16++ Fca definition of money laundering ideas in 2021

Home » about money loundering Info » 16++ Fca definition of money laundering ideas in 2021Your Fca definition of money laundering images are ready in this website. Fca definition of money laundering are a topic that is being searched for and liked by netizens today. You can Download the Fca definition of money laundering files here. Download all royalty-free photos and vectors.

If you’re looking for fca definition of money laundering images information connected with to the fca definition of money laundering keyword, you have visit the right blog. Our site always gives you suggestions for viewing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and images that match your interests.

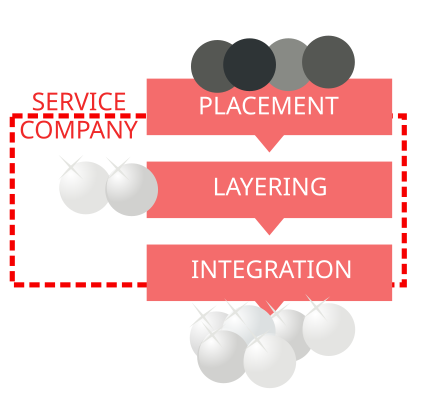

Fca Definition Of Money Laundering. 149 rows The Money Laundering Regulations give the FCA responsibility for supervising the anti. However unlike market manipulation and insider trading markets-based money laundering does not. Financial crime staff should be alert to action taken by regulators in other parts of the financial services industry. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures.

Bitconnect V 1 0 Bitconnect V 2 0 Bitconnect V 3 0 Bitconnect V 4 Food Rice Bitcoin From pinterest.com

Bitconnect V 1 0 Bitconnect V 2 0 Bitconnect V 3 0 Bitconnect V 4 Food Rice Bitcoin From pinterest.com

Further information on managing money-laundering risk. B constitutes an offence under section 327 Concealing etc section 328 Arrangements or section 329 Acquisition use and possession of the Proceeds of Crime Act 2002. The Money Laundering Regulations 2017 came into force on 26 June 2017 and updates the UKs anti-money laundering AML regime. On 10 January 2020 changes to the Governments Money Laundering Regulations came into force. The Financial Conduct Authoritys FCA recent Final Notice against Interactive Brokers UK IBUK which attracted a fine of 1049000 is a case in point. The FCAs June 2019 thematic review TR194 Understanding the Money Laundering Risks in the Capital Markets is one example of recent guidance that incidentally also exposes how lack of previous guidance may have impacted firms understanding of the risks in this area.

The FCAs June 2019 thematic review TR194 Understanding the Money Laundering Risks in the Capital Markets is one example of recent guidance that incidentally also exposes how lack of previous guidance may have impacted firms understanding of the risks in this area.

Situations that present a higher money laundering risk might include but are not restricted to. And transactions which are unusual lack an obvious economic or lawful purpose are complex or large or might lend themselves to anonymity. However unlike market manipulation and insider trading markets-based money laundering does not. The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering Steering Group. Imise their money laundering risk. We encourage banks to consider our financial crime guidance which we believe helps banks adopt proportionate and effective anti-money laundering systems and controls.

Source: gr.pinterest.com

Source: gr.pinterest.com

Money Laundering Definition Fca on August 08 2021. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. In particular the review found that participants were generally at the early stages of their thinking in relation to money-laundering. What is the FCA definition of Money Laundering Anti-money Laundering Compliance FC. However unlike market manipulation and insider trading markets-based money laundering does not.

Source: shuftipro.com

Source: shuftipro.com

Customers linked to higher risk countries or business sectors. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. AML compliance is required from all FCA registered firms. B constitutes an offence under section 327 Concealing etc section 328 Arrangements or section 329 Acquisition use and possession of the Proceeds of Crime Act 2002. An assessment of the extent to which the risk would be increased by a business relationship with a PEP family member or close associate.

Source: pinterest.com

Source: pinterest.com

Money laundering Box 33. The Money Laundering Regulations 2017 came into force on 26 June 2017 and updates the UKs anti-money laundering AML regime. We encourage banks to consider our financial crime guidance which we believe helps banks adopt proportionate and effective anti-money laundering systems and controls. On 10 January 2020 changes to the Governments Money Laundering Regulations came into force. Situations that present a higher money laundering risk might include but are not restricted to.

Source: pinterest.com

Source: pinterest.com

The job of the MLRO is to act as the focal point within the relevant firm for the oversight of all activity relating to anti-money laundering. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. Situations that present a higher money laundering risk might include but are not restricted to. On 10 January 2020 changes to the Governments Money Laundering Regulations came into force. 149 rows The Money Laundering Regulations give the FCA responsibility for supervising the anti.

Source: pinterest.com

Source: pinterest.com

On 10 January 2020 changes to the Governments Money Laundering Regulations came into force. The FCA would expect that this is a case-by-case assessment and not an automatic assessment that a relationship creates a high risk of money laundering. The FCAs approach to enforcement of breaches of AML obligations is set out in our Enforcement guide. Money laundering Box 33. We encourage banks to consider our financial crime guidance which we believe helps banks adopt proportionate and effective anti-money laundering systems and controls.

Source: wikiwand.com

Source: wikiwand.com

On 10 January 2020 changes to the Governments Money Laundering Regulations came into force. Money Laundering Definition Fca on August 08 2021. The Financial Conduct Authoritys FCA recent Final Notice against Interactive Brokers UK IBUK which attracted a fine of 1049000 is a case in point. Money laundering Box 33. Who needs to report.

Source: id.pinterest.com

Source: id.pinterest.com

The FCAs approach to enforcement of breaches of AML obligations is set out in our Enforcement guide. On 10 January 2020 changes to the Governments Money Laundering Regulations came into force. Situations that present a higher money laundering risk might include but are not restricted to. We encourage banks to consider our financial crime guidance which we believe helps banks adopt proportionate and effective anti-money laundering systems and controls. Markets-based money laundering likewise involves the misuse of the markets for financial gain and the trades involved may have an impact on market transparency and efficiency thus meeting the general definition of market abuse.

Source: tookitaki.ai

Source: tookitaki.ai

An assessment of the extent to which the risk would be increased by a business relationship with a PEP family member or close associate. Who needs to report. However unlike market manipulation and insider trading markets-based money laundering does not. Money Laundering Definition Fca on August 08 2021. The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering Steering Group.

Source: pinterest.com

Source: pinterest.com

The FCA would expect that this is a case-by-case assessment and not an automatic assessment that a relationship creates a high risk of money laundering. The job of the MLRO is to act as the focal point within the relevant firm for the oversight of all activity relating to anti-money laundering. Money laundering Box 33. He needs to be senior to be free to act on his own authority and to be informed of any relevant knowledge or suspicion in the relevant firm. Regulation 23 requires authorised persons to inform us if they are undertaking Money Service Business MSB or Trust or Company Service TCSP activities.

Source: shuftipro.com

Source: shuftipro.com

Money Laundering Definition Fca on August 08 2021. The Money Laundering Regulations 2017 came into force on 26 June 2017 and updates the UKs anti-money laundering AML regime. Who needs to report. The FCA would expect that this is a case-by-case assessment and not an automatic assessment that a relationship creates a high risk of money laundering. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering.

Source: ciphertrace.com

Source: ciphertrace.com

And transactions which are unusual lack an obvious economic or lawful purpose are complex or large or might lend themselves to anonymity. Financial crime staff should be alert to action taken by regulators in other parts of the financial services industry. We encourage banks to consider our financial crime guidance which we believe helps banks adopt proportionate and effective anti-money laundering systems and controls. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. B constitutes an offence under section 327 Concealing etc section 328 Arrangements or section 329 Acquisition use and possession of the Proceeds of Crime Act 2002.

Source: ar.pinterest.com

Source: ar.pinterest.com

Or who have unnecessarily complex or opaque beneficial ownership structures. Money laundering Box 33. The Proceeds of Crime Act 2002 requires you to submit a Suspicious Activity Report to the National Crime Agency if you know or suspect that a person is engaged in or attempting money laundering. And transactions which are unusual lack an obvious economic or lawful purpose are complex or large or might lend themselves to anonymity. The FCAs June 2019 thematic review TR194 Understanding the Money Laundering Risks in the Capital Markets is one example of recent guidance that incidentally also exposes how lack of previous guidance may have impacted firms understanding of the risks in this area.

Source: bitquery.io

Source: bitquery.io

Regulation 23 requires authorised persons to inform us if they are undertaking Money Service Business MSB or Trust or Company Service TCSP activities. He needs to be senior to be free to act on his own authority and to be informed of any relevant knowledge or suspicion in the relevant firm. AML compliance is required from all FCA registered firms. Financial crime staff should be alert to action taken by regulators in other parts of the financial services industry. Markets-based money laundering likewise involves the misuse of the markets for financial gain and the trades involved may have an impact on market transparency and efficiency thus meeting the general definition of market abuse.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca definition of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas