14+ Fincen travel rule requirements information

Home » about money loundering Info » 14+ Fincen travel rule requirements informationYour Fincen travel rule requirements images are ready in this website. Fincen travel rule requirements are a topic that is being searched for and liked by netizens today. You can Download the Fincen travel rule requirements files here. Find and Download all free images.

If you’re searching for fincen travel rule requirements images information connected with to the fincen travel rule requirements topic, you have come to the right site. Our website frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

Fincen Travel Rule Requirements. The CDD Rule has four core requirements. Comments on the proposed rule are due November 27 2020 and FinCEN and the Board anticipate issuing a final rule at some point thereafter. The name of the transmittor. The account number of the transmittor if used.

Fincen S Proposed Rule Change For Travel Rule Threshold Would More Than Double Compliance Events At Us Vasps Ciphertrace From ciphertrace.com

Fincen S Proposed Rule Change For Travel Rule Threshold Would More Than Double Compliance Events At Us Vasps Ciphertrace From ciphertrace.com

The proposed rule lowers the applicable threshold from 3000 to. It requires covered financial institutions to establish and maintain written policies and procedures that are reasonably designed to. Travel rulerequires all financial institutions to pass on certain information to the next financial institution in certain funds transmittals involving more than one financial institution. The Travel Rule was promoted by FinCEN in keeping with their mandate to enforce the Bank Secrecy Act. Recordkeeping Rule Requires financial institutions to collect and retain certain information related to funds transfers and transmittals in amounts of 3000 or more. Bank Secrecy Act regulations require depository institutions to file with FinCEN currency transaction reports CTRs on transactions in currency of more than 10000 large currency transactions.

It requires covered financial institutions to establish and maintain written policies and procedures that are reasonably designed to.

The FATF Travel Rule Recommendation 16 obligates member countries virtual asset service providers VASPs financial institutions and obliged entities to share beneficiary and originator information with counterparties during transmittals above 1000. Bank Secrecy Act regulations require depository institutions to file with FinCEN currency transaction reports CTRs on transactions in currency of more than 10000 large currency transactions. A Bank Secrecy Act BSA rule 31 CFR 10333goften called theTravel rulerequires all financial institutions to pass on certain informationto the next financial institution in certain funds transmittals involving morethan one financial institution. The proposed new rule will definitely apply to Convertible Virtual Currencies CVCs. FINCEN GUIDANCE 1 The Financial Crimes Enforcement Network FinCEN is issuing this interpretive guidance to remind persons subject to the Bank Secrecy Act BSA how FinCEN regulations relating to money services businesses MSBs apply to certain business models. The address of the transmittor.

Source: tier1fin.com

Source: tier1fin.com

Identify and verify the identity of customers. Recordkeeping Rule Requires financial institutions to collect and retain certain information related to funds transfers and transmittals in amounts of 3000 or more. The identity of the transmittors financial institution. Under the new rule proposed by FinCEN and the Board however the Travel Rule documentation requirements would apply to all international transfers of 250 or more. FINCEN GUIDANCE 1 The Financial Crimes Enforcement Network FinCEN is issuing this interpretive guidance to remind persons subject to the Bank Secrecy Act BSA how FinCEN regulations relating to money services businesses MSBs apply to certain business models.

Source: kyc-chain.com

Source: kyc-chain.com

The FinCEN Travel Rule has many requirements and nuances that can challenge and confuse new and seasoned AML compliance professionals alike. Comments on the proposed rule are due November 27 2020 and FinCEN and the Board anticipate issuing a final rule at some point thereafter. For a discussion of the concept of business model as used within this guidance. Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over 3000. Under the new rule proposed by FinCEN and the Board however the Travel Rule documentation requirements would apply to all international.

Source: ciphertrace.com

Source: ciphertrace.com

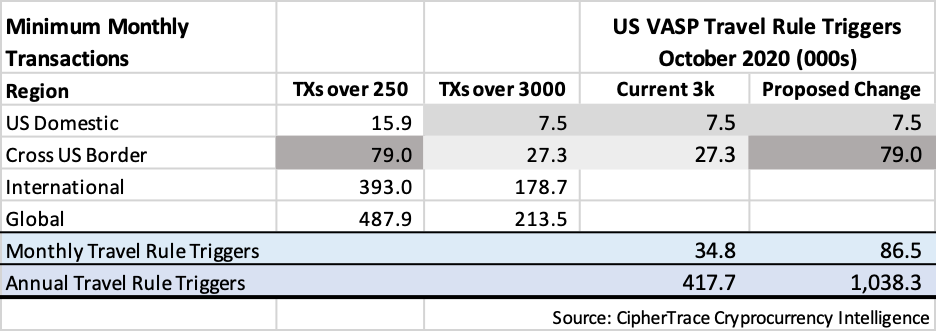

16 to help mitigate money laundering and terrorist financing risks associated with virtual asset activities. The account number of the transmittor if used. In October 2020 FinCEN released a proposed rule change lowering the threshold for travel rule information sharing and retention from 3000 to 250 for all cross-border payments involving US financial institutions. The proposed new rule will definitely apply to Convertible Virtual Currencies CVCs. This rule became effective May 28 1996 and was issued by the Treasury Departments Financial Crimes Enforcement Network FinCEN.

Source: pinterest.com

Source: pinterest.com

The FinCEN Travel Rule has many requirements and nuances that can challenge and confuse new and seasoned AML compliance professionals alike. The identity of the transmittors financial institution. The CDD Rule has four core requirements. The Travel Rule requires that when transmitting funds worth 3000 or more FinCEN-regulated businesses must provide the recipient institution with information about the identities of those sending and receiving the funds. The FinCEN Travel Rule has many requirements and nuances that can challenge and confuse new and seasoned AML compliance professionals alike.

The FinCEN Travel Rule has many requirements and nuances that can challenge and confuse new and seasoned AML compliance professionals alike. It requires covered financial institutions to establish and maintain written policies and procedures that are reasonably designed to. All transmittors financial institutions must include and send the following in the transmittal order. The CDD Rule has four core requirements. Under the new rule proposed by FinCEN and the Board however the Travel Rule documentation requirements would apply to all international transfers of 250 or more.

Source: tier1fin.com

Source: tier1fin.com

The Travel Rule requires that when transmitting funds worth 3000 or more FinCEN-regulated businesses must provide the recipient institution with information about the identities of those sending and receiving the funds. Identify and verify the identity of the beneficial owners of companies opening accounts. The address of the transmittor. A Bank Secrecy Act BSA rule 31 CFR 10333goften called theTravel rulerequires all financial institutions to pass on certain informationto the next financial institution in certain funds transmittals involving morethan one financial institution. Travel rulerequires all financial institutions to pass on certain information to the next financial institution in certain funds transmittals involving more than one financial institution.

Source: slideshare.net

Source: slideshare.net

What are the Travel rules requirements. However the provisions of 31 CFR. The Travel Rule requires that when transmitting funds worth 3000 or more FinCEN-regulated businesses must provide the recipient institution with information about the identities of those sending and receiving the funds. The FATF Travel Rule Recommendation 16 obligates member countries virtual asset service providers VASPs financial institutions and obliged entities to share beneficiary and originator information with counterparties during transmittals above 1000. The identity of the transmittors financial institution.

Source: pinterest.com

Source: pinterest.com

All transmittors financial institutions must include and send the following in the transmittal order. Comments on the proposed rule are due November 27 2020 and FinCEN and the Board anticipate issuing a final rule at some point thereafter. Identify and verify the identity of the beneficial owners of companies opening accounts. Travel Rule Requirements Global anti-money laundering watchdog the Financial Action Task Force FATF has modified their Travel Rule guidance R. The address of the transmittor.

Source: tier1fin.com

Source: tier1fin.com

The name of the transmittor. However the provisions of 31 CFR. The proposed new rule will definitely apply to Convertible Virtual Currencies CVCs. The FinCEN Travel Rule has many requirements and nuances that can challenge and confuse new and seasoned AML compliance professionals alike. Recordkeeping Rule Requires financial institutions to collect and retain certain information related to funds transfers and transmittals in amounts of 3000 or more.

Source: ciphertrace.com

Source: ciphertrace.com

Travel rulerequires all financial institutions to pass on certain information to the next financial institution in certain funds transmittals involving more than one financial institution. The name of the transmittor. The account number of the transmittor if used. Travel rulerequires all financial institutions to pass on certain information to the next financial institution in certain funds transmittals involving more than one financial institution. The proposed rule lowers the applicable threshold from 3000 to.

Source: tier1fin.com

Source: tier1fin.com

Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over 3000. FINCEN GUIDANCE 1 The Financial Crimes Enforcement Network FinCEN is issuing this interpretive guidance to remind persons subject to the Bank Secrecy Act BSA how FinCEN regulations relating to money services businesses MSBs apply to certain business models. The proposed rule lowers the applicable threshold from 3000 to. The CDD Rule has four core requirements. However the provisions of 31 CFR.

The proposed new rule will definitely apply to Convertible Virtual Currencies CVCs. The amount of the transmittal order. Travel Rule Requirements Global anti-money laundering watchdog the Financial Action Task Force FATF has modified their Travel Rule guidance R. The proposed new rule will definitely apply to Convertible Virtual Currencies CVCs. This rule became effective May 28 1996 and was issued by the Treasury Departments Financial Crimes Enforcement Network FinCEN.

Source: ciphertrace.com

Source: ciphertrace.com

The name of the transmittor. 16 to help mitigate money laundering and terrorist financing risks associated with virtual asset activities. Under the new rule proposed by FinCEN and the Board however the Travel Rule documentation requirements would apply to all international. Comments on the proposed rule are due November 27 2020 and FinCEN and the Board anticipate issuing a final rule at some point thereafter. What are the Travel rules requirements.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fincen travel rule requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas