17++ Examples of trade finance based money laundering ideas in 2021

Home » about money loundering Info » 17++ Examples of trade finance based money laundering ideas in 2021Your Examples of trade finance based money laundering images are available in this site. Examples of trade finance based money laundering are a topic that is being searched for and liked by netizens today. You can Get the Examples of trade finance based money laundering files here. Download all royalty-free photos and vectors.

If you’re looking for examples of trade finance based money laundering pictures information connected with to the examples of trade finance based money laundering interest, you have visit the right site. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

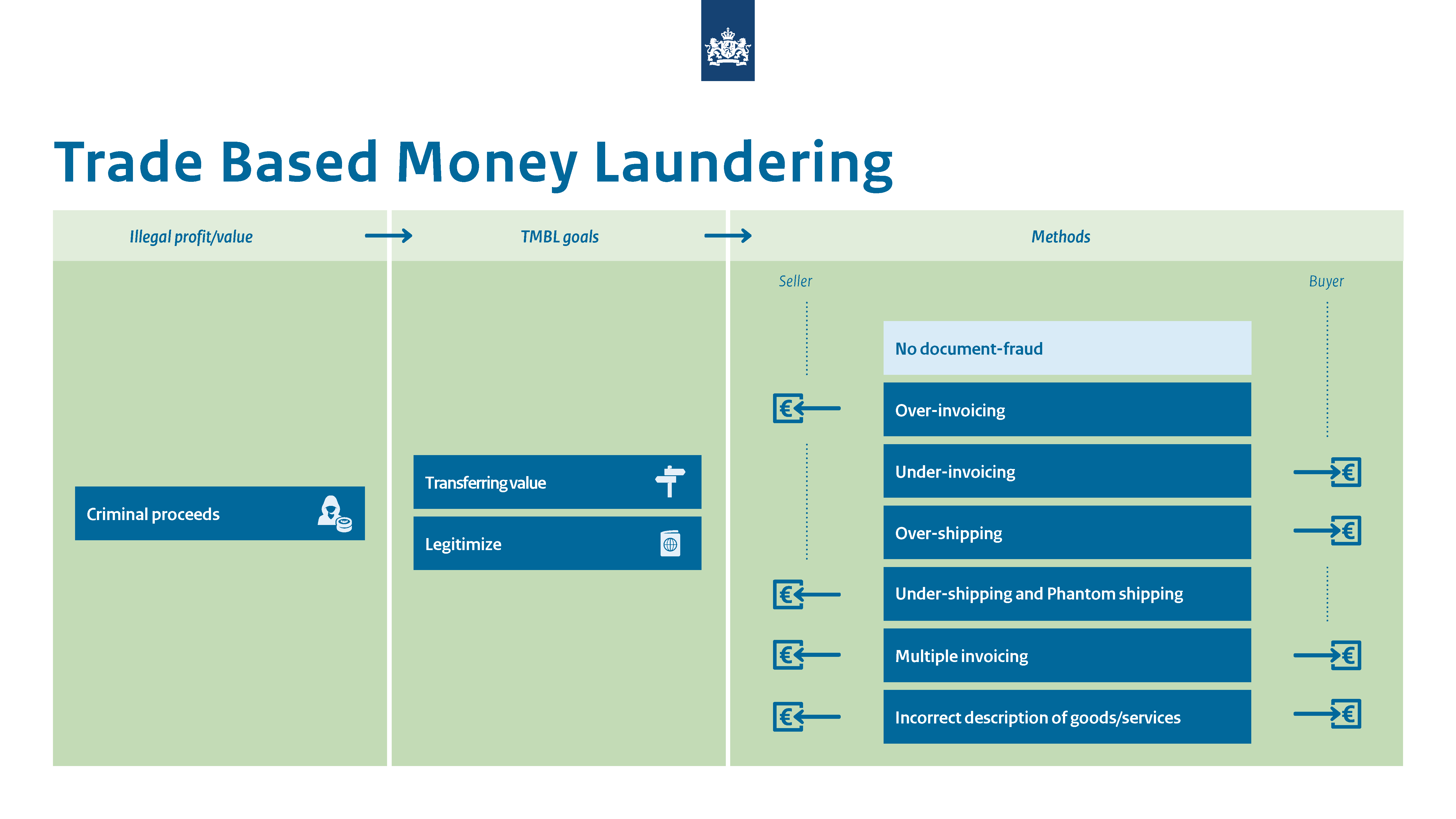

Examples Of Trade Finance Based Money Laundering. Trade-Based Money Laundering Examples Examples of trade-based money laundering activities that should raise red flags include. 13 Jul 2021 1211 PM IST. The largest in terms of dollars is TBML which is estimated to be hundreds of billions of dollars. On Trade Based Money Laundering activities Why because trade has increasingly been used to launder money for criminal purposes Reasons for trades popularity.

Marketing Strategies For Fintech Startup Fintech Startups Fintech Marketing Strategy Examples From pinterest.com

Marketing Strategies For Fintech Startup Fintech Startups Fintech Marketing Strategy Examples From pinterest.com

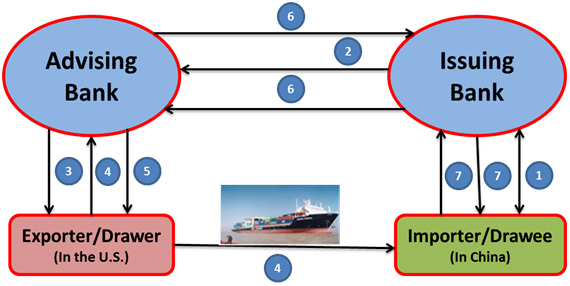

A letter of credit for a high-value cross-border import is revealed to hide unusual behavior when examined by the routing bank. Trade-Based Money Laundering Examples Examples of trade-based money laundering activities that should raise red flags including. The tremendous volume of trade makes it easy to hide individual transactions The complexity that is involved in multiple foreign exchangecross border transactions. The Asia Development Bank the Asia-Pacific Group on Money Laundering the Eastern and Southern Africa Anti-Money Laundering Group the Egmont Group represented by the Ukraine the Gulf Cooperation Council the World Bank and the World Customs Organisation. A letter of credit for a high-value cross-border import is revealed to contain anomalies when examined by the routing bank. Gold silver crude base metals Bullion prices traded firm on Tuesday with spot gold prices at COMEX trading near 1809 per ounce while spot silver prices were trading marginal up at 2624 per ounce in morning trade.

Examples of Trade Based Money Laundering 3 very common methods relate directly to invoicing these are called over-invoicing under-invoicing multiple-invoicing and relate directly to charging a different amount than is actually due for the goodsservices in question.

13 Jul 2021 1211 PM IST. Examples of how TBMLFT may be carried out. 1 The specific risks associated with trade-based money laundering involving the international trade of services warrant. Trade-Based Money Laundering Examples Examples of trade-based money laundering activities that should raise red flags including. On Trade Based Money Laundering activities Why because trade has increasingly been used to launder money for criminal purposes Reasons for trades popularity. They presented these to their bank exporters.

Source: pinterest.com

Source: pinterest.com

In that 2018 Assessment the Treasury Department described various trade-based money laundering enforcement cases including those involving the international trade of gold as well as cases involving intersections between the US. The term trade-based money laundering and terrorist financing TBMLFT refers to the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illegal origins or finance their activities. A letter of credit for a high-value cross-border import is revealed to contain anomalies when examined by the routing bank. 13 Jul 2021 1211 PM IST. In that 2018 Assessment the Treasury Department described various trade-based money laundering enforcement cases including those involving the international trade of gold as well as cases involving intersections between the US.

Source: complyadvantage.com

Source: complyadvantage.com

Examples of Trade Based Money Laundering 3 very common methods relate directly to invoicing these are called over-invoicing under-invoicing multiple-invoicing and relate directly to charging a different amount than is actually due for the goodsservices in question. S Ltd and F Ltd falsified trade-based documentation such as purchase orders certificates of origin and bills of lading during a 6 month period. And China Peru Mexico and Guatemala. Trade Based Money Laundering is an important channel of criminal activities and with the growth of global trade. A letter of credit for a high-value cross-border import is revealed to hide unusual behavior when examined by the routing bank.

Source: pinterest.com

Source: pinterest.com

For banks and financial institutions it is important to know the business KYB and ultimate business owners UBOs to detect shell companies and any other business entities having money laundering risks associated with them. Trade-Based Money Laundering Examples Examples of trade-based money laundering activities that should raise red flags include. Double-invoicing improper payments. Examples of Trade Based Money Laundering 3 very common methods relate directly to invoicing these are called over-invoicing under-invoicing multiple-invoicing and relate directly to charging a different amount than is actually due for the goodsservices in question. 1 The specific risks associated with trade-based money laundering involving the international trade of services warrant.

Source: amlc.eu

Source: amlc.eu

The Asia Development Bank the Asia-Pacific Group on Money Laundering the Eastern and Southern Africa Anti-Money Laundering Group the Egmont Group represented by the Ukraine the Gulf Cooperation Council the World Bank and the World Customs Organisation. A letter of credit for a high-value cross-border import is revealed to contain anomalies when examined by the routing bank. Trade-Based Money Laundering Examples Examples of trade-based money laundering activities that should raise red flags include. A letter of credit for a high-value cross-border import is revealed to contain anomalies when examined by the routing bank. A letter of credit for a high-value cross-border import is revealed to hide unusual behavior when examined by the routing bank.

Source: compliancealert.org

Source: compliancealert.org

For banks and financial institutions it is important to know the business KYB and ultimate business owners UBOs to detect shell companies and any other business entities having money laundering risks associated with them. The Asia Development Bank the Asia-Pacific Group on Money Laundering the Eastern and Southern Africa Anti-Money Laundering Group the Egmont Group represented by the Ukraine the Gulf Cooperation Council the World Bank and the World Customs Organisation. A letter of credit for a high-value cross-border import is revealed to hide unusual behavior when examined by the routing bank. Trade-Based Money Laundering Examples Examples of trade-based money laundering activities that should raise red flags include. 13 Jul 2021 1211 PM IST.

In one example supplied by police agency Europol a trading network involving cars and automotive parts was found to be laundering funds on behalf of drug traffickers and tax fraudsters with ties to Mafia activity. Trade-Based Money Laundering Examples Examples of trade-based money laundering activities that should raise red flags include. Trade-based financial crime in its simplest terms is the use of legitimate international trade financing products to aid in committing crimes. For banks and financial institutions it is important to know the business KYB and ultimate business owners UBOs to detect shell companies and any other business entities having money laundering risks associated with them. A letter of credit for a high-value cross-border import is revealed to contain anomalies when examined by the routing bank.

Source: piranirisk.com

Source: piranirisk.com

Trade-Based Money Laundering Examples Examples of trade-based money laundering activities that should raise red flags including. Trade-based financial crime in its simplest terms is the use of legitimate international trade financing products to aid in committing crimes. The largest in terms of dollars is TBML which is estimated to be hundreds of billions of dollars. Examples of Trade Based Money Laundering 3 very common methods relate directly to invoicing these are called over-invoicing under-invoicing multiple-invoicing and relate directly to charging a different amount than is actually due for the goodsservices in question. Examples of trade-based money laundering red flags include.

Source: letstalkaml.com

Source: letstalkaml.com

For the purpose of this study trade-based money laundering is defined as the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illicit origins. Examples of trade-based money laundering red flags include. In one example supplied by police agency Europol a trading network involving cars and automotive parts was found to be laundering funds on behalf of drug traffickers and tax fraudsters with ties to Mafia activity. On Trade Based Money Laundering activities Why because trade has increasingly been used to launder money for criminal purposes Reasons for trades popularity. In trade based money laundering the involvement of shell companies is often witnessed.

Source: pinterest.com

Source: pinterest.com

Trade Based Money Laundering is an important channel of criminal activities and with the growth of global trade. On Trade Based Money Laundering activities Why because trade has increasingly been used to launder money for criminal purposes Reasons for trades popularity. Examples of Trade Based Money Laundering 3 very common methods relate directly to invoicing these are called over-invoicing under-invoicing multiple-invoicing and relate directly to charging a different amount than is actually due for the goodsservices in question. The Financial Services Businesses are not the only entities that confront money laundering risks although law enforcement agencies efforts to combat money laundering have focused primarily on the financial system money laundering poses a threat to non financial businesses as well particularly those engaged in global trade. For banks and financial institutions it is important to know the business KYB and ultimate business owners UBOs to detect shell companies and any other business entities having money laundering risks associated with them.

Source: pinterest.com

Source: pinterest.com

The Financial Services Businesses are not the only entities that confront money laundering risks although law enforcement agencies efforts to combat money laundering have focused primarily on the financial system money laundering poses a threat to non financial businesses as well particularly those engaged in global trade. The Financial Services Businesses are not the only entities that confront money laundering risks although law enforcement agencies efforts to combat money laundering have focused primarily on the financial system money laundering poses a threat to non financial businesses as well particularly those engaged in global trade. S Ltd and F Ltd falsified trade-based documentation such as purchase orders certificates of origin and bills of lading during a 6 month period. A letter of credit for a high-value cross-border import is revealed to hide unusual behavior when examined by the routing bank. Double-invoicing improper payments.

Source: moneylaunderingnews.com

Source: moneylaunderingnews.com

For the purpose of this study trade-based money laundering is defined as the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illicit origins. Trade-Based Money Laundering Examples Examples of trade-based money laundering activities that should raise red flags including. Examples of Trade Based Money Laundering 3 very common methods relate directly to invoicing these are called over-invoicing under-invoicing multiple-invoicing and relate directly to charging a different amount than is actually due for the goodsservices in question. The tremendous volume of trade makes it easy to hide individual transactions The complexity that is involved in multiple foreign exchangecross border transactions. For the purpose of this study trade-based money laundering is defined as the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illicit origins.

Source: pinterest.com

Source: pinterest.com

In one example supplied by police agency Europol a trading network involving cars and automotive parts was found to be laundering funds on behalf of drug traffickers and tax fraudsters with ties to Mafia activity. Trade-Based Money Laundering Examples Examples of trade-based money laundering activities that should raise red flags include. In that 2018 Assessment the Treasury Department described various trade-based money laundering enforcement cases including those involving the international trade of gold as well as cases involving intersections between the US. Examples of Trade Based Money Laundering 3 very common methods relate directly to invoicing these are called over-invoicing under-invoicing multiple-invoicing and relate directly to charging a different amount than is actually due for the goodsservices in question. S Ltd and F Ltd falsified trade-based documentation such as purchase orders certificates of origin and bills of lading during a 6 month period.

Source: acamstoday.org

Source: acamstoday.org

The largest in terms of dollars is TBML which is estimated to be hundreds of billions of dollars. Trade-based financial crime in its simplest terms is the use of legitimate international trade financing products to aid in committing crimes. Examples of trade-based money laundering red flags include. Gold silver crude base metals Bullion prices traded firm on Tuesday with spot gold prices at COMEX trading near 1809 per ounce while spot silver prices were trading marginal up at 2624 per ounce in morning trade. S Ltd and F Ltd falsified trade-based documentation such as purchase orders certificates of origin and bills of lading during a 6 month period.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title examples of trade finance based money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas