20++ Examples of suspicious activity money laundering uk information

Home » about money loundering idea » 20++ Examples of suspicious activity money laundering uk informationYour Examples of suspicious activity money laundering uk images are available. Examples of suspicious activity money laundering uk are a topic that is being searched for and liked by netizens now. You can Find and Download the Examples of suspicious activity money laundering uk files here. Get all free vectors.

If you’re looking for examples of suspicious activity money laundering uk images information linked to the examples of suspicious activity money laundering uk interest, you have visit the ideal blog. Our site frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly search and locate more informative video articles and graphics that match your interests.

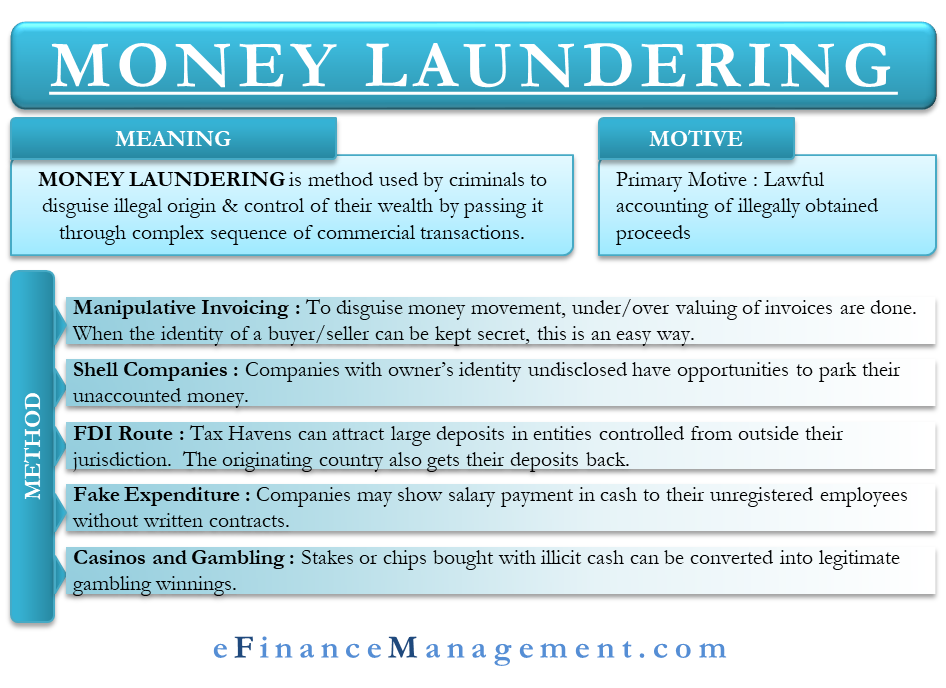

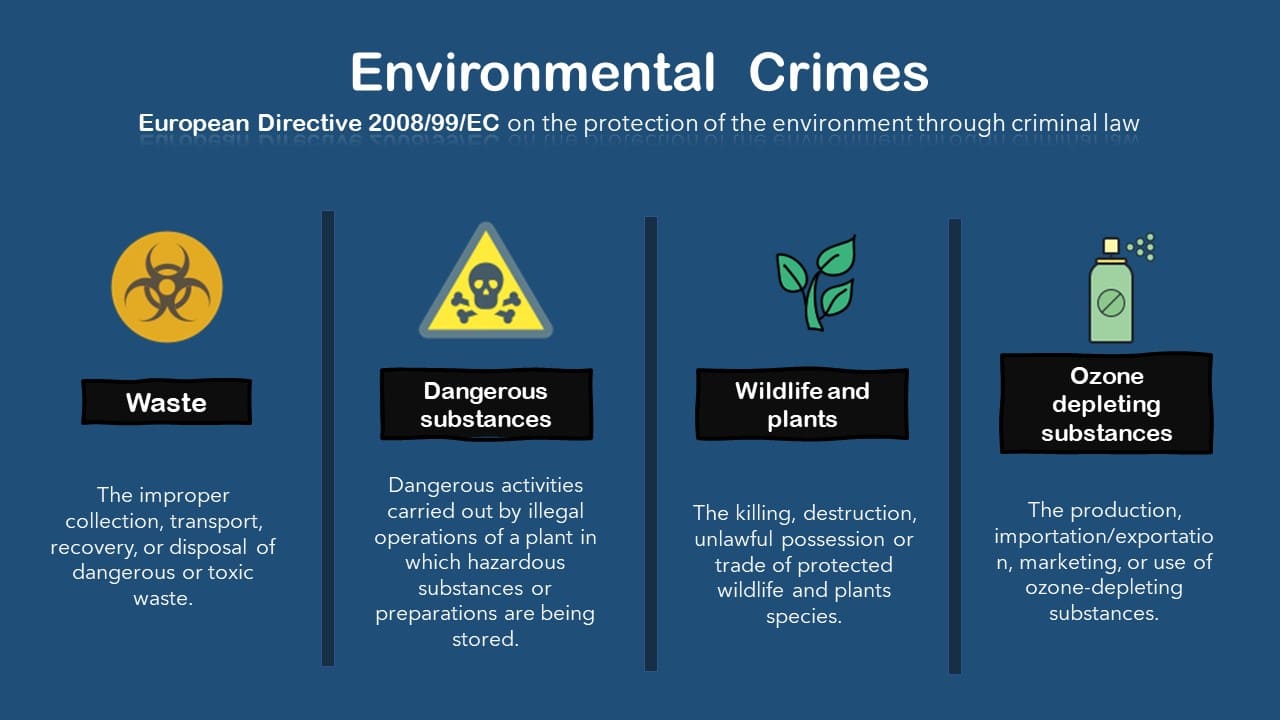

Examples Of Suspicious Activity Money Laundering Uk. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing. Buying and selling of a security with no discernible purpose or in circumstances which appear unusual. A subject that has opened multiple current accounts in quick succession and used them to launder funds on behalf of others.

Money Laundering Wikiwand From wikiwand.com

Money Laundering Wikiwand From wikiwand.com

The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information. For example if youre acting for a client in a property transaction and you suspect the purchase funds are criminal property youd need a DAML before you could exchange contracts. Suspicious Activity Reports SARs must be submitted to the National Crime Agency NCA. The term DAML refers to appropriate consent given by the NCA to a firm to carry out an activity that is otherwise prohibited by the principal money laundering offences under POCA. Examples of unusual dealing patterns and abnormal transactions may be as follows. MONEY LAUNDERING REGULATIONS Internal Suspicious Activity Report to the MLRO STRICTLY CONFIDENTIAL ClientRef No.

Often its just because its something unusual for your business for example.

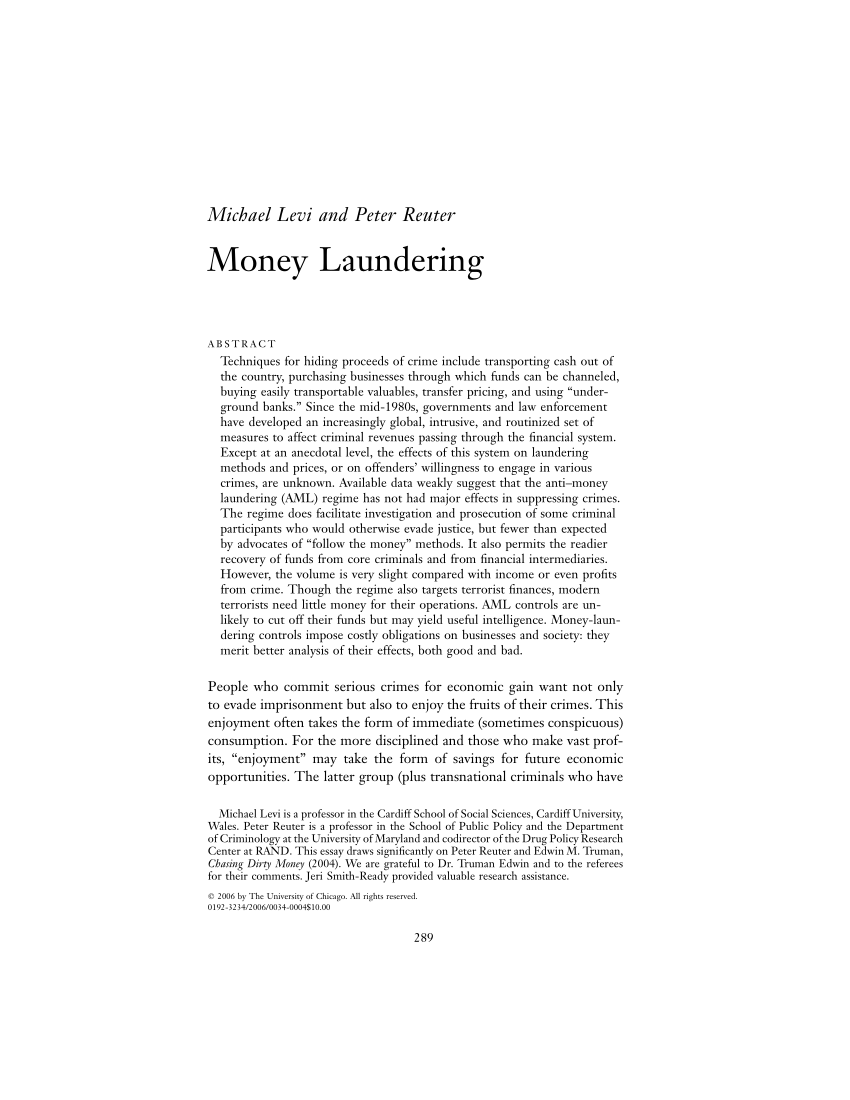

The term DAML refers to appropriate consent given by the NCA to a firm to carry out an activity that is otherwise prohibited by the principal money laundering offences under POCA. The case was resolved after four days. The UK Financial Intelligence Unit UKFIU sited within the National Crime Agency NCA receives analyses and distributes the. IAIS Examples of money laundering and suspicious transactions involving insurance October 2004 Page 3 of 9 the applicant for insurance business purchases policies in amounts considered beyond the customers apparent means the applicant for insurance business establishes a. Reports alert law enforcement to potential instances of money laundering or terrorist financing. A large number of security transactions across a number of jurisdictions.

Source: pinterest.com

Source: pinterest.com

Below are extracts taken from the SAR annual report 2018 produced by the NCA which give examples of suspicious activities and the use of SARs. What is a suspicious activity report. The UK Financial Intelligence Unit UKFIU sited within the National Crime Agency NCA receives analyses and distributes the. The confidentiality and sensitivity of suspicious activity reports SARs in the context of disclosure in private civil litigation. Below are extracts taken from the SAR annual report 2018 produced by the NCA which give examples of suspicious activities and the use of SARs.

Source: pinterest.com

Source: pinterest.com

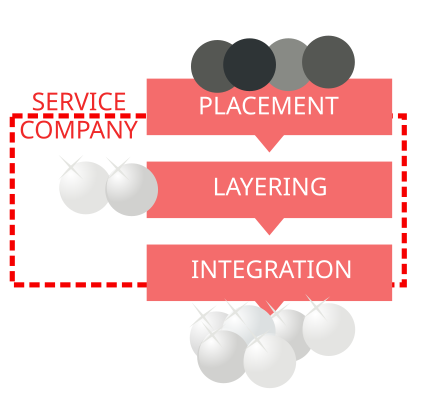

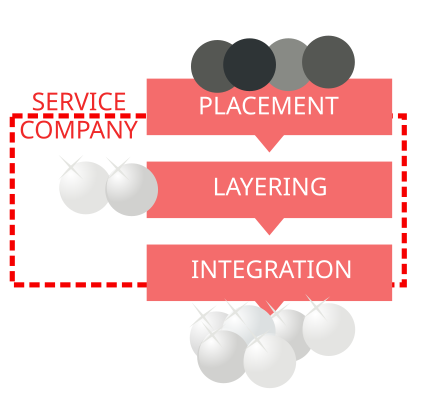

The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. Examples of suspicious transactions are listed below. A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing. The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information. Placement is vital for money launderers as it helps to mask dirty funds with clean money and provide legitimacy to the funds.

Source: researchgate.net

Source: researchgate.net

A SAR reported that a limited company was deliberately understating its business income on its VAT returns. The accountant however was unavailable when the officer called several times. A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing. The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information. Suspicious Activity Reports SARs must be submitted to the National Crime Agency NCA.

Night deposits ATM deposits exchanging money for cashiers checks or larger bills and smuggling cash out of the country are all examples of placement. Suspicious Activity Reports SARs must be submitted to the National Crime Agency NCA. A subject that has opened multiple current accounts in quick succession and used them to launder funds on behalf of others. When it became clear that the reporter was not seeking a defence to money laundering the case was closed. Ultimately submitting a SAR protects you your firm the profession and the UK from the risk of laundering the proceeds of crime.

Source: efinancemanagement.com

Source: efinancemanagement.com

The list is non exhaustive and only provides examples of ways in which money may be laundered through the capital market. Reports alert law enforcement to potential instances of money laundering or terrorist financing. MONEY LAUNDERING REGULATIONS Internal Suspicious Activity Report to the MLRO STRICTLY CONFIDENTIAL ClientRef No. A subject that has opened multiple current accounts in quick succession and used them to launder funds on behalf of others. The list is non exhaustive and only provides examples of ways in which money may be laundered through the capital market.

Source: researchgate.net

Source: researchgate.net

Below are extracts taken from the SAR annual report 2018 produced by the NCA which give examples of suspicious activities and the use of SARs. The case was resolved after four days. When it became clear that the reporter was not seeking a defence to money laundering the case was closed. A SAR reported that a limited company was deliberately understating its business income on its VAT returns. A large number of security transactions across a number of jurisdictions.

Source: wikiwand.com

Source: wikiwand.com

Reasons for the report Signed Date of signature To be completed by the MLRO Action Taken. When it became clear that the reporter was not seeking a defence to money laundering the case was closed. SARs are made by financial institutions and other professionals such as solicitors accountants and estate agents and are a vital source of intelligence not only on economic crime but on a wide range of criminal activity. Reasons for the report Signed Date of signature To be completed by the MLRO Action Taken. MONEY LAUNDERING REGULATIONS Internal Suspicious Activity Report to the MLRO STRICTLY CONFIDENTIAL ClientRef No.

Source: pideeco.be

Source: pideeco.be

Transactions not in keeping with the investors normal activity the financial markets in which the investor is active and the business which the investor operates. The list is non exhaustive and only provides examples of ways in which money may be laundered through the capital market. IAIS Examples of money laundering and suspicious transactions involving insurance October 2004 Page 3 of 9 the applicant for insurance business purchases policies in amounts considered beyond the customers apparent means the applicant for insurance business establishes a. Suspicious Activity Reports SARs alert law enforcement to potential instances of money laundering or terrorist financing. Reports alert law enforcement to potential instances of money laundering or terrorist financing.

Source: wikiwand.com

Source: wikiwand.com

The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information. The case was resolved after four days. The confidentiality and sensitivity of suspicious activity reports SARs in the context of disclosure in private civil litigation. Buying and selling of a security with no discernible purpose or in circumstances which appear unusual. The term DAML refers to appropriate consent given by the NCA to a firm to carry out an activity that is otherwise prohibited by the principal money laundering offences under POCA.

Source: researchgate.net

Source: researchgate.net

SARs are made by financial institutions and other professionals such as solicitors accountants and estate agents and are a vital source of intelligence not only on economic crime but on a wide range of criminal activity. Examples of suspicious transactions are listed below. Examples of unusual dealing patterns and abnormal transactions may be as follows. A subject that has opened multiple current accounts in quick succession and used them to launder funds on behalf of others. The confidentiality and sensitivity of suspicious activity reports SARs in the context of disclosure in private civil litigation.

Source: fsblockchain.medium.com

Source: fsblockchain.medium.com

Suspicious Activity Reports SARs must be submitted to the National Crime Agency NCA. A suspicious activity report SAR is a piece of information that alerts law enforcement of potential money laundering or terrorist financing. A large number of security transactions across a number of jurisdictions. The case was resolved after four days. Reports alert law enforcement to potential instances of money laundering or terrorist financing.

Source: academia.edu

Source: academia.edu

The case was resolved after four days. SARs are made by financial institutions and other professionals such as solicitors accountants and estate agents and are a vital source of intelligence not only on economic crime but on a wide range of criminal activity. Examples of suspicious transactions are listed below. A subject that has opened multiple current accounts in quick succession and used them to launder funds on behalf of others. For example if youre acting for a client in a property transaction and you suspect the purchase funds are criminal property youd need a DAML before you could exchange contracts.

Source: tookitaki.ai

Source: tookitaki.ai

A subject that has opened multiple current accounts in quick succession and used them to launder funds on behalf of others. MONEY LAUNDERING REGULATIONS Internal Suspicious Activity Report to the MLRO STRICTLY CONFIDENTIAL ClientRef No. Suspicious Activity Reports SARs alert law enforcement to potential instances of money laundering or terrorist financing. IAIS Examples of money laundering and suspicious transactions involving insurance October 2004 Page 3 of 9 the applicant for insurance business purchases policies in amounts considered beyond the customers apparent means the applicant for insurance business establishes a. A subject that has opened multiple current accounts in quick succession and used them to launder funds on behalf of others.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title examples of suspicious activity money laundering uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information