12++ Fca aml record keeping info

Home » about money loundering Info » 12++ Fca aml record keeping infoYour Fca aml record keeping images are ready. Fca aml record keeping are a topic that is being searched for and liked by netizens now. You can Download the Fca aml record keeping files here. Download all free photos.

If you’re looking for fca aml record keeping pictures information linked to the fca aml record keeping interest, you have visit the right site. Our site always gives you suggestions for seeking the maximum quality video and picture content, please kindly search and find more informative video content and images that match your interests.

Fca Aml Record Keeping. 1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediaries. In several smaller banks a tick-box approach to AML due diligence was noted. We are responsible for supervising how some consumer credit firms comply with the MLRs. The FCAs financial crime rules are set out in SYSC 63.

Ppt Kyc Anti Money Laundering Ca Ramesh Shetty Fca Disa Ica Cisa Usa Powerpoint Presentation Id 317809 From slideserve.com

Ppt Kyc Anti Money Laundering Ca Ramesh Shetty Fca Disa Ica Cisa Usa Powerpoint Presentation Id 317809 From slideserve.com

6 years from the date superseded. Financial institutions are additionally expected to integrate the FCAs reviews policy statements and anti-money laundering AML annual reports into their policies and procedures. 1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediaries. Failure to digest the number and detailed nature of such publications was specifically cited by the FCA in its recent assessment of Barclays oversights in managing risks posed by some of its high-risk customers. All reporting entities must keep records to comply with their AMLCTF obligations. Retention requirements are driven by multiple pieces of legislation.

These areas include but are not limited to.

The minimum compliance arrangements noted by the FCA include. Retention requirements are driven by multiple pieces of legislation. 1 if relating to a pension transfer pension conversion 4. Information required to evidence how the FCA operates on a day to day basis this will include processes procedures and evidence of operational decisions taken. As stated in rule. Record-keeping involves creating full and accurate records and storing and managing them.

Source:

Anti-money laundering record keeping. In several smaller banks a tick-box approach to AML due diligence was noted. Skills knowledge and expertise assessments. Pension opt-out or FSAVC indefinitely. Information required to evidence how the FCA operates on a day to day basis this will include processes procedures and evidence of operational decisions taken.

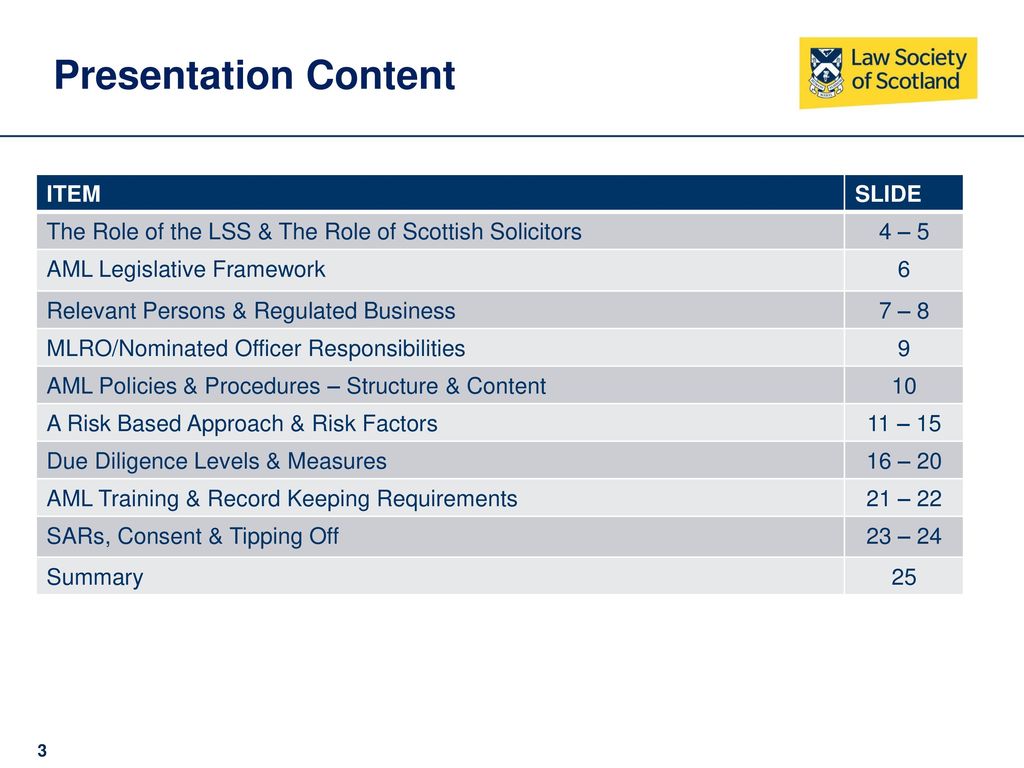

Source: slideplayer.com

Source: slideplayer.com

The minimum compliance arrangements noted by the FCA include. The records in 1 must be sufficient to enable the FCA to fulfil its supervisory tasks and to perform the enforcement actions under the regulatory system including MiFID MiFIR and the Market Abuse Regulation and in particular to ascertain that the common platform firm has complied with all obligations including those with respect to clients or potential clients and to the integrity of the market. Record keeping Keeping records of all customer identification documents and transactions to more easily investigate possible ML threats. We are responsible for supervising how some consumer credit firms comply with the MLRs. 2 if relating to a life policy personal pension scheme stakeholder pension scheme or.

Source: tookitaki.ai

Source: tookitaki.ai

Motor vehicle dealers who are insurers or who act as insurance intermediaries and solicitors also have record-keeping obligations to comply with the Financial Transactions Reports Act 1988. The records should be kept up to date as stated in the rule. These areas include but are not limited to. The records in 1 must be sufficient to enable the FCA to fulfil its supervisory tasks and to perform the enforcement actions under the regulatory system including MiFID MiFIR and the Market Abuse Regulation and in particular to ascertain that the common platform firm has complied with all obligations including those with respect to clients or potential clients and to the integrity of the market. Record keeping Keeping records of all customer identification documents and transactions to more easily investigate possible ML threats.

Source: slideplayer.com

Source: slideplayer.com

Financial institutions are additionally expected to integrate the FCAs reviews policy statements and anti-money laundering AML annual reports into their policies and procedures. Information security and Business continuity. The records should be kept up to date as stated in the rule. Motor vehicle dealers who are insurers or who act as insurance intermediaries and solicitors also have record-keeping obligations to comply with the Financial Transactions Reports Act 1988. To meet the criteria of record keeping it is recommended you consider the following Should a meeting between staff be held where AML CFT compliance is discussed ensure there is some type of written record of these discussions.

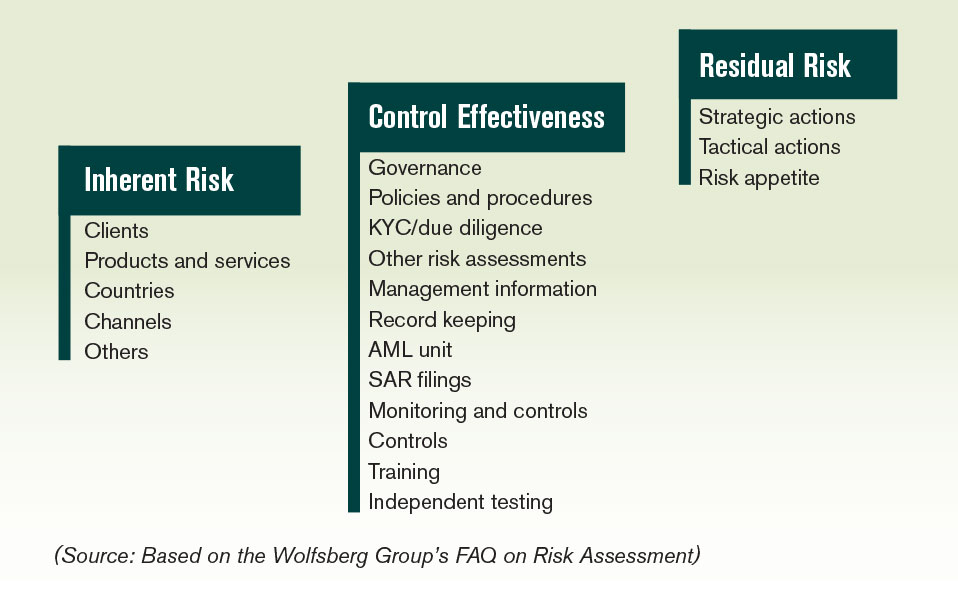

Source: acamstoday.org

Source: acamstoday.org

In this video we cover AMLCFT record keeping. The records should be kept up to date as stated in the rule. We are responsible for supervising how some consumer credit firms comply with the MLRs. Scope of the Applicants business. These are some of the tasks you are obliged to perform so your business is in line with AML requirements.

Source: sumsub.com

As stated in rule. The Fourth Money Laundering Directive came into effect on 26 June 2017 introducing a number of enhancements to previous requirements related to combatting money laundering and terrorist financing. SMCR compliance. In several smaller banks a tick-box approach to AML due diligence was noted. CMCOB 241 G 01042019.

Source: neopay.co.uk

Source: neopay.co.uk

Information required to evidence how the FCA operates on a day to day basis this will include processes procedures and evidence of operational decisions taken. 1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediaries. 2 if relating to a life policy personal pension scheme stakeholder pension scheme or. 1 if relating to a pension transfer pension conversion 4. Scope of responsibilities for certain approved persons of small non-directive insurers.

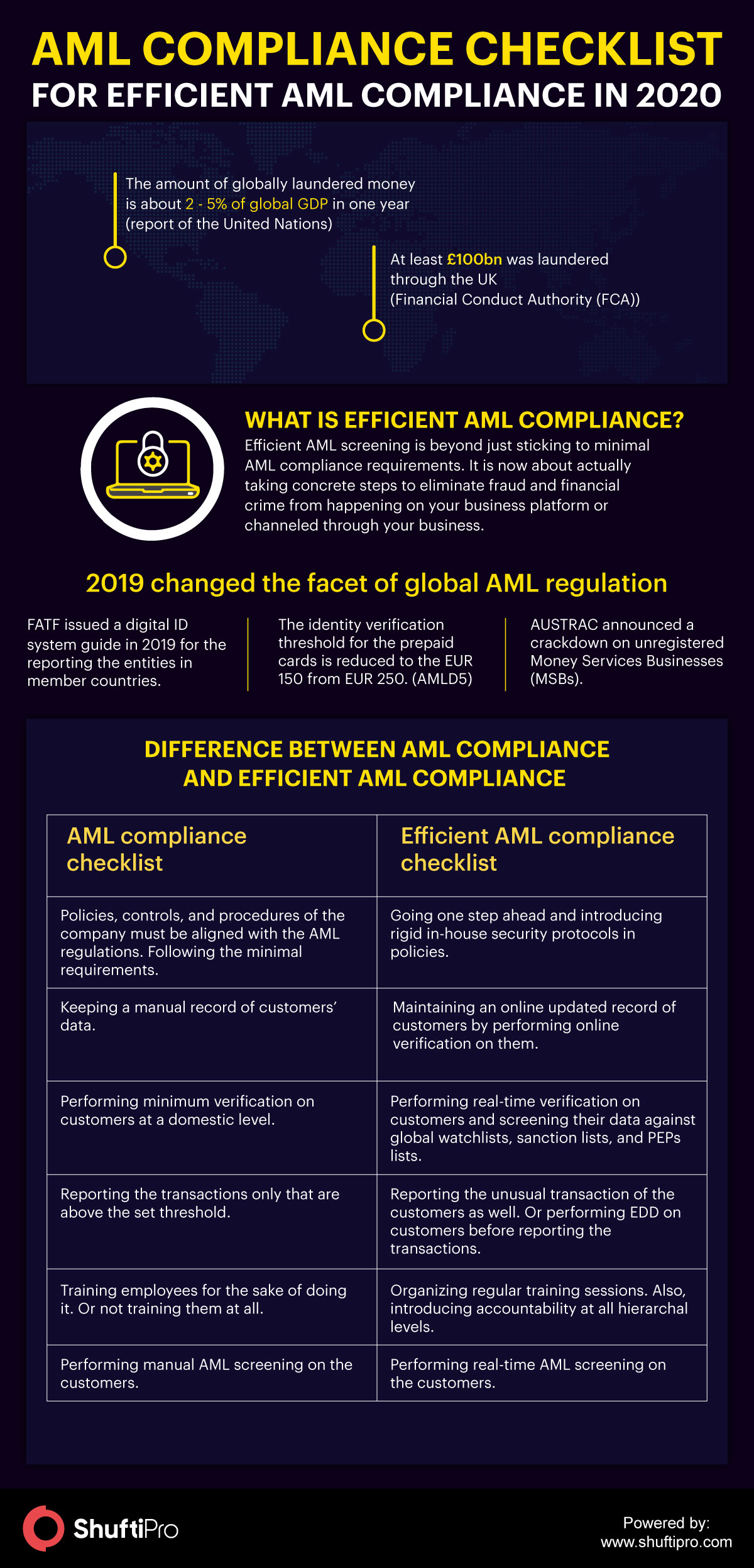

Source: shuftipro.com

Source: shuftipro.com

Skills knowledge and expertise assessments. Record keeping and management information. There are additional anti-money laundering AML rules in the Handbook for these firms set. As a minimum the FCA authorisation application process expects firms to have a compliance program or FCA Compliance Manual that covers all the areas noted in the full and limited permissions guidance notes. Retention requirements are driven by multiple pieces of legislation.

Source: slideshare.net

Source: slideshare.net

Record keeping Keeping records of all customer identification documents and transactions to more easily investigate possible ML threats. The records should be kept up to date as stated in the rule. There are additional anti-money laundering AML rules in the Handbook for these firms set. The Fourth Money Laundering Directive came into effect on 26 June 2017 introducing a number of enhancements to previous requirements related to combatting money laundering and terrorist financing. Anti-money laundering record keeping.

Source: hirett.co.uk

Source: hirett.co.uk

But it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk that they may be used to handle the proceeds from crime. 1 if relating to a pension transfer pension conversion 4. Record the date the staff who were in attendance and at least bullet points on the topics of discussion. As part of this changes were also introduced in relation to retaining and. Along with customer due diligence and suspicious transaction and activity reporting record keeping is corners.

Source:

Finance HR Key Retention Exception Drivers s Exceptions Exceptions rs s Exceptions Exceptions Exceptions rs rs. Scope of responsibilities for certain approved persons of small non-directive insurers. Record-keeping involves creating full and accurate records and storing and managing them. Record keeping Keeping records of all customer identification documents and transactions to more easily investigate possible ML threats. And to meet the.

Source: slideserve.com

Source: slideserve.com

Retention requirements are driven by multiple pieces of legislation. Firm must retain its records relating to suitability for a minimum of the following periods. Record the date the staff who were in attendance and at least bullet points on the topics of discussion. The records should be kept up to date as stated in the rule. Financial crime and AML procedures.

Source: protiviti.com

Source: protiviti.com

Scope of the Applicants business. Anti-money laundering record keeping. To meet the criteria of record keeping it is recommended you consider the following Should a meeting between staff be held where AML CFT compliance is discussed ensure there is some type of written record of these discussions. Record keeping Keeping records of all customer identification documents and transactions to more easily investigate possible ML threats. The Fourth Money Laundering Directive came into effect on 26 June 2017 introducing a number of enhancements to previous requirements related to combatting money laundering and terrorist financing.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fca aml record keeping by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas