17++ Examples of money laundering red flags information

Home » about money loundering idea » 17++ Examples of money laundering red flags informationYour Examples of money laundering red flags images are ready in this website. Examples of money laundering red flags are a topic that is being searched for and liked by netizens today. You can Find and Download the Examples of money laundering red flags files here. Get all free vectors.

If you’re searching for examples of money laundering red flags pictures information related to the examples of money laundering red flags interest, you have come to the right site. Our site always gives you hints for downloading the maximum quality video and image content, please kindly search and find more enlightening video content and images that fit your interests.

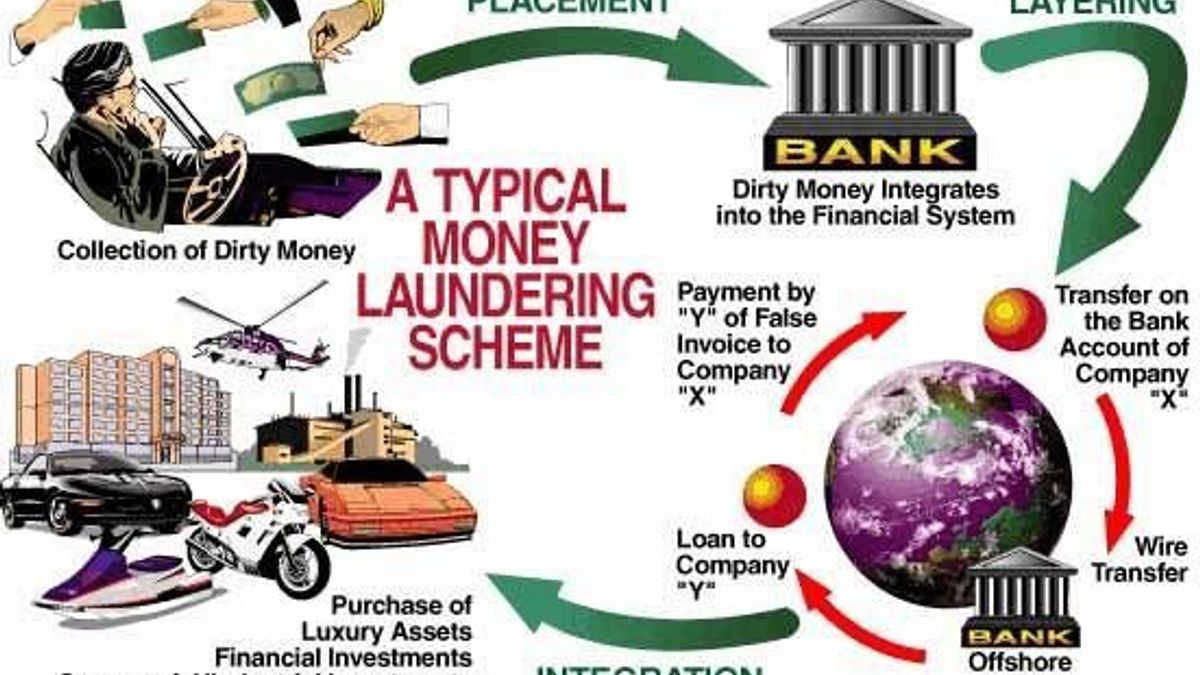

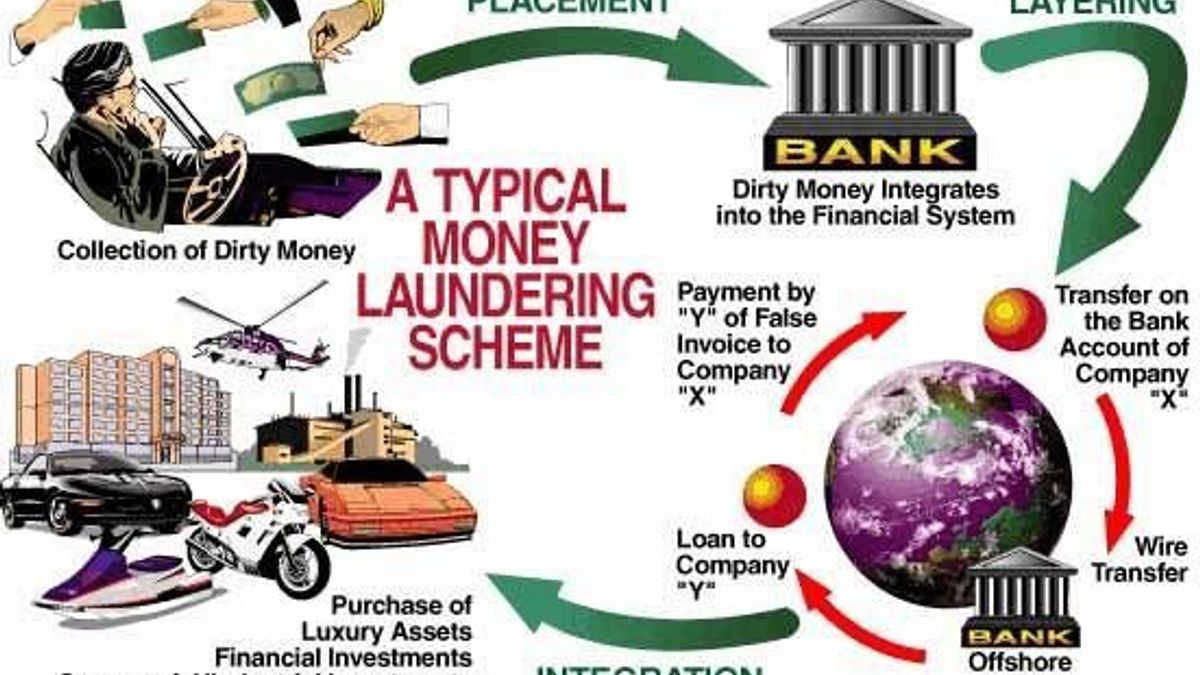

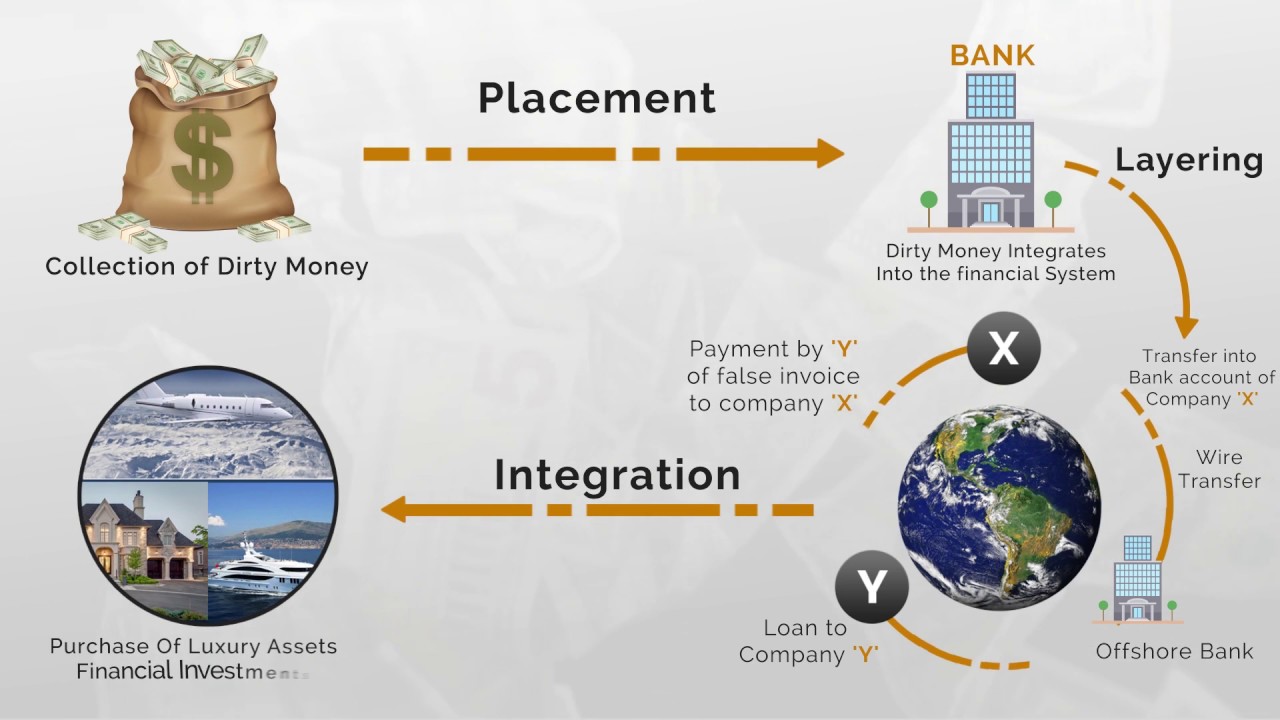

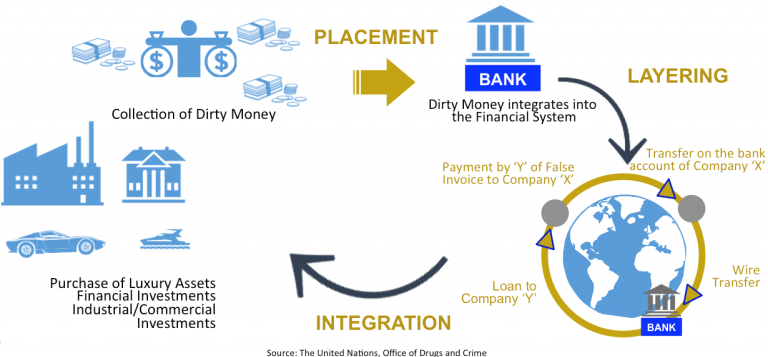

Examples Of Money Laundering Red Flags. Use of multiple accounts or foreign accounts. Prepaid crypto cards also create opportunities for money laundering as they allow criminals to convert dirty virtual assets into fiat money. Night deposits ATM deposits exchanging money for cashiers checks or larger bills and smuggling cash out of the country are all examples of placement. The FATF claims that in case any of the following activities occur there may be a high likelihood of money.

What Is Money Laundering And How Is It Done From jagranjosh.com

What Is Money Laundering And How Is It Done From jagranjosh.com

If the way a business is structured seems a little unusual it should raise a red flag. Required service was denied by another professional. Red flags of money laundering for trust and corporate services providers are harder to spot but these 10 should be reported to your MLRO for a. Night deposits ATM deposits exchanging money for cashiers checks or larger bills and smuggling cash out of the country are all examples of placement. Documents that cannot be verified. If the activities include sending money to sanctioned areas or unregistered jurisdictions your financial institution may want to consider giving the account a closer look.

2013 outlining the vulnerabilities of legal professionals to money laundering and terrorist financing.

However even if offenders exploit these money laundering schemes to hide the origins of illicit funds their. BSAAML compliance involves due diligence in the scrutiny of a customer. The FATF claims that in case any of the following activities occur there may be a high likelihood of money. Multiple tax ID numbers. The ownership structure is overly complicated when there is no legitimate or economic reason. 2013 outlining the vulnerabilities of legal professionals to money laundering and terrorist financing.

Source: financialcrimeacademy.org

Source: financialcrimeacademy.org

The client changed the consultant several times in a short time or met with multiple legal counsels without a valid reason. If the way a business is structured seems a little unusual it should raise a red flag. Prepaid crypto cards also create opportunities for money laundering as they allow criminals to convert dirty virtual assets into fiat money. Business transactions involve countries where there is a high risk of money laundering andor the. Loans from non-institutional lenders.

Source: highspeedtraining.co.uk

Source: highspeedtraining.co.uk

Conveyancing transactions are a target due to criminals being able to launder large sums of money in a single transaction. Documents that cannot be verified. The FCAs report sets out seven examples of typologies of money laundering in capital markets and identifies some of the key risk areas and red flags. Loans from non-institutional lenders. The client is ready to pay significantly higher wages than usual without a legitimate reason.

Source: pinterest.com

Source: pinterest.com

This guidance will be useful to firms in. Loans from non-institutional lenders. Sudden deviations from the norm should be considered red flags. Placement is vital for money launderers as it helps to mask dirty funds with clean money and. Why do people put money in the dryer.

Source: sumsub.com

Source: sumsub.com

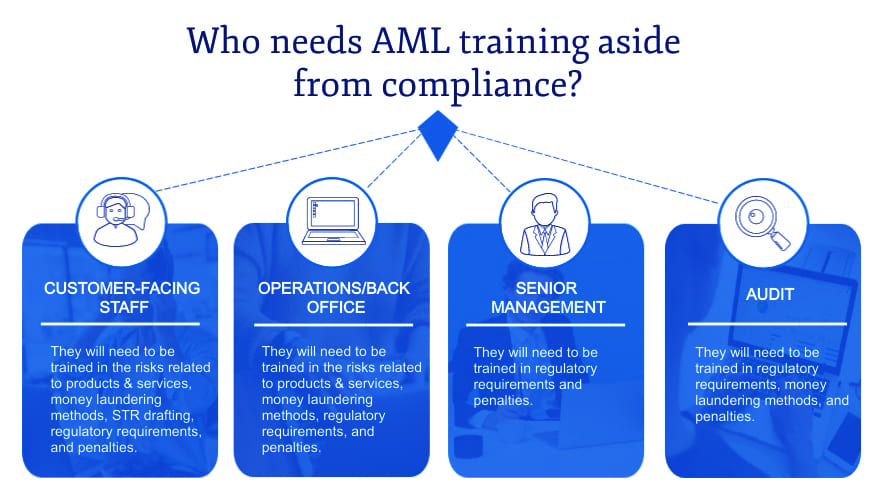

This guidance will be useful to firms in enhancing internal training for front-line and financial crime teams informing internal AML risk assessments and enhancing transaction monitoring systems. Sudden deviations from the norm should be considered red flags. If the activities include sending money to sanctioned areas or unregistered jurisdictions your financial institution may want to consider giving the account a closer look. The FATF claims that in case any of the following activities occur there may be a high likelihood of money. Prepaid crypto cards also create opportunities for money laundering as they allow criminals to convert dirty virtual assets into fiat money.

Source: jagranjosh.com

Source: jagranjosh.com

Sudden deviations from the norm should be considered red flags. Business transactions involve countries where there is a high risk of money laundering andor the. The FCAs report sets out seven examples of typologies of money laundering in capital markets and identifies some of the key risk areas and red flags. Unexplained payments from a third party. Transactions or activities listed here may not necessarily be indicative of money laundering if they are consistent with a customers legitimate business.

Source: wikiwand.com

Source: wikiwand.com

The FATF claims that in case any of the following activities occur there may be a high likelihood of money. 2002 red flag 16 The customers account has wire transfers that have no apparent business purpose to or from a country identified as a money laundering risk or a bank secrecy haven Wire transfers originate from jurisdictions that have been highlighted in relation to black market peso exchange activities. 2013 outlining the vulnerabilities of legal professionals to money laundering and terrorist financing. The client changed the consultant several times in a short time or met with multiple legal counsels without a valid reason. Conveyancing transactions are a target due to criminals being able to launder large sums of money in a single transaction.

Source: youtube.com

Source: youtube.com

Use of multiple accounts or foreign accounts. The report identifies 42 Red Flag Indicators or warning signs of money laundering and terrorist financing. The client changed the consultant several times in a short time or met with multiple legal counsels without a valid reason. Transactions or activities listed here may not necessarily be indicative of money laundering if they are consistent with a customers legitimate business. Documents that cannot be verified.

Source: pideeco.be

Source: pideeco.be

If the activities include sending money to sanctioned areas or unregistered jurisdictions your financial institution may want to consider giving the account a closer look. BSAAML compliance involves due diligence in the scrutiny of a customer. Unusual exchange of denominations. Red flags of money laundering for trust and corporate services providers are harder to spot but these 10 should be reported to your MLRO for a. If the way a business is structured seems a little unusual it should raise a red flag.

Source: slideshare.net

Source: slideshare.net

The FATF claims that in case any of the following activities occur there may be a high likelihood of money. Sudden deviations from the norm should be considered red flags. Loans from non-institutional lenders. For example a long-dormant account that suddenly experiences a high level of activity should raise an eyebrow. BSAAML compliance involves due diligence in the scrutiny of a customer.

Source: shuftipro.com

Source: shuftipro.com

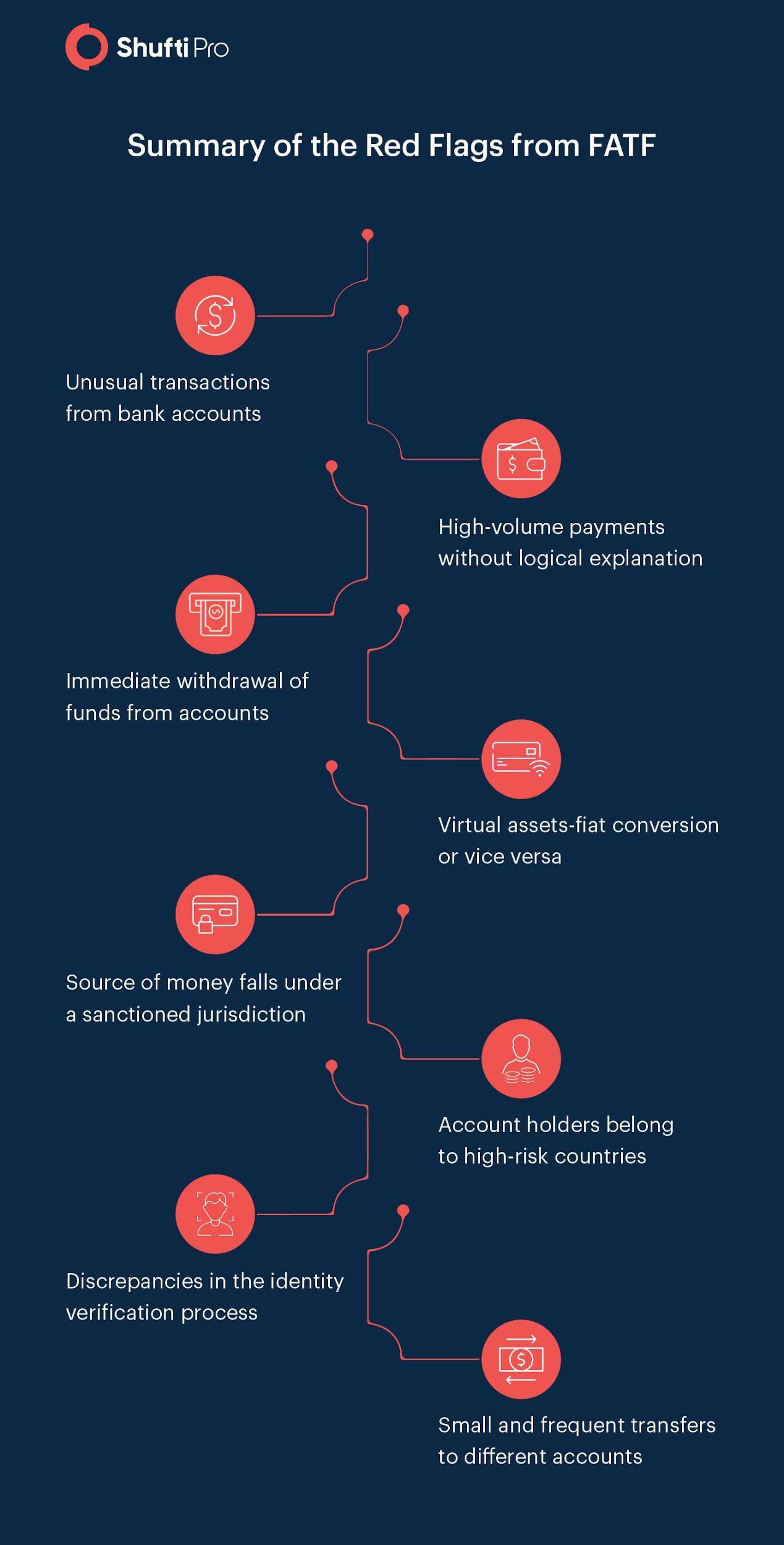

Business transactions involve countries where there is a high risk of money laundering andor the. The FATFs money laundering red flag indicator guidelines provide cryptocurrency exchanges with detailed information for minimizing crypto-related AML risks. The six indicators and red flags have been summarized below. Documents that cannot be verified. Business transactions involve countries where there is a high risk of money laundering andor the.

Source: shuftipro.com

Source: shuftipro.com

The FATFs money laundering red flag indicator guidelines provide cryptocurrency exchanges with detailed information for minimizing crypto-related AML risks. However even if offenders exploit these money laundering schemes to hide the origins of illicit funds their. Transactions or activities listed here may not necessarily be indicative of money laundering if they are consistent with a customers legitimate business. 2013 outlining the vulnerabilities of legal professionals to money laundering and terrorist financing. Why do people put money in the dryer.

Source: letstalkaml.com

Source: letstalkaml.com

Sudden deviations from the norm should be considered red flags. Also many of the red flags involve more than one type of transaction. Prepaid crypto cards also create opportunities for money laundering as they allow criminals to convert dirty virtual assets into fiat money. Loans from non-institutional lenders. 2013 outlining the vulnerabilities of legal professionals to money laundering and terrorist financing.

Source: financialcrimeacademy.org

Source: financialcrimeacademy.org

Also many of the red flags involve more than one type of transaction. Multiple tax ID numbers. Unexplained payments from a third party. Required service was denied by another professional. This guidance will be useful to firms in enhancing internal training for front-line and financial crime teams informing internal AML risk assessments and enhancing transaction monitoring systems.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title examples of money laundering red flags by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information