16+ Fca aml definition info

Home » about money loundering Info » 16+ Fca aml definition infoYour Fca aml definition images are ready in this website. Fca aml definition are a topic that is being searched for and liked by netizens today. You can Find and Download the Fca aml definition files here. Get all free vectors.

If you’re searching for fca aml definition images information related to the fca aml definition interest, you have visit the right site. Our site frequently provides you with hints for seeking the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

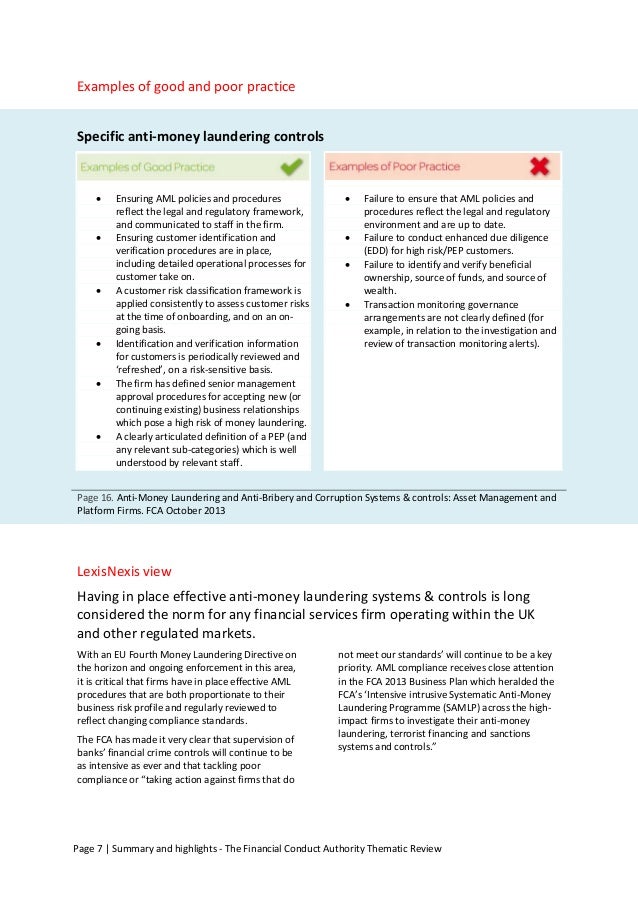

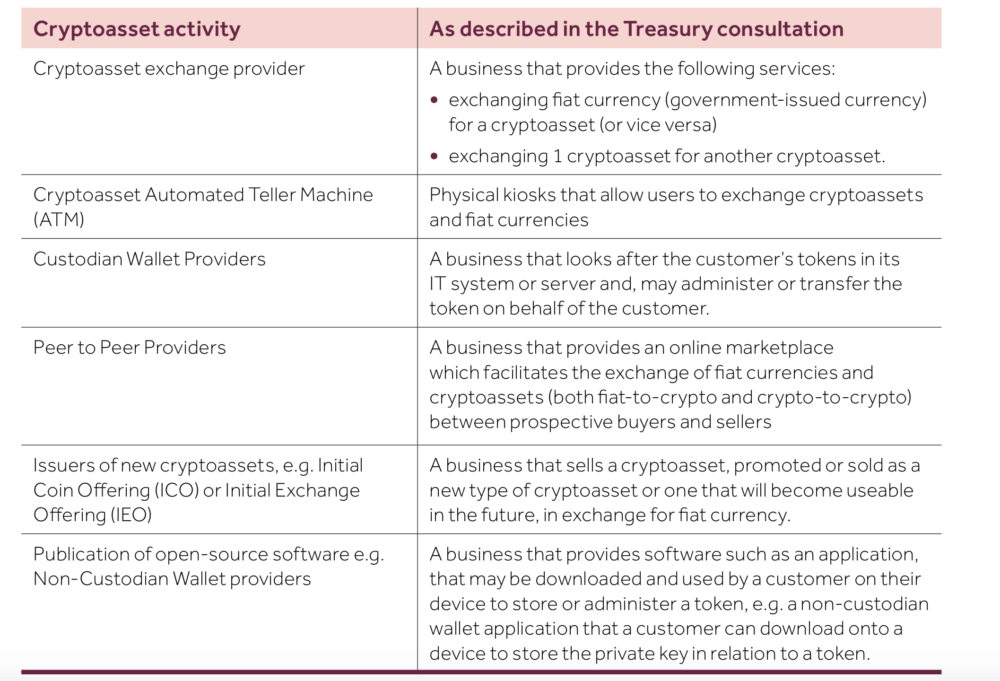

Fca Aml Definition. The AML failings identified by the FCA are wide-ranging covering top level governance right down to front line staff. The quality of the. Ownershipmanagement structure including the possible impactinfluence that ultimate beneficial owners with political connections may have. Which cryptoassets are regulated under the FCA crypto asset AML regime.

Registration Of Cryptoasset Businesses Under The Uk Aml Regulations Don T Let It Be Your Cryptonite Perspectives Reed Smith Llp From reedsmith.com

Registration Of Cryptoasset Businesses Under The Uk Aml Regulations Don T Let It Be Your Cryptonite Perspectives Reed Smith Llp From reedsmith.com

Ownershipmanagement structure including the possible impactinfluence that ultimate beneficial owners with political connections may have. The definition of a cryptoasset in the MLRs is quite broad. In March 2021 the FCA charged a bank with an offence of failing to adhere to requirements under the Money Laundering Regulations 2007 which was the legislation that preceded and has now been repealed by the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Regulations Money Laundering Offence - Defined Explained and Expanded One of the main changes the 6AMLD provides is the definition. FCA becomes AML and CTF supervisor of UK cryptoasset activities. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. The risk-based approach means a focus on outputs.

This report sets out our obligations relating to anti-money laundering our approach to carrying out those obligations and the trends and emerging risks in money laundering that we are seeing in the firms we regulate.

They are capable of. The FCAs concern is that without a robust SAR process in place employees are unlikely to know what to do in the event of suspicious activity and risk tipping off the customer. Update on on-going process also. The risk-based approach means a focus on outputs. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. 149 rows AML Anti-money laundering.

Source: a-teaminsight.com

Source: a-teaminsight.com

They are capable of. The AML failings identified by the FCA are wide-ranging covering top level governance right down to front line staff. They are capable of. 149 rows AML Anti-money laundering. Ad AML coverage from every angle.

Source: fadilozturk.com

Source: fadilozturk.com

Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. The AML failings identified by the FCA are wide-ranging covering top level governance right down to front line staff. Within the main body of the Handbook the definition of politically exposed person has been updated to reflect the changes made in the AMLCFT Code that came into force on 1 June 2019. Appendix Da and Appendix Db have been amended to reflect the FATF statement issued on 21 June 2019 and the FATFs statement entitled Improving Global AMLCFT Compliance. And to meet the.

Source: psplab.com

Source: psplab.com

Ownershipmanagement structure including the possible impactinfluence that ultimate beneficial owners with political connections may have. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. A firm that is a20 management company or an operator of an electronic system in relation to lending 20 must taking into4account the nature scale and complexity of its business and the nature and range of financial services and activities8 undertaken in the course of that business establish implement and maintain adequate policies and procedures designed to detect any risk of failure by the firm to comply. Update on on-going process also. The risk-based approach means a focus on outputs.

Source: slideshare.net

Source: slideshare.net

This report sets out our obligations relating to anti-money laundering our approach to carrying out those obligations and the trends and emerging risks in money laundering that we are seeing in the firms we regulate. In March 2021 the FCA charged a bank with an offence of failing to adhere to requirements under the Money Laundering Regulations 2007 which was the legislation that preceded and has now been repealed by the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Regulations Money Laundering Offence - Defined Explained and Expanded One of the main changes the 6AMLD provides is the definition. The definition of a cryptoasset in the MLRs is quite broad. Regular assessments of correspondent banking risks taking into account various money laundering risk factors such as the country and its AML regime. The FCAs concern is that without a robust SAR process in place employees are unlikely to know what to do in the event of suspicious activity and risk tipping off the customer.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

The FCAs concern is that without a robust SAR process in place employees are unlikely to know what to do in the event of suspicious activity and risk tipping off the customer. And to meet the. Annex I financial institution. Latest news reports from the medical literature videos from the experts and more. Which cryptoassets are regulated under the FCA crypto asset AML regime.

Source: slideserve.com

Source: slideserve.com

Ad AML coverage from every angle. In March 2021 the FCA charged a bank with an offence of failing to adhere to requirements under the Money Laundering Regulations 2007 which was the legislation that preceded and has now been repealed by the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Regulations Money Laundering Offence - Defined Explained and Expanded One of the main changes the 6AMLD provides is the definition. 149 rows AML Anti-money laundering. FCA becomes AML and CTF supervisor of UK cryptoasset activities. The FCAs concern is that without a robust SAR process in place employees are unlikely to know what to do in the event of suspicious activity and risk tipping off the customer.

Source: psplab.com

Source: psplab.com

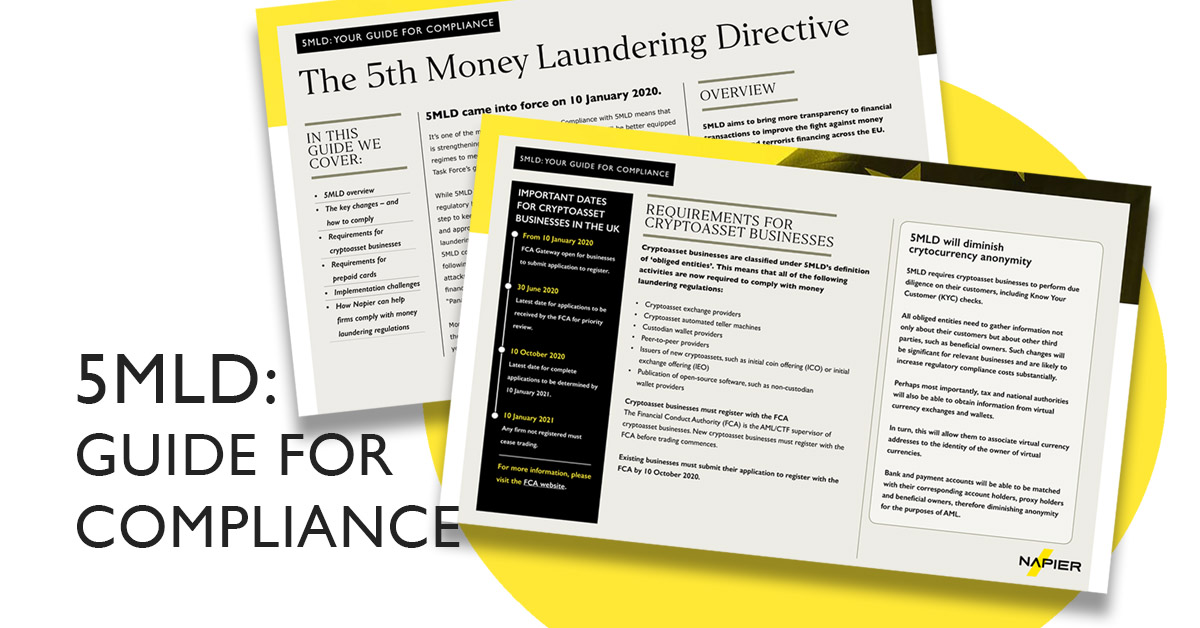

The FCA is now the anti-money laundering and counter terrorist financing AMLCTF supervisor for businesses carrying out certain cryptoasset activities under the amended Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 MLRs. A firm that is a20 management company or an operator of an electronic system in relation to lending 20 must taking into4account the nature scale and complexity of its business and the nature and range of financial services and activities8 undertaken in the course of that business establish implement and maintain adequate policies and procedures designed to detect any risk of failure by the firm to comply. The risk-based approach means a focus on outputs. Ad AML coverage from every angle. They are capable of.

Source: financefeeds.com

Source: financefeeds.com

They are capable of. These cookies are set by a range of social media services that we have added to the site to enable you to share our content with your friends and networks. Appendix Da and Appendix Db have been amended to reflect the FATF statement issued on 21 June 2019 and the FATFs statement entitled Improving Global AMLCFT Compliance. But it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk that they may be used to handle the proceeds from crime. The FCA is now the anti-money laundering and counter terrorist financing AMLCTF supervisor for businesses carrying out certain cryptoasset activities under the amended Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 MLRs.

Source: reedsmith.com

Source: reedsmith.com

Ad AML coverage from every angle. The quality of the. They are capable of. It is a crypto-secured digitalised representation of value or contractual rights running on a form of DLT including blockchain that is capable of being transferred stored or traded by electronic means. Appendix Da and Appendix Db have been amended to reflect the FATF statement issued on 21 June 2019 and the FATFs statement entitled Improving Global AMLCFT Compliance.

Source: psplab.com

Source: psplab.com

They are capable of. In March 2021 the FCA charged a bank with an offence of failing to adhere to requirements under the Money Laundering Regulations 2007 which was the legislation that preceded and has now been repealed by the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Regulations Money Laundering Offence - Defined Explained and Expanded One of the main changes the 6AMLD provides is the definition. This report sets out our obligations relating to anti-money laundering our approach to carrying out those obligations and the trends and emerging risks in money laundering that we are seeing in the firms we regulate. 149 rows AML Anti-money laundering. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

The FCA is now the anti-money laundering and counter terrorist financing AMLCTF supervisor for businesses carrying out certain cryptoasset activities under the amended Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 MLRs. The FCAs concern is that without a robust SAR process in place employees are unlikely to know what to do in the event of suspicious activity and risk tipping off the customer. This report sets out our obligations relating to anti-money laundering our approach to carrying out those obligations and the trends and emerging risks in money laundering that we are seeing in the firms we regulate. But it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk that they may be used to handle the proceeds from crime. The risk-based approach to anti-money laundering.

Source: slideshare.net

Source: slideshare.net

Latest news reports from the medical literature videos from the experts and more. 1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediaries. Which cryptoassets are regulated under the FCA crypto asset AML regime. This report sets out our obligations relating to anti-money laundering our approach to carrying out those obligations and the trends and emerging risks in money laundering that we are seeing in the firms we regulate. Annex I financial institution.

Source: hirett.co.uk

Source: hirett.co.uk

Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. A firm that is a20 management company or an operator of an electronic system in relation to lending 20 must taking into4account the nature scale and complexity of its business and the nature and range of financial services and activities8 undertaken in the course of that business establish implement and maintain adequate policies and procedures designed to detect any risk of failure by the firm to comply. This report sets out our obligations relating to anti-money laundering our approach to carrying out those obligations and the trends and emerging risks in money laundering that we are seeing in the firms we regulate. Ad AML coverage from every angle. FCA becomes AML and CTF supervisor of UK cryptoasset activities.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca aml definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas