12++ Fca aml thematic review ideas in 2021

Home » about money loundering idea » 12++ Fca aml thematic review ideas in 2021Your Fca aml thematic review images are available. Fca aml thematic review are a topic that is being searched for and liked by netizens today. You can Find and Download the Fca aml thematic review files here. Get all royalty-free images.

If you’re looking for fca aml thematic review images information connected with to the fca aml thematic review keyword, you have pay a visit to the right site. Our website always gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

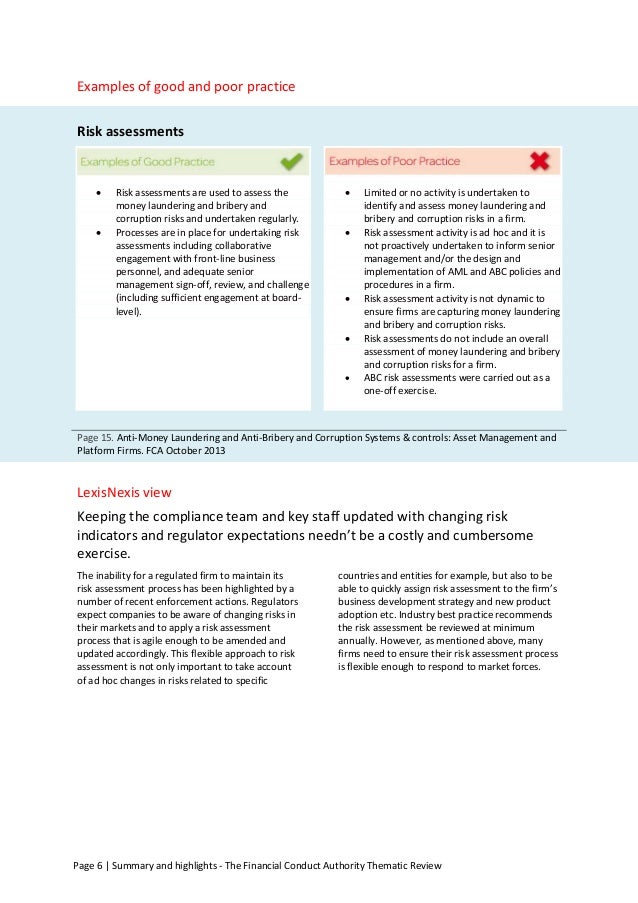

Fca Aml Thematic Review. In July 2007 theFSAundertook a review of the anti-money laundering AML systems and controls at severalFSA-regulated private banks. The FCAs latest review assessed the systems controls implemented by firms to tackle anti-money laundering and anti-bribery corruption within asset management and the platform sector. Understanding the money laundering risks in the capital markets. We use a thematic review to assess a current or emerging risk regarding an issue or product across a number of firms in a sector or market.

Https Www Handbook Fca Org Uk Handbook Document Fc Fc2 Fca 20160307 Pdf From

11 The aim of the thematic review was to increase our understanding of the risks of money laundering and terrorist financing in the e-money sector. The review covered 19 firms representing a broad range of market segments and participants and focused on secondary markets. The review was conducted in response to a report by theFSAsIntelligence team which had highlighted the high risk of. It includes the consolidated examples of good and poor practice that were included with the reviews findings. FCA found some risks specific to the markets which were not effectively mitigated by the nature of the firms involved and a lack of. Thematic reviews First published.

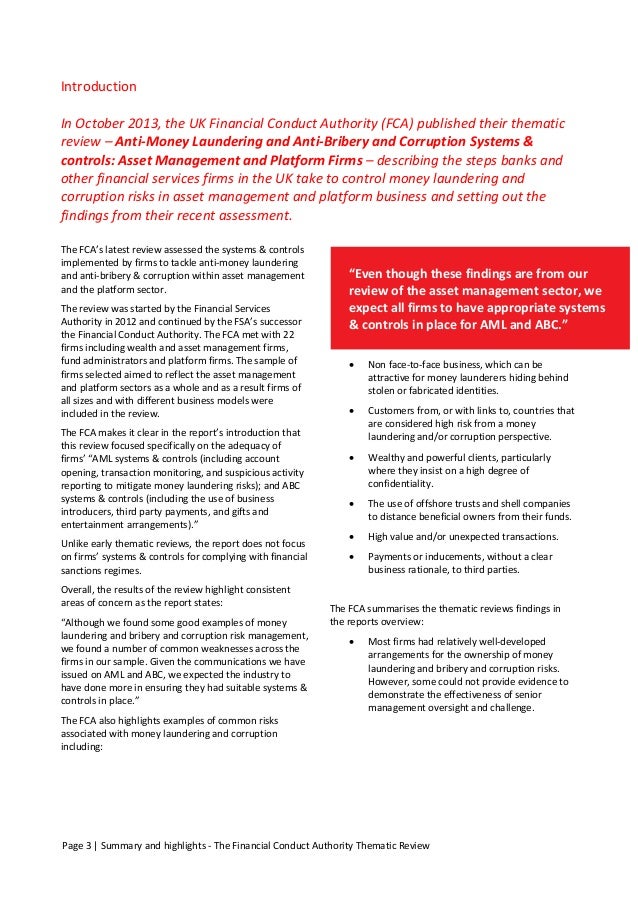

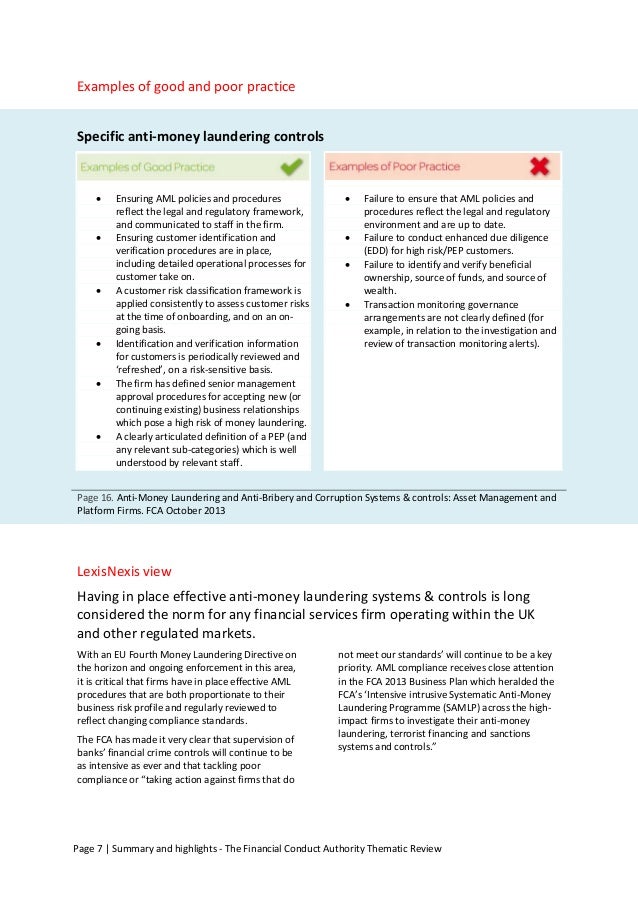

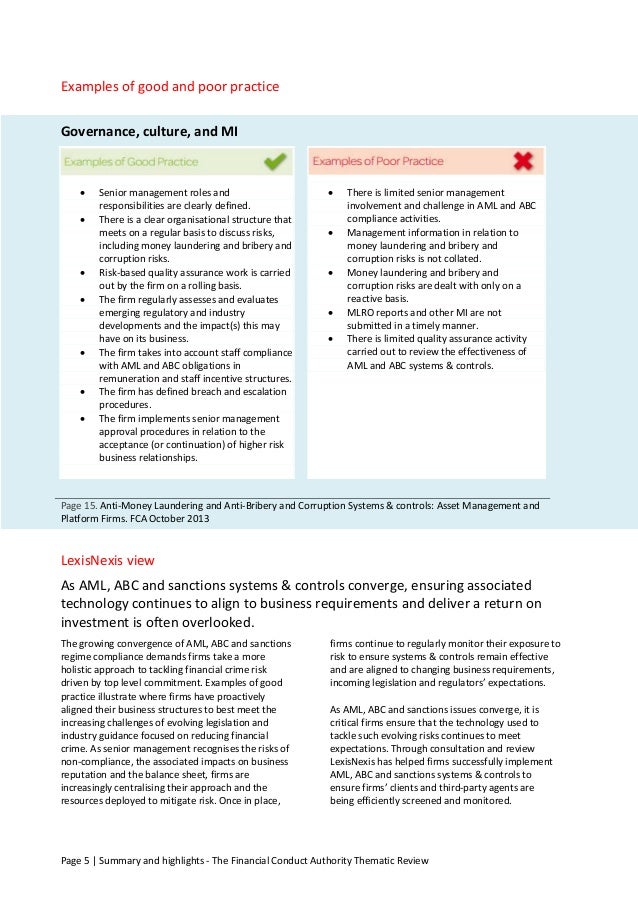

Highlighting good and bad practice firms can use the findings to get a greater understanding of the regulators expectations and formulate a plan to improve controls where.

On 3 October 2018 the FCA published the findings of their long-awaited AML Thematic Review into the e-money sector. Financial crime thematic reviews April 2015 1. We visited 13 authorised Electronic Money Institutions and registered small Electronic Money Institutions referred to as EMIs to assess their anti-money laundering AML and. We also refer to this as issues and products work or cross-firm work. 12 In this report by capital markets we mean financial markets where shares derivatives. A guide for firms contains summaries of and links to thematic reviews of various financial crime risks.

Source:

The FCA visited 13 e-money firms representative of the sector and for each conducted a pre-visit document review followed by an on-site review including interviews systems walk-throughs and file reviews. Two areas where firms may be used to facilitate financial crime are money laundering and bribery and corruption. Highlighting good and bad practice firms can use the findings to get a greater understanding of the regulators expectations and formulate a plan to improve controls where. We visited 13 authorised Electronic Money Institutions and registered small Electronic Money Institutions referred to as EMIs to assess their anti-money laundering AML and. Understanding the money laundering risks in the capital markets.

Source:

Financial crime thematic reviews April 2015 1. The purpose of the thematic review was to increase the FCAs knowledge of EMIs compliance with the MLRs 2017 and in particular the specific new rules. The FCA has published a report of the findings from its thematic review of anti-money laundering AML and anti-bribery and corruption ABC systems and controls in the asset management and platform sector TR139. 12 In this report by capital markets we mean financial markets where shares derivatives. The FCA visited 13 e-money firms representative of the sector and for each conducted a pre-visit document review followed by an on-site review including interviews systems walk-throughs and file reviews.

Source: slideshare.net

Source: slideshare.net

The FCA found that there was a positive culture within EMIs around AML and CTF issues a good awareness as well as understanding among the EMIs of their financial crime obligations and that most EMIs demonstrated a low risk appetite. Today just to note TR194 was published on 46 the Financial Conduct Authority FCA published its latest thematic review TR194 which looks at money laundering ML risks in capital markets. The review covered 19 firms representing a broad range of market segments and participants and focused on secondary markets. It can focus on finding out what is happening and suggesting ways of tackling the problem. The FCA has published a report of the findings from its thematic review of anti-money laundering AML and anti-bribery and corruption ABC systems and controls in the asset management and platform sector TR139.

Source: latham.london

Source: latham.london

The FCA visited 13 e-money firms representative of the sector and for each conducted a pre-visit document review followed by an on-site review including interviews systems walk-throughs and file reviews. FCA found some risks specific to the markets which were not effectively mitigated by the nature of the firms involved and a lack of. It can focus on finding out what is happening and suggesting ways of tackling the problem. We carried out this thematic review to look at the money-laundering risks and vulnerabilities in the capital markets and where possible to develop case studies to help inform the industry. Understanding the money laundering risks in the capital markets.

Source: slideshare.net

Source: slideshare.net

The review was conducted in response to a report by theFSAsIntelligence team which had highlighted the high risk of. This thematic review is a follow-up to the 2011 AML review4 The objective was to assess the extent to which our actions have affected the quality of AML systems and controls in smaller banks5 Given the 2011 AML review findings we focused on high-risk customers PEPs and correspondent banking. The FCA found that there was a positive culture within EMIs around AML and CTF issues a good awareness as well as understanding among the EMIs of their financial crime obligations and that most EMIs demonstrated a low risk appetite. 11 The aim of the thematic review was to increase our understanding of the risks of money laundering and terrorist financing in the e-money sector. The FCAs thematic review of e-money institutions gives clarity on expectations around anti-money laundering controls.

Source: bovill.com

Source: bovill.com

12 In this report by capital markets we mean financial markets where shares derivatives. We carried out this thematic review to look at the money-laundering risks and vulnerabilities in the capital markets and where possible to develop case studies to help inform the industry. This thematic review is a follow-up to the 2011 AML review4 The objective was to assess the extent to which our actions have affected the quality of AML systems and controls in smaller banks5 Given the 2011 AML review findings we focused on high-risk customers PEPs and correspondent banking. 11 The aim of the thematic review was to increase our understanding of the risks of money laundering and terrorist financing in the e-money sector. Introduction 11 Part 2 of Financial crime.

Source: bovill.com

Source: bovill.com

We visited 13 authorised Electronic Money Institutions and registered small Electronic Money Institutions referred to as EMIs to assess their anti-money laundering AML and. On 3 October 2018 the FCA published the findings of their long-awaited AML Thematic Review into the e-money sector. Thematic reviews First published. We visited 13 authorised Electronic Money Institutions and registered small Electronic Money Institutions referred to as EMIs to assess their anti-money laundering AML and. FCA e-money thematic review shows AML expectations.

Source: slideshare.net

Source: slideshare.net

The purpose of the thematic review was to increase the FCAs knowledge of EMIs compliance with the MLRs 2017 and in particular the specific new rules. The review was conducted in response to a report by theFSAsIntelligence team which had highlighted the high risk of. It can focus on finding out what is happening and suggesting ways of tackling the problem. We also refer to this as issues and products work or cross-firm work. Highlighting good and bad practice firms can use the findings to get a greater understanding of the regulators expectations and formulate a plan to improve controls where.

Source:

The FCA visited 19 market sector operators. A guide for firms contains summaries of and links to thematic reviews of various financial crime risks. We use a thematic review to assess a current or emerging risk regarding an issue or product across a number of firms in a sector or market. We carried out this thematic review to look at the money-laundering risks and vulnerabilities in the capital markets and where possible to develop case studies to help inform the industry. 11 The aim of the thematic review was to increase our understanding of the risks of money laundering and terrorist financing in the e-money sector.

Source: slideshare.net

Source: slideshare.net

Brief overview of the report. We visited 13 authorised Electronic Money Institutions and registered small Electronic Money Institutions referred to as EMIs to assess their anti-money laundering AML and. Two areas where firms may be used to facilitate financial crime are money laundering and bribery and corruption. It includes the consolidated examples of good and poor practice that were included with the reviews findings. We use a thematic review to assess a current or emerging risk regarding an issue or product across a number of firms in a sector or market.

Source: slideshare.net

Source: slideshare.net

We visited 13 authorised Electronic Money Institutions and registered small Electronic Money Institutions referred to as EMIs to assess their anti-money laundering AML and. The purpose of the thematic review was to increase the FCAs knowledge of EMIs compliance with the MLRs 2017 and in particular the specific new rules. We visited 13 authorised Electronic Money Institutions and registered small Electronic Money Institutions referred to as EMIs to assess their anti-money laundering AML and. The review was conducted in response to a report by theFSAsIntelligence team which had highlighted the high risk of. The FCA has published its long-awaited thematic review on money laundering risks in capital markets.

Source:

The FCA has published a report of the findings from its thematic review of anti-money laundering AML and anti-bribery and corruption ABC systems and controls in the asset management and platform sector TR139. We visited 13 authorised Electronic Money Institutions and registered small Electronic Money Institutions referred to as EMIs to assess their anti-money laundering AML and. We use a thematic review to assess a current or emerging risk regarding an issue or product across a number of firms in a sector or market. The FCA found that there was a positive culture within EMIs around AML and CTF issues a good awareness as well as understanding among the EMIs of their financial crime obligations and that most EMIs demonstrated a low risk appetite. A guide for firms contains summaries of and links to thematic reviews of various financial crime risks.

Source:

11 The aim of this thematic review was to carry out a diagnostic piece of work looking at the money-laundering risks and vulnerabilities in the capital markets and where possible to develop case studies to help inform the industry. FCA e-money thematic review shows AML expectations. We visited 13 authorised Electronic Money Institutions and registered small Electronic Money Institutions referred to as EMIs to assess their anti-money laundering AML and. The FCA visited 19 market sector operators. We use a thematic review to assess a current or emerging risk regarding an issue or product across a number of firms in a sector or market.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca aml thematic review by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information