13+ Fca form a smcr info

Home » about money loundering Info » 13+ Fca form a smcr infoYour Fca form a smcr images are ready. Fca form a smcr are a topic that is being searched for and liked by netizens now. You can Find and Download the Fca form a smcr files here. Find and Download all royalty-free vectors.

If you’re looking for fca form a smcr pictures information related to the fca form a smcr keyword, you have pay a visit to the ideal blog. Our website always gives you suggestions for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

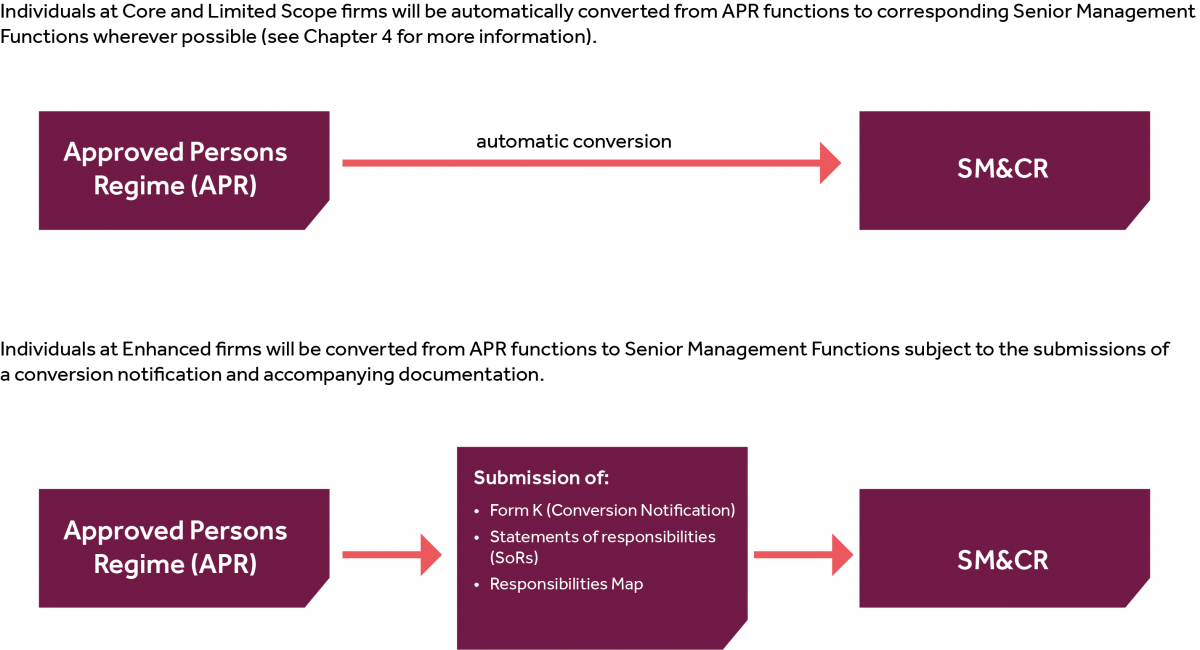

Fca Form A Smcr. The opt-up will take effect three months from the date of this notification. To comply with the SMCR FCA-authorised firms will need to make changes to governance documentation compliance and HR procedures and processes and submit additional documentation to the FCA. If a firm submits this form to opt-up that firm will be subject to the rules of the new SMCR classification three calendar months. In SUP 157 or in Senior Managers Regime.

Both the applicant firm and the candidate will be treated by the FCA as having taken these notes into consideration when completing this form. Insurers are also in scope but we have provided a separate guide and Policy Statement PS for these firms. They apply to all employees of solo-regulated firms except for certain ancillary staff who are specifically excluded read pages 45-46 of the SMCR guide for FCA solo-regulated firms PDF. The above questions should be completed whether submission of this form is online or in one of the other ways set out. Extension of SMCR implementation periods for solo-regulated firms. To comply with the SMCR FCA-authorised firms will need to make changes to governance documentation compliance and HR procedures and processes and submit additional documentation to the FCA.

Long Form A UK Relevant Authorised Persons and Third Country Relevant Authorised Persons only.

We welcome the publication of the statutory instrument. An application for an individual to perform a specified SMF or for Appointed Representatives only controlled function at the firm s. Importantly the FCA have clarified that firms must submit their Form K Conversion Notification by 2359 on 24 November 2019. We have also applied the SMCR to the FCA and published information about how weve done this. Following a request from the FCA the Treasury has made a statutory instrument to delay from 9 December 2020 until 31 March 2021 the deadline for solo-regulated firms to have undertaken the first assessment of the fitness and propriety of their Certified Persons. In this context employee is defined more broadly than its usual meaning and generally includes groups.

Source: shlegal.com

Source: shlegal.com

Both the applicant firm and the candidate will be treated by the FCA as having taken these notes into consideration when completing this form. To comply with the SMCR FCA-authorised firms will need to make changes to governance documentation compliance and HR procedures and processes and submit additional documentation to the FCA. The FCA this week has released additional guidance to solo-regulated firms submitting SMCR forms in respect of Senior Managers ahead of the implementation deadline of 9 December 2019. From collation of required documents to completion of the form and finally in assisting you to field enquiries from your FCA case officer. In particular this note includes a set of Frequently Asked Questions FAQs on how the two sets of.

Source: rbcompliance.co.uk

Source: rbcompliance.co.uk

A currently approved individual is applying for an additional controlled function at the same firm. Financial Conduct Authoritys FCA equivalent proposals in paragraphs 492 to 497 of FCA CP 1829 Temporary permissions regime for inbound firms and funds. All other SMCR firms should complete Section 3A instead. The SMCR has applied to UK banks building societies credit unions branches of foreign banks operating in the UK and the largest investment firms regulated by the PRA and the FCA since 7 March 2016. A short Form A can generally be used where.

Source: p2pfinancenews.co.uk

Source: p2pfinancenews.co.uk

Both the applicant firm and the candidate will be treated by the FCA as having taken these notes into consideration when completing this form. In SUP 157 or in Senior Managers Regime. Between the SMCR and the current FCA Approved Persons regime. Scope SMCR firms can also use this form to notify the FCA that they agree to be subject to the rules for core SMCR firms set out in SYSC 23 Annex 1. A currently approved individual is applying for an additional controlled function at the same firm.

Source:

Between the SMCR and the current FCA Approved Persons regime. Both the applicant and the candidate will be treated by the FCA as having taken these notes into consideration when completing this form. Short Form A Solo-regulated firms including EEA and third country Application to perform controlled functions including senior management functions FCA Handbook Reference. All other SMCR firms should complete Section 3A instead. The SMCR will apply to all FCA solo-regulated firms authorised under Financial Services and Markets Act 2000 FSMA as well as EEA and third-country branches.

Source:

Financial Conduct Authoritys FCA equivalent proposals in paragraphs 492 to 497 of FCA CP 1829 Temporary permissions regime for inbound firms and funds. On 3 April the FCA published a statement alerting FCA solo-regulated firms of its expectations under the Senior Managers and Certification Regime SMCR during the continued COVID-19 situation. An application for an individual to perform a specified SMF or for Appointed Representatives only controlled function at the firm s. Both the applicant firm and the candidate will be treated by the FCA as having taken these notes into consideration when completing this form. Its purpose is to inform firms of their need to keep their governance arrangements under review and to make appropriate adjustments as circumstances change.

A short Form A can generally be used where. We welcome the publication of the statutory instrument. Insurers are also in scope but we have provided a separate guide and Policy Statement PS for these firms. Scope SMCR firms can also use this form to notify the FCA that they agree to be subject to the rules for core SMCR firms set out in SYSC 23 Annex 1. In SUP 157 or in Senior Managers Regime.

Source: automotive-compliance.co.uk

Source: automotive-compliance.co.uk

We have also applied the SMCR to the FCA and published information about how weve done this. Performing controlled functions at an FCA solo regulated firm prior to commencement of the SMCR. The deadline for solo-regulated firms to comply with. On 3 April the FCA published a statement alerting FCA solo-regulated firms of its expectations under the Senior Managers and Certification Regime SMCR during the continued COVID-19 situation. Form K now available.

Source:

SUP 10C Annex 3D 9 December 2019. SUP 10C Annex 3D. Both the applicant firm and the candidate will be treated by the FCA as having taken these notes into consideration when completing this form. If a firm submits this form to opt-up that firm will be subject to the rules of the new SMCR classification three calendar months. Importantly the FCA have clarified that firms must submit their Form K Conversion Notification by 2359 on 24 November 2019.

Source: pinterest.com

Source: pinterest.com

The FCA this week has released additional guidance to solo-regulated firms submitting SMCR forms in respect of Senior Managers ahead of the implementation deadline of 9 December 2019. Short Form A Solo-regulated firms including EEA and third country Application to perform controlled functions including senior management functions Chapter. We welcome the publication of the statutory instrument. Following commencement of the SMCR only appointed representatives should complete this section. A currently approved individual is applying for an additional controlled function at the same firm.

Source: leamancrellin.co.uk

Source: leamancrellin.co.uk

Both the applicant and the candidate will be treated by the FCA as having taken these notes into consideration when completing this form. Form K now available. Scope SMCR firms can also use this form to notify the FCA that they agree to be subject to the rules for core SMCR firms set out in SYSC 23 Annex 1. In this context employee is defined more broadly than its usual meaning and generally includes groups. Both the applicant and the candidate will be treated by the FCA as having taken these notes into consideration when completing this form.

Source: rbcompliance.co.uk

Source: rbcompliance.co.uk

In particular this note includes a set of Frequently Asked Questions FAQs on how the two sets of. The above questions should be completed whether submission of this form is online or in one of the other ways set out. Performing controlled functions at an FCA solo regulated firm prior to commencement of the SMCR. The FCA this week has released additional guidance to solo-regulated firms submitting SMCR forms in respect of Senior Managers ahead of the implementation deadline of 9 December 2019. In several respects the SMCR is a more onerous regime.

Source: fca.org.uk

Source: fca.org.uk

In several respects the SMCR is a more onerous regime. Long Form A Solo-regulated firms including EEA and third country Application to perform controlled functions including senior management functions FCA Handbook Reference. They apply to all employees of solo-regulated firms except for certain ancillary staff who are specifically excluded read pages 45-46 of the SMCR guide for FCA solo-regulated firms PDF. The opt-up will take effect three months from the date of this notification. SUP 10C Annex 3D.

Source:

Importantly the FCA have clarified that firms must submit their Form K Conversion Notification by 2359 on 24 November 2019. All other SMCR firms should complete Section 3A instead. Why regulations have changed. Long Form A UK Relevant Authorised Persons and Third Country Relevant Authorised Persons only. Following a request from the FCA the Treasury has made a statutory instrument to delay from 9 December 2020 until 31 March 2021 the deadline for solo-regulated firms to have undertaken the first assessment of the fitness and propriety of their Certified Persons.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fca form a smcr by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas