20++ Fca anti money laundering report ideas in 2021

Home » about money loundering idea » 20++ Fca anti money laundering report ideas in 2021Your Fca anti money laundering report images are ready. Fca anti money laundering report are a topic that is being searched for and liked by netizens today. You can Download the Fca anti money laundering report files here. Get all free photos.

If you’re looking for fca anti money laundering report pictures information related to the fca anti money laundering report topic, you have come to the ideal blog. Our website frequently provides you with hints for refferencing the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Fca Anti Money Laundering Report. AML compliance is required from all FCA registered firms. 6 Financial Conduct Authority Anti-money laundering Annual Report 201718 Chapter 2 Policy developments. The Financial Conduct Authority FCA has released their Anti-money laundering AML Annual report for 201718. The newly published Report states that some of the FCAs current AML investigations are now dual track ie.

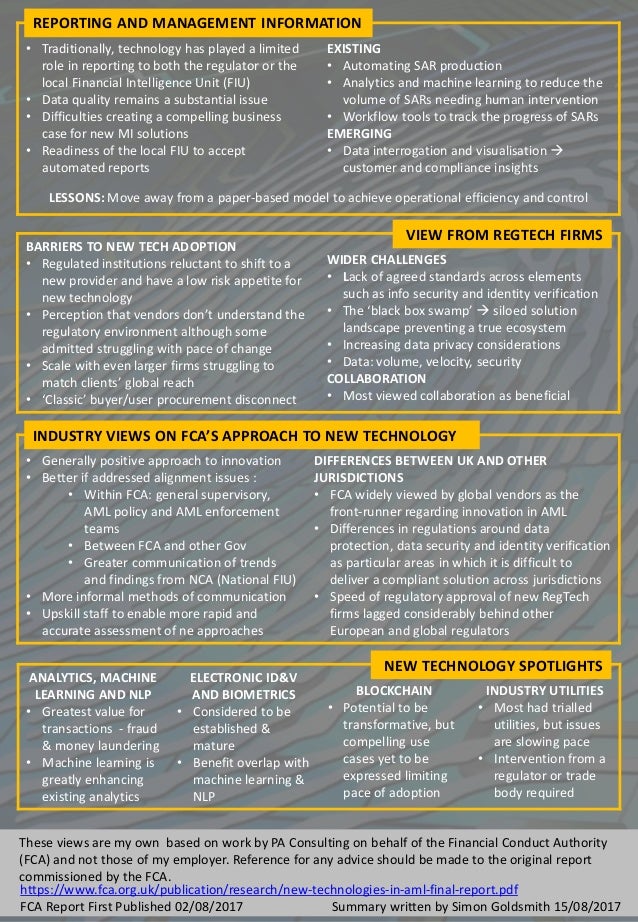

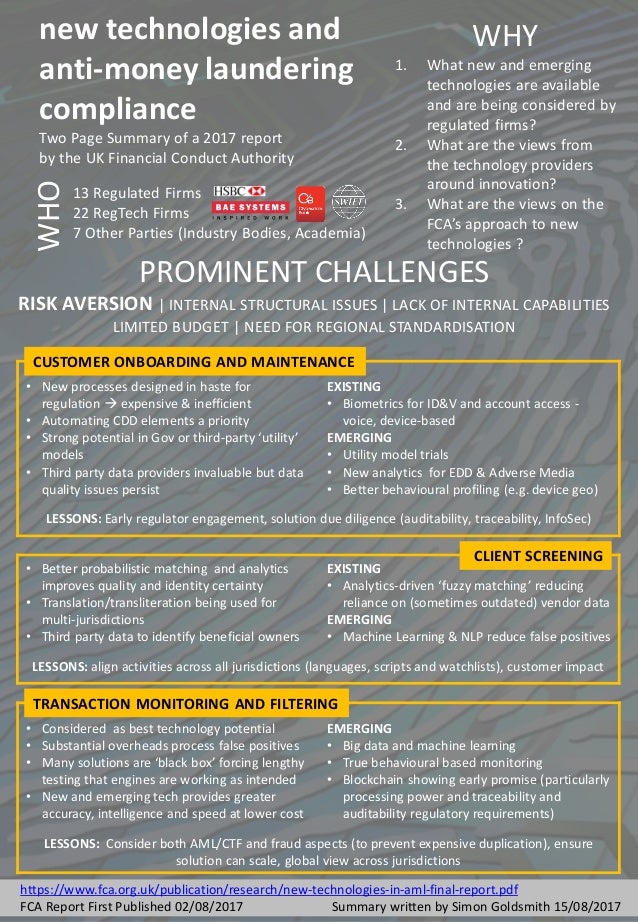

New Technologies And Anti Money Laundering Compliance Personal Summa From slideshare.net

New Technologies And Anti Money Laundering Compliance Personal Summa From slideshare.net

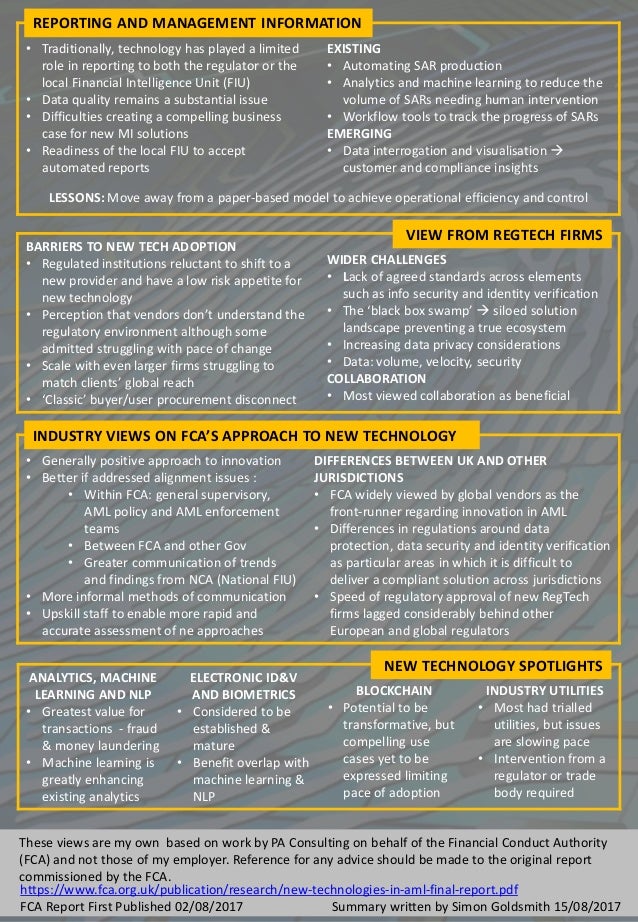

AML supervision strategy The quality of firms AML systems and controls remains high on the FCAs agenda as is the implementation of its AML supervision strategy. Where anti- money laundering tasks are delegated by a relevant firms MLRO the FSA will expect the MLRO to take ultimate managerial responsibility for ensuring that the duties imposed on the MLRO by this sourcebook are complied with. Introduction Money laundering harms society. We believe the report will be of interest to financial firms who are considering the use of new technologies in relation to their anti-money laundering compliance efforts. It enables criminal activity and undermines the reputation of the UK financial services sector. The FCA has released its third annual anti-money laundering AML report 2015-2016 emphasizing financial crime as one of the regulators top seven priorities for 20162017.

As the biggest AML supervisor in the UK we played a major part in this Mutual Evaluation working closely with the Treasury and other partners.

The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering Steering Group. In this the FCAs fourth Anti-money laundering Report we explain how we have sought to achieve our AML objectives in the last year. It enables criminal activity and undermines the reputation of the UK financial services sector. Reporting discrepancies to Companies House. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. The Financial Conduct Authority FCA has released their Anti-money laundering AML Annual report for 201718.

Source: slideplayer.com

Source: slideplayer.com

Our risk-based approach to AML supervision developments in our AML supervision strategy findings and outcomes from our recent specialist supervision work. The newly published Report states that some of the FCAs current AML investigations are now dual track ie. Duty to respond to requests for information about accounts and safe-deposit boxes. Fca anti money laundering report 2019. AML compliance is required from all FCA registered firms.

Source: leaprate.com

Source: leaprate.com

Nothing in the report which was drafted by the consultants that we commissioned represents guidance. In this the FCAs fourth Anti-money laundering Report we explain how we have sought to achieve our AML objectives in the last year. The FCA has released its third annual anti-money laundering AML report 2015-2016 emphasizing financial crime as one of the regulators top seven priorities for 20162017. This was published alongside the FCAs Annual Report and Accounts 2017 18 Annual Diversity Report Annual Competition Report and Annual Enforcement Performance Account. The firm has identified good sources of information on money laundering risks such as National Risk Assessments ESA Guidelines FATF mutual evaluations and typology reports NCA alerts press reports court judgements reports by non-governmental organisations and commercial due diligence providers.

Source: ibsintelligence.com

Source: ibsintelligence.com

On 9 July 2019 the FCA published its Anti-money Laundering AML Annual Report for 20182019The report echoes Mark Stewards comments in a speech earlier this year in relation to the FCAs increasing focus on criminal investigations for money laundering. The newly published Report states that some of the FCAs current AML investigations are now dual track ie. 1 FCA Anti-Money Laundering Annual Report making the UK financial sector a difficult target for criminals. This was published alongside the FCAs Annual Report and Accounts 2017 18 Annual Diversity Report Annual Competition Report and Annual Enforcement Performance Account. 6 Financial Conduct Authority Anti-money laundering Annual Report 201718 Chapter 2 Policy developments.

Source: coinfomania.com

Source: coinfomania.com

On 9 July 2019 the FCA published its Anti-money Laundering AML Annual Report for 20182019The report echoes Mark Stewards comments in a speech earlier this year in relation to the FCAs increasing focus on criminal investigations for money laundering. Introduction Money laundering harms society. AML supervision strategy The quality of firms AML systems and controls remains high on the FCAs agenda as is the implementation of its AML supervision strategy. 1 FCA Anti-Money Laundering Annual Report making the UK financial sector a difficult target for criminals. Where anti- money laundering tasks are delegated by a relevant firms MLRO the FSA will expect the MLRO to take ultimate managerial responsibility for ensuring that the duties imposed on the MLRO by this sourcebook are complied with.

Source: sumsub.com

Including the FCAs work. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. Including the FCAs work. Regulation 30A is a new requirement for firms to report to Companies House discrepancies between the information the firm holds on their customers compared with the information held in the Companies House Register. It enables criminal activity and undermines the reputation of the UK financial services sector.

Source:

As the biggest AML supervisor in the UK we played a major part in this Mutual Evaluation working closely with the Treasury and other partners. This was published alongside the FCAs Annual Report and Accounts 2017 18 Annual Diversity Report Annual Competition Report and Annual Enforcement Performance Account. Including the FCAs work. The FCA investigation was disclosed in Monzos annual report which showed the banks pre-tax losses widened 12 in the year to February to 130m due. Regulation 30A is a new requirement for firms to report to Companies House discrepancies between the information the firm holds on their customers compared with the information held in the Companies House Register.

Source: slideplayer.com

Source: slideplayer.com

We carried out this thematic review to look at the money-laundering risks and vulnerabilities in the capital markets and where possible to develop case studies to help inform the industry. What steps could the FCA take to encourage more innovation in anti-money laundering compliance. The FCA has released its third annual anti-money laundering AML report 2015-2016 emphasizing financial crime as one of the regulators top seven priorities for 20162017. It enables criminal activity and undermines the reputation of the UK financial services sector. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering.

Source: slideserve.com

Source: slideserve.com

Our risk-based approach to AML supervision developments in our AML supervision strategy findings and outcomes from our recent specialist supervision work. The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering Steering Group. 6 Financial Conduct Authority Anti-money laundering Annual Report 201718 Chapter 2 Policy developments. Where anti- money laundering tasks are delegated by a relevant firms MLRO the FSA will expect the MLRO to take ultimate managerial responsibility for ensuring that the duties imposed on the MLRO by this sourcebook are complied with. 1 FCA Anti-Money Laundering Annual Report making the UK financial sector a difficult target for criminals.

Source: finextra.com

Source: finextra.com

The purpose of the FCR is to increase the FCAs understanding of a variety of issues on a firm by firm basis such as the total number of clients the number of high risk clients the number of internal suspicious reports and external suspicious activity reports SARS submitted as well as the most common types of fraud. Duty to respond to requests for information about accounts and safe-deposit boxes. Where anti- money laundering tasks are delegated by a relevant firms MLRO the FSA will expect the MLRO to take ultimate managerial responsibility for ensuring that the duties imposed on the MLRO by this sourcebook are complied with. Our risk-based approach to AML supervision developments in our AML supervision strategy findings and outcomes from our recent specialist supervision work. The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering Steering Group.

Source: slideshare.net

Source: slideshare.net

Nothing in the report which was drafted by the consultants that we commissioned represents guidance. The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering Steering Group. Duty to respond to requests for information about accounts and safe-deposit boxes. Regulation 30A is a new requirement for firms to report to Companies House discrepancies between the information the firm holds on their customers compared with the information held in the Companies House Register. As the biggest AML supervisor in the UK we played a major part in this Mutual Evaluation working closely with the Treasury and other partners.

Source: slideshare.net

Source: slideshare.net

Nothing in the report which was drafted by the consultants that we commissioned represents guidance. It enables criminal activity and undermines the reputation of the UK financial services sector. We believe the report will be of interest to financial firms who are considering the use of new technologies in relation to their anti-money laundering compliance efforts. We carried out this thematic review to look at the money-laundering risks and vulnerabilities in the capital markets and where possible to develop case studies to help inform the industry. Our risk-based approach to AML supervision developments in our AML supervision strategy findings and outcomes from our recent specialist supervision work.

Source: biia.com

Source: biia.com

On 9 July 2019 the FCA published its Anti-money Laundering AML Annual Report for 20182019The report echoes Mark Stewards comments in a speech earlier this year in relation to the FCAs increasing focus on criminal investigations for money laundering. 6 Financial Conduct Authority Anti-money laundering Annual Report 201718 Chapter 2 Policy developments. In this the FCAs fourth Anti-money laundering Report we explain how we have sought to achieve our AML objectives in the last year. The firm has identified good sources of information on money laundering risks such as National Risk Assessments ESA Guidelines FATF mutual evaluations and typology reports NCA alerts press reports court judgements reports by non-governmental organisations and commercial due diligence providers. The FCA has released its third annual anti-money laundering AML report 2015-2016 emphasizing financial crime as one of the regulators top seven priorities for 20162017.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

Including the FCAs work. 6 Financial Conduct Authority Anti-money laundering Annual Report 201718 Chapter 2 Policy developments. Fca anti money laundering report 2019. AML supervision strategy The quality of firms AML systems and controls remains high on the FCAs agenda as is the implementation of its AML supervision strategy. The purpose of the FCR is to increase the FCAs understanding of a variety of issues on a firm by firm basis such as the total number of clients the number of high risk clients the number of internal suspicious reports and external suspicious activity reports SARS submitted as well as the most common types of fraud.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca anti money laundering report by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information