10++ Fca new technologies and anti money laundering compliance info

Home » about money loundering Info » 10++ Fca new technologies and anti money laundering compliance infoYour Fca new technologies and anti money laundering compliance images are ready in this website. Fca new technologies and anti money laundering compliance are a topic that is being searched for and liked by netizens now. You can Find and Download the Fca new technologies and anti money laundering compliance files here. Download all royalty-free photos.

If you’re searching for fca new technologies and anti money laundering compliance images information connected with to the fca new technologies and anti money laundering compliance keyword, you have come to the right blog. Our site frequently gives you suggestions for viewing the highest quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

Fca New Technologies And Anti Money Laundering Compliance. Firms must have in place policies and procedures in relation to customer due diligence and monitoring among. The risk-based approach to anti-money laundering. Anti-money laundering guidance for the legal sector. FCA TechSprint on global anti-money laundering and financial crime By Matthew Gregory UK on July 11 2019 Posted in Fintech United Kingdom On 10 July 2019 the FCA announced that from 29 July to 2 August 2019 it will be holding a follow-up to its 2018 AML Financial Crime TechSprint.

All You Need To Know About Anti Money Laundering Aml Compliance From fineksus.com

All You Need To Know About Anti Money Laundering Aml Compliance From fineksus.com

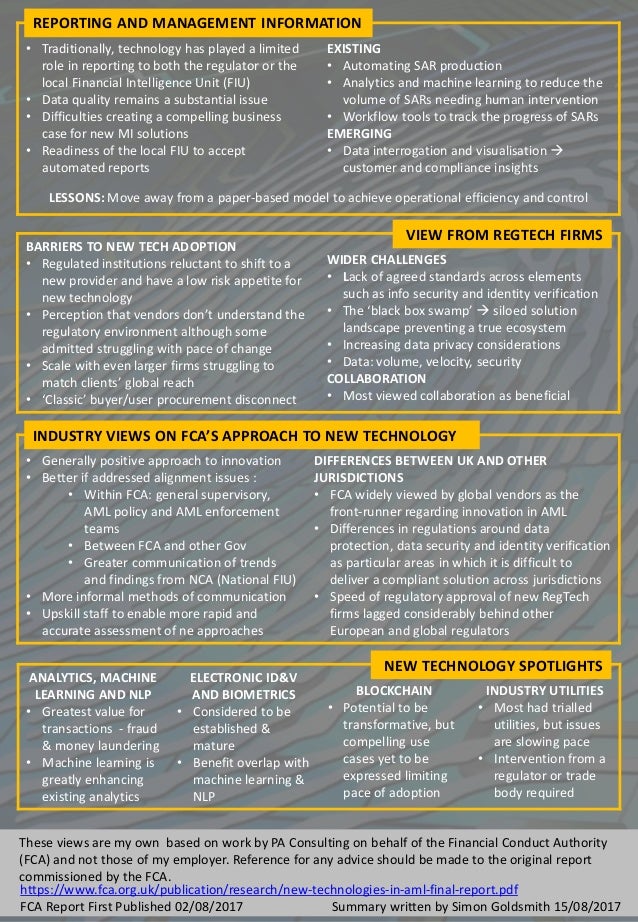

The FCA has shared a number of useful resources on how the financial services industry can use new technologies to support AML compliance particularly in the area of client due diligence CDD. New technologies and anti-money laundering compliance report. Introduction new technologies and anti-money laundering compliance 4 background to the review 5. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. New Technologies And Anti Money Laundering Compliance Personal Summa. Fca aml enforcement cases.

The banking sector like many other industries is experiencing big disruption.

The report is intended to increase the FCAs understanding of emerging technologies and their. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. New Technologies And Anti Money Laundering Compliance Personal Summa. New technologies and anti-money laundering compliance report Research Published. Introduction new technologies and anti-money laundering compliance 4 background to the review 5. Some of the nuances touched on in the report include the pseudonymous nature of digital assets privacy enhancing protocols and tools self-hosted wallets and non.

Source: tookitaki.ai

Source: tookitaki.ai

Regulations Anti-Money Laundering and Financing of Terrorism are different in each country. In summary the report finds that many new technologies are perceived as having potential in anti-money laundering AML compliance with regulated firms slowly trailing a wide variety of innovative solutions both to manage their financial crime risk. Facebook 0 Tweet 0 LinkedIn 0. Regulations Anti-Money Laundering and Financing of Terrorism are different in each country. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures.

Source: skillcast.com

Source: skillcast.com

Steps are being taken to reduce the burden of compliance through innovative methods of streamlining AML activity De-risking. New technologies and anti-money laundering compliance report. In summary the report finds that many new technologies are perceived as having potential in anti-money laundering AML compliance with regulated firms slowly trailing a wide variety of innovative solutions both to manage their financial crime risk. Sanction Scanner provides technology-compatible Anti-Money Laundering solutions to strengthen FinTech companys AML compliance processes. Facebook 0 Tweet 0 LinkedIn 0.

Source: qa.nonprod.trulioo.com

Source: qa.nonprod.trulioo.com

We commissioned a survey and report on emerging technologies with potential for enhancing financial firms work to detect and prevent money laundering and for helping make the UK a hostile environment for criminals money. Every company is becoming a tech company. Regulations Anti-Money Laundering and Financing of Terrorism are different in each country. Fca aml enforcement cases. We have this thesis that every company needs to be a financial services company too.

Source: fineksus.com

Source: fineksus.com

Regulations Anti-Money Laundering and Financing of Terrorism are different in each country. The risk-based approach to anti-money laundering. On 2 August the FCA published its report on new technologies and anti-money laundering compliance. On August 2nd the FCA published the results of a survey on new technologies and financial firms work to detect and prevent money laundering to help make the UK a hostile environment for criminals money. New technologies and anti-money laundering compliance report.

Source: biia.com

Source: biia.com

The FCA publishes report on new technologies and AML compliance. But more to do industry views on the fcas approach to new technologies in aml compliance. Fca anti money laundering guidance. It is interesting then to look at the types of cases the FCA has opened in 2020 as an indication of the areas in which misconduct arose. Regulations Anti-Money Laundering and Financing of Terrorism are different in each country.

Source: pdfprof.com

Source: pdfprof.com

Regulations Anti-Money Laundering and Financing of Terrorism are different in each country. The Advent of New Technologies Brings New Hurdles for Anti-Money Laundering Compliance but Also New Opportunities. We have this thesis that every company needs to be a financial services company too. New technologies and anti-money laundering compliance report. The banking sector like many other industries is experiencing big disruption.

Source: slideshare.net

Source: slideshare.net

We have this thesis that every company needs to be a financial services company too. On 2 August the FCA published its report on new technologies and anti-money laundering compliance. In summary the report finds that many new technologies are perceived as having potential in anti-money laundering AML compliance with regulated firms slowly trailing a wide variety of innovative solutions both to manage their financial crime risk. FCA resources on using new technology to support AML compliance. Steps are being taken to reduce the burden of compliance through innovative methods of streamlining AML activity De-risking.

Source: theaccountant-online.com

Source: theaccountant-online.com

Fca aml enforcement cases. Sanction Scanner provides technology-compatible Anti-Money Laundering solutions to strengthen FinTech companys AML compliance processes. The FCA has shared a number of useful resources on how the financial services industry can use new technologies to support AML compliance particularly in the area of client due diligence CDD. On August 2nd the FCA published the results of a survey on new technologies and financial firms work to detect and prevent money laundering to help make the UK a hostile environment for criminals money. The FCAs Anti-Money Laundering AML Report.

Source: shuftipro.com

Source: shuftipro.com

Sanction Scanner provides technology-compatible Anti-Money Laundering solutions to strengthen FinTech companys AML compliance processes. The banking sector like many other industries is experiencing big disruption. On 2 August the FCA published its report on new technologies and anti-money laundering compliance. The risk-based approach means a focus on outputs. In summary the report finds that many new technologies are perceived as having potential in anti-money laundering AML compliance with regulated firms slowly trailing a wide variety of innovative solutions both to manage their financial crime risk.

Source: slideshare.net

Source: slideshare.net

The report is intended to increase the FCAs understanding of emerging technologies and their. The banking sector like many other industries is experiencing big disruption. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. New technologies and anti-money laundering compliance report. Steps are being taken to reduce the burden of compliance through innovative methods of streamlining AML activity De-risking.

Source:

The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. Every company is becoming a tech company. On August 2nd the FCA published the results of a survey on new technologies and financial firms work to detect and prevent money laundering to help make the UK a hostile environment for criminals money. With DeFi being a fast-moving space approaches to anti-money laundering regulation and investor protection policies will also have to keep up and account for the associated nuances. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation.

Source: pinterest.com

Source: pinterest.com

The report details findings of 3 months of research. Introduction new technologies and anti-money laundering compliance 4 background to the review 5. We have this thesis that every company needs to be a financial services company too. Facebook 0 Tweet 0 LinkedIn 0. FCA TechSprint on global anti-money laundering and financial crime By Matthew Gregory UK on July 11 2019 Posted in Fintech United Kingdom On 10 July 2019 the FCA announced that from 29 July to 2 August 2019 it will be holding a follow-up to its 2018 AML Financial Crime TechSprint.

Source: pinterest.com

Source: pinterest.com

In May 2019 the FCA held a three-day global anti money laundering and financial crime TechSprint an event that addressed how new technology can be applied to combat money laundering and financial crime effectively. In August 2017 the FCA published a report undertaken by PA Consulting on emerging. Sanction Scanner provides technology-compatible Anti-Money Laundering solutions to strengthen FinTech companys AML compliance processes. Introduction new technologies and anti-money laundering compliance 4 background to the review 5. The report is intended to increase the FCAs understanding of emerging technologies and their.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca new technologies and anti money laundering compliance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas