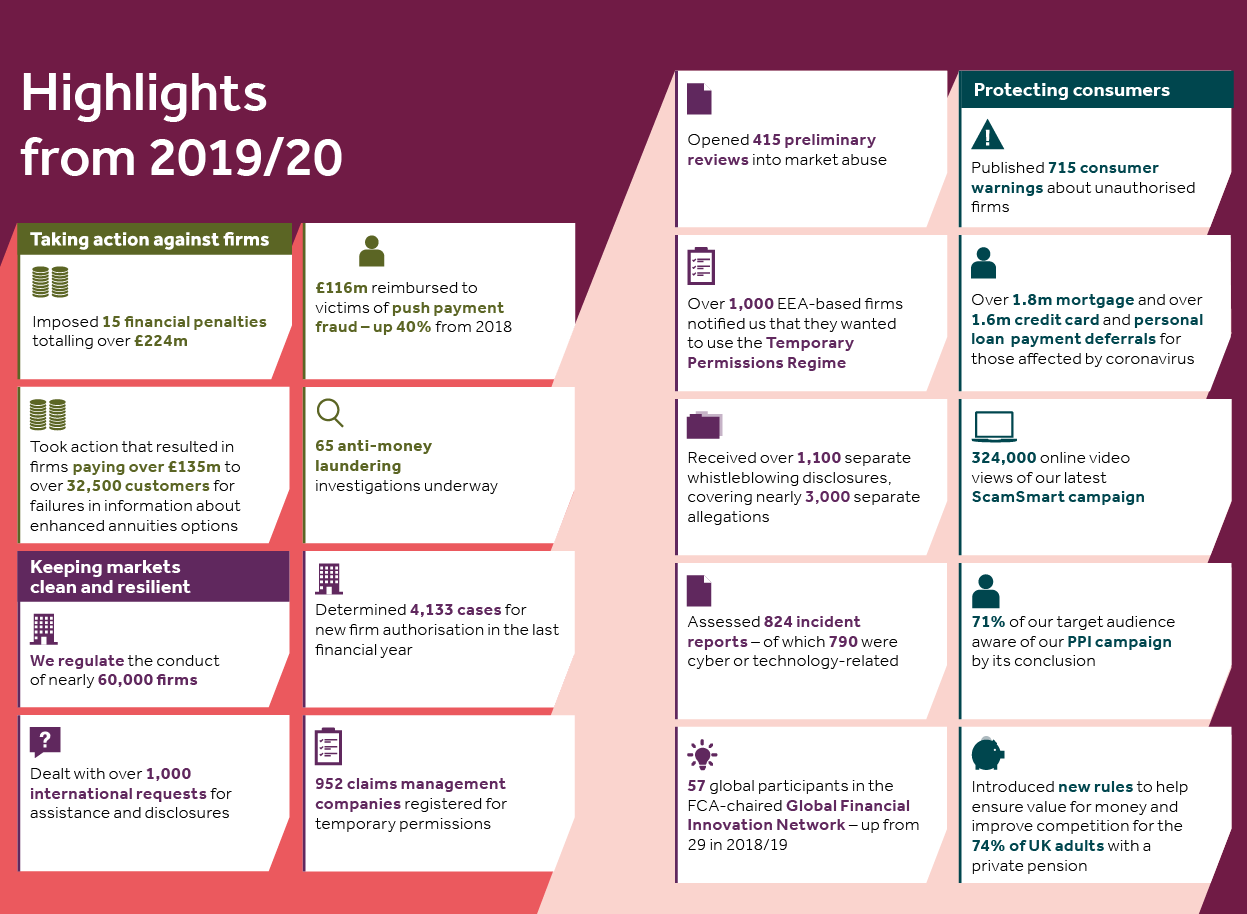

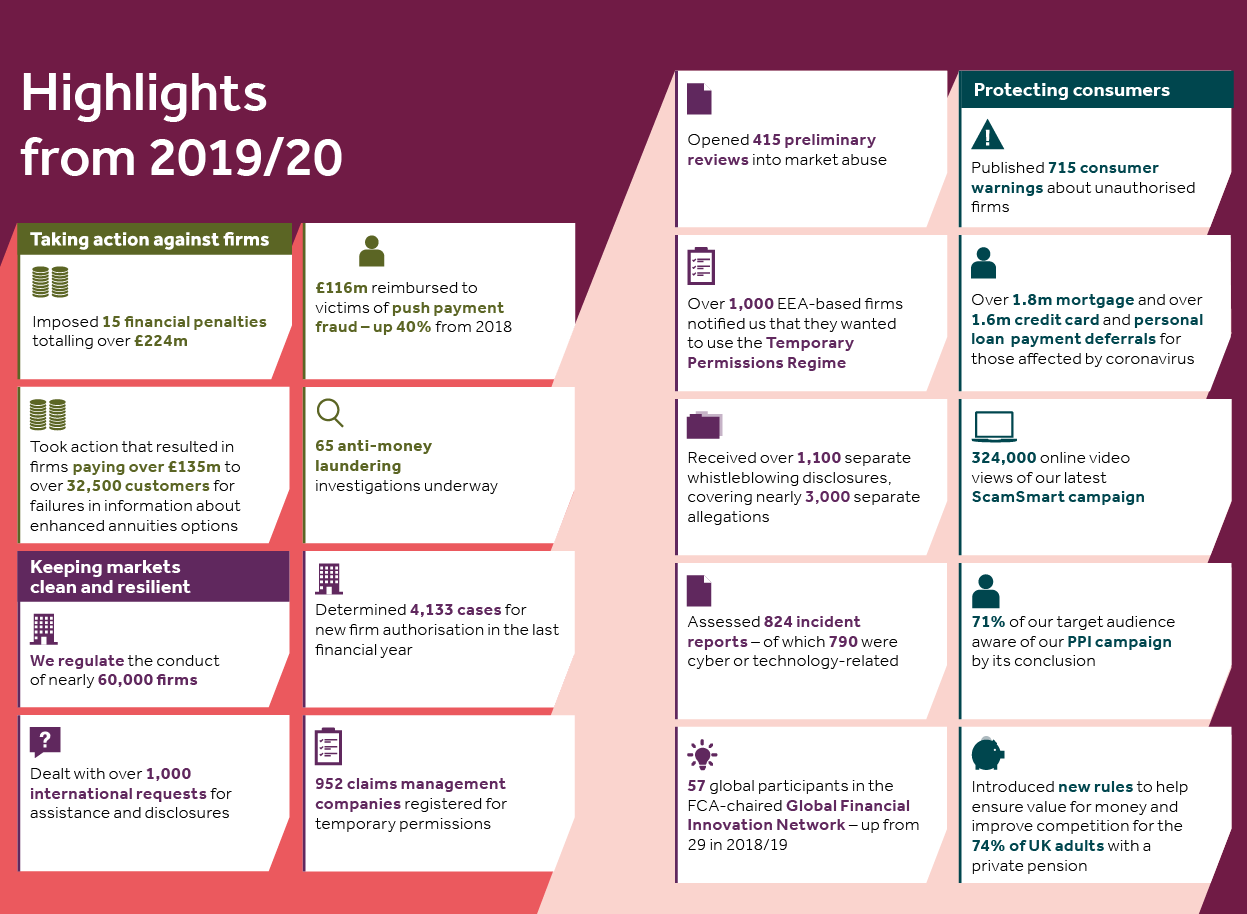

17++ Fca aml risk assessment ideas in 2021

Home » about money loundering Info » 17++ Fca aml risk assessment ideas in 2021Your Fca aml risk assessment images are ready in this website. Fca aml risk assessment are a topic that is being searched for and liked by netizens now. You can Find and Download the Fca aml risk assessment files here. Download all free photos.

If you’re looking for fca aml risk assessment images information related to the fca aml risk assessment keyword, you have pay a visit to the ideal site. Our website frequently gives you hints for refferencing the highest quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

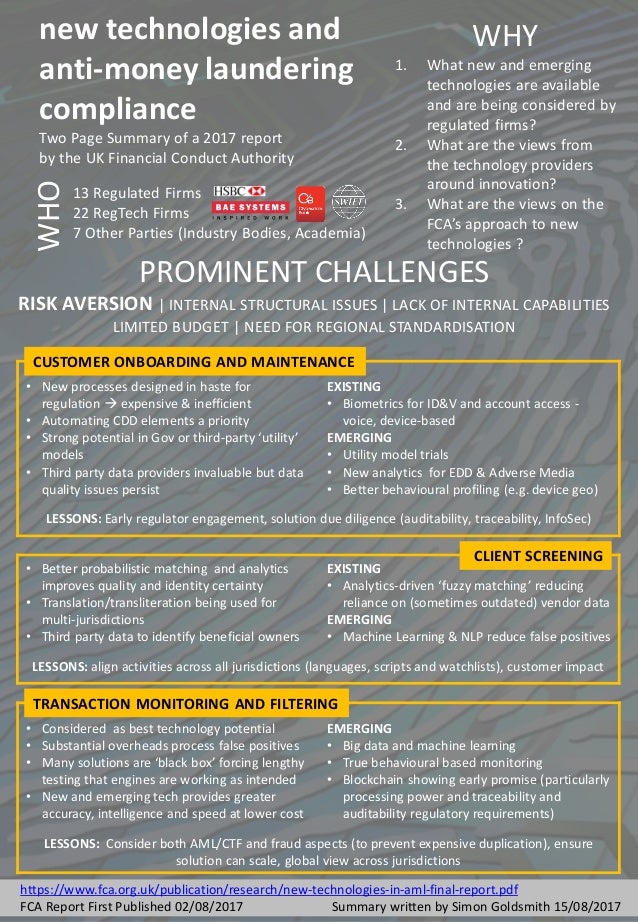

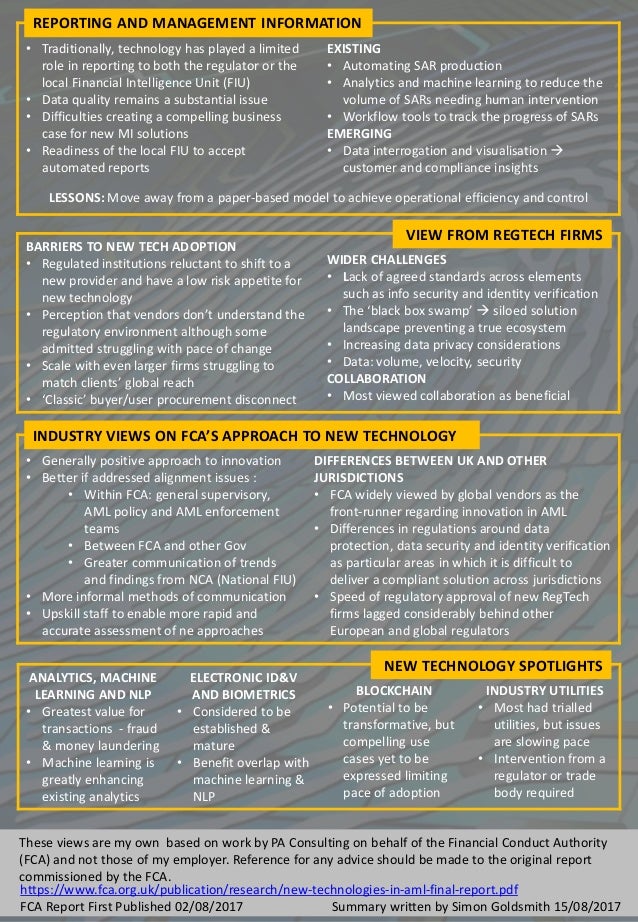

Fca Aml Risk Assessment. 2 unlikely may occur at some point. The FCA makes it clear in the reports introduction that. Risk assessment process has been highlighted by a number of recent enforcement actions. As the risks change over time your risk assessment will need to be kept up-to-date.

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An From financialcrimes.vercel.app

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An From financialcrimes.vercel.app

4 probable the event is likely to occur in most cases. The draft LSAG AML Guidance for the legal sector 2021 describes this high level risk assessment as the cornerstone of anti-money laundering compliance. What you should do. There are also issues with how the risk rating rationales are being. 0 - no likelihood of the risk factor impacting the business. Efforts to understand risk are piecemeal and lack coordination.

3 possible likely that the event will occur at some point.

They should seek to take into account the latest NRA findings and guidance when completing internal assessments. They note CRAs being too generic failing to recognise differences between AML and terrorist financing risks or between correspondent banking and trade finance products. Therefore Banks should review their triage process which identifies high medium and low risks and ensure that the appropriate sign-off process is in place and understood by the 3LOD. As the risks change over time your risk assessment will need to be kept up-to-date. 2 unlikely may occur at some point. They should seek to take into account the latest NRA findings and guidance when completing internal assessments.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

The draft LSAG AML Guidance for the legal sector 2021 describes this high level risk assessment as the cornerstone of anti-money laundering compliance. These questions will help you to consider whether your firms approach isappropriate. Customer risk assessments. 4 probable the event is likely to occur in most cases. The questions draw attention to some of the key points firms.

Source: biia.com

Source: biia.com

3 possible likely that the event will occur at some point. The firm assesses where risks are greater and concentrates its resources accordingly. Customer risk assessments. They note CRAs being too generic failing to recognise differences between AML and terrorist financing risks or between correspondent banking and trade finance products. They should seek to take into account the latest NRA findings and guidance when completing internal assessments.

Source: psplab.com

Source: psplab.com

These risk assessments should be properly documented with appropriate consideration being given to all relevant risks. Review existing AML risk assessments to ensure capital market-specific red flags and scenarios from. The draft LSAG AML Guidance for the legal sector 2021 describes this high level risk assessment as the cornerstone of anti-money laundering compliance. They should seek to take into account the latest NRA findings and guidance when completing internal assessments. The key risks and the methodology in place to assess the aggregate inherent risk profile of individual customers.

Source: slideshare.net

Source: slideshare.net

The questions draw attention to some of the key points firms. They note CRAs being too generic failing to recognise differences between AML and terrorist financing risks or between correspondent banking and trade finance products. Risk assessment process has been highlighted by a number of recent enforcement actions. The firms risk assessment is comprehensive. Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment.

Source: amlrightsource.com

Source: amlrightsource.com

Under Regulation 17 of the Money Laundering Regulations supervisors are required to undertake a risk assessment covering the international and domestic risks of money laundering. Risk assessments are incomplete. Risk assessment process has been highlighted by a number of recent enforcement actions. What you should do. The assessments highlight key risk areas how well those risks are managed and support a risk-based allocation of resource to the highest risk areas as well as the establishment of strategic more long term and tactical immediate workaround action plans for managing the identified risks.

Source: slideshare.net

Source: slideshare.net

The UKs National Risk Assessment NRA of Money Laundering and Terrorist Financing was published in 2020. Review existing AML risk assessments to ensure capital market-specific red flags and scenarios from. Risk assessment process has been highlighted by a number of recent enforcement actions. Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment. 0 - no likelihood of the risk factor impacting the business.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

The implications of this are that first line employees often do not own or fully understand the financial crime risk faced by the firm impacting their ability to identify and tackle potentially suspicious activity. 4 probable the event is likely to occur in most cases. There are also issues with how the risk rating rationales are being. Not only does it demonstrate that you have been through the required. Overcoming Common Challenges When Updating a Risk Assessment.

Source: pinterest.com

Source: pinterest.com

Text in brackets expands on this TheFCAmay followsimilar lines of inquirywhen discussing financial crime issues with firms. What you should do. The UKs National Risk Assessment NRA of Money Laundering and Terrorist Financing was published in 2020. Risk assessment process has been highlighted by a number of recent enforcement actions. Asset Management and Platform Firms.

Source: br.pinterest.com

Source: br.pinterest.com

It is also mandatory for regulated firms and supervisory authorities ie. The key risks and the methodology in place to assess the aggregate inherent risk profile of individual customers. It identifies assesses and mitigates the risks of money laundering and terrorist financing affecting the UK. Text in brackets expands on this TheFCAmay followsimilar lines of inquirywhen discussing financial crime issues with firms. These questions will help you to consider whether your firms approach isappropriate.

Source: asiatokenfund.com

Source: asiatokenfund.com

As the risks change over time your risk assessment will need to be kept up-to-date. It identifies assesses and mitigates the risks of money laundering and terrorist financing affecting the UK. Risk assessment is a one-off exercise. Efforts to understand risk are piecemeal and lack coordination. Risk assessments should be carried out regularly in order to identify assess and manage AML and ABC risks.

Source: tookitaki.ai

Source: tookitaki.ai

The draft LSAG AML Guidance for the legal sector 2021 describes this high level risk assessment as the cornerstone of anti-money laundering compliance. A n Enterprise Wide Risk Assessment EWRA enables FIs to assess their BSAAML risk profile incorporate appropriate risk management processes and maintain adequate controls to mitigate risk. Customer risk assessments. This is scored from 0 5. They should seek to take into account the latest NRA findings and guidance when completing internal assessments.

Source: ar.pinterest.com

Source: ar.pinterest.com

3 possible likely that the event will occur at some point. Under Regulation 17 of the Money Laundering Regulations supervisors are required to undertake a risk assessment covering the international and domestic risks of money laundering. The results of the risks assessments should be used to inform the implementation of additional controls if necessary. For lower risk factors the FCA expects first line of defence staff to document their assessment for accepting this risk at on-boarding and periodic review. Customer risk assessments.

Source: sumsub.com

A n Enterprise Wide Risk Assessment EWRA enables FIs to assess their BSAAML risk profile incorporate appropriate risk management processes and maintain adequate controls to mitigate risk. Customer risk assessments. Review existing AML risk assessments to ensure capital market-specific red flags and scenarios from. Central to meeting your AML obligations is a risk assessment of your firms business as it will help you develop effective and proportionate prevention procedures. The assessments highlight key risk areas how well those risks are managed and support a risk-based allocation of resource to the highest risk areas as well as the establishment of strategic more long term and tactical immediate workaround action plans for managing the identified risks.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca aml risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas