18++ Federal anti money laundering statute ideas

Home » about money loundering idea » 18++ Federal anti money laundering statute ideasYour Federal anti money laundering statute images are ready in this website. Federal anti money laundering statute are a topic that is being searched for and liked by netizens now. You can Find and Download the Federal anti money laundering statute files here. Find and Download all royalty-free images.

If you’re looking for federal anti money laundering statute images information linked to the federal anti money laundering statute interest, you have pay a visit to the ideal site. Our website frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

Federal Anti Money Laundering Statute. Federal Laws Against Money Laundering. Money Laundering Overview. Domestic money laundering transactions 1956 a 1. And undercover sting money laundering transactions.

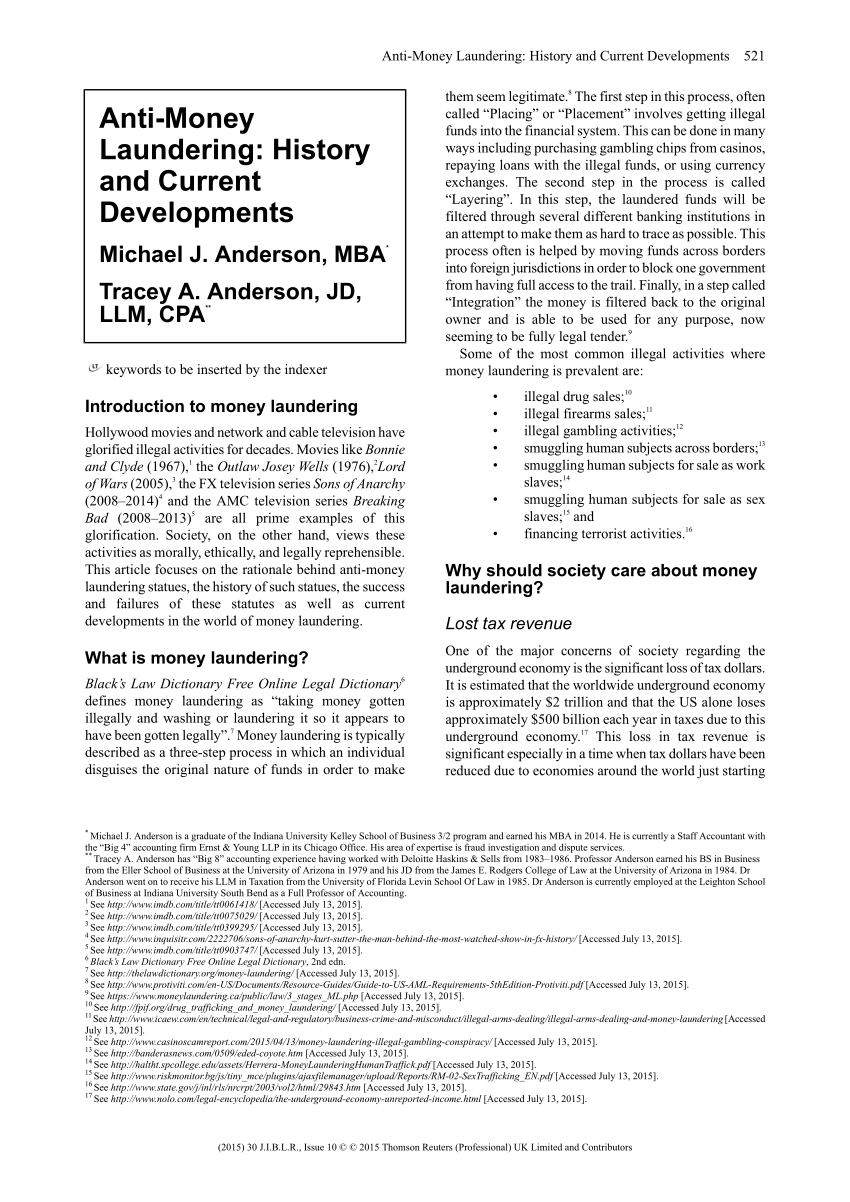

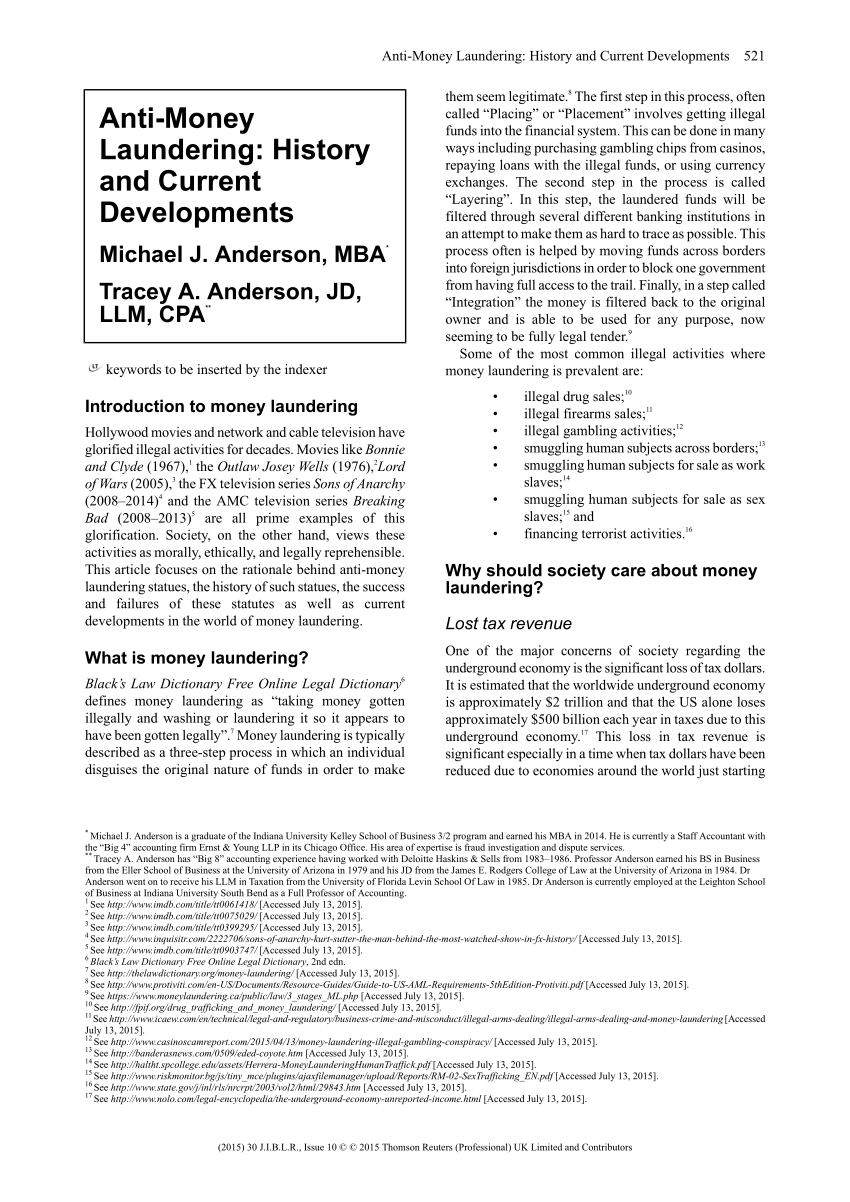

Pdf Anti Money Laundering History And Current Developments From researchgate.net

Pdf Anti Money Laundering History And Current Developments From researchgate.net

In order to qualify as money laundering a person must conduct or attempt to conduct a financial transaction with the intent to. Money Laundering Overview. 1956 and 18 USC. It is usually charged as a 3 rd degree felony with 7500 in fines or twice the value of the money involved whichever is greater. International money laundering transactions 1956 a 2. In Oklahoma money laundering is considered a federal crime.

And undercover sting money laundering transactions.

1956 and 18 USC. Section 47 GwG Prohibition of disclosure power to issue statutory instruments Anti-Money Laundering Section 47 GwG Prohibition of disclosure power to issue statutory instruments 1 An obliged entity must not inform the contracting party the instructing party of. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. It consists of two sections 18 USC. Money Laundering Overview. 23 1831j or section 213 or 214 of the Federal Credit Union Act 12 USC.

Source: pymnts.com

Source: pymnts.com

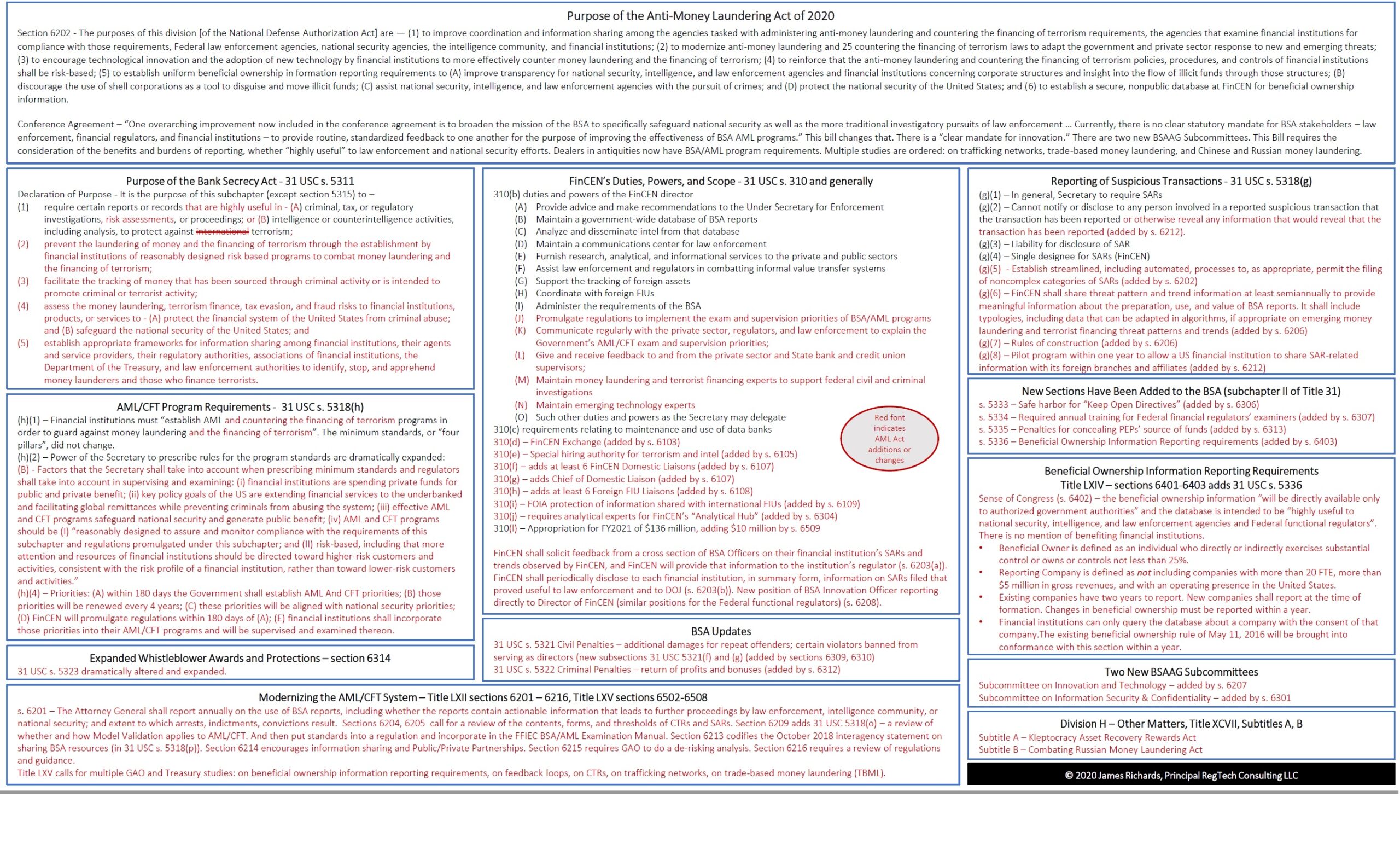

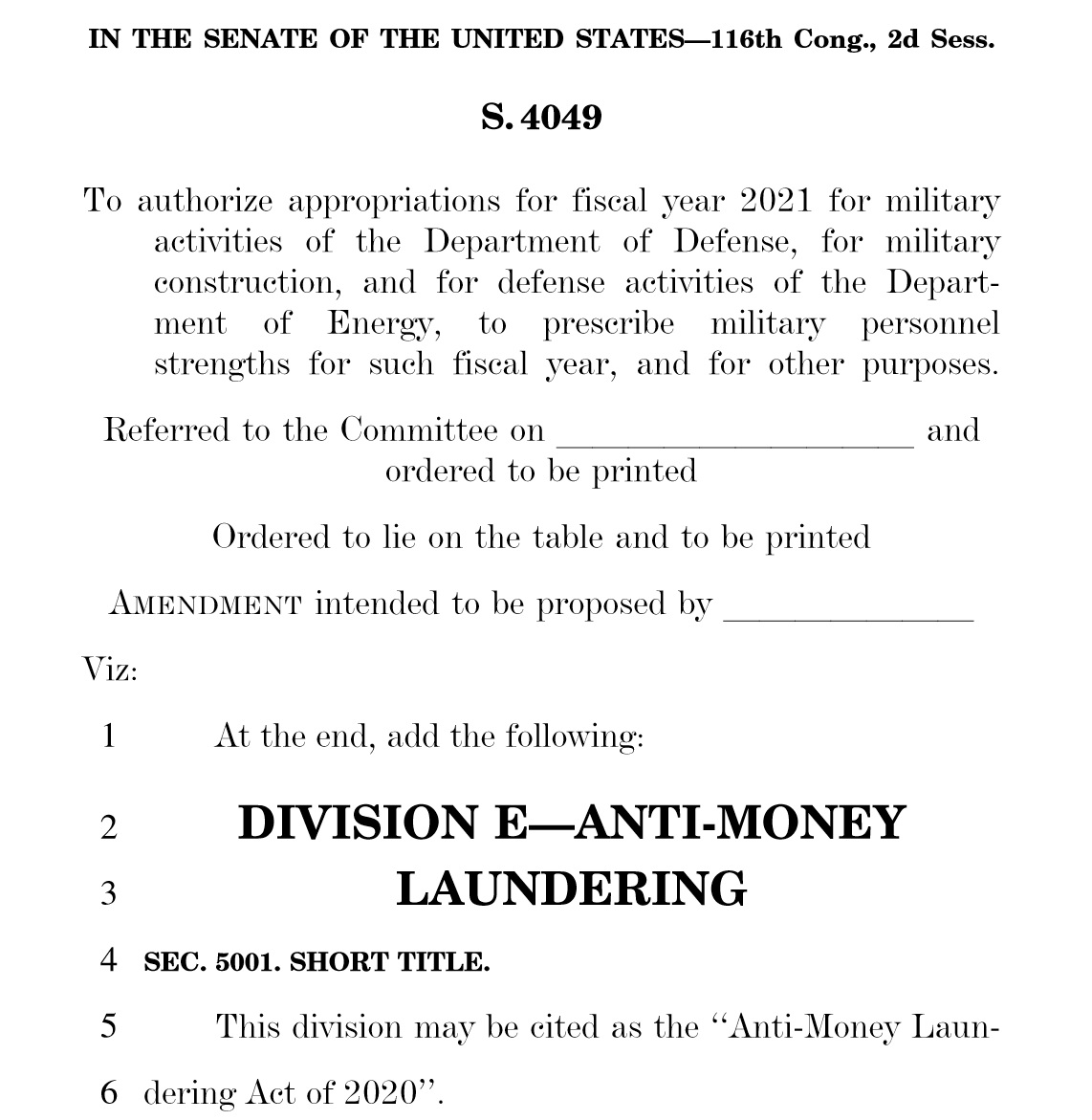

In a surprise bout of bipartisanship and overriding a presidential veto both chambers of Congress signaled a new priority for 2021the strengthening of federal anti-money laundering provisions albeit by an unexpected vehicle. 2 1The Federal Ministry of Finance may by means of a statutory order not requiring the consent of the Bundesrat exempt from the scope of this Act obliged entities under subsection 1 nos. Section 47 GwG Prohibition of disclosure power to issue statutory instruments Anti-Money Laundering Section 47 GwG Prohibition of disclosure power to issue statutory instruments 1 An obliged entity must not inform the contracting party the instructing party of. The Currency Reporting Statutes The first money laundering statutes were the currency reporting offenses set forth in title 31. A Clean Start to 2021.

Source: regtechconsulting.net

Source: regtechconsulting.net

In order to qualify as money laundering a person must conduct or attempt to conduct a financial transaction with the intent to. 6 of the. Domestic money laundering transactions 1956 a 1. The Currency Reporting Statutes The first money laundering statutes were the currency reporting offenses set forth in title 31. Promote the performance of a specified unlawful activity.

Source: blog.gao.gov

Source: blog.gao.gov

2 1The Federal Ministry of Finance may by means of a statutory order not requiring the consent of the Bundesrat exempt from the scope of this Act obliged entities under subsection 1 nos. What are the US. In the principal federal criminal money laundering statutes 18 USC. 23 1831j or section 213 or 214 of the Federal Credit Union Act 12 USC. Promote the performance of a specified unlawful activity.

Source: researchgate.net

Source: researchgate.net

To avoid a transaction reporting requirement under State or Federal law shall be sentenced to a fine of not more than 500000 or twice the value of the monetary instrument or funds involved in the transportation transmission or transfer whichever is greater or. In a surprise bout of bipartisanship and overriding a presidential veto both chambers of Congress signaled a new priority for 2021the strengthening of federal anti-money laundering provisions albeit by an unexpected vehicle. Code Section 1956 is the main federal statute that defines prohibits and penalizes money laundering. Changes to Federal Anti-Money Laundering Laws. The purpose of the reporting requirement is to allow the Government to enforce the tax laws and to track and monitor cash involved in criminal activity.

Source: iclg.com

Source: iclg.com

602 Anti-Money Laundering ProgramStatute 603 Anti-Money Laundering ProgramRegulations 604 Anti-Money Laundering ProgramGeneral Considerations 605 Anti-Money Laundering ProgramPenalties 606 Definition of Financial Institution 607 Banking Industry Anti-Money Laundering Program 608 Casino and Card Club Anti. The Money Laundering Control Act of 1986 Public Law 99-570 is a United States Act of Congress that made money laundering a federal crime. 23 1831j or section 213 or 214 of the Federal Credit Union Act 12 USC. Anti-Money Laundering Act AMLA The Federal Board of Revenue Anti-Money Laundering and Combating Financing of Terrorism Regulations for Designated Non-Financial Businesses and Professions FBR AMLCFT Regulations for DNFBPs AMLCFT Sanction Rules 2020 SRO NO 950I2020 AMLCFT Sanction Rules 10. Under Ohio Revised Code Section 131555 charges for money laundering can vary.

Source: regtechconsulting.net

Source: regtechconsulting.net

Money Laundering Overview. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. 6 COORDINATION WITH OTHER PROVISIONS OF LAWThis subsection shall not apply with respect to any employer that is subject to section 33 of the Federal Deposit Insurance Act 12 USC. It is usually charged as a 3 rd degree felony with 7500 in fines or twice the value of the money involved whichever is greater. It was passed in 1986.

Source: telecom-paris.fr

Source: telecom-paris.fr

FINRA reviews a firms compliance with AML rules under FINRA Rule 3310 which sets forth minimum standards for a firms. Under Ohio Revised Code Section 131555 charges for money laundering can vary. 23 1831j or section 213 or 214 of the Federal Credit Union Act 12 USC. It for the first time in the United States criminalized money laundering. Domestic money laundering transactions 1956 a 1.

Source: farahatco.com

Source: farahatco.com

The purpose of the reporting requirement is to allow the Government to enforce the tax laws and to track and monitor cash involved in criminal activity. The Money Laundering Control Act of 1986 Public Law 99-570 is a United States Act of Congress that made money laundering a federal crime. It is usually charged as a 3 rd degree felony with 7500 in fines or twice the value of the money involved whichever is greater. 1956 and 1957 and to varying degrees in several other federal criminal statutes money laundering involves the flow of resources to and from several hundred other federal state and foreign crimes2 It consists of. It consists of two sections 18 USC.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

In the principal federal criminal money laundering statutes 18 USC. Section 47 GwG Prohibition of disclosure power to issue statutory instruments Anti-Money Laundering Section 47 GwG Prohibition of disclosure power to issue statutory instruments 1 An obliged entity must not inform the contracting party the instructing party of. 6 COORDINATION WITH OTHER PROVISIONS OF LAWThis subsection shall not apply with respect to any employer that is subject to section 33 of the Federal Deposit Insurance Act 12 USC. Commercial Corporate Litigation. It for the first time in the United States criminalized money laundering.

Source:

In order to qualify as money laundering a person must conduct or attempt to conduct a financial transaction with the intent to. 6 COORDINATION WITH OTHER PROVISIONS OF LAWThis subsection shall not apply with respect to any employer that is subject to section 33 of the Federal Deposit Insurance Act 12 USC. In the principal federal criminal money laundering statutes 18 USC. Under Ohio Revised Code Section 131555 charges for money laundering can vary. Promote the performance of a specified unlawful activity.

Source: everycrsreport.com

Source: everycrsreport.com

1956 and 1957 and to varying degrees in several other federal criminal statutes money laundering involves the flow of resources to and from several hundred other federal state and foreign crimes2 It consists of. Code Section 1956 is the main federal statute that defines prohibits and penalizes money laundering. Anti-Money Laundering Act AMLA The Federal Board of Revenue Anti-Money Laundering and Combating Financing of Terrorism Regulations for Designated Non-Financial Businesses and Professions FBR AMLCFT Regulations for DNFBPs AMLCFT Sanction Rules 2020 SRO NO 950I2020 AMLCFT Sanction Rules 10. It is usually charged as a 3 rd degree felony with 7500 in fines or twice the value of the money involved whichever is greater. Section 1956 a defines three types of criminal conduct.

Source:

In Oklahoma money laundering is considered a federal crime. In order to qualify as money laundering a person must conduct or attempt to conduct a financial transaction with the intent to. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. FINRA reviews a firms compliance with AML rules under FINRA Rule 3310 which sets forth minimum standards for a firms. Antimoney laundering and counterterrorism financing program has the meaning given by section 83.

Source: actico.com

Source: actico.com

It was passed in 1986. Code Section 1956 is the main federal statute that defines prohibits and penalizes money laundering. 2 1The Federal Ministry of Finance may by means of a statutory order not requiring the consent of the Bundesrat exempt from the scope of this Act obliged entities under subsection 1 nos. Federal Laws Against Money Laundering. 602 Anti-Money Laundering ProgramStatute 603 Anti-Money Laundering ProgramRegulations 604 Anti-Money Laundering ProgramGeneral Considerations 605 Anti-Money Laundering ProgramPenalties 606 Definition of Financial Institution 607 Banking Industry Anti-Money Laundering Program 608 Casino and Card Club Anti.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title federal anti money laundering statute by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information