16+ Failing to report money laundering penalty uk info

Home » about money loundering Info » 16+ Failing to report money laundering penalty uk infoYour Failing to report money laundering penalty uk images are ready. Failing to report money laundering penalty uk are a topic that is being searched for and liked by netizens now. You can Find and Download the Failing to report money laundering penalty uk files here. Find and Download all royalty-free vectors.

If you’re looking for failing to report money laundering penalty uk pictures information connected with to the failing to report money laundering penalty uk interest, you have visit the right blog. Our website always provides you with hints for seeing the maximum quality video and picture content, please kindly search and find more informative video content and graphics that match your interests.

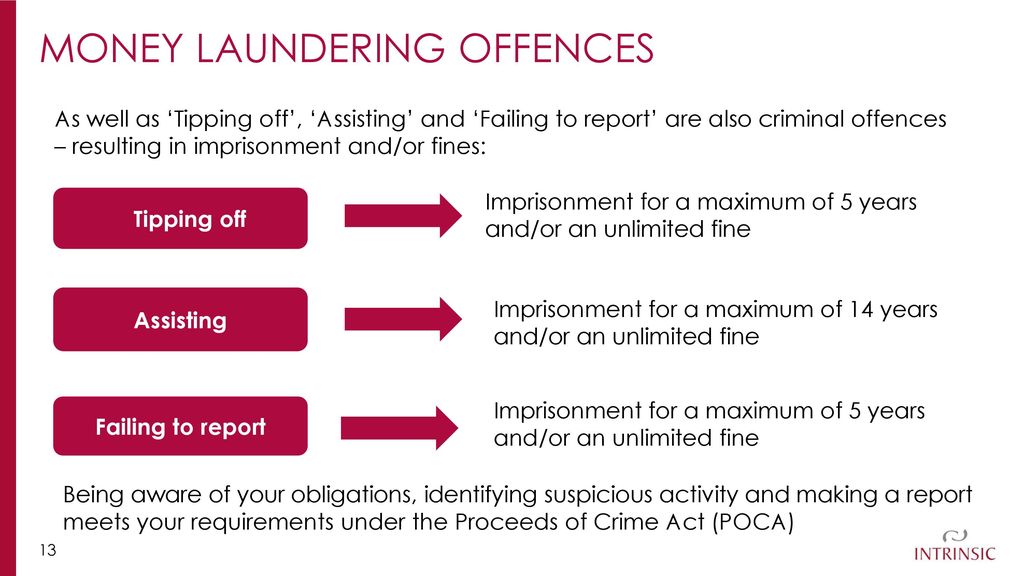

Failing To Report Money Laundering Penalty Uk. You also risk committing a failure to disclose offence. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. The guidance suggests that the CPS will now seek to prosecute those in the regulated sector who have failed to report suspicions of money laundering even though there is insufficient evidence to establish that money laundering was planned or has taken place. Previously the CPS would not prosecute in such circumstances.

Prevention Of Money Laundering Combating Terrorist Financing Ppt Video Online Download From slideplayer.com

Prevention Of Money Laundering Combating Terrorist Financing Ppt Video Online Download From slideplayer.com

The type of offence you may commit depends on whether you carry out regulated or non-regulated work. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. Under POCA 2002 certain offences are created for those people working in both the regulated sector and non-regulated sector who have knowledgesuspicion of money laundering but who fail to disclose this information to the appropriate authorities. You need to report breaches of the money laundering regulations you need to report a business that should be registered with HMRC but is not Published 23 October 2014. The ICAEW has severely reprimanded the director of a Leeds accountancy firm for failing to report suspicions that a client was engaged in money laundering activities. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field.

Members of the regulated sectors including accountancy banking property and legal sectors must report any suspicion about possible money laundering activity to the National Crime Agency by creating a Suspicious Activity Report.

In addition the current criminal penalty for a failure to report sanctions breaches should not be extended to include all individuals and companies. In the consultation the Commission leans in favour of introducing a failure to prevent offence which would result in corporates being held criminally liable if they failed to take reasonable measures to ensure that their employees or associates report suspected money laundering. It has also fined the banks former money laundering reporting officer MLRO Steven Smith 17900 and prohibited him from performing the MLRO or compliance oversight functions at regulated firms. The type of offence you may commit depends on whether you carry out regulated or non-regulated work. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. You risk committing a principal money laundering offence if you have knowledge or suspicion of money laundering and carry on with a prohibited transaction without making a report.

Source: wikiwand.com

Source: wikiwand.com

What is the penalty for it in the UK Money laundering under the Proceeds of Crime Act can lead to a sentence of up to 14 years in jail or a large fine. The TACT Regulations 2007 and the POCA Regulations 2007. Members of the regulated sectors including accountancy banking property and legal sectors must report any suspicion about possible money laundering activity to the National Crime Agency by creating a Suspicious Activity Report. Rather the Government should read across the conclusions of the Law Commission on the failure to report money laundering offence and retain the reporting obligation on regulated professionals alone. Previously the CPS would not prosecute in such circumstances.

Source: researchgate.net

Source: researchgate.net

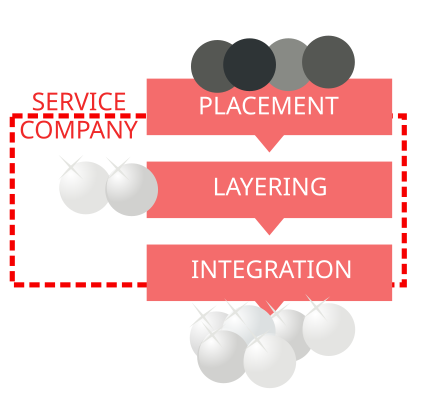

It is a course of by which dirty money is transformed into clear cash. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. There are four separate offences relating to the failure to disclose information under POCA 2002. You also risk committing a failure to disclose offence. Suspicious Activity Report Kangs Financial Fraud Team.

Source: slideplayer.com

Source: slideplayer.com

Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. What is the penalty for it in the UK Money laundering under the Proceeds of Crime Act can lead to a sentence of up to 14 years in jail or a large fine. Financial services firms are at risk from those seeking to launder money. For a legal entity the maximum penalty is an unlimited fine. Agustus 08 2021 The concept of money laundering is essential to be understood for those working in the financial sector.

Source: financialcrimeacademy.org

Source: financialcrimeacademy.org

The guidance suggests that the CPS will now seek to prosecute those in the regulated sector who have failed to report suspicions of money laundering even though there is insufficient evidence to establish that money laundering was planned or has taken place. In addition the current criminal penalty for a failure to report sanctions breaches should not be extended to include all individuals and companies. Fines For Money Laundering Uk. Members of the regulated sectors including accountancy banking property and legal sectors must report any suspicion about possible money laundering activity to the National Crime Agency by creating a Suspicious Activity Report. The sources of the money in precise are felony and the money is invested in a means that makes it appear to be clear money.

Source: in.pinterest.com

Source: in.pinterest.com

The sources of the money in precise are felony and the money is invested in a means that makes it appear to be clear money. Rather the Government should read across the conclusions of the Law Commission on the failure to report money laundering offence and retain the reporting obligation on regulated professionals alone. The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. You also risk committing a failure to disclose offence.

Source: slideplayer.com

Source: slideplayer.com

For a legal entity the maximum penalty is an unlimited fine. In addition the current criminal penalty for a failure to report sanctions breaches should not be extended to include all individuals and companies. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. Members of the regulated sectors including accountancy banking property and legal sectors must report any suspicion about possible money laundering activity to the National Crime Agency by creating a Suspicious Activity Report. Agustus 08 2021 The concept of money laundering is essential to be understood for those working in the financial sector.

Source: slideplayer.com

Source: slideplayer.com

The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information. The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information. Suspicious Activity Reports SARs alert law enforcement to potential instances of money laundering or terrorist financing. The ICAEW has severely reprimanded the director of a Leeds accountancy firm for failing to report suspicions that a client was engaged in money laundering activities. Agustus 08 2021 The concept of money laundering is essential to be understood for those working in the financial sector.

Source: researchgate.net

Source: researchgate.net

The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years imprisonment. Rather the Government should read across the conclusions of the Law Commission on the failure to report money laundering offence and retain the reporting obligation on regulated professionals alone. The guidance suggests that the CPS will now seek to prosecute those in the regulated sector who have failed to report suspicions of money laundering even though there is insufficient evidence to establish that money laundering was planned or has taken place. It has also fined the banks former money laundering reporting officer MLRO Steven Smith 17900 and prohibited him from performing the MLRO or compliance oversight functions at regulated firms. SARs are made by financial institutions and other professionals such as solicitors accountants and estate agents and are a vital source of intelligence not only on economic crime but on a wide range of criminal activity.

Source: vinciworks.com

Source: vinciworks.com

In the consultation the Commission leans in favour of introducing a failure to prevent offence which would result in corporates being held criminally liable if they failed to take reasonable measures to ensure that their employees or associates report suspected money laundering. In the consultation the Commission leans in favour of introducing a failure to prevent offence which would result in corporates being held criminally liable if they failed to take reasonable measures to ensure that their employees or associates report suspected money laundering. The sources of the money in precise are felony and the money is invested in a means that makes it appear to be clear money. The maximum penalty for tipping off off a money launderer is an unlimited fine and up to five years imprisonment. Financial services firms are at risk from those seeking to launder money.

Source: slideplayer.com

Source: slideplayer.com

The Money Laundering and Terrorist Financing Amendment Regulations 2019 sets out the amendments to the Money Laundering Terrorist Financing and Transfer of Funds Information. In the consultation the Commission leans in favour of introducing a failure to prevent offence which would result in corporates being held criminally liable if they failed to take reasonable measures to ensure that their employees or associates report suspected money laundering. What is the penalty for it in the UK Money laundering under the Proceeds of Crime Act can lead to a sentence of up to 14 years in jail or a large fine. The guidance suggests that the CPS will now seek to prosecute those in the regulated sector who have failed to report suspicions of money laundering even though there is insufficient evidence to establish that money laundering was planned or has taken place. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering.

Source: researchgate.net

Source: researchgate.net

In addition the current criminal penalty for a failure to report sanctions breaches should not be extended to include all individuals and companies. There are four separate offences relating to the failure to disclose information under POCA 2002. Suspicious Activity Report Kangs Financial Fraud Team. What is the penalty for it in the UK Money laundering under the Proceeds of Crime Act can lead to a sentence of up to 14 years in jail or a large fine. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine.

Source: iclg.com

Source: iclg.com

You need to report breaches of the money laundering regulations you need to report a business that should be registered with HMRC but is not Published 23 October 2014. For a legal entity the maximum penalty is an unlimited fine. Suspicious Activity Reports SARs alert law enforcement to potential instances of money laundering or terrorist financing. SARs are made by financial institutions and other professionals such as solicitors accountants and estate agents and are a vital source of intelligence not only on economic crime but on a wide range of criminal activity. The ICAEW has severely reprimanded the director of a Leeds accountancy firm for failing to report suspicions that a client was engaged in money laundering activities.

Source: slideplayer.com

Source: slideplayer.com

Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. The type of offence you may commit depends on whether you carry out regulated or non-regulated work. Previously the CPS would not prosecute in such circumstances. Rather the Government should read across the conclusions of the Law Commission on the failure to report money laundering offence and retain the reporting obligation on regulated professionals alone. What is the penalty for it in the UK Money laundering under the Proceeds of Crime Act can lead to a sentence of up to 14 years in jail or a large fine.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title failing to report money laundering penalty uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas