17+ Fca anti money laundering guidance info

Home » about money loundering Info » 17+ Fca anti money laundering guidance infoYour Fca anti money laundering guidance images are available in this site. Fca anti money laundering guidance are a topic that is being searched for and liked by netizens now. You can Get the Fca anti money laundering guidance files here. Download all free images.

If you’re searching for fca anti money laundering guidance images information related to the fca anti money laundering guidance topic, you have come to the ideal blog. Our website frequently gives you hints for seeing the highest quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

Fca Anti Money Laundering Guidance. Money laundering risk is disregarded when transactions involve another group entity especially if the group entity is in a high risk jurisdiction. 23 The sourcebook has the status of general guidance issued by the FCA under section 139A of the Financial Services and Markets Act 2000 as amended. The announcement recognised that while PBSs knowledge of innovations and emerging risks in their sectors brings substantial benefits to the regime having several organisations supervising the same sectors and issuing guidance. Fca anti money laundering guidance.

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk From webnuk.wordpress.com

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk From webnuk.wordpress.com

The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. The FCA has now published guidance on one aspect of the new regime. The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. 1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediariesBut it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk that they may be used to handle the proceeds from crime. In practice this includes businesses that offer finance leases commercial lenders and providers of safe deposit boxes. The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering.

The Financial Conduct Authoritys FCAs predecessor streamlined its rules by removing the Money Laundering source book and replacing it with the principle based rules found in the Senior Management Arrangements Systems.

21 This guidance is aimed at any institution that has its anti -money laundering systems and controls overseen by the FCA1 It discusses how they can meet their obligations when opening new relationships or monitoring existing relationships. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. Based approach guidance agreed by Anti-Money Laundering Supervisors Forum members in 20088. 23 The sourcebook has the status of general guidance issued by the FCA under section 139A of the Financial Services and Markets Act 2000 as amended. FCG provides guidance on financial crime systems and controls both generally and in relation to specific risks such as money laundering bribery and corruption and. It applies only to business relationships undertaken in the course of business in the UK.

Source: ibsintelligence.com

Source: ibsintelligence.com

The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. Appoint a Money Laundering Reporting Officer MLRO who is a focus for the firms AML activity. 24 It is proposed this guidance will come into effect on 1 January 2018. Effective systems and controls can help firms to detect prevent and deter financial crime. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. They should know about the money-laundering risks to your firm and make sure steps are taken to mitigate those risks effectively. The FCA is empowered to impose fines and at least in theory bring criminal prosecutions for breaches of The Money Laundering Terrorist Financing and.

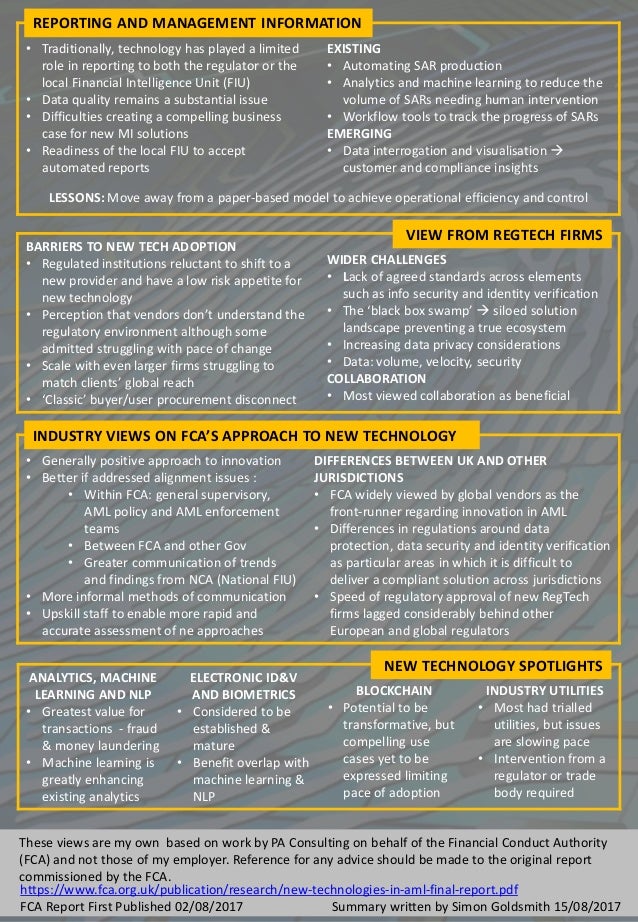

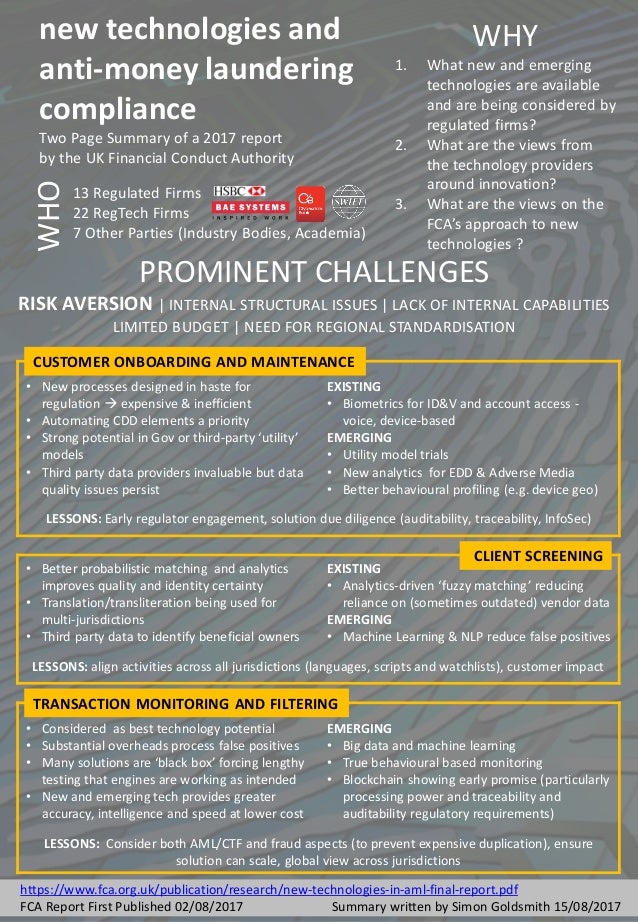

Source: slideshare.net

Source: slideshare.net

FCGalso contains guidance on how firms can meet the requirements of the Money Laundering Regulationsand the EU Funds Transfer Regulation. Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. The announcement recognised that while PBSs knowledge of innovations and emerging risks in their sectors brings substantial benefits to the regime having several organisations supervising the same sectors and issuing guidance. They should know about the money-laundering risks to your firm and make sure steps are taken to mitigate those risks effectively.

Source: finextra.com

Source: finextra.com

We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations. The FCA has now published guidance on one aspect of the new regime. 24 It is proposed this guidance will come into effect on 1 January 2018. Those responsible for reviewing escalated transactions have an extensive knowledge of trade-based money laundering. We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations.

Source: slideshare.net

Source: slideshare.net

We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations. 24 It is proposed this guidance will come into effect on 1 January 2018. 1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediariesBut it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk that they may be used to handle the proceeds from crime. FCA Anti-Money Laundering Guidance The team at Ecompli are well-versed in providing FCA Anti-Money Laundering guidance to businesses throughout the UK. In practice this includes businesses that offer finance leases commercial lenders and providers of safe deposit boxes.

The Financial Conduct Authoritys FCAs predecessor streamlined its rules by removing the Money Laundering source book and replacing it with the principle based rules found in the Senior Management Arrangements Systems. While the relevant parts of the guide that refer to theMoney Laundering Regulationsmay berelevant guidanceunder these regulations it is not approved by HM Treasury. 24 It is proposed this guidance will come into effect on 1 January 2018. FCG provides guidance on financial crime systems and controls both generally and in relation to specific risks such as money laundering bribery and corruption and. And to meet the.

When considering a firms systems and controls against money laundering and terrorist financing we will consider whether the firm has followed relevant provisions of the JMLSGs guidance guidance issued by the FCA or taken account of the ESA guidelines. When considering a firms systems and controls against money laundering and terrorist financing we will consider whether the firm has followed relevant provisions of the JMLSGs guidance guidance issued by the FCA or taken account of the ESA guidelines. Money laundering risk is disregarded when transactions involve another group entity especially if the group entity is in a high risk jurisdiction. Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. It applies only to business relationships undertaken in the course of business in the UK.

FCG provides guidance on financial crime systems and controls both generally and in relation to specific risks such as money laundering bribery and corruption and. We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations. Based approach guidance agreed by Anti-Money Laundering Supervisors Forum members in 20088. 21 This guidance is aimed at any institution that has its anti -money laundering systems and controls overseen by the FCA1 It discusses how they can meet their obligations when opening new relationships or monitoring existing relationships. The announcement recognised that while PBSs knowledge of innovations and emerging risks in their sectors brings substantial benefits to the regime having several organisations supervising the same sectors and issuing guidance.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

1This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediariesBut it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk that they may be used to handle the proceeds from crime. FCG provides guidance on financial crime systems and controls both generally and in relation to specific risks such as money laundering bribery and corruption and. The announcement recognised that while PBSs knowledge of innovations and emerging risks in their sectors brings substantial benefits to the regime having several organisations supervising the same sectors and issuing guidance. The Financial Conduct Authoritys FCAs predecessor streamlined its rules by removing the Money Laundering source book and replacing it with the principle based rules found in the Senior Management Arrangements Systems. FCA Anti-Money Laundering Guidance The team at Ecompli are well-versed in providing FCA Anti-Money Laundering guidance to businesses throughout the UK.

Source: shuftipro.com

Source: shuftipro.com

Money laundering risk is disregarded when transactions involve another group entity especially if the group entity is in a high risk jurisdiction. Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. Appoint a Money Laundering Reporting Officer MLRO who is a focus for the firms AML activity. The FCA has now published guidance on one aspect of the new regime. And to meet the.

Source: slideplayer.com

Source: slideplayer.com

The announcement recognised that while PBSs knowledge of innovations and emerging risks in their sectors brings substantial benefits to the regime having several organisations supervising the same sectors and issuing guidance. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. In March 2017 we consulted on guidance GC172 in. And to meet the. Fca anti money laundering guidance.

Source: asiatokenfund.com

Source: asiatokenfund.com

Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. Dealing with the appropriate treatment of Politically Exposed Persons PEPs for anti-money laundering. Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. Appoint a Money Laundering Reporting Officer MLRO who is a focus for the firms AML activity. Those responsible for reviewing escalated transactions have an extensive knowledge of trade-based money laundering.

Source: biia.com

Source: biia.com

It applies only to business relationships undertaken in the course of business in the UK. Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. While the relevant parts of the guide that refer to theMoney Laundering Regulationsmay berelevant guidanceunder these regulations it is not approved by HM Treasury. FCG 318 13122018. The FCA has now published guidance on one aspect of the new regime.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca anti money laundering guidance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas