15+ Fca aml outsourcing ideas in 2021

Home » about money loundering Info » 15+ Fca aml outsourcing ideas in 2021Your Fca aml outsourcing images are ready. Fca aml outsourcing are a topic that is being searched for and liked by netizens today. You can Find and Download the Fca aml outsourcing files here. Find and Download all free vectors.

If you’re looking for fca aml outsourcing pictures information connected with to the fca aml outsourcing topic, you have pay a visit to the right blog. Our site frequently provides you with hints for downloading the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Fca Aml Outsourcing. The FCA has three proactive programmes for AML supervision. In most instances a firm would be outsourcing when they are involved in an arrangement where a service provider performs a process service or activity on behalf of a firm which the firm would otherwise carry out itself. We did not assess other services the EMIs provided such as money remittance. In June 2020 the FCA issued a 378m fine to Commerzbank London for its failures to put in place adequate AML systems and controls between October 2012 and September 2017.

Know Your Compliance Fca Templates Aml Policy Gdpr Templates From knowyourcompliance.com

Know Your Compliance Fca Templates Aml Policy Gdpr Templates From knowyourcompliance.com

FINRA reviews a firms compliance with AML rules under FINRA Rule. The FCAs Handbook Glossary sets out the definition of outsourcing. We also provide policy templates and procedures for the UK GDPR AML Market Abuse Information. In June 2020 the FCA issued a 378m fine to Commerzbank London for its failures to put in place adequate AML systems and controls between October 2012 and September 2017. Despite the reviews narrow scope the FCAs findings are readily applicable to other outsourcing contexts so regulated firms outside the life insurance sector should be aware of these. Suitable for those looking to comly with the FCA Handbook rules or to gain FCA authorisation.

FCA have specific Rules on outsourcing contained in SYSC 8 which sets out their expectation of matters that UK firms should address when considering outsourcing any functions to a Group unit or a third party entity.

We also excluded activities outside the FCAs supervisory remit including gift cards that can be used only within a limited network or. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. Ad AML coverage from every angle. The FCA will not hesitate to use its criminal civil and regulatory powers where appropriate. In most instances a firm would be outsourcing when they are involved in an arrangement where a service provider performs a process service or activity on behalf of a firm which the firm would otherwise carry out itself. Institutions referred to as EMIs to assess their anti-money laundering AML and counter-terrorist financing CTF controls.

Source: knowyourcompliance.com

Source: knowyourcompliance.com

The FCA will continue to apply the FCA FG165 Guidance for firms outsourcing to the cloud and other thirdparty IT ser- vices in the UK. Cryptos Estonia FIU. Outsourcing is a written arrangement of any kind between a regulated financial service provider and a service provider whether regulated or unregulated whereby the service provider performs an activity which would otherwise be performed by the regulated firm. We can also liaise with your accounting function to ensure that the crucial regulatory filings through FCA Gabriel are made accurately and on time. The FCA has stated that they will keep this guidance under review and where appropriate consult to update this to ensure it remains.

Source: shuftipro.com

Source: shuftipro.com

FCA have specific Rules on outsourcing contained in SYSC 8 which sets out their expectation of matters that UK firms should address when considering outsourcing any functions to a Group unit or a third party entity. The importance the financial regulators place on effective oversight and management of outsourcing arrangements has been highlighted by both the PRA and the FCA in the fines they have imposed totalling 1887252 on RRaphael Sons plc the Bank for failing to manage its outsourcing arrangements properly. Know Your Compliance Limited specialise in developing FCA Policy Templates and regulatory compliance policies procedures checklists and training packages. We can also liaise with your accounting function to ensure that the crucial regulatory filings through FCA Gabriel are made accurately and on time. FCA have specific Rules on outsourcing contained in SYSC 8 which sets out their expectation of matters that UK firms should address when considering outsourcing any functions to a Group unit or a third party entity.

Source: planetcompliance.com

Source: planetcompliance.com

Outsourcing may affect a firms exposure to operational risk through significant changes to and reduced control over people processes and systems used in outsourced activities. With the one year implementation period now in full flight it runs 31 March 2021 until 31 March 2022 this post provides a reminder of the policy objectives key dates and goals that firms should be. The Financial Conduct Authority is consulting on guidance for financial institutions when outsourcing to the cloud and other third-party IT services. Commerzbank London undertook a significant remediation exercise to bring its AML controls into compliance. FCA have specific Rules on outsourcing contained in SYSC 8 which sets out their expectation of matters that UK firms should address when considering outsourcing any functions to a Group unit or a third party entity.

We did not assess other services the EMIs provided such as money remittance. Know Your Compliance Limited specialise in developing FCA Policy Templates and regulatory compliance policies procedures checklists and training packages. In June 2020 the FCA issued a 378m fine to Commerzbank London for its failures to put in place adequate AML systems and controls between October 2012 and September 2017. FINRA reviews a firms compliance with AML rules under FINRA Rule. Despite the reviews narrow scope the FCAs findings are readily applicable to other outsourcing contexts so regulated firms outside the life insurance sector should be aware of these.

Source: skillcast.com

Source: skillcast.com

In November 2015 the FCA published a consultation paper entitled Proposed guidance for firms outsourcing to the cloud and other. This section provides additional guidance on managing outsourcing arrangements and will be relevant to some extent to other forms of third party dependency in relation to operational risk. Institutions referred to as EMIs to assess their anti-money laundering AML and counter-terrorist financing CTF controls. FCA have specific Rules on outsourcing contained in SYSC 8 which sets out their expectation of matters that UK firms should address when considering outsourcing any functions to a Group unit or a third party entity. We also provide policy templates and procedures for the UK GDPR AML Market Abuse Information.

Source: knowyourcompliance.com

Source: knowyourcompliance.com

In a speech by Mark Steward Executive Director of Enforcement and Market Oversight on 24 March at the AML and ABC Forum the FCA has further reinforced its role in policing firms Anti Money Laundering AML systems and controls. AML Policies and Procedures. In March this year the FCA and PRA issued their finalised policies on operational resilience outsourcing and third party risk management our earlier post provides an introduction to these. The FCA has three proactive programmes for AML supervision. Suitable for those looking to comly with the FCA Handbook rules or to gain FCA authorisation.

Source: twitter.com

Source: twitter.com

Know Your Compliance Limited specialise in developing FCA Policy Templates and regulatory compliance policies procedures checklists and training packages. Cryptos Estonia FIU. This section provides additional guidance on managing outsourcing arrangements and will be relevant to some extent to other forms of third party dependency in relation to operational risk. Outsourcing is a written arrangement of any kind between a regulated financial service provider and a service provider whether regulated or unregulated whereby the service provider performs an activity which would otherwise be performed by the regulated firm. We did not assess other services the EMIs provided such as money remittance.

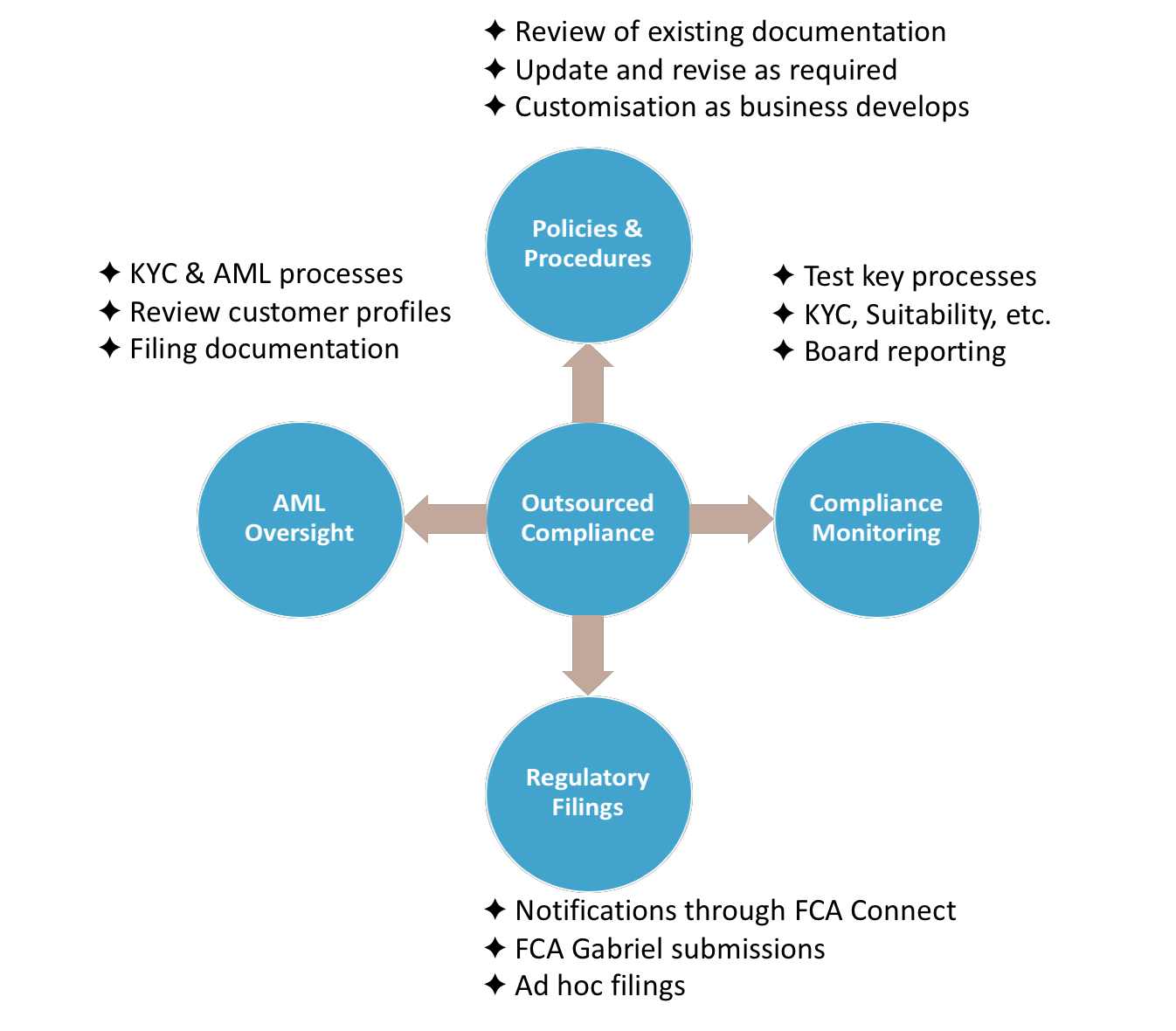

Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. AML Oversight While the responsibility for complying with AMLCTF legislation will still rely with the firm RiskSave can undertake the daily processes of ensuring compliance as well as the periodic review of customer files to ensure that profiles are kept up to date. The FCA has stated that they will keep this guidance under review and where appropriate consult to update this to ensure it remains. In June 2020 the FCA issued a 378m fine to Commerzbank London for its failures to put in place adequate AML systems and controls between October 2012 and September 2017. Outsourcing may affect a firms exposure to operational risk through significant changes to and reduced control over people processes and systems used in outsourced activities.

Source: knowyourcompliance.com

Source: knowyourcompliance.com

Latest news reports from the medical literature videos from the experts and more. The firm its auditors the FCA 7 and any other relevant competent authority must have effective access to data related to the outsourced activities as well as to the business premises of the service provider. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. FINRA reviews a firms compliance with AML rules under FINRA Rule. With the one year implementation period now in full flight it runs 31 March 2021 until 31 March 2022 this post provides a reminder of the policy objectives key dates and goals that firms should be.

Suitable for those looking to comly with the FCA Handbook rules or to gain FCA authorisation. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. On 4 March 2020 the Financial Conduct Authority published a short set of findings from its review of outsourcing in the UK life insurance sector. The FCAs Handbook Glossary sets out the definition of outsourcing. We can also liaise with your accounting function to ensure that the crucial regulatory filings through FCA Gabriel are made accurately and on time.

Source: bovill.com

Source: bovill.com

Cryptos Estonia FIU. The FCA has three proactive programmes for AML supervision. In November 2015 the FCA published a consultation paper entitled Proposed guidance for firms outsourcing to the cloud and other. In March this year the FCA and PRA issued their finalised policies on operational resilience outsourcing and third party risk management our earlier post provides an introduction to these. Ad AML coverage from every angle.

Source: ocorian.com

Source: ocorian.com

We can also liaise with your accounting function to ensure that the crucial regulatory filings through FCA Gabriel are made accurately and on time. And the FCA 7 and any other relevant competent authority must be able to exercise those rights of access. The FCA has three proactive programmes for AML supervision. Outsourcing may affect a firms exposure to operational risk through significant changes to and reduced control over people processes and systems used in outsourced activities. The firm its auditors the FCA 7 and any other relevant competent authority must have effective access to data related to the outsourced activities as well as to the business premises of the service provider.

Source: knowyourcompliance.com

Source: knowyourcompliance.com

On 4 March 2020 the Financial Conduct Authority published a short set of findings from its review of outsourcing in the UK life insurance sector. The FCAs approach to AML supervision is a risk-based approach utilising information from the National risk assessment of money laundering and terrorist financing and the financial crime data return. And the FCA 7 and any other relevant competent authority must be able to exercise those rights of access. We also excluded activities outside the FCAs supervisory remit including gift cards that can be used only within a limited network or. The FCA has three proactive programmes for AML supervision.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fca aml outsourcing by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas