20+ Fifth pillar of anti money laundering ideas

Home » about money loundering Info » 20+ Fifth pillar of anti money laundering ideasYour Fifth pillar of anti money laundering images are ready. Fifth pillar of anti money laundering are a topic that is being searched for and liked by netizens today. You can Get the Fifth pillar of anti money laundering files here. Download all royalty-free photos and vectors.

If you’re searching for fifth pillar of anti money laundering images information connected with to the fifth pillar of anti money laundering interest, you have visit the ideal site. Our website always gives you hints for seeing the highest quality video and image content, please kindly hunt and locate more informative video articles and images that match your interests.

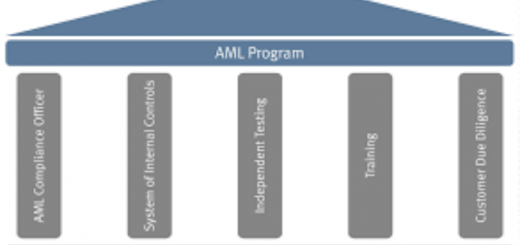

Fifth Pillar Of Anti Money Laundering. The idea that a fifth pillar of Anti-Money Laundering AML compliance customer due diligence requiring US. The fifth pillar of Bank Secrecy ActAnti-Money Laundering BSAAML compliance is now fully in effect. The May 11 2018 deadline for implementation has come and gone. Banks broker-dealers mutual funds commodity futures merchants and.

Fincen New Cdd Rule What Is The Fifth Pillar Capital Compliance Experts From capitalcomplianceexperts.com

Fincen New Cdd Rule What Is The Fifth Pillar Capital Compliance Experts From capitalcomplianceexperts.com

FinCEN mandated this fifth pillar of the Bank Secrecy. These known vulnerabilities are often referred to as Key Risk Indicators KRIs. What use to be known as the four absolutes for an AML compliance program should be revised to reflect a new absolute. Creating a system of internal controls. Banks broker-dealers mutual funds commodity futures merchants and introducing brokers covered financial institutions to identify and verify beneficial owners. 1 development of internal policies procedures and related controls 2 designation of a compliance officer 3 a thorough and ongoing training program and 4 independent review for compliance.

1 written policies and procedures.

The idea that a fifth pillar of Anti-Money Laundering AML compliance customer due diligence requiring US. At this time the fifth pillar does not specifically include crypto MSBsmoney transmitters but that doesnt mean it doesnt apply to crypto businesses. Hence this is part of the reason for the addition of the AML fifth pillar on beneficial ownership becoming mandated in May 2018 see related article The Five Pillars of A Successful AML Program. FinCEN Unveils Fifth Pillar of Anti-Money Laundering Compliance. New Customer Due Diligence CDD and beneficial ownership exam procedures have been published by the Federal Financial Institutions Examination Council FFIEC. Written Internal Policies Procedures and Controls.

Source: capitalcomplianceexperts.com

Source: capitalcomplianceexperts.com

The Federal Register states that FinCEN views the fifth pillar as nothing more than an explicit codification of existing expectations. 1 development of internal policies procedures and related controls 2 designation of a compliance officer 3 a thorough and ongoing training program and 4 independent review for compliance. The May 11 2018 deadline for implementation has come and gone. The risk assessment does this by identifying those aspects of a business that are most likely to attract money launderers or those wishing to finance a terrorist act. This means that a bad guy could purchase a house or condo using dirty cash with few questions being asked.

Source: capitalcomplianceexperts.com

Source: capitalcomplianceexperts.com

Does The 5th BSA Compliance Pillar Apply To Crypto Businesses. 1 written policies and procedures. The risk assessment does this by identifying those aspects of a business that are most likely to attract money launderers or those wishing to finance a terrorist act. The Federal Register states that FinCEN views the fifth pillar as nothing more than an explicit codification of existing expectations. Designation of an AML CO.

Source: amltrainer.com

Source: amltrainer.com

What use to be known as the four absolutes for an AML compliance program should be revised to reflect a new absolute. The newest or fifth pillar supports customer due diligence controls already in place i. At this time the fifth pillar does not specifically include crypto MSBsmoney transmitters but that doesnt mean it doesnt apply to crypto businesses. Banks broker-dealers mutual funds commodity futures merchants and. 1 written policies and procedures.

Source: acamstoday.org

Source: acamstoday.org

Customer awareness Privacy has become a major concern for most people. The Fifth Pillar and FinCENs New Rules on Customer Due Diligence On May 11 2016 the Financial Crimes Enforcement Network FinCEN published in the Federal Register a final rule Final Rule implementing significant changes to the customer due diligence regime within Bank Secrecy Act and anti-money laundering compliance. 3 independent testing of the institutions AML program. The idea that a fifth pillar of Anti-Money Laundering AML compliance customer due diligence requiring US. Designation of an AML CO.

Source:

Therefore it is in the banks best interest to proactively inform current and potential customers of the Rule. 3 independent testing of the institutions AML program. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering Directive was published in the Official Journal of the European Union. The Member States had to transpose this Directive by 10 January 2020. Customer awareness Privacy has become a major concern for most people.

Source: slideplayer.com

Source: slideplayer.com

The Five Pillars of an Anti-Money Laundering Program That new absolute or the fifth pillar is the customer due diligence requirement. Does The 5th BSA Compliance Pillar Apply To Crypto Businesses. This means that a bad guy could purchase a house or condo using dirty cash with few questions being asked. While banks have begun implementing the new fifth pillar for anti-money laundering programs there are additional topics to consider prior to the Rules go-live date. Ongoing Training for Employees.

Source: slideplayer.com

Source: slideplayer.com

FinCEN Unveils Fifth Pillar of Anti-Money Laundering Compliance. Creating a system of internal controls. 3 independent testing of the institutions AML program. FinCEN mandated this fifth pillar of the Bank Secrecy. The idea that a fifth pillar of Anti-Money Laundering AML compliance customer due diligence requiring US.

Source: financialservicesperspectives.com

Source: financialservicesperspectives.com

The risk assessment does this by identifying those aspects of a business that are most likely to attract money launderers or those wishing to finance a terrorist act. 2 a designated AML compliance officer. FinCEN Unveils Fifth Pillar of Anti-Money Laundering Compliance. As these expectations should already be taken into account in a banks internal controls 2 A banks Bank Secrecy Actanti-money laundering BSAAML program should be designed to meet the requirements of the four pillars while also incorporating the new. There are four pillars to an effective BSAAML program.

Source: theofy.world

Source: theofy.world

Customer awareness Privacy has become a major concern for most people. The idea that a fifth pillar of Anti-Money Laundering AML compliance customer due diligence requiring US. Creating a system of internal controls. A shell company can be used to hide the true identity of any natural person. What is the 5th pillar.

Source: acamstoday.org

Source: acamstoday.org

These known vulnerabilities are often referred to as Key Risk Indicators KRIs. Known as the Fifth Pillar of BSAAML Bank Secrecy Act Anti-Money Laundering compliance this regulation promises to improve global corporate transparency by requiring financial institutions to identify and verify beneficial owners of legal entity customers that open new accounts. 2 a designated AML compliance officer. What is the 5th pillar. The idea that a fifth pillar of Anti-Money Laundering AML compliance customer due diligence requiring US.

Source: amltrainer.com

Source: amltrainer.com

Banks broker-dealers mutual funds commodity futures merchants and introducing brokers covered financial institutions to identify and verify beneficial owners. These known vulnerabilities are often referred to as Key Risk Indicators KRIs. And 4 implementation of an adequate employee training program. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering Directive was published in the Official Journal of the European Union. In its Notice to Members 17-40 1 FINRA refers to the first four pillars as the foundation to a broker-dealers written AML program and includes.

Source: amltrainer.com

Source: amltrainer.com

The idea that a fifth pillar of Anti-Money Laundering AML compliance customer due diligence requiring US. The idea that a fifth pillar of Anti-Money Laundering AML compliance customer due diligence requiring US. The idea that a fifth pillar of Anti-Money Laundering AML compliance customer due diligence requiring US. Creating a system of internal controls. Customer awareness Privacy has become a major concern for most people.

Source:

The idea that a fifth pillar of Anti-Money Laundering AML compliance customer due diligence requiring US. New Customer Due Diligence CDD and beneficial ownership exam procedures have been published by the Federal Financial Institutions Examination Council FFIEC. There are four pillars to an effective BSAAML program. FinCEN Unveils Fifth Pillar of Anti-Money Laundering Compliance. As these expectations should already be taken into account in a banks internal controls 2 A banks Bank Secrecy Actanti-money laundering BSAAML program should be designed to meet the requirements of the four pillars while also incorporating the new.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fifth pillar of anti money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas