20+ Fca sar reporting ideas

Home » about money loundering Info » 20+ Fca sar reporting ideasYour Fca sar reporting images are available. Fca sar reporting are a topic that is being searched for and liked by netizens now. You can Download the Fca sar reporting files here. Download all royalty-free photos and vectors.

If you’re searching for fca sar reporting pictures information linked to the fca sar reporting keyword, you have pay a visit to the right site. Our site always gives you hints for refferencing the highest quality video and picture content, please kindly hunt and find more informative video content and images that match your interests.

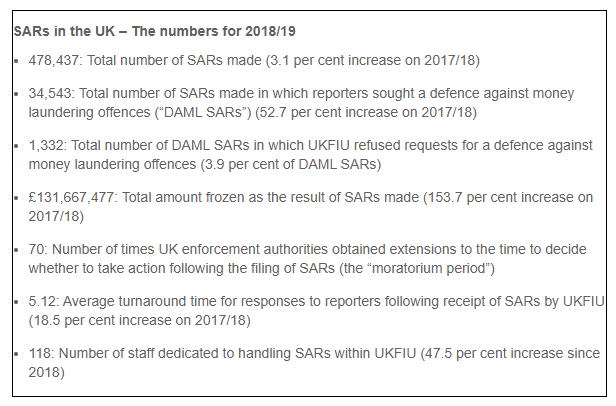

Fca Sar Reporting. Ultimately submitting a SAR protects you your firm the profession and the UK from the risk of laundering the proceeds of crime. Reason for suspicion Submitting a SAR provides law enforcement with valuable information on potential criminality. The National Crime Agency NCA has more on SARs. FCA fine for failures around suspicious activity reporting highlights the risks in relying on group-wide controls in UK companies.

Anti Money Laundering Ppt Download From slideplayer.com

Anti Money Laundering Ppt Download From slideplayer.com

Reports alert law enforcement to potential instances of money laundering or terrorist financing. During the meeting it was agreed that. Give you the opportunity to flag the SAR as a request for a defence against money laundering DAMLconsent issue. See FCG Annex 1 list of common terms for more information about nominated officers and Suspicious Activity Reports. Money laundering under part 7 of the Proceeds of Crime Act 2002 POCA terrorist financing under part 3 of the Terrorism Act 2000 TACT This guide explains how to report suspicious activity to the NCA. Suspicious Activity Reports SARs must be submitted to the National Crime Agency NCA.

Might constitute market abuse.

Give you the opportunity to flag the SAR as a request for a defence against money laundering DAMLconsent issue. Where anti- money laundering tasks are delegated by a relevant firms MLRO the FSA will expect the MLRO to take ultimate managerial responsibility for ensuring that the duties imposed on the MLRO by this sourcebook are complied with. What is a SAR. Suspicious Activity Reports SARs must be submitted to the National Crime Agency NCA. SUP 15103 R 03072016. To the FCA requires sufficient indications which may not be apparent until after the transaction has taken place that the transaction or order.

Source: sumsub.com

Suspicious Activity Reports SARs must be submitted to the National Crime Agency NCA. 1 Notification of suspicious transactions or orders. Ultimately submitting a SAR protects you your firm the profession and the UK from the risk of laundering the proceeds of crime. Might constitute market abuse. SUP 15104 G 03072016 RP.

Source:

Suspicious Activity Reports SARs and Suspicious Transaction and Order Reports STORs On 26 July 2019 colleagues from the Financial Conduct Authority FCA and UK Finance attended a meeting of the SARs Collaboration Working Group. The responsibilities to be discharged by the MLRO are set out in ML 7111 R. Ultimately submitting a SAR protects you your firm the profession and the UK from the risk of laundering the proceeds of crime. Suspicious Activity Reports SARs and Suspicious Transaction and Order Reports STORs On 26 July 2019 colleagues from the Financial Conduct Authority FCA and UK Finance attended a meeting of the SARs Collaboration Working Group. SARs are made by financial institutions and other professionals such as.

FCA fine for failures around suspicious activity reporting highlights the risks in relying on group-wide controls in UK companies. Reporting Annex 42B requirements 16 Guidance notes for completion of the Annual Financial Crime Report The form in SUP 16 Annex 42ARshould only be completed byfirmsandelectronic money institutions subject to the reporting requirements in SUP 16234Rand SUP 16155ADof theFCA Handbook. The letter was sent in response to a request by UK Finance a trade association following a meeting of the SARs Collaboration Working Group. The nominated officer has a legal obligation to report any knowledge or suspicions of money laundering to the National Crime Agency NCA through a Suspicious Activity Report also known as a SAR. On October 18 the Financial Conduct Authority FCA published a letter giving guidance on the distinction between suspicious activity reports SARs and suspicious transaction and order reports.

Source: corporatefinancialweeklydigest.com

Source: corporatefinancialweeklydigest.com

Suspicious Activity Reports SARs must be submitted to the National Crime Agency NCA. Suspicious Activity Reports SARs alert law enforcement to potential instances of money laundering or terrorist financing. The National Crime Agency NCA has more on SARs. All firms Annual accounts and reports Annual controllers reporting Client asset reports Client money and assets reporting Market data reporting Product sales data reporting Remuneration data reporting Reporting complaints Where to submit your returns. Specialist advice should be.

Source: slideplayer.com

Source: slideplayer.com

Reports alert law enforcement to potential instances of money laundering or terrorist financing. To the FCA requires sufficient indications which may not be apparent until after the transaction has taken place that the transaction or order. What is a SAR. The National Crime Agency NCA has more on SARs. Guide to submitting a Suspicious Transaction Order Report STOR using Connect Author.

Source:

1 Notification of suspicious transactions or orders. A SAR is a Suspicious Activity Report a piece of information which alerts law enforcement that certain clientcustomer activity is in some way suspicious and might indicate money laundering or. FCA fine for failures around suspicious activity reporting highlights the risks in relying on group-wide controls in UK companies. On October 18 the Financial Conduct Authority FCA published a letter giving guidance on the distinction between suspicious activity reports SARs and suspicious transaction and order reports. A suspicious activity report SAR is a disclosure made to the National Crime Agency NCA about known or suspected.

Source: slideplayer.com

Source: slideplayer.com

Money laundering under part 7 of the Proceeds of Crime Act 2002 POCA terrorist financing under part 3 of the Terrorism Act 2000 TACT This guide explains how to report suspicious activity to the NCA. 1 Notification of suspicious transactions or orders. The letter was sent in response to a request by UK Finance a trade association following a meeting of the SARs Collaboration Working Group. Please make sure the form is completed in full. Guide to submitting a Suspicious Transaction Order Report STOR using Connect Author.

Source:

IBUK is a London based broker which arranges and executes. A suspicious activity report SAR is a disclosure made to the National Crime Agency NCA about known or suspected. SUP 15103 R 03072016. Log in to Connect and complete the STOR form to report a STOR to us. 1 Notification of suspicious transactions or orders.

Source:

How to submit a STOR. The nominated officer has a legal obligation to report any knowledge or suspicions of money laundering to the National Crime Agency NCA through a Suspicious Activity Report also known as a SAR. Suspicious Activity Reports SARs are governed by the Proceeds of Crime Act 2002 and the Terrorism Act 2000 and do not fall under our market abuse regime. Please make sure the form is completed in full. During the meeting it was agreed that.

Source: biia.com

Source: biia.com

Reports alert law enforcement to potential instances of money laundering or terrorist financing. Find out more about the type of reports you should be sending us to comply with our regulatory requirements. All firms Annual accounts and reports Annual controllers reporting Client asset reports Client money and assets reporting Market data reporting Product sales data reporting Remuneration data reporting Reporting complaints Where to submit your returns. Reports alert law enforcement to potential instances of money laundering or terrorist financing. The nominated officer has a legal obligation to report any knowledge or suspicions of money laundering to the National Crime Agency NCA through a Suspicious Activity Report also known as a SAR.

Source: researchgate.net

Source: researchgate.net

The responsibilities to be discharged by the MLRO are set out in ML 7111 R. On October 18 the Financial Conduct Authority FCA published a letter giving guidance on the distinction between suspicious activity reports SARs and suspicious transaction and order reports STORs. How to submit a STOR. Guide to submitting a Suspicious Transaction Order Report STOR using Connect Author. Reporters that submit SARs via SAR Online will also receive an acknowledgement.

Source:

Suspicious Activity Reports SARs must be submitted to the National Crime Agency NCA. The content of this article is intended to provide a general guide to the subject matter. Reports alert law enforcement to potential instances of money laundering or terrorist financing. Ultimately submitting a SAR protects you your firm the profession and the UK from the risk of laundering the proceeds of crime. A SAR is a Suspicious Activity Report a piece of information which alerts law enforcement that certain clientcustomer activity is in some way suspicious and might indicate money laundering or.

Source: ibsintelligence.com

Source: ibsintelligence.com

A SAR is a Suspicious Activity Report a piece of information which alerts law enforcement that certain clientcustomer activity is in some way suspicious and might indicate money laundering or. In that respect readers may well be interested in the speech we report on elsewhere in this issue FCA pulls no punches in its quest for clean markets. To the FCA requires sufficient indications which may not be apparent until after the transaction has taken place that the transaction or order. The content of this article is intended to provide a general guide to the subject matter. Following a hearing in front of its Regulatory Decisions Committee RDC the FCA has issued a Final Notice to Interactive Brokers UK Limited IBUK.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fca sar reporting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas