14+ Fca aml training requirements information

Home » about money loundering idea » 14+ Fca aml training requirements informationYour Fca aml training requirements images are available. Fca aml training requirements are a topic that is being searched for and liked by netizens today. You can Download the Fca aml training requirements files here. Get all royalty-free photos.

If you’re looking for fca aml training requirements pictures information related to the fca aml training requirements interest, you have come to the right site. Our website frequently provides you with hints for downloading the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Fca Aml Training Requirements. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. Training including monitoring staff completion activity and incentivising staff to adhere to training requirements through performance management protocols. This course is designed for anyone who requires an introduction to the regulatory environment for UK financial services firms as well as those who require training on the FCAs Conduct Rules. 2 knowledge of the laws relating toMCD credit agreementsfor consumers in particular consumer protection.

Navigating The Disconnect Fca Expectations For Aml Still Not Being Met Avyse Partners From avyse.co.uk

Navigating The Disconnect Fca Expectations For Aml Still Not Being Met Avyse Partners From avyse.co.uk

Vetting and training should be appropriate to employees roles. This course is designed for anyone who requires an introduction to the regulatory environment for UK financial services firms as well as those who require training on the FCAs Conduct Rules. Financial Services Act 2008. One large bank judged that staff AML training and awareness were suitable for the development of a risk-based approach. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. There were areas where some firms understood and met their obligations and others where improvement was needed.

Ad AML coverage from every angle.

Firms must employ staff who possess the skills knowledge and expertise to carry out their functions effectively. Meeting their legal and regulatory obligations in the areas of both anti-money laundering and terrorist financing. Vetting and training should be appropriate to employees roles. Firms must have effective ways of managing their money laundering risks and meeting their obligations. We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. 2 knowledge of the laws relating toMCD credit agreementsfor consumers in particular consumer protection.

Source: pinterest.com

Source: pinterest.com

Latest news reports from the medical literature videos from the experts and more. Latest news reports from the medical literature videos from the experts and more. So in Retail training had been re-designed to produce a more balanced package. 2 knowledge of the laws relating toMCD credit agreementsfor consumers in particular consumer protection. Vetting and training should be appropriate to employees roles.

Source: slideplayer.com

Source: slideplayer.com

Ad AML coverage from every angle. Ad AML coverage from every angle. Latest news reports from the medical literature videos from the experts and more. First and foremost in whatever jurisdiction you operate your regulations should be the first point of call when determining AML training obligations. One large bank judged that staff AML training and awareness were suitable for the development of a risk-based approach.

Source: pinterest.com

Source: pinterest.com

Vetting and training should be appropriate to employees roles. Staff were also required to complete refresher training. 3 knowledge and understanding of the property purchasing process. The firm believed that the training was good quality and included separate modules on financial crime which were compulsory for staff to complete. Meeting their legal and regulatory obligations in the areas of both anti-money laundering and terrorist financing.

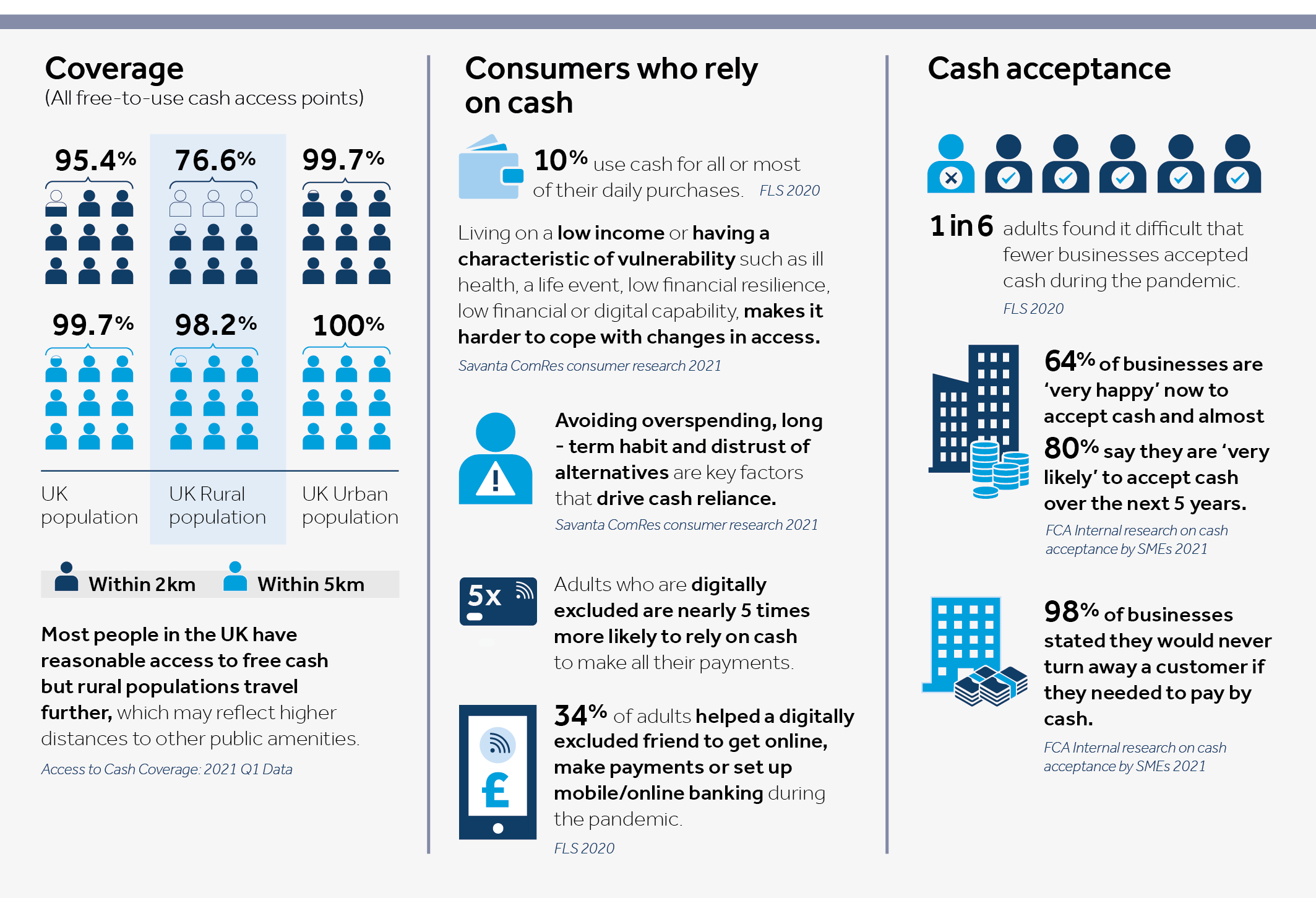

Source: fca.org.uk

Source: fca.org.uk

An audit of all training completed was stored on-line. If they do not align their AML processes with those recommended by the JMLSG they will need to demonstrate that their alternative. One large bank judged that staff AML training and awareness were suitable for the development of a risk-based approach. We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. They should review employees competence and take appropriate action to ensure they remain competent for their role.

Source: elearning.lgca.uk

Source: elearning.lgca.uk

3 knowledge and understanding of the property purchasing process. If they do not align their AML processes with those recommended by the JMLSG they will need to demonstrate that their alternative. We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. Financial Services Act 2008. 2 knowledge of the laws relating toMCD credit agreementsfor consumers in particular consumer protection.

Source: slideshare.net

Source: slideshare.net

AML Financial Crime Prevention FCA Regulations Senior Managers Certification Regime SMCR Risk Management Prudential Regulation Cybercrime Senior Management The Board CISI Qualifications Front Office Finance Induction Training. Firms must have effective ways of managing their money laundering risks and meeting their obligations. Firms must employ staff who possess the skills knowledge and expertise to carry out their functions effectively. Risk-based approach to anti-money laundering AML 2008 13 Box 51 Firms implementation of a risk-based approach to AML 14 6 Data security in Financial Services 2008 17 Box 61 Governance 18 Box 62 Training and awareness 19 Box 63 Staff recruitment and. It is particularly suitable for employees taking up a position within an authorised firm for the first time and those needing a refresher including individuals requiring certification under the SMCR.

Source: pinterest.com

Source: pinterest.com

Meeting their legal and regulatory obligations in the areas of both anti-money laundering and terrorist financing. AML Financial Crime Prevention FCA Regulations Senior Managers Certification Regime SMCR Risk Management Prudential Regulation Cybercrime Senior Management The Board CISI Qualifications Front Office Finance Induction Training. Financial Services Act 2008. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. Risk-based approach to anti-money laundering AML 2008 13 Box 51 Firms implementation of a risk-based approach to AML 14 6 Data security in Financial Services 2008 17 Box 61 Governance 18 Box 62 Training and awareness 19 Box 63 Staff recruitment and.

Source: pinterest.com

Source: pinterest.com

Training including monitoring staff completion activity and incentivising staff to adhere to training requirements through performance management protocols. We deploy leading experts from the compliance industry many of whom have worked for security intelligence and tier 1 Banks. Firms must employ staff who possess the skills knowledge and expertise to carry out their functions effectively. In the UK the MLR2017 outlines two key requirements for employee training. 3 knowledge and understanding of the property purchasing process.

Source: pinterest.com

Source: pinterest.com

If they do not align their AML processes with those recommended by the JMLSG they will need to demonstrate that their alternative. The firm believed that the training was good quality and included separate modules on financial crime which were compulsory for staff to complete. There were areas where some firms understood and met their obligations and others where improvement was needed. It is particularly suitable for employees taking up a position within an authorised firm for the first time and those needing a refresher including individuals requiring certification under the SMCR. First it requires employees to be made aware of the laws relating to money laundering and terrorist financing.

Source: br.pinterest.com

Source: br.pinterest.com

The firm believed that the training was good quality and included separate modules on financial crime which were compulsory for staff to complete. Latest news reports from the medical literature videos from the experts and more. If they do not align their AML processes with those recommended by the JMLSG they will need to demonstrate that their alternative. Risk-based approach to anti-money laundering AML 2008 13 Box 51 Firms implementation of a risk-based approach to AML 14 6 Data security in Financial Services 2008 17 Box 61 Governance 18 Box 62 Training and awareness 19 Box 63 Staff recruitment and. 3 knowledge and understanding of the property purchasing process.

Source: sumsub.com

In the UK the MLR2017 outlines two key requirements for employee training. Ad AML coverage from every angle. Training including monitoring staff completion activity and incentivising staff to adhere to training requirements through performance management protocols. The firm believed that the training was good quality and included separate modules on financial crime which were compulsory for staff to complete. Firms must have effective ways of managing their money laundering risks and meeting their obligations.

Source: avyse.co.uk

Source: avyse.co.uk

First and foremost in whatever jurisdiction you operate your regulations should be the first point of call when determining AML training obligations. So in Retail training had been re-designed to produce a more balanced package. First it requires employees to be made aware of the laws relating to money laundering and terrorist financing. One large bank judged that staff AML training and awareness were suitable for the development of a risk-based approach. Ad AML coverage from every angle.

Source: neopay.co.uk

Source: neopay.co.uk

Latest news reports from the medical literature videos from the experts and more. Ad AML coverage from every angle. AML Financial Crime Prevention FCA Regulations Senior Managers Certification Regime SMCR Risk Management Prudential Regulation Cybercrime Senior Management The Board CISI Qualifications Front Office Finance Induction Training. This course is designed for anyone who requires an introduction to the regulatory environment for UK financial services firms as well as those who require training on the FCAs Conduct Rules. In the UK the MLR2017 outlines two key requirements for employee training.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fca aml training requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information