20+ Financial crime risk layering information

Home » about money loundering idea » 20+ Financial crime risk layering informationYour Financial crime risk layering images are ready in this website. Financial crime risk layering are a topic that is being searched for and liked by netizens now. You can Download the Financial crime risk layering files here. Get all royalty-free images.

If you’re searching for financial crime risk layering images information related to the financial crime risk layering interest, you have visit the right blog. Our site frequently gives you hints for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

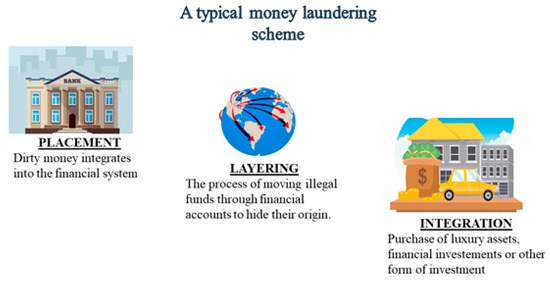

Financial Crime Risk Layering. During the layering stage the goal is to disconnect the money from the illegal activity that generated it. The Principles particularly address the risks resulting from the many layers of intermediation between the issuer and final beneficial owners. The Financial Action Task Force FATF a global standards-setting body for fighting economic crime makes the remarks in a detailed new report. With the evolution of the financial landscape and advancement in technology financial institutions must adopt a proactive approach driven by technology to detect and deter financial crime.

Financial Risk Management Risk Management Monitor From riskmanagementmonitor.com

Financial Risk Management Risk Management Monitor From riskmanagementmonitor.com

The Principles particularly address the risks resulting from the many layers of intermediation between the issuer and final beneficial owners. The layering stage is the most complex and often entails the international movement of the funds. Here the illicit money is separated from its source. This is done by the sophisticated layering of financial transactions that obscure the audit trail and sever the link with the original crime. As international banks shy away from traders in developing markets financial crime watchdogs warn that opportunities are widening for criminal groups looking to exploit the international trade system to profit from environmental crime. Awareness of financial crime risk is in understanding how different types of risk manifest themselves beyond functional or divisional segmentation.

Generally the more layers money passes through the harder it becomes to connect the funds to criminal activity.

Financial criminals go about their business in three stages. The Financial Action Task Force FATF a global standards-setting body for fighting economic crime makes the remarks in a detailed new report. Financial crime risk Whether it is anti-money laundering fraud conduct or sanctions financial crime is a global problem. The Principles particularly address the risks resulting from the many layers of intermediation between the issuer and final beneficial owners. The Financial Action Task Force FATF is an independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. Preventing and detecting suspicious activity is rapidly becoming one of the greatest challenges for financial institutionsimpacting not just monetary losses but reputation brand culture relationships and regulatory censure.

Source: slidetodoc.com

Source: slidetodoc.com

The layering stage is the most complex and often entails the international movement of the funds. But financial institutions have been subject to. The Layering Stage Camouflage. As international banks shy away from traders in developing markets financial crime watchdogs warn that opportunities are widening for criminal groups looking to exploit the international trade system to profit from environmental crime. This is done by the sophisticated layering of financial transactions that obscure the audit trail and sever the link with the original crime.

Source: in.pinterest.com

Source: in.pinterest.com

Financial crime risk Whether it is anti-money laundering fraud conduct or sanctions financial crime is a global problem. The primary purpose of this stage is to separate the illicit money from its source. Sound financial crime risk management exposes licensees to serious risks especially reputational operational compliance and legal risks see BCBS Guidelines for the Sound Management of Risks relating to ML FT1 23. Todays Financial Crime Risk Management is characterised by a reactive rules-driven detection approach fuelled by response to regulation. Securities Services Association ISSA Financial Crime Compliance Principles FCCP.

Source: pinterest.com

Source: pinterest.com

In 2020 expect to see more criminal activity in areas such as trade finance securities and insurance. The FATF Recommendations are recognised as the global anti -money. Preventing and detecting suspicious activity is rapidly becoming one of the greatest challenges for financial institutionsimpacting not just monetary losses but reputation brand culture relationships and regulatory censure. Todays Financial Crime Risk Management is characterised by a reactive rules-driven detection approach fuelled by response to regulation. The Financial Action Task Force FATF a global standards-setting body for fighting economic crime makes the remarks in a detailed new report.

Source: es.pinterest.com

Source: es.pinterest.com

The layering stage is the most complex and often entails the international movement of the funds. The FATF Recommendations are recognised as the global anti -money. Sound financial crime risk management exposes licensees to serious risks especially reputational operational compliance and legal risks see BCBS Guidelines for the Sound Management of Risks relating to ML FT1 23. The Principles particularly address the risks resulting from the many layers of intermediation between the issuer and final beneficial owners. During the layering stage the goal is to disconnect the money from the illegal activity that generated it.

Source: riskmanagementmonitor.com

Source: riskmanagementmonitor.com

The Financial Action Task Force FATF a global standards-setting body for fighting economic crime makes the remarks in a detailed new report. Securities Services Association ISSA Financial Crime Compliance Principles FCCP. The Financial Action Task Force FATF is an independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. As international banks shy away from traders in developing markets financial crime watchdogs warn that opportunities are widening for criminal groups looking to exploit the international trade system to profit from environmental crime. In 2020 expect to see more criminal activity in areas such as trade finance securities and insurance.

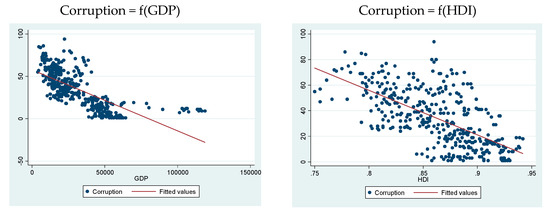

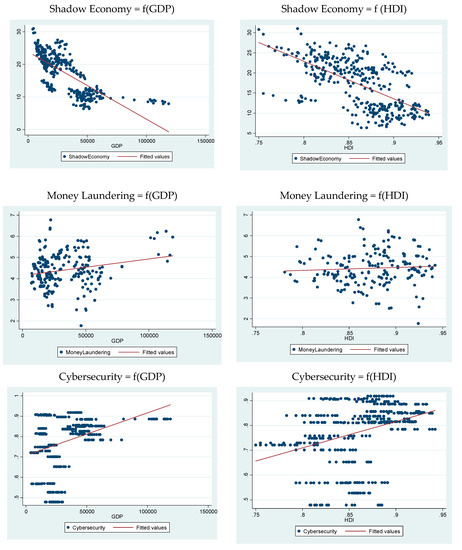

Source: mdpi.com

Source: mdpi.com

The Layering Stage Camouflage. As international banks shy away from traders in developing markets financial crime watchdogs warn that opportunities are widening for criminal groups looking to exploit the international trade system to profit from environmental crime. The goal of money laundering is to move the cash around to create layers that obfuscate the source of the criminal funds and ultimately turn the proceeds of crime into legitimate assets. Crimes that generate significant financial proceeds such as theft extortion drug trafficking and human trafficking almost always require a money laundering component so that criminals can avoid detection by authorities and use the illegal money that they make in the legitimate economy. The Layering Stage Camouflage.

Source: pinterest.com

Source: pinterest.com

This is done by the sophisticated layering of financial transactions that obscure the audit trail and sever the link with the original crime. Awareness of financial crime risk is in understanding how different types of risk manifest themselves beyond functional or divisional segmentation. The goal of money laundering is to move the cash around to create layers that obfuscate the source of the criminal funds and ultimately turn the proceeds of crime into legitimate assets. As international banks shy away from traders in developing markets financial crime watchdogs warn that opportunities are widening for criminal groups looking to exploit the international trade system to profit from environmental crime. The Financial Action Task Force FATF is an independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction.

Source: mdpi.com

Source: mdpi.com

Prevention Risk The initial phase in the lifecycle of financial. They often attempt to use banks in order to attain their aims. The primary purpose of this stage is to separate the illicit money from its source. Awareness of financial crime risk is in understanding how different types of risk manifest themselves beyond functional or divisional segmentation. The layering stage is the most complex and often entails the international movement of the funds.

Source: pinterest.com

Source: pinterest.com

The Financial Action Task Force FATF is an independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. During the layering stage the goal is to disconnect the money from the illegal activity that generated it. The FCCP aim to become the standard in financial crime prevention across the securities industry. This is done by the sophisticated layering of financial transactions that obscure the audit trail and sever the link with the original crime. Preventing and detecting suspicious activity is rapidly becoming one of the greatest challenges for financial institutionsimpacting not just monetary losses but reputation brand culture relationships and regulatory censure.

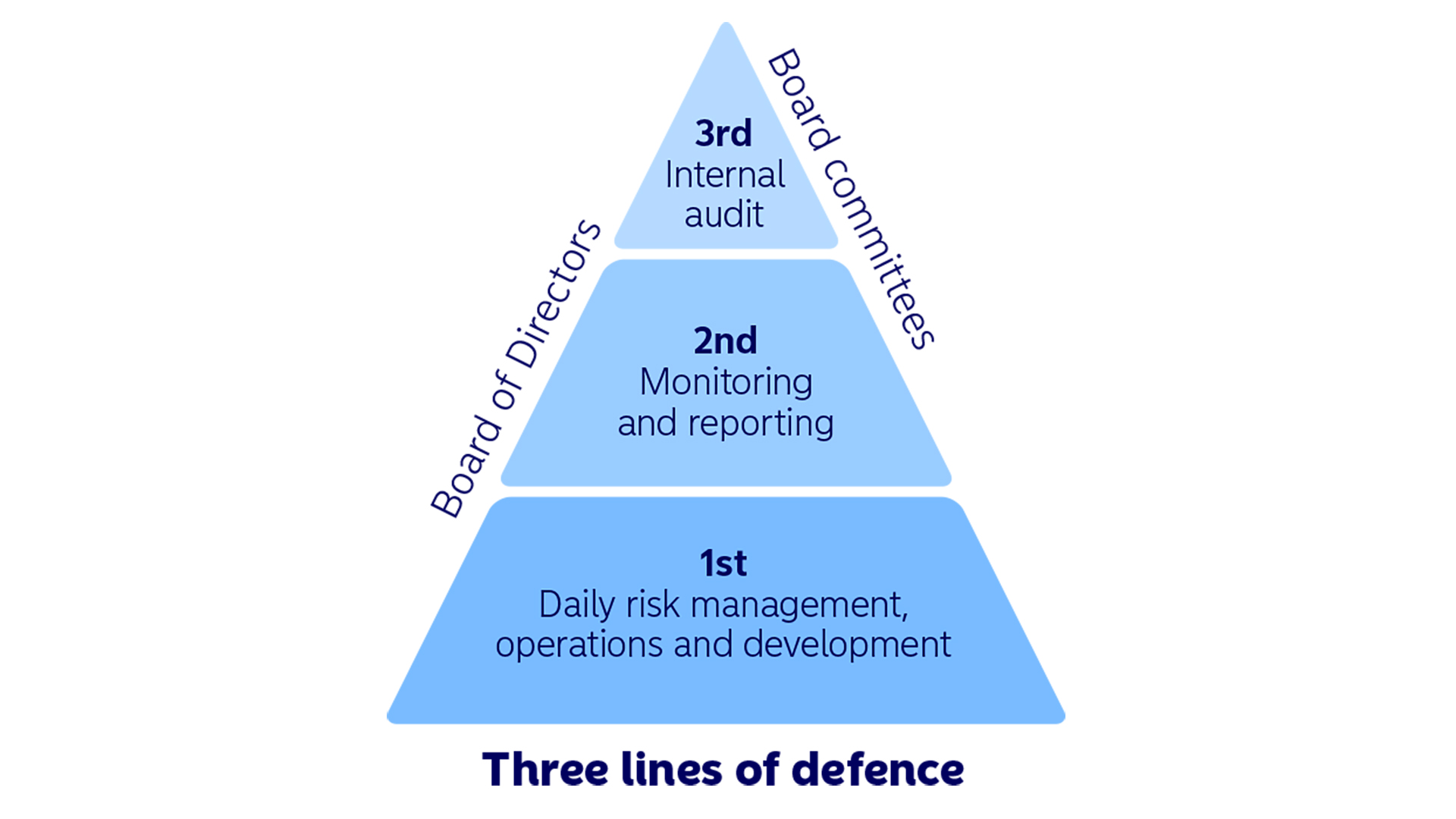

Source: nordea.com

Source: nordea.com

Prevention Risk The initial phase in the lifecycle of financial. The goal of money laundering is to move the cash around to create layers that obfuscate the source of the criminal funds and ultimately turn the proceeds of crime into legitimate assets. Sound financial crime risk management exposes licensees to serious risks especially reputational operational compliance and legal risks see BCBS Guidelines for the Sound Management of Risks relating to ML FT1 23. Understanding the Financial Crime Risks of Trade Trade risk is not so black and white Trade activity is not homogenous but a varied multi-layered and complex combination of actions involving people goods paper and money in many different variations. This is done by the sophisticated layering of financial transactions that obscure the audit trail and sever the link with the original crime.

Source: pinterest.com

Source: pinterest.com

The Principles particularly address the risks resulting from the many layers of intermediation between the issuer and final beneficial owners. Sound financial crime risk management exposes licensees to serious risks especially reputational operational compliance and legal risks see BCBS Guidelines for the Sound Management of Risks relating to ML FT1 23. The criminal moves laundered money back into the financial system. Prevention Risk The initial phase in the lifecycle of financial. This is done by the sophisticated layering of financial transactions that obscure the audit trail and sever the link with the original crime.

Source: tr.pinterest.com

Source: tr.pinterest.com

As international banks shy away from traders in developing markets financial crime watchdogs warn that opportunities are widening for criminal groups looking to exploit the international trade system to profit from environmental crime. The Financial Action Task Force FATF a global standards-setting body for fighting economic crime makes the remarks in a detailed new report. In 2020 expect to see more criminal activity in areas such as trade finance securities and insurance. Sound financial crime risk management exposes licensees to serious risks especially reputational operational compliance and legal risks see BCBS Guidelines for the Sound Management of Risks relating to ML FT1 23. With the evolution of the financial landscape and advancement in technology financial institutions must adopt a proactive approach driven by technology to detect and deter financial crime.

Source: mdpi.com

Source: mdpi.com

The Principles particularly address the risks resulting from the many layers of intermediation between the issuer and final beneficial owners. Crimes that generate significant financial proceeds such as theft extortion drug trafficking and human trafficking almost always require a money laundering component so that criminals can avoid detection by authorities and use the illegal money that they make in the legitimate economy. The Principles particularly address the risks resulting from the many layers of intermediation between the issuer and final beneficial owners. Generally the more layers money passes through the harder it becomes to connect the funds to criminal activity. The criminal moves laundered money back into the financial system.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title financial crime risk layering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information

- 10++ How does money laundering through real estate work info