16++ Firm wide money laundering risk assessment template ideas

Home » about money loundering idea » 16++ Firm wide money laundering risk assessment template ideasYour Firm wide money laundering risk assessment template images are available in this site. Firm wide money laundering risk assessment template are a topic that is being searched for and liked by netizens now. You can Download the Firm wide money laundering risk assessment template files here. Download all royalty-free vectors.

If you’re looking for firm wide money laundering risk assessment template pictures information linked to the firm wide money laundering risk assessment template interest, you have visit the right blog. Our website frequently provides you with suggestions for viewing the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

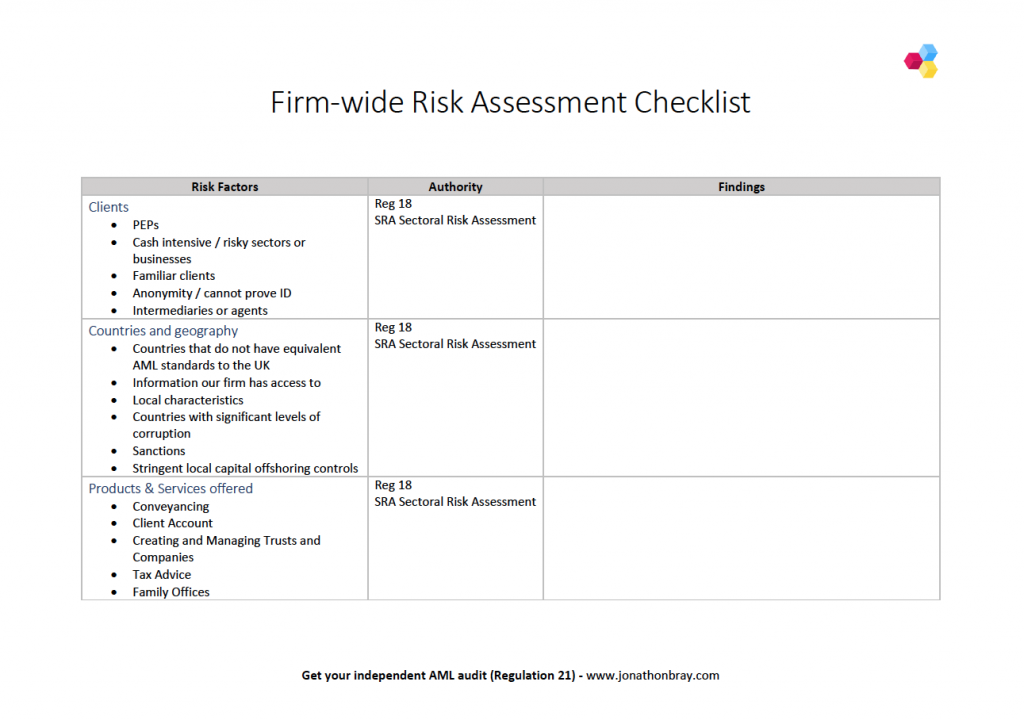

Firm Wide Money Laundering Risk Assessment Template. Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 it is a legal requirement for every accountancy firm to have a documented firm-wide risk assessment. Do we act for clients who have connections with countries which are high risk for money laundering. MLTF Risk Internal Governance Framework Assessment Yes No Risk Score Comments 1. Firm-wide risk assessment methodology The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR17 require firms to take the appropriate steps to identify and assess the risk that they could be used for money laundering including terrorist financing.

This Template Company Wide Risk Assessment is designed for use by a low risk business that wishes to assess the risks of money laundering and terrorist financing to which its business may be subject. But where do you start. This involves following a number of steps. 9292017 115534 AM. Money Laundering Risk Assessment Form The concept of money laundering is very important to be understood for these working within the monetary sector. It is a process by which soiled money is converted into clear money.

MLTF Risk Internal Governance Framework Assessment Yes No Risk Score Comments 1.

Carry out a detailed risk assessment of. Help sheets Providing essential guidance to help you comply with the Money Laundering regulations. This Template Lettings Agency Firm Wide Risk Assessment is for use by Residential Letting Agents dealing with high value lettings at a monthly rent of 10000 euros or more to assess the risks of money laundering and terrorism financing to which its business may be subject. 69 The firm carries out an effective annual compliance review which covers the full business and also higher risk areas. Do we act for clients who have connections with countries which are high risk for money laundering. New anti-money laundering risk assessment form available to firms.

Source: researchgate.net

Source: researchgate.net

69 The firm carries out an effective annual compliance review which covers the full business and also higher risk areas. The Money Laundering Risk Assessment Template. 3 Appendix 1 - Periodic Enterprise-Wide Money LaunderingTerrorist Financing MLTF Risk Assessment SampleI. Put in place policies controls and procedures to reduce any risks of money laundering as identified. 69 The firm carries out an effective annual compliance review which covers the full business and also higher risk areas.

Source: slideshare.net

Source: slideshare.net

The sources of the money in actual are legal and the money is invested in a approach that makes it appear like clear cash and. A business that is regulated under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 as. Identify the money laundering risks that are relevant to your business. Help Sheet - AML Training. As part of our ongoing work to refresh the anti-money laundering AML resources we make available to the profession we have recently added an example AML Risk Assessment Form which can be downloaded and used by member firms.

Source: slideshare.net

Source: slideshare.net

Put in place policies controls and procedures to reduce any risks of money laundering as identified. Completing a Firm-Wide Risk Assessment Questionnaire leading a discussion of money laundering and financial crime risks at a partners meeting on date alternatively consulting heads of. Money Laundering Risk Assessment Form The concept of money laundering is very important to be understood for these working within the monetary sector. Asking the right questions in your firm-wide risk assessment is a huge responsibility. 9292017 115534 AM.

Source: researchgate.net

Source: researchgate.net

Before beginning this exercise you should review the. This Template Company Wide Risk Assessment is designed for use by a low risk business that wishes to assess the risks of money laundering and terrorist financing to which its business may be subject. This Template Lettings Agency Firm Wide Risk Assessment is for use by Residential Letting Agents dealing with high value lettings at a monthly rent of 10000 euros or more to assess the risks of money laundering and terrorism financing to which its business may be subject. But where do you start. Regulation 18 states that a firm must take appropriate steps to identify and assess the risks of money laundering and terrorist financing to which its business is subject Firm Wide Risk Assessment The firm wide risk assessment is the foundation document on which your Policy control and.

Source: researchgate.net

Source: researchgate.net

The supervisory authorities advise that once a firm has completed their money laundering risk assessment they will then need to. ACCA has created a template with some hints and tips to aid members and. Identify the money laundering risks that are relevant to your business. FIRM NAME Firm-wide risk assessment Under the Criminal Justice Money Laundering and Terrorist Financing Amendment Act 2018 it is a requirement for every accountancy firm to have a documented firm-wide risk assessment. It is a process by which soiled money is converted into clear money.

Source: researchgate.net

Source: researchgate.net

Does the Company have a legal and regulatory compliance programme that includes a designated officer that is responsible. Asking the right questions in your firm-wide risk assessment is a huge responsibility. Carry out a detailed risk assessment of. The sources of the money in actual are legal and the money is invested in a approach that makes it appear like clear cash and. MLTF Risk Internal Governance Framework Assessment Yes No Risk Score Comments 1.

Source: yumpu.com

Source: yumpu.com

The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML plan for a small firm. AML Risk Assessment Template AML Policy Template. The supervisory authorities advise that once a firm has completed their money laundering risk assessment they will then need to. MLTF Risk Internal Governance Framework Assessment Yes No Risk Score Comments 1. You might already know that the Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 MLR 2017 make it a legal requirement for every relevant firm to document its risk analysis including having an AML firm wide risk assessment.

This Template Lettings Agency Firm Wide Risk Assessment is for use by Residential Letting Agents dealing with high value lettings at a monthly rent of 10000 euros or more to assess the risks of money laundering and terrorism financing to which its business may be subject. Risk Assessment Form Individual Firm-wide Risk Identification and Assessment Template Suspicious Activity Report Changes Required to Policies and Procedures under the 2017 Money Laundering Regulations. MLTF Risk Internal Governance Framework Assessment Yes No Risk Score Comments 1. 69 The firm carries out an effective annual compliance review which covers the full business and also higher risk areas. You might already know that the Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 MLR 2017 make it a legal requirement for every relevant firm to document its risk analysis including having an AML firm wide risk assessment.

Source: researchgate.net

Source: researchgate.net

Carry out a detailed risk assessment of. Put in place policies controls and procedures to reduce any risks of money laundering as identified. FIRM NAME Firm-wide risk assessment Under the Criminal Justice Money Laundering and Terrorist Financing Amendment Act 2018 it is a requirement for every accountancy firm to have a documented firm-wide risk assessment. AML Risk Assessment Template AML Policy Template. Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 it is a legal requirement for every accountancy firm to have a documented firm-wide risk assessment.

Source: pinterest.com

Source: pinterest.com

Firm-wide risk assessment methodology The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR17 require firms to take the appropriate steps to identify and assess the risk that they could be used for money laundering. You might already know that the Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017 MLR 2017 make it a legal requirement for every relevant firm to document its risk analysis including having an AML firm wide risk assessment. 255 rows AML Risk Assessment Template and Sample Rating Matrix Downloadable Template. Identify the money laundering risks that are relevant to your business. Put in place policies controls and procedures to reduce any risks of money laundering as identified.

Source: docplayer.net

Source: docplayer.net

69 The firm carries out an effective annual compliance review which covers the full business and also higher risk areas. CCABIs Anti-Money Laundering Guidance For The. Help sheets Providing essential guidance to help you comply with the Money Laundering regulations. But where do you start. Firm-wide risk assessment methodology The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR17 require firms to take the appropriate steps to identify and assess the risk that they could be used for money laundering.

Source: yumpu.com

Source: yumpu.com

3 Appendix 1 - Periodic Enterprise-Wide Money LaunderingTerrorist Financing MLTF Risk Assessment SampleI. FIRM NAME Firm-wide risk assessment Under the Criminal Justice Money Laundering and Terrorist Financing Amendment Act 2018 it is a requirement for every accountancy firm to have a documented firm-wide risk assessment. 3 Appendix 1 - Periodic Enterprise-Wide Money LaunderingTerrorist Financing MLTF Risk Assessment SampleI. CCABIs Anti-Money Laundering Guidance For The. Firm-Wide Risk Assessment Questionnaire Our client types and locations.

Source: lexology.com

Source: lexology.com

The firm has a robust firm-wide risk assessment with key risks communicated to staff and mitigations in place. 9292017 115534 AM. Risk Assessment Form Individual Firm-wide Risk Identification and Assessment Template Suspicious Activity Report Changes Required to Policies and Procedures under the 2017 Money Laundering Regulations. Firm-wide risk assessment methodology The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR17 require firms to take the appropriate steps to identify and assess the risk that they could be used for money laundering including terrorist financing. The supervisory authorities advise that once a firm has completed their money laundering risk assessment they will then need to.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title firm wide money laundering risk assessment template by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information