaking up cash amounts into sums lower than the threshold so that theyre not picked up by banks and therefore reported.

Source: slideshare.net

Source: slideshare.net

Bank employees should be aware of and alert to structuring schemes. First a customer might deposit currency on multiple days in amounts under 10000 eg 990000 for the intended purpose of circumventing a financial institutions obligation to report any cash deposit over 10000 on a currency transaction report as described in 31 CFR. Bank employees should be aware of and alert to structuring schemes. Use currency to purchase official bank checks money orders or travelers checks with currency in amounts less than 10000 and possibly in amounts less than the 3000 recordkeeping threshold for the currency. Many money launderers rely on this placement technique because numerous deposits.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title example of structuring in money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information