15+ Fca money laundering risk assessment information

Home » about money loundering idea » 15+ Fca money laundering risk assessment informationYour Fca money laundering risk assessment images are ready. Fca money laundering risk assessment are a topic that is being searched for and liked by netizens today. You can Download the Fca money laundering risk assessment files here. Find and Download all free photos and vectors.

If you’re looking for fca money laundering risk assessment images information connected with to the fca money laundering risk assessment topic, you have come to the ideal site. Our site frequently gives you hints for downloading the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

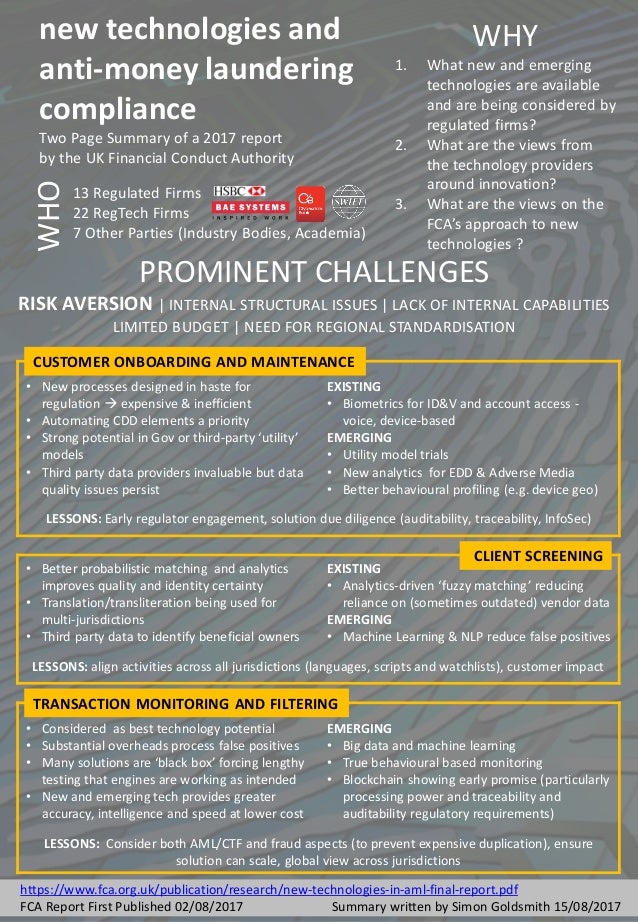

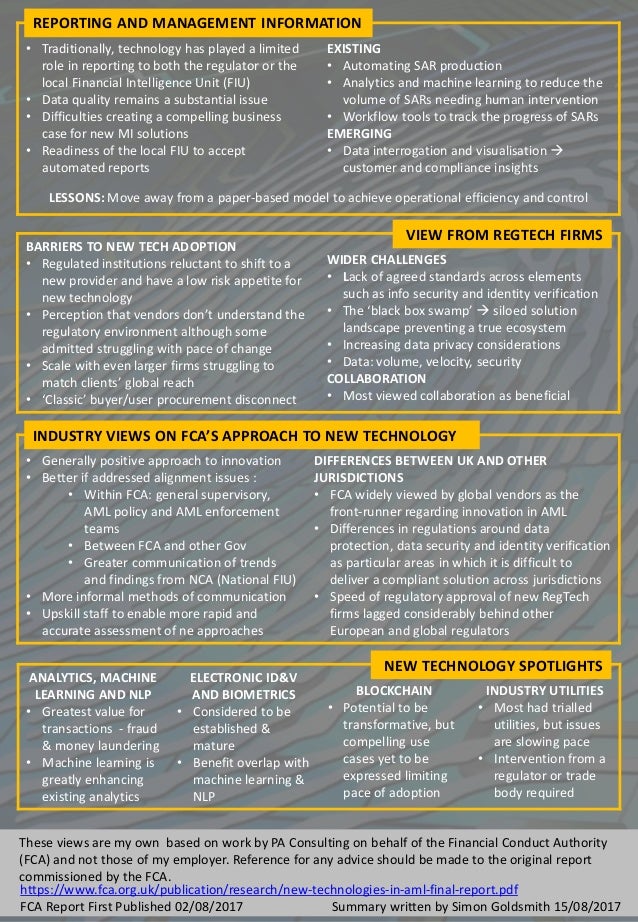

Fca Money Laundering Risk Assessment. A firm is required by Regulation 18 of the Money Laundering Regulations to undertake a risk assessment. This risk assessment should be proportionate to the nature and scale of your firms activities taking into account a range of factors such as the products and services you offer and the way in. It identifies assesses and mitigates the risks of money laundering and terrorist financing affecting the UK. Risk assessment You should identify and assess the financial crime risks to which your business is exposed.

Fca Fines Deutsche Bank 163 Million For Serious Anti Money Laundering Controls Failings Planet Compliance From planetcompliance.com

Fca Fines Deutsche Bank 163 Million For Serious Anti Money Laundering Controls Failings Planet Compliance From planetcompliance.com

Business-wide risk assessment 37 The business-wide risk assessment should be constantly reviewed and include any. Financial sector on the prevention of money laundering and combating terrorist financing isrelevant guidanceand is approved by HM Treasury under theMoney Laundering Regulations. Anti-money laundering analysis. And a member of the. In two cases the firms had commissioned consultants to carry out a further review of AML policies. In 2017 the UK National Risk Assessment of money laundering and terrorist financing assessed capital markets to be exposed to high risks of money laundering.

The 2020 national risk assessment NRA is the third comprehensive assessment of money laundering and terrorist financing.

Ownershipmanagement structure including the possible impactinfluence that ultimate beneficial owners with political connections may have. He was a member of the British Bankers Association Money Laundering Committee from 2003 -10. Risk assessment is a continuous process based on the best information available from internal and external sources. The assessment of money laundering risk is at the core of the firms AML effort and is essential to the development of effective AML policies and procedures. Anti-money laundering analysis. The 2020 national risk assessment NRA is the third comprehensive assessment of money laundering and terrorist financing.

It identifies assesses and mitigates the risks of money laundering and terrorist financing affecting the UK. 2 are comprehensive and proportionate to the nature scale. The types of customer you have. For example we dontalways see firms differentiate between money laundering. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing.

Source: ar.pinterest.com

Source: ar.pinterest.com

Money laundering risk assessment Most large firms had undertaken a formal money laundering risk assessment. Install in minutes to identify analyze effectively prioritize respond to risks. When you assess the risks of money laundering that apply to your business you need to consider. Help small financial adviser firms adopt appropriate practices to mitigate money laundering and terrorist financing risks. For example we dontalways see firms differentiate between money laundering.

Source: pinterest.com

Source: pinterest.com

In two cases the firms had commissioned consultants to carry out a further review of AML policies. And a member of the. Money laundering risk assessment Most large firms had undertaken a formal money laundering risk assessment. Ad SimpleRisk is a comprehensive tool for your entire enterprise risk management program. The Money Laundering Reporting Officers MLROs in these firms had also documented the risks posed by their customers and productsbusiness lines.

Source: asiatokenfund.com

Source: asiatokenfund.com

Risk assessment is a continuous process based on the best information available from internal and external sources. A firm is required by Regulation 18 of the Money Laundering Regulations to undertake a risk assessment. He was a member of the British Bankers Association Money Laundering Committee from 2003 -10. In two cases the firms had commissioned consultants to carry out a further review of AML policies. The regulator refuses to publish its own assessment of high risk jurisdictions on the grounds that it may damage the UKs foreign relations.

Source: tookitaki.ai

Source: tookitaki.ai

1 enable it to identify assess monitor and manage money laundering risk. The types of customer you have. Efforts to understand risk are piecemeal and lack coordination. 1 enable it to identify assess monitor and manage money laundering risk. And a member of the.

Source: lumynassociates.co.uk

Source: lumynassociates.co.uk

Businesses carrying out certain cryptoasset activities also need to comply with the MLRs in relation to those activities from 10 January 2020 and to register with us during 2020. The quality of the respondents. Risk assessment is a continuous process based on the best information available from internal and external sources. For example we dontalways see firms differentiate between money laundering. Install in minutes to identify analyze effectively prioritize respond to risks.

Source: pinterest.com

Source: pinterest.com

Ad SimpleRisk is a comprehensive tool for your entire enterprise risk management program. Install in minutes to identify analyze effectively prioritize respond to risks. Risk assessments are incomplete. A firm must ensure the policies and procedures established under SYSC 611 R include systems and controls that. When you assess the risks of money laundering that apply to your business you need to consider.

Source: biia.com

Source: biia.com

This risk assessment should be proportionate to the nature and scale of your firms activities taking into account a range of factors such as the products and services you offer and the way in. They should seek to take into account the latest NRA findings and guidance when completing internal assessments. 1 enable it to identify assess monitor and manage money laundering risk. Efforts to understand risk are piecemeal and lack coordination. And a member of the.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

Efforts to understand risk are piecemeal and lack coordination. Risk assessment You should identify and assess the financial crime risks to which your business is exposed. The assessment of money laundering risk is at the core of the firms AML effort and is essential to the development of effective AML policies and procedures. Their risk assessment must be comprehensive and proportionate to the nature scale and complexity of the firms business activities. We have developed a set of questions about management responsibilities reports a risk-based approach training suspicious activities and identifying customers.

Source: planetcompliance.com

Source: planetcompliance.com

Money laundering risk assessment Most large firms had undertaken a formal money laundering risk assessment. Anti-money laundering analysis. We have developed a set of questions about management responsibilities reports a risk-based approach training suspicious activities and identifying customers. Risk assessment is a one-off exercise. 1 enable it to identify assess monitor and manage money laundering risk.

Source: member.fintech.global

Source: member.fintech.global

Install in minutes to identify analyze effectively prioritize respond to risks. He was a member of the British Bankers Association Money Laundering Committee from 2003 -10. Antimoney laundering Self Assessment Tool This is to. Risk assessments are incomplete. We have developed a set of questions about management responsibilities reports a risk-based approach training suspicious activities and identifying customers.

Source: slideshare.net

Source: slideshare.net

UK FCA and EU blacklists update 04 Dec 2018. A firm is required by Regulation 18 of the Money Laundering Regulations to undertake a risk assessment. As confirmed in DEPP 623G EG 1212Gand EG 19155G theFCAwill continue to have regard to. The regulator refuses to publish its own assessment of high risk jurisdictions on the grounds that it may damage the UKs foreign relations. He was a member of the British Bankers Association Money Laundering Committee from 2003 -10.

Source: slideshare.net

Source: slideshare.net

It identifies assesses and mitigates the risks of money laundering and terrorist financing affecting the UK. The quality of the respondents. 1 enable it to identify assess monitor and manage money laundering risk. It identifies assesses and mitigates the risks of money laundering and terrorist financing affecting the UK. The regulator refuses to publish its own assessment of high risk jurisdictions on the grounds that it may damage the UKs foreign relations.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca money laundering risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information