12+ Fiamla due diligence information

Home » about money loundering Info » 12+ Fiamla due diligence informationYour Fiamla due diligence images are available. Fiamla due diligence are a topic that is being searched for and liked by netizens today. You can Download the Fiamla due diligence files here. Find and Download all free vectors.

If you’re looking for fiamla due diligence images information related to the fiamla due diligence topic, you have come to the ideal site. Our site always provides you with suggestions for seeking the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

Fiamla Due Diligence. They are intended to assist CSPs in complying with their obligations in relation to the prevention detection and reporting of money laundering financing of terrorism and proliferation. Enhancing existing due diligence requirements 11 sources of terrorist funds 12 laundering of terrorist related funds 13 the nine special recommendations on terrorist financing 14 4. It also captures the elements of conspiracy under section 4 of the FIAMLA. CDD measures must be taken by means of independent information and reliable source documents.

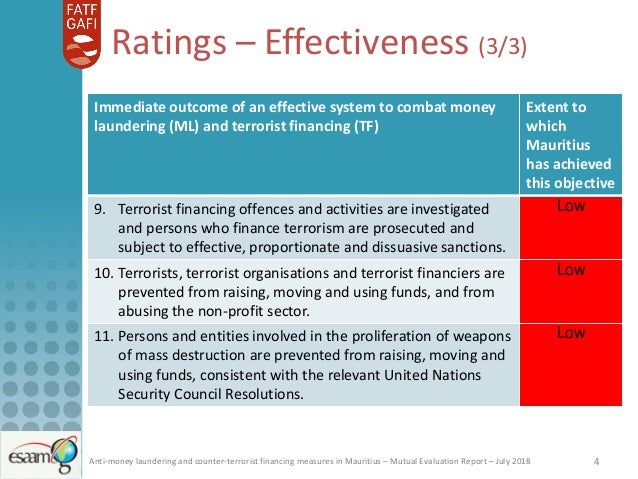

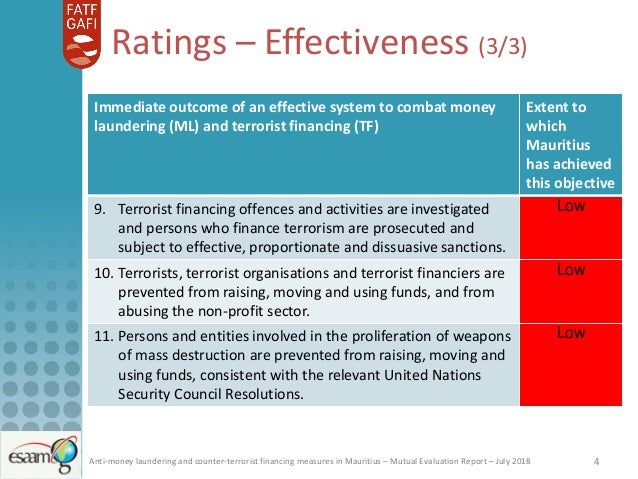

Mauritius Mutual Evaluation Ratings 2018 From slideshare.net

Mauritius Mutual Evaluation Ratings 2018 From slideshare.net

Laundering Act FIAMLA 2002. Confirm an investor is a good fit before reaching out. Financial institutions usually carry out the exercise before the onboarding of a particular client business. In accordance with section 17C4 of the FIAMLA Where the risks are lower a reporting person may conduct simplified due diligence measures unless there is a suspicion of money laundering or terrorism financing in which case enhanced CDD measures shall be undertaken. Where a reporting person determines that the beneficiary who is a legal person or a legal arrangement presents a higher risk the reporting person shall take enhanced due diligence measures which shall include reasonable measures to identify and verify the identity of the beneficial owner of the beneficiary at the time of payout. Systems and controls including sound customer due diligence CDD measures based on international standards.

Commission means the Independent Commission Against Corruption established under the Prevention of Corruption Act 2002.

They are intended to assist CSPs in complying with their obligations in relation to the prevention detection and reporting of money laundering financing of terrorism and proliferation. Confirm an investor is a good fit before reaching out. The Handbook aims at assisting financial institutions in meeting their obligations under the Financial Intelligence and Anti-Money Laundering Act FIAMLA the Financial. CDD measures must be taken by means of independent information and reliable source documents. In accordance with section 17C4 of the FIAMLA Where the risks are lower a reporting person may conduct simplified due diligence measures unless there is a suspicion of money laundering or terrorism financing in which case enhanced CDD measures shall be undertaken. Ad Request your PitchBook free trial to see how our global data will benefit you.

Source: belstarcentre.com

Source: belstarcentre.com

Systems and controls including sound customer due diligence CDD measures based on international standards. Under section 3 of the FIAMLA the definition is broader as it puts an added layer of obligation on members of a relevant profession and occupation to prevent its services from being used to commit money laundering and the financing of terrorism. Financial institutions usually carry out the exercise before the onboarding of a particular client business. CDD means customer due diligence. Enhancing existing due diligence requirements 11 sources of terrorist funds 12 laundering of terrorist related funds 13 the nine special recommendations on terrorist financing 14 4.

Source: lexaquila.org

Source: lexaquila.org

Where a reporting person determines that the beneficiary who is a legal person or a legal arrangement presents a higher risk the reporting person shall take enhanced due diligence measures which shall include reasonable measures to identify and verify the identity of the beneficial owner of the beneficiary at the time of payout. Through compliance with their obligations the. The Handbook aims at assisting financial institutions in meeting their obligations under the Financial Intelligence and Anti-Money Laundering Act FIAMLA the Financial. Customer Due Diligence CDD The FIAMLA and the Regulations have been amended to include legal obligations related to more detailed Customer Due Diligence CDD measures particularly concerning the identification of legal persons legal arrangements and beneficial ownership. ACRONYMS AMLCFT Anti-Money Laundering and Combating the Financing of Terrorism CDD Customer Due Diligence CO Compliance Officer DNFBPs Designated Non-Financial Businesses and Professions EDD Enhanced Due Diligence ESAAMLG Eastern and Southern Africa Anti-Money Laundering Group FATF Financial Action Task Force FIAMLA Financial Intelligence Anti-Money.

Source: elibrary.imf.org

Source: elibrary.imf.org

The legislative framework of mauritius part a anti-money laundering 16. Customer Due Diligence CDD Non-compliance of FIAMLA Regulations 2018 Financial institutions are now required to carry out Business Risk Assessment and Customer Risk Assessment of. Laundering Act FIAMLA 2002. Find out what to look for. Systems and controls including sound customer due diligence CDD measures based on international standards.

CDD means customer due diligence. Customer Due Diligence CDD The FIAMLA and the Regulations have been amended to include legal obligations related to more detailed Customer Due Diligence CDD measures particularly concerning the identification of legal persons legal arrangements and beneficial ownership. In accordance with section 17C4 of the FIAMLA Where the risks are lower a reporting person may conduct simplified due diligence measures unless there is a suspicion of money laundering or terrorism financing in which case enhanced CDD measures shall be undertaken. They are intended to assist CSPs in complying with their obligations in relation to the prevention detection and reporting of money laundering financing of terrorism and proliferation. Systems and controls including sound customer due diligence CDD measures based on international standards.

Source: slideshare.net

Source: slideshare.net

As part of their duties to combat money laundering and terrorism financing financial institutions have the duty to conduct Customer Due Diligence CDD by proceeding with the identification and verification of a customers identity. The Handbook aims at assisting financial institutions in meeting their obligations under the Financial Intelligence and Anti-Money Laundering Act FIAMLA the Financial. Ad Request your PitchBook free trial to see how our global data will benefit you. CDD means customer due diligence. Enhancing existing due diligence requirements 11 sources of terrorist funds 12 laundering of terrorist related funds 13 the nine special recommendations on terrorist financing 14 4.

Source: elibrary.imf.org

Source: elibrary.imf.org

According to section 19H of the FIAMLA a regulatory body shall have such powers as are necessary to enable it to effectively discharge its functions and may in particular a issue guidelines for the purposes of combating money laundering activities and the financing of terrorism and proliferation activities. CDD measures must be taken by means of independent information and reliable source documents. 41 rows In addition to several changes brought to the Financial Intelligence and Anti. They are intended to assist CSPs in complying with their obligations in relation to the prevention detection and reporting of money laundering financing of terrorism and proliferation. According to section 19H of the FIAMLA a regulatory body shall have such powers as are necessary to enable it to effectively discharge its functions and may in particular a issue guidelines for the purposes of combating money laundering activities and the financing of terrorism and proliferation activities.

Source: templegroup.mu

Source: templegroup.mu

In accordance with section 17C4 of the FIAMLA Where the risks are lower a reporting person may conduct simplified due diligence measures unless there is a suspicion of money laundering or terrorism financing in which case enhanced CDD measures shall be undertaken. Where a reporting person determines that the beneficiary who is a legal person or a legal arrangement presents a higher risk the reporting person shall take enhanced due diligence measures which shall include reasonable measures to identify and verify the identity of the beneficial owner of the beneficiary at the time of payout. Customer Due Diligence CDD Non-compliance of FIAMLA Regulations 2018 Financial institutions are now required to carry out Business Risk Assessment and Customer Risk Assessment of. Customer Due Diligence CDD The FIAMLA and the Regulations have been amended to include legal obligations related to more detailed Customer Due Diligence CDD measures particularly concerning the identification of legal persons legal arrangements and beneficial ownership. Commission means the Independent Commission Against Corruption established under the Prevention of Corruption Act 2002.

Source: iflr1000.com

Source: iflr1000.com

Customer Due Diligence CDD The FIAMLA and the Regulations have been amended to include legal obligations related to more detailed Customer Due Diligence CDD measures particularly concerning the identification of legal persons legal arrangements and beneficial ownership. CDD measures must be taken by means of independent information and reliable source documents. Customer Due Diligence CDD Non-compliance of FIAMLA Regulations 2018 Financial institutions are now required to carry out Business Risk Assessment and Customer Risk Assessment of. According to section 17 of Financial Intelligence Anti-Money Laundering Act FIAMLA 2002 financial institutions are under a statutory duty to locate analyse and understand MLTF risks for clients products and services transactions geographical areas and delivery channels. CDD measures must be taken by means of independent information and reliable source documents.

Ad Request your PitchBook free trial to see how our global data will benefit you. Customer Due Diligence CDD Non-compliance of FIAMLA Regulations 2018 Financial institutions are now required to carry out Business Risk Assessment and Customer Risk Assessment of. Find out what to look for. Under section 3 of the FIAMLA the definition is broader as it puts an added layer of obligation on members of a relevant profession and occupation to prevent its services from being used to commit money laundering and the financing of terrorism. Enhancing existing due diligence requirements 11 sources of terrorist funds 12 laundering of terrorist related funds 13 the nine special recommendations on terrorist financing 14 4.

Customer Due Diligence CDD The FIAMLA and the Regulations have been amended to include legal obligations related to more detailed Customer Due Diligence CDD measures particularly concerning the identification of legal persons legal arrangements and beneficial ownership. In accordance with section 17C4 of the FIAMLA Where the risks are lower a reporting person may conduct simplified due diligence measures unless there is a suspicion of money laundering or terrorism financing in which case enhanced CDD measures shall be undertaken. Under section 3 of the FIAMLA the definition is broader as it puts an added layer of obligation on members of a relevant profession and occupation to prevent its services from being used to commit money laundering and the financing of terrorism. Customer Due Diligence CDD Non-compliance of FIAMLA Regulations 2018 Financial institutions are now required to carry out Business Risk Assessment and Customer Risk Assessment of. CDD measures must be taken by means of independent information and reliable source documents.

ACRONYMS AMLCFT Anti-Money Laundering and Combating the Financing of Terrorism CDD Customer Due Diligence CO Compliance Officer DNFBPs Designated Non-Financial Businesses and Professions EDD Enhanced Due Diligence ESAAMLG Eastern and Southern Africa Anti-Money Laundering Group FATF Financial Action Task Force FIAMLA Financial Intelligence Anti-Money. 41 rows In addition to several changes brought to the Financial Intelligence and Anti. ACRONYMS AMLCFT Anti-Money Laundering and Combating the Financing of Terrorism CDD Customer Due Diligence CO Compliance Officer DNFBPs Designated Non-Financial Businesses and Professions EDD Enhanced Due Diligence ESAAMLG Eastern and Southern Africa Anti-Money Laundering Group FATF Financial Action Task Force FIAMLA Financial Intelligence Anti-Money. Laundering Act FIAMLA 2002. Enhancing existing due diligence requirements 11 sources of terrorist funds 12 laundering of terrorist related funds 13 the nine special recommendations on terrorist financing 14 4.

Source: axis.mu

Source: axis.mu

Customer Due Diligence CDD The FIAMLA and the Regulations have been amended to include legal obligations related to more detailed Customer Due Diligence CDD measures particularly concerning the identification of legal persons legal arrangements and beneficial ownership. Through compliance with their obligations the. Ad Request your PitchBook free trial to see how our global data will benefit you. CDD means customer due diligence. Find out what to look for.

Ad Request your PitchBook free trial to see how our global data will benefit you. Find out what to look for. Commission means the Independent Commission Against Corruption established under the Prevention of Corruption Act 2002. CDD means customer due diligence. Customer Due Diligence CDD The FIAMLA and the Regulations have been amended to include legal obligations related to more detailed Customer Due Diligence CDD measures particularly concerning the identification of legal persons legal arrangements and beneficial ownership.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fiamla due diligence by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas