18++ Fca and aml regulations info

Home » about money loundering Info » 18++ Fca and aml regulations infoYour Fca and aml regulations images are available in this site. Fca and aml regulations are a topic that is being searched for and liked by netizens today. You can Download the Fca and aml regulations files here. Get all free images.

If you’re searching for fca and aml regulations pictures information connected with to the fca and aml regulations keyword, you have visit the ideal blog. Our website always gives you hints for seeing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

Fca And Aml Regulations. FCA AML requirements. The reporting requirement only applies to firms who are authorised under FSMA and supervised by us under the Money Laundering Regulations. We are the anti-money laundering and counter-terrorist financing AMLCTF supervisor of UK cryptoasset businesses under the MLRs. As a reminder the FCA requires firms to take reasonable care to establish and maintain systems and controls that are effective for countering the risk that the firm may be used to further financial crime FCA Handbook SYSC 326R.

Fca Issues Warning Letter To Retail Banks Over Anti Money Laundering From ibsintelligence.com

Fca Issues Warning Letter To Retail Banks Over Anti Money Laundering From ibsintelligence.com

The FCAs approach to AML supervision is a risk-based approach utilising information from the National risk assessment of money laundering and terrorist financing and the financial crime data return. These include carrying out customer due diligence measures to check that your. Each year many companies receive FCA penalties which vary according to the volume of non-compliance regulations. As a reminder the FCA requires firms to take reasonable care to establish and maintain systems and controls that are effective for countering the risk that the firm may be used to further financial crime FCA Handbook SYSC 326R. One of the FCAs. FCA has specific laws and regulations to prevent money laundering and entities obliged to comply with FCA laws must comply with them or they will be subject to FCA AML penalties.

The reporting requirement only applies to firms who are authorised under FSMA and supervised by us under the Money Laundering Regulations.

The FCA has three proactive programmes for AML supervision. From 10 January 2020 the FCA will become the anti-money laundering and counter terrorist financing AMLCTF supervisor for cryptoassets businesses FCA Tightens Grip on Crypto AML The UKs Financial Conduct Authority is expanding their Anti-Money Laundering regulations to all cryptocurrency firms in a recently released consultation paper which seeks to make crypto firms regardless of operating turnover adhere to submitting an annual report on how they are dealing with their AML risk AML. The FCA and PRA issued a joint statement on arrangements for senior management in dual regulated firms and we have also published a statement for solo-regulated firms. A firm must ensure the policies and procedures established under SYSC 611 R include systems and controls that. The FCA goal is to create a fair and honest market for large and small businesses in the market. All banks and financial institutions in the UK must register with the FCA.

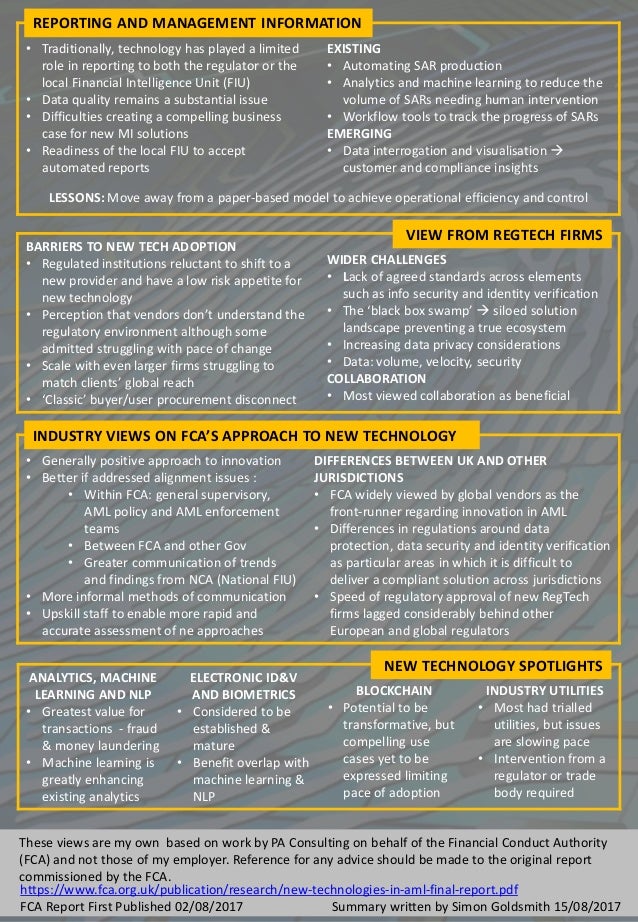

Source: slideshare.net

Source: slideshare.net

While we do not regulate or supervise the cryptocurrency business these firms are required to be registered with the FCA and they are required to comply with the Money Laundering Regulations. The FCA oversees compliance with AML regulations in the UK and has the power to investigate money laundering and terrorism financing offenses in conjunction with other law enforcement agencies and authorities such as the Crown Prosecution Service CPS. As a reminder the FCA requires firms to take reasonable care to establish and maintain systems and controls that are effective for countering the risk that the firm may be used to further financial crime FCA Handbook SYSC 326R. Who needs to report. The Financial Conduct Authority FCA has been criticised for its lack of enforcement of anti-money laundering AML legislation so far in 2020.

Source: ibsintelligence.com

Source: ibsintelligence.com

We are the anti-money laundering and counter-terrorist financing AMLCTF supervisor of UK cryptoasset businesses under the MLRs. As a reminder the FCA requires firms to take reasonable care to establish and maintain systems and controls that are effective for countering the risk that the firm may be used to further financial crime FCA Handbook SYSC 326R. The reporting requirement only applies to firms who are authorised under FSMA and supervised by us under the Money Laundering Regulations. Same old same old. Money laundering risk is the risk that a firm may be used to further money laundering.

Source: shuftipro.com

Source: shuftipro.com

As a reminder the FCA requires firms to take reasonable care to establish and maintain systems and controls that are effective for countering the risk that the firm may be used to further financial crime FCA Handbook SYSC 326R. When all procedures are performed it is necessary to ensure that the company employees understand and follow these processes. These include carrying out customer due diligence measures to check that your. The assessment of money laundering risk is at the core of the firms AML effort and is essential to the development of effective AML policies and procedures. The FCA has three proactive programmes for AML supervision.

Source: ar.pinterest.com

Source: ar.pinterest.com

The guidance in FCG 224G on risk assessment in relation to financial crime also applies to AML. The reporting requirement only applies to firms who are authorised under FSMA and supervised by us under the Money Laundering Regulations. When all procedures are performed it is necessary to ensure that the company employees understand and follow these processes. Ad AML coverage from every angle. All banks and financial institutions in the UK must register with the FCA.

Source: pinterest.com

Source: pinterest.com

FCA AML requirements. The FCA goal is to create a fair and honest market for large and small businesses in the market. These statements said that individuals performing required functions including the Money Laundering Reporting Officer SMF17 should only be furloughed as a last resort. AML Regulator of United Kingdom FCA - The Financial Conduct Authority The Financial Conduct Authority is a financial regulatory organization in the United Kingdom. The FCA has three proactive programmes for AML supervision.

Source: pt.slideshare.net

Source: pt.slideshare.net

As of 10 th January 2020 the Financial Conduct Authority FCA was made responsible for the regulation of cryptocurrency service providers CSPs for the purposes of AMLCTF. The reporting requirement only applies to firms who are authorised under FSMA and supervised by us under the Money Laundering Regulations. As a reminder the FCA requires firms to take reasonable care to establish and maintain systems and controls that are effective for countering the risk that the firm may be used to further financial crime FCA Handbook SYSC 326R. AML Regulator of United Kingdom FCA - The Financial Conduct Authority The Financial Conduct Authority is a financial regulatory organization in the United Kingdom. The FCA oversees compliance with AML regulations in the UK and has the power to investigate money laundering and terrorism financing offenses in conjunction with other law enforcement agencies and authorities such as the Crown Prosecution Service CPS.

Source: pinterest.com

Source: pinterest.com

Same old same old. You must meet certain day-to-day responsibilities if your business is covered by the Money Laundering Regulations. The assessment of money laundering risk is at the core of the firms AML effort and is essential to the development of effective AML policies and procedures. From 10 January 2020 the FCA will become the anti-money laundering and counter terrorist financing AMLCTF supervisor for cryptoassets businesses FCA Tightens Grip on Crypto AML The UKs Financial Conduct Authority is expanding their Anti-Money Laundering regulations to all cryptocurrency firms in a recently released consultation paper which seeks to make crypto firms regardless of operating turnover adhere to submitting an annual report on how they are dealing with their AML risk AML. The FCA has three proactive programmes for AML supervision.

Source: pinterest.com

Source: pinterest.com

When all procedures are performed it is necessary to ensure that the company employees understand and follow these processes. From 10 January 2020 the FCA will be the anti-money laundering and counter terrorist financing AMLCTF supervisor of UK cryptoassets businesses under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations. The FCA oversees compliance with AML regulations in the UK and has the power to investigate money laundering and terrorism financing offenses in conjunction with other law enforcement agencies and authorities such as the Crown Prosecution Service CPS. These statements said that individuals performing required functions including the Money Laundering Reporting Officer SMF17 should only be furloughed as a last resort. The FCA and PRA issued a joint statement on arrangements for senior management in dual regulated firms and we have also published a statement for solo-regulated firms.

Source: sygna.io

Source: sygna.io

Same old same old. The FCA goal is to create a fair and honest market for large and small businesses in the market. Key points from Mark Stewards speech. HM Revenue and Customs HMRC. Money laundering risk is the risk that a firm may be used to further money laundering.

Source: pinterest.com

Source: pinterest.com

According to FCA regulations the most important factor in fulfilling AML obligations is to conduct a risk assessment regularly. A firm must ensure the policies and procedures established under SYSC 611 R include systems and controls that. Ad AML coverage from every angle. All banks and financial institutions in the UK must register with the FCA. From 10 January 2020 the FCA will be the anti-money laundering and counter terrorist financing AMLCTF supervisor of UK cryptoassets businesses under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations.

Source: psplab.com

Source: psplab.com

The Money Laundering Regulations 2017 came into force on 26 June 2017 and updates the UKs anti-money laundering AML regime. FCA AML requirements. The Financial Conduct Authority FCA has been criticised for its lack of enforcement of anti-money laundering AML legislation so far in 2020. Key points from Mark Stewards speech. You must meet certain day-to-day responsibilities if your business is covered by the Money Laundering Regulations.

Source: ar.pinterest.com

Source: ar.pinterest.com

According to FCA regulations the most important factor in fulfilling AML obligations is to conduct a risk assessment regularly. Key points from Mark Stewards speech. The FCA also recently started its first criminal proceedings against a bank relating to its AML systems and controls. Are comprehensive and proportionate to the nature scale and complexity of its activities. From 10 January 2020 the FCA will be the anti-money laundering and counter terrorist financing AMLCTF supervisor of UK cryptoassets businesses under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations.

Source: sumsub.com

The Money Laundering Regulations 2017 came into force on 26 June 2017 and updates the UKs anti-money laundering AML regime. You must meet certain day-to-day responsibilities if your business is covered by the Money Laundering Regulations. All banks and financial institutions in the UK must register with the FCA. Who needs to report. Regulation 23 requires authorised persons to inform us if they are undertaking Money Service Business MSB or Trust or Company Service TCSP activities.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca and aml regulations by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas