20++ Fca guidance money laundering regulations info

Home » about money loundering Info » 20++ Fca guidance money laundering regulations infoYour Fca guidance money laundering regulations images are available. Fca guidance money laundering regulations are a topic that is being searched for and liked by netizens now. You can Find and Download the Fca guidance money laundering regulations files here. Find and Download all royalty-free vectors.

If you’re looking for fca guidance money laundering regulations images information linked to the fca guidance money laundering regulations interest, you have visit the ideal blog. Our website always gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

Fca Guidance Money Laundering Regulations. It also applies to Annex I financial institutions and e-money institutions for whom we are the supervisory authority under the Money Laundering Regulations. It provides a high-level FCA guide to financial crime. To being regulated by us. With regular audits how companies apply these policies and procedures are monitored and managed.

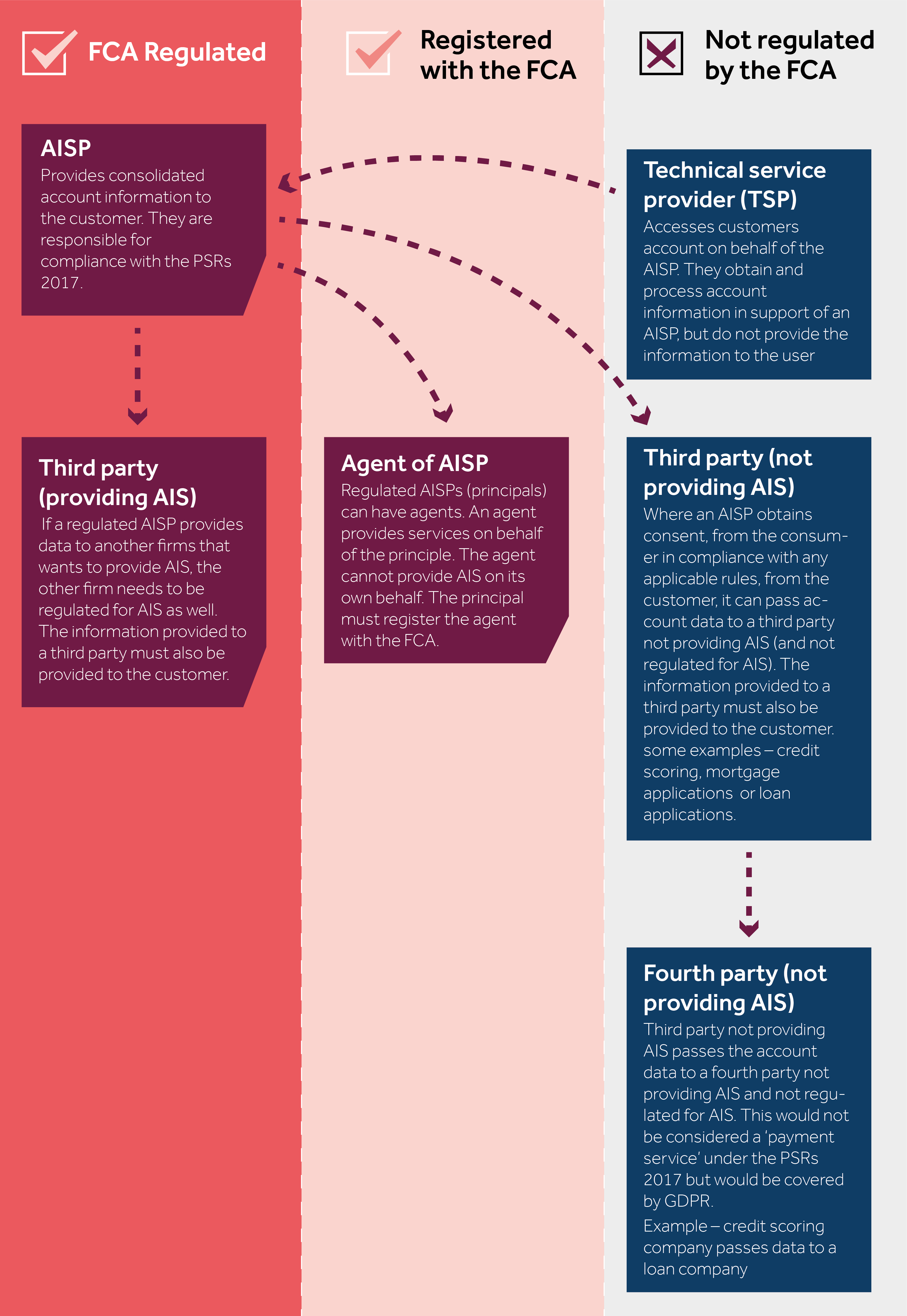

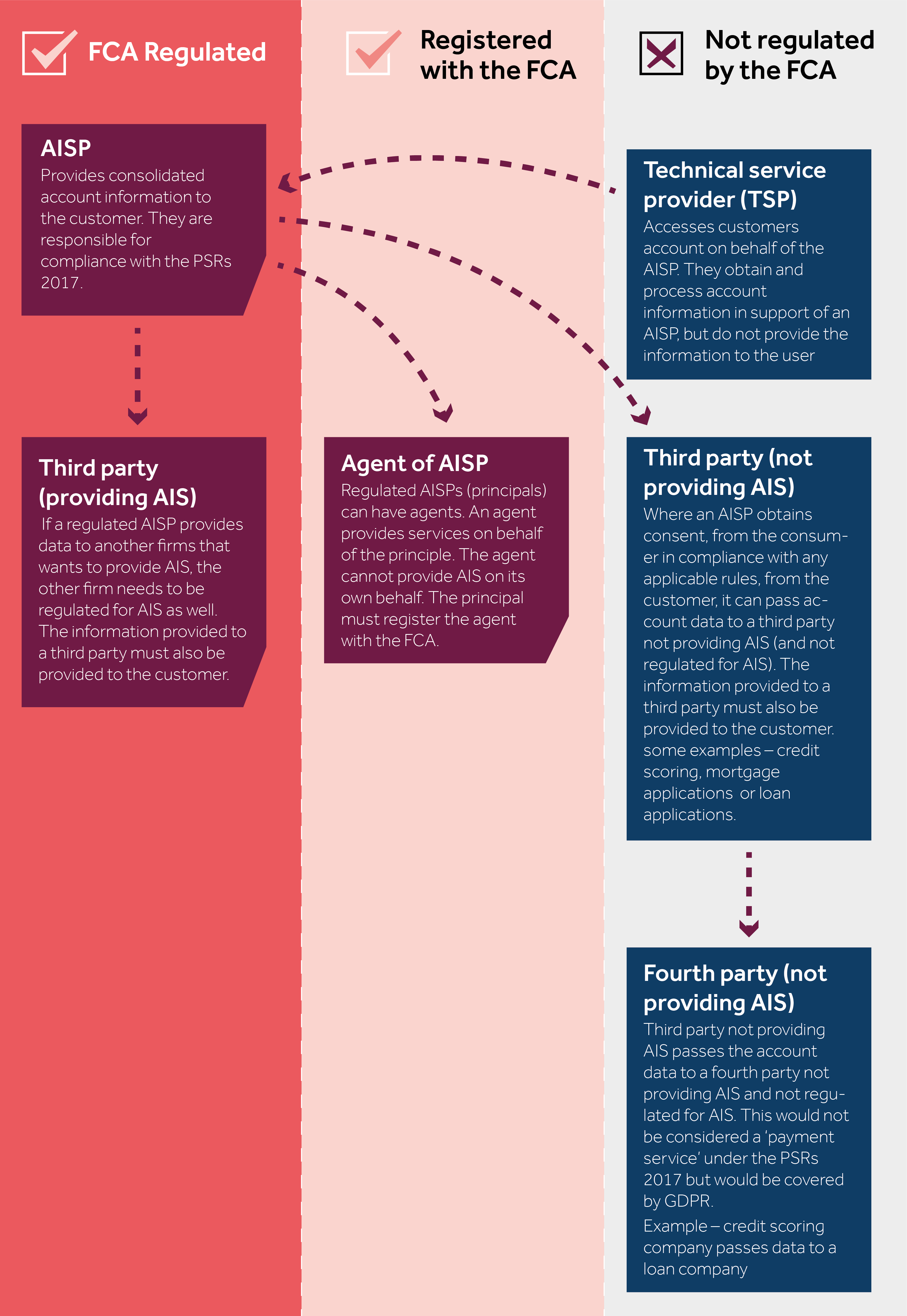

Aisp Models Under Psd2 Fca From fca.org.uk

Aisp Models Under Psd2 Fca From fca.org.uk

FCA expects all companies that are subject to the Money Laundering Regulations to fulfill complementary regulatory obligations in addition to policies and procedures to minimize the risk of money laundering. The Money Laundering Regulations 2017 came into force on 26 June 2017 and updates the UKs anti-money laundering AML regime. Guidance to firms on steps that can be taken to reduce financial crime risk. The Money Laundering Regulations impose requirements including amongst other things obligations to apply customer due diligence measures and conduct ongoing monitoring of business relationships on designated types of business. FCGalso contains guidance on how firms can meet the requirements of the Money Laundering Regulationsand the EU Funds Transfer Regulation. This includes knowing about the money laundering risks to which the firm is exposed and ensuring that steps are taken to mitigate those.

1The FCA has investigation and sanctioning powers in relation to both criminal and civil breaches of the Money Laundering Regulations.

Failures in anti-money laundering controls will not automatically result in disciplinary sanctions although enforcement action is more likely where a firm has not taken adequate steps to identify its money laundering risks or put in place appropriate controls to mitigate those risks and. FCA expects all companies that are subject to the Money Laundering Regulations to fulfill complementary regulatory obligations in addition to policies and procedures to minimize the risk of money laundering. FCGalso contains guidance on how firms can meet the requirements of the Money Laundering Regulationsand the EU Funds Transfer Regulation. To being regulated by us. We expect senior management to take responsibility for the firms anti-money laundering AML measures. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing.

Source: fca.org.uk

Source: fca.org.uk

It provides a high-level FCA guide to financial crime. FCA expects all companies that are subject to the Money Laundering Regulations to fulfill complementary regulatory obligations in addition to policies and procedures to minimize the risk of money laundering. Firms also need to ensure that the measures they take in meeting customer due diligence and ongoing monitoring are commensurate to those risks. In it we explain. Failures in anti-money laundering controls will not automatically result in disciplinary sanctions although enforcement action is more likely where a firm has not taken adequate steps to identify its money laundering risks or put in place appropriate controls to mitigate those risks and.

Source: pinterest.com

Source: pinterest.com

The regulations require firms subject to anti-money laundering obligations to ensure that they create policies and procedures that assess the risks they face from money laundering and terrorist financing. FCA has specific laws and regulations to prevent money laundering and entities obliged to comply with FCA laws must comply with them or they will be subject to FCA AML penalties. In practice this includes businesses that offer finance leases commercial lenders and providers of safe. Failures in anti-money laundering controls will not automatically result in disciplinary sanctions although enforcement action is more likely where a firm has not taken adequate steps to identify its money laundering risks or put in place appropriate controls to mitigate those risks and. The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed.

Source: rbcompliance.co.uk

Source: rbcompliance.co.uk

We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations. The guidance in FCG 221G on governance in relation to financial crime also applies to money laundering. We expect senior management to take responsibility for the firms anti-money laundering AML measures. In March 2017 we consulted on guidance GC172 in. Guidance to firms on steps that can be taken to reduce financial crime risk.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

We expect senior management to take responsibility for the firms anti-money laundering AML measures. FCGalso contains guidance on how firms can meet the requirements of the Money Laundering Regulationsand the EU Funds Transfer Regulation. Businesses carrying out certain cryptoasset activities also need to comply with the MLRs in relation to those activities from 10 January 2020 and to register with us during 2020. It also applies to Annex I financial institutions and e-money institutions for whom we are the supervisory authority under the Money Laundering Regulations. Firms also need to ensure that the measures they take in meeting customer due diligence and ongoing monitoring are commensurate to those risks.

Source: br.pinterest.com

Source: br.pinterest.com

Firms also need to ensure that the measures they take in meeting customer due diligence and ongoing monitoring are commensurate to those risks. The FCA when considering whether a breach of its rules on systems and controls against money laundering has occurred will have regard to whether a firm has followed relevant provisions in the guidance for the United Kingdom financial sector issued by the Joint Money Laundering. This includes knowing about the money laundering risks to which the firm is exposed and ensuring that steps are taken to mitigate those. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. Businesses carrying out certain cryptoasset activities also need to comply with the MLRs in relation to those activities from 10 January 2020 and to register with us during 2020.

Source: ar.pinterest.com

Source: ar.pinterest.com

More sector specific guidance on responsibilities under the Money Laundering Regulations can be found in guidance for. In practice this includes businesses that offer finance leases commercial lenders and providers of safe. Firms also need to ensure that the measures they take in meeting customer due diligence and ongoing monitoring are commensurate to those risks. In it we explain. It provides a high-level FCA guide to financial crime.

Source: fca.org.uk

Source: fca.org.uk

FCGalso contains guidance on how firms can meet the requirements of the Money Laundering Regulationsand the EU Funds Transfer Regulation. The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. This includes knowing about the money laundering risks to which the firm is exposed and ensuring that steps are taken to mitigate those. It provides a high-level FCA guide to financial crime. Fca anti money laundering guidance.

Source: sygna.io

Source: sygna.io

Businesses carrying out certain cryptoasset activities also need to comply with the MLRs in relation to those activities from 10 January 2020 and to. Anti-money laundering guidance for the legal sector. While the relevant parts of the guide that refer to theMoney Laundering Regulationsmay berelevant guidanceunder these regulations it is not approved by HM Treasury. FCGalso contains guidance on how firms can meet the requirements of the Money Laundering Regulationsand the EU Funds Transfer Regulation. The regulations require firms subject to anti-money laundering obligations to ensure that they create policies and procedures that assess the risks they face from money laundering and terrorist financing.

Source: biia.com

Source: biia.com

With regular audits how companies apply these policies and procedures are monitored and managed. Fca anti money laundering guidance. Regulation 23 requires authorised persons to inform us if they are undertaking Money Service Business MSB or Trust or Company Service TCSP activities. It also applies to Annex I financial institutions and e-money institutions for whom we are the supervisory authority under the Money Laundering Regulations. It provides a high-level FCA guide to financial crime.

Source: fca.org.uk

Source: fca.org.uk

These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. 1The FCA has investigation and sanctioning powers in relation to both criminal and civil breaches of the Money Laundering Regulations. While the relevant parts of the guide that refer to theMoney Laundering Regulationsmay berelevant guidanceunder these regulations it is not approved by HM Treasury. The guidance in FCG 221G on governance in relation to financial crime also applies to money laundering. FCG 312 13122018 1 This guidance does not apply to payment institutions which are supervised for compliance with the Money Laundering Regulations by HM Revenue and Customs.

Source: ar.pinterest.com

Source: ar.pinterest.com

We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations. This includes knowing about the money laundering risks to which the firm is exposed and ensuring that steps are taken to mitigate those. We expect senior management to take responsibility for the firms anti-money laundering AML measures. The Money Laundering Terrorist Financing and Transfer of Funds Information on. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing.

Source: in.pinterest.com

Source: in.pinterest.com

While the relevant parts of the guide that refer to theMoney Laundering Regulationsmay berelevant guidanceunder these regulations it is not approved by HM Treasury. In practice this includes businesses that offer finance leases commercial lenders and providers of safe. In it we explain. Failures in anti-money laundering controls will not automatically result in disciplinary sanctions although enforcement action is more likely where a firm has not taken adequate steps to identify its money laundering risks or put in place appropriate controls to mitigate those risks and. This includes knowing about the money laundering risks to which the firm is exposed and ensuring that steps are taken to mitigate those.

FCA expects all companies that are subject to the Money Laundering Regulations to fulfill complementary regulatory obligations in addition to policies and procedures to minimize the risk of money laundering. We are publishing finalised guidance for how financial services firms should treat customers who are politically exposed persons when meeting their anti-money laundering obligations. While the relevant parts of the guide that refer to theMoney Laundering Regulationsmay berelevant guidanceunder these regulations it is not approved by HM Treasury. The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. Fca anti money laundering guidance.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fca guidance money laundering regulations by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas