17+ Fca aml supervision info

Home » about money loundering Info » 17+ Fca aml supervision infoYour Fca aml supervision images are available in this site. Fca aml supervision are a topic that is being searched for and liked by netizens today. You can Download the Fca aml supervision files here. Download all royalty-free images.

If you’re looking for fca aml supervision images information linked to the fca aml supervision interest, you have come to the ideal blog. Our site always gives you hints for seeking the maximum quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

Fca Aml Supervision. The FCA is now the anti-money laundering and counter terrorist financing AMLCTF supervisor for businesses carrying out certain cryptoasset activities under the amended Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 MLRs. As from 10 January 2021 the FCA is the AML supervisor of cryptocurrency firms. OPBAS housed within the FCA ensures a robust and consistently high standard of AML supervision across the legal and accountancy sectors. Anti-Money Laundering Supervision by the Legal and Accountancy Professional Body Supervisors 17 PBSs have responded differently to the challenges they face.

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An From financialcrimes.vercel.app

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An From financialcrimes.vercel.app

Others have been less proactive in their approach. OPBAS housed within the FCA ensures a robust and consistently high standard of AML supervision across the legal and accountancy sectors. Any UK business conducting specific cryptoasset activities falls within scope of the. Any business which undertakes or expects to undertake cryptoasset activities to be formally confirmed by. This page highlights some specific new areas that firms need to comply with. HMRC delivers its supervisory responsibility through its Anti-Money Laundering Supervisory AMLS teams.

12 HMRC is one of 25 Anti-Money Laundering AML supervisors in the UK.

As from 10 January 2021 the FCA is the AML supervisor of cryptocurrency firms. Your business may already be supervised for example because youre authorised by the Financial Conduct Authority FCA or belong to a professional body like the Law Society. They update the UKs AML regime to incorporate international standards set by the Financial Action Task Force FATF and to transpose the EUs 5th Money Laundering Directive. While we do not regulate or supervise the cryptocurrency business these firms are required to be registered with the FCA and they are required to comply with the Money Laundering Regulations. The FCA has three proactive programmes for AML supervision. Faces effective and risk-based supervision by the FCA is critical to the overall effectiveness of the UKs AMLCTF regime.

Source: biia.com

Source: biia.com

As from 10 January 2021 the FCA is the AML supervisor of cryptocurrency firms. Any business which undertakes or expects to undertake cryptoasset activities to be formally confirmed by. We are the anti-money laundering and counter-terrorist financing AMLCTF supervisor of UK cryptoasset businesses under the MLRs. HMRC delivers its supervisory responsibility through its Anti-Money Laundering Supervisory AMLS teams. While we do not regulate or supervise the cryptocurrency business these firms are required to be registered with the FCA and they are required to comply with the Money Laundering Regulations.

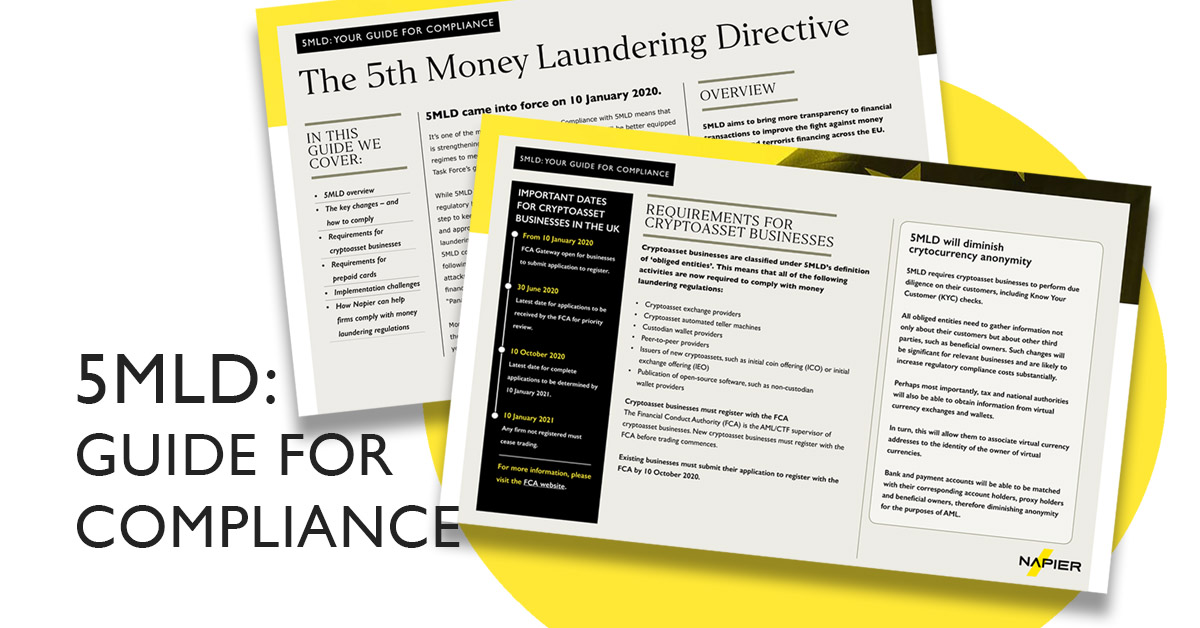

Source: napier.ai

Source: napier.ai

Any business which undertakes or expects to undertake cryptoasset activities to be formally confirmed by. Any UK business conducting specific cryptoasset activities falls within scope of the regulations and will need to comply with their requirements. Since 2015 the FCA has prioritised tackling financial crime and is committed to improving intelligence sharing with the government and relevant agencies and to use intelligence data and technology to. Your business may already be supervised for example because youre authorised by the Financial Conduct Authority FCA or belong to a professional body like the Law Society. As from 10 January 2021 the FCA is the AML supervisor of cryptocurrency firms.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

A Director of Enforcement at the Financial Conduct Authority FCA has set out some of the key challenges the regulator expects in its new role as AMLCTF anti-money launderingcounter terrorist financing supervisor for some types of crypto businesses. The FCA is now the anti-money laundering and counter terrorist financing AMLCTF supervisor for businesses carrying out certain cryptoasset activities under the amended Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 MLRs. Any business which undertakes or expects to undertake cryptoasset activities to be formally confirmed by. See IFA AML supervision for further information. Ensuring a robust and consistently high standard of supervision by the professional body AML supervisors PBSs overseeing the legal.

Source: sumsub.com

Anti-Money Laundering Supervision by the Legal and Accountancy Professional Body Supervisors 17 PBSs have responded differently to the challenges they face. While we do not regulate or supervise the cryptocurrency business these firms are required to be registered with the FCA and they are required to comply with the Money Laundering Regulations. OPBAS housed within the FCA ensures a robust and consistently high standard of AML supervision across the legal and accountancy sectors. 12 HMRC is one of 25 Anti-Money Laundering AML supervisors in the UK. This page highlights some specific new areas that firms need to comply with.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

On 10 January 2020 changes to the Governments Money Laundering Regulations came into force. The Office for Professional Body Anti-Money Laundering Supervision OPBAS is a new regulator set up by the government to strengthen the UKs anti-money laundering AML supervisory regime and ensure the professional body AML supervisors provide consistently high standards of AML supervision. Your business may already be supervised for example because youre authorised by the Financial Conduct Authority FCA or belong to a professional body like the Law Society. Faces effective and risk-based supervision by the FCA is critical to the overall effectiveness of the UKs AMLCTF regime. They update the UKs AML regime to incorporate international standards set by the Financial Action Task Force FATF and to transpose the EUs 5th Money Laundering Directive.

Source: fcpablog.com

Source: fcpablog.com

While we do not regulate or supervise the cryptocurrency business these firms are required to be registered with the FCA and they are required to comply with the Money Laundering Regulations. The Financial Conduct Authority FCA has become the anti-money laundering and counter terrorist financing AMLCTF supervisor for businesses carrying out certain cryptoasset activities. Since 2015 the FCA has prioritised tackling financial crime and is committed to improving intelligence sharing with the government and relevant agencies and to use intelligence data and technology to. As from 10 January 2021 the FCA is the AML supervisor of cryptocurrency firms. Any business which undertakes or expects to undertake cryptoasset activities to be formally confirmed by.

Source:

Regulated by the FCA for another purpose. OPBAS housed within the FCA ensures a robust and consistently high standard of AML supervision across the legal and accountancy sectors. Any UK business conducting specific cryptoasset activities falls within scope of the. Some have responded positively and implemented changes quickly. FCA sets out approach to AML crypto supervision.

Source: avyse.co.uk

Source: avyse.co.uk

The role of supervision in the AMLCFT framework is to supervise and monitor financial institutions to ensure their effective management of MLTF risk and compliance assessment and with AMLCFT preventive measures. The SAMLP has been running since early 2012 and currently covers 14 major. As part of the FCAs approach to AML supervision it undertakes a Systematic Anti-Money Laundering Programme SAMLP. 12 HMRC is one of 25 Anti-Money Laundering AML supervisors in the UK. The FCA has three proactive programmes for AML supervision.

Source:

A Director of Enforcement at the Financial Conduct Authority FCA has set out some of the key challenges the regulator expects in its new role as AMLCTF anti-money launderingcounter terrorist financing supervisor for some types of crypto businesses. The role of supervision in the AMLCFT framework is to supervise and monitor financial institutions to ensure their effective management of MLTF risk and compliance assessment and with AMLCFT preventive measures. The FCA has three proactive programmes for AML supervision. FCA sets out approach to AML crypto supervision. We are the anti-money laundering and counter-terrorist financing AMLCTF supervisor of UK cryptoasset businesses under the MLRs.

Source: sygna.io

Source: sygna.io

Your business may already be supervised for example because youre authorised by the Financial Conduct Authority FCA or belong to a professional body like the Law Society. The FCA has three proactive programmes for AML supervision. The Financial Conduct Authority FCA has become the anti-money laundering and counter terrorist financing AMLCTF supervisor for businesses carrying out certain cryptoasset activities. From 10 January 2020 the FCA will be the anti-money laundering and counter terrorist financing AMLCTF supervisor of UK cryptoassets businesses under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer. The role of supervision in the AMLCFT framework is to supervise and monitor financial institutions to ensure their effective management of MLTF risk and compliance assessment and with AMLCFT preventive measures.

Source: tookitaki.ai

Source: tookitaki.ai

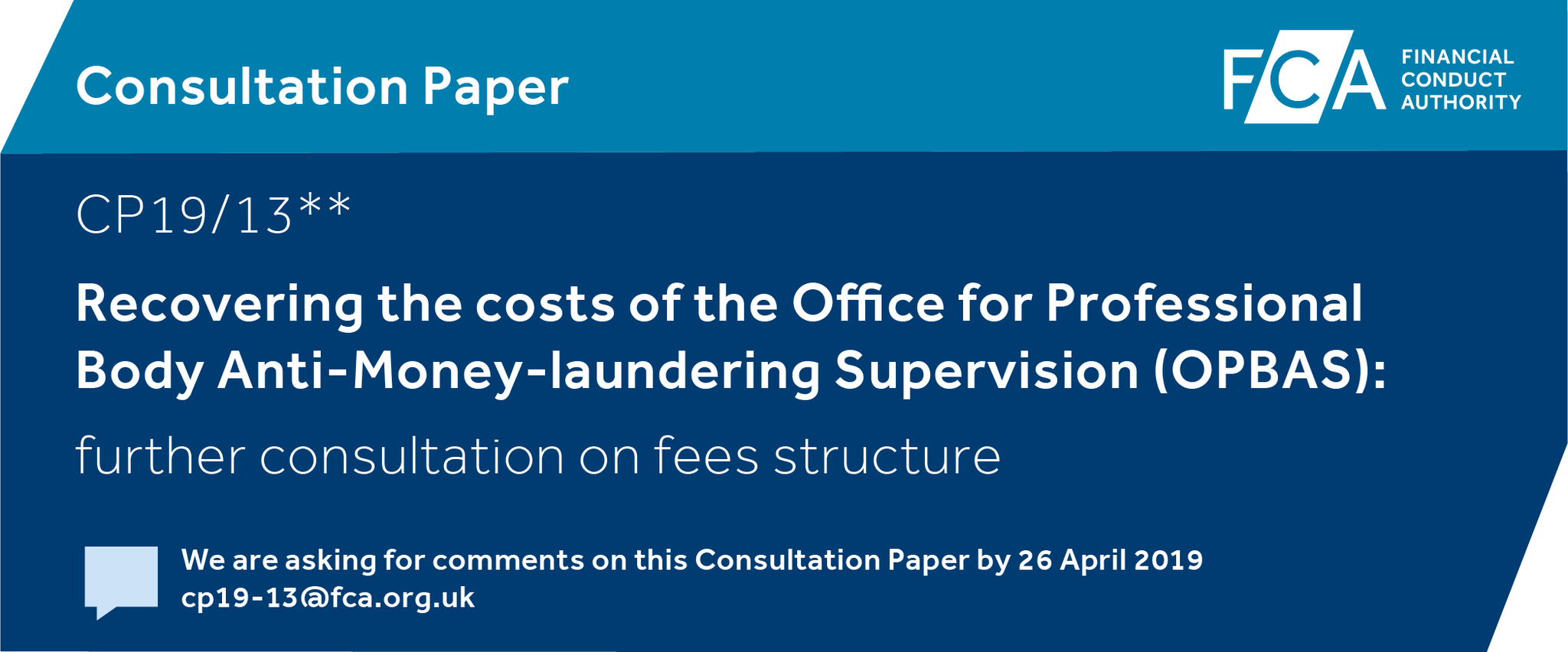

The role of supervision in the AMLCFT framework is to supervise and monitor financial institutions to ensure their effective management of MLTF risk and compliance assessment and with AMLCFT preventive measures. On 15 October 2019 the FCA published Consultation Paper CP1929 on its fee proposals for the recovery of costs of supervising cryptoasset businesses when it becomes the Anti-Money Laundering AMLCounter Terrorist Financing CTF supervisor for such businesses from 10 January 2020. Regulated by the FCA for another purpose. While we do not regulate or supervise the cryptocurrency business these firms are required to be registered with the FCA and they are required to comply with the Money Laundering Regulations. It also ensures better collaboration through information and intelligence sharing between professional body supervisors statutory AML supervisors HM Revenue and Customs the Gambling Commission and.

Source: twitter.com

Source: twitter.com

We are the anti-money laundering and counter-terrorist financing AMLCTF supervisor of UK cryptoasset businesses under the MLRs. See IFA AML supervision for further information. The SAMLP has been running since early 2012 and currently covers 14 major. The Financial Conduct Authority FCA has become the anti-money laundering and counter terrorist financing AMLCTF supervisor for businesses carrying out certain cryptoasset activities. OPBAS supervises the 25 professional body supervisors in the legal and accountancy sectors.

Source: fintech-alliance.com

Source: fintech-alliance.com

Since 2015 the FCA has prioritised tackling financial crime and is committed to improving intelligence sharing with the government and relevant agencies and to use intelligence data and technology to. Any business which undertakes or expects to undertake cryptoasset activities to be formally confirmed by. It also ensures better collaboration through information and intelligence sharing between professional body supervisors statutory AML supervisors HM Revenue and Customs the Gambling Commission and. From 10 January 2020 the FCA will be the anti-money laundering and counter terrorist financing AMLCTF supervisor of UK cryptoassets businesses under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer. Regulated by the FCA for another purpose.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fca aml supervision by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas