20++ Fca aml culture information

Home » about money loundering Info » 20++ Fca aml culture informationYour Fca aml culture images are ready in this website. Fca aml culture are a topic that is being searched for and liked by netizens now. You can Get the Fca aml culture files here. Get all royalty-free vectors.

If you’re searching for fca aml culture pictures information connected with to the fca aml culture keyword, you have visit the right site. Our website frequently gives you hints for seeing the highest quality video and image content, please kindly hunt and find more enlightening video articles and images that match your interests.

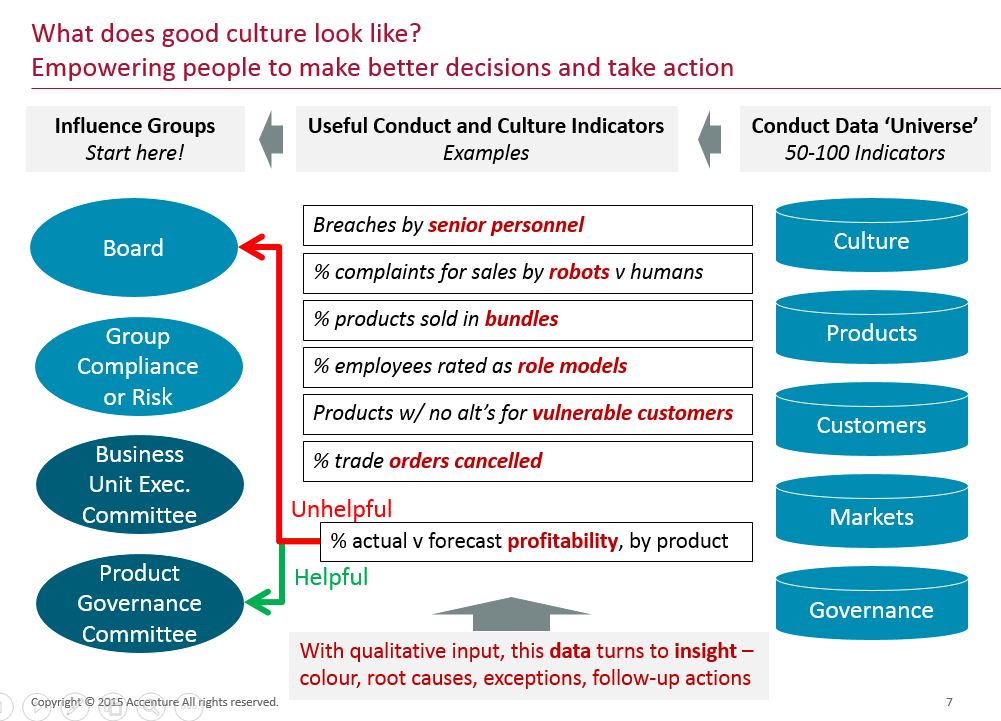

Fca Aml Culture. These rules which form part of the FCAs Handbook contain simple and direct instructions. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. An AML supervision strategy was launched by the FCA in 201314 and the regulator has also increased its use of attestations on financial crime issues with large and small firms. Essays in our Discussion Paper on transforming culture in financial services indicate that culture is about encouraging and incentivising good things not just stopping bad things from happening.

Culture Conduct The Global Regulatory Agenda From regulationasia.com

Culture Conduct The Global Regulatory Agenda From regulationasia.com

With customer confidence still on the recovery restoring trust in the industry to its former level is still some way off. We currently have 42 investigations ongoing into firms and individuals involving for example systems and controls over politically exposed persons customers with significant cash intensive operations correspondent banking and trade finance and transaction. Ad AML coverage from every angle. To act with integrity. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules prescribe in detail how firms have to do this. We expect firms to foster cultures which support the spirit of regulation in preventing harm to consumers and markets.

Latest news reports from the medical literature videos from the experts and more.

An AML supervision strategy was launched by the FCA in 201314 and the regulator has also increased its use of attestations on financial crime issues with large and small firms. Now the FCA has recycled the word purposeful in a recent speech by Mark Steward that stresses the importance of purposeful anti-money laundering AML systems and controls. We currently have 42 investigations ongoing into firms and individuals involving for example systems and controls over politically exposed persons customers with significant cash intensive operations correspondent banking and trade finance and transaction. This suggests that some form of meaning behind AML systems and controls is required for them to be. As a reminder the FCA requires firms to take reasonable care to establish and maintain systems and controls that are effective for countering the risk that the firm may be used to further financial crime FCA. Ad AML coverage from every angle.

Source: fca.org.uk

Source: fca.org.uk

Latest news reports from the medical literature videos from the experts and more. The primary driver of ML risk is the customer a risk exacerbated by the fact that orders are routed through multiple firms with no-one being able to see the full chain are more responsible than them for preventing money laundering. Recent FCA notices found systemic weaknesses or failures in the banks AML systems and controls and repeatedly noted that these failings were at all levels of the business and management. To act with integrity. Two of our biggest sanctions in the last 12 months related to failures to address financial crime and anti-money laundering AML risks.

Source: financialservicesblog.accenture.com

Source: financialservicesblog.accenture.com

Authoritys FCA latest business plan describes firms culture along with governance as pivotal to building public trust and confidence in UK financial services3 While regulators do not prescribe a firms culture they expect boards to exert strong cultural leadership and take responsibility for establishing and overseeing the right. Work on firm culture is embedded in the work of our supervisors and is an important priority for the FCA. As a reminder the FCA requires firms to take reasonable care to establish and maintain systems and controls that are effective for countering the risk that the firm may be used to further financial crime FCA. 1An effective AML and sanctions control framework depends on senior management setting and enforcing a clear level of risk appetite and embedding a culture of compliance where financial crime is not acceptable. Essays in our Discussion Paper on transforming culture in financial services indicate that culture is about encouraging and incentivising good things not just stopping bad things from happening.

Source: fca.org.uk

Source: fca.org.uk

FCA highlighted the Linear Investments case as highlighting the need for firms to have effective surveillance in place and not just rely on others. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules prescribe in detail how firms have to do this. Authoritys FCA latest business plan describes firms culture along with governance as pivotal to building public trust and confidence in UK financial services3 While regulators do not prescribe a firms culture they expect boards to exert strong cultural leadership and take responsibility for establishing and overseeing the right. Culture in financial services is widely accepted as a key root cause of the major conduct failings that have occurred within the industry in recent history. At a few banks the general AML culture was a concern with senior management andor compliance challenging us about the whole point of the AML regime or the need to identify PEPs.

Source: sanctionsassociation.org

Source: sanctionsassociation.org

Nevertheless the FCA is steadfast on achieving this and its recent publication of the FCAs 201617. To be open and cooperative with the regulators. Our quick guide gives you the lowdown on the FCAs evolving approach to culture and conduct and a practical framework thatll help you master the basics. Among other findings were. If you cannot measure cultural alignment you cannot hope to measure or manage conduct risk.

Here the FCA has suggested that the purpose behind the culture is meaningful. Culture in financial services is widely accepted as a key root cause of the major conduct failings that have occurred within the industry in recent history. They apply to everyone in the firm and there are only five of them. Authoritys FCA latest business plan describes firms culture along with governance as pivotal to building public trust and confidence in UK financial services3 While regulators do not prescribe a firms culture they expect boards to exert strong cultural leadership and take responsibility for establishing and overseeing the right. Two of our biggest sanctions in the last 12 months related to failures to address financial crime and anti-money laundering AML risks.

Source: psplab.com

Source: psplab.com

Ad AML coverage from every angle. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules prescribe in detail how firms have to do this. Ad AML coverage from every angle. Recent FCA notices found systemic weaknesses or failures in the banks AML systems and controls and repeatedly noted that these failings were at all levels of the business and management. Two of our biggest sanctions in the last 12 months related to failures to address financial crime and anti-money laundering AML risks.

Source: pinterest.com

Source: pinterest.com

Work on firm culture is embedded in the work of our supervisors and is an important priority for the FCA. This suggests that some form of meaning behind AML systems and controls is required for them to be. FCA highlighted the Linear Investments case as highlighting the need for firms to have effective surveillance in place and not just rely on others. The primary driver of ML risk is the customer a risk exacerbated by the fact that orders are routed through multiple firms with no-one being able to see the full chain are more responsible than them for preventing money laundering. Ad AML coverage from every angle.

Source: pinterest.com

Source: pinterest.com

Our quick guide gives you the lowdown on the FCAs evolving approach to culture and conduct and a practical framework thatll help you master the basics. Culture in financial services is widely accepted as a key root cause of the major conduct failings that have occurred within the industry in recent history. We expect firms to foster cultures which support the spirit of regulation in preventing harm to consumers and markets. The primary driver of ML risk is the customer a risk exacerbated by the fact that orders are routed through multiple firms with no-one being able to see the full chain are more responsible than them for preventing money laundering. We currently have 42 investigations ongoing into firms and individuals involving for example systems and controls over politically exposed persons customers with significant cash intensive operations correspondent banking and trade finance and transaction.

Source: p2pfinancenews.co.uk

Source: p2pfinancenews.co.uk

Examples of good practice include. Our quick guide gives you the lowdown on the FCAs evolving approach to culture and conduct and a practical framework thatll help you master the basics. They apply to everyone in the firm and there are only five of them. Ad AML coverage from every angle. During 2014 the FCA said one of its key areas of focus in its deep dive assessments was AML and financial controls.

Source: regulationasia.com

Source: regulationasia.com

To pay due regard to the interests of customers and treat customers fairly and to observe proper standards of market conduct. Essays in our Discussion Paper on transforming culture in financial services indicate that culture is about encouraging and incentivising good things not just stopping bad things from happening. Here the FCA has suggested that the purpose behind the culture is meaningful. An AML supervision strategy was launched by the FCA in 201314 and the regulator has also increased its use of attestations on financial crime issues with large and small firms. We expect firms to foster cultures which support the spirit of regulation in preventing harm to consumers and markets.

Source: pinterest.com

Source: pinterest.com

Two of our biggest sanctions in the last 12 months related to failures to address financial crime and anti-money laundering AML risks. Work on firm culture is embedded in the work of our supervisors and is an important priority for the FCA. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules prescribe in detail how firms have to do this. 1An effective AML and sanctions control framework depends on senior management setting and enforcing a clear level of risk appetite and embedding a culture of compliance where financial crime is not acceptable. An AML supervision strategy was launched by the FCA in 201314 and the regulator has also increased its use of attestations on financial crime issues with large and small firms.

Source: osborneclarke.com

Source: osborneclarke.com

Senior management taking leadership on AML and sanctions issues for example through everyday decision-making and staff communications. Examples of good practice include. As a reminder the FCA requires firms to take reasonable care to establish and maintain systems and controls that are effective for countering the risk that the firm may be used to further financial crime FCA. Work on firm culture is embedded in the work of our supervisors and is an important priority for the FCA. To pay due regard to the interests of customers and treat customers fairly and to observe proper standards of market conduct.

Source: fca.org.uk

Source: fca.org.uk

Given its impact firms culture is a priority for the FCA. Essays in our Discussion Paper on transforming culture in financial services indicate that culture is about encouraging and incentivising good things not just stopping bad things from happening. Our quick guide gives you the lowdown on the FCAs evolving approach to culture and conduct and a practical framework thatll help you master the basics. Latest news reports from the medical literature videos from the experts and more. Given its impact firms culture is a priority for the FCA.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca aml culture by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas