20+ First component of kyc ideas in 2021

Home » about money loundering Info » 20+ First component of kyc ideas in 2021Your First component of kyc images are ready in this website. First component of kyc are a topic that is being searched for and liked by netizens now. You can Download the First component of kyc files here. Get all free photos and vectors.

If you’re looking for first component of kyc images information connected with to the first component of kyc keyword, you have pay a visit to the ideal blog. Our website frequently gives you hints for seeking the maximum quality video and image content, please kindly search and locate more informative video articles and graphics that match your interests.

First Component Of Kyc. When performed one or. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. When establishing a business relationship. The first component mobile connectivity has served as the bedrock for much of the fintech revolution creating digital financial ecosystems in developing countries.

3 Key Elements Of Kyc Compliance 2020 From exporthub.co

3 Key Elements Of Kyc Compliance 2020 From exporthub.co

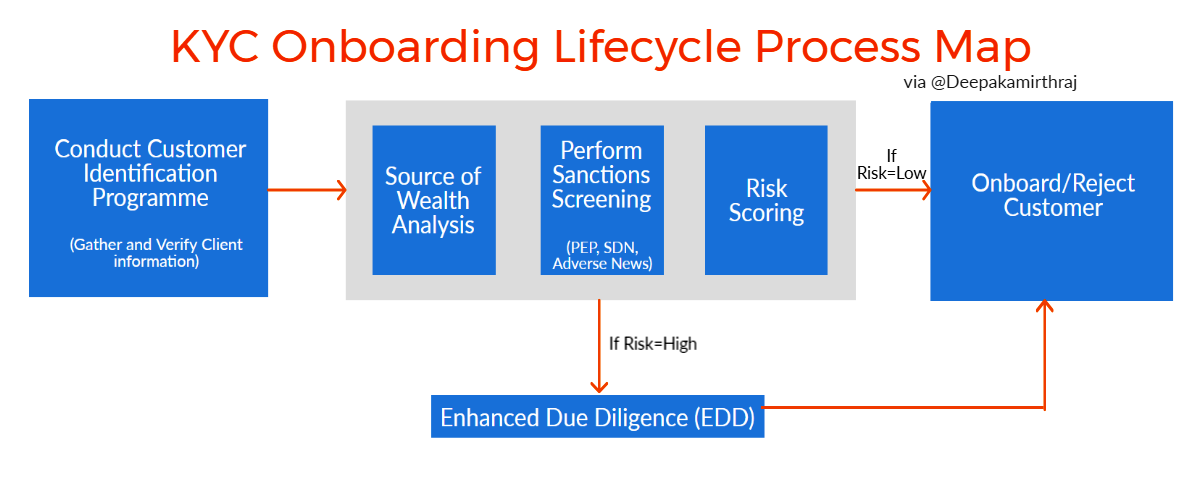

Mutual fund investments are in trend these days. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. KYC is the process whereby a business verifies the identity of its customers through government issued ID cards or passports. Certified articles of incorporation. The first component of KYC is the Customer Identification Program or CIP which entails obtaining identifying information on a companys founders and leadership team. Entities are required to implement on procedure analysis of the client in these cases.

To comply with the first component CIP a bank typically asks the customer for scores of identifying information.

The CIP is the first component of the KYC process that helps ascertain the identity of an individual attempting to make financial transactions ensuring that it is safe to do business with this person. The first component of the set of measures and actions that need to be undertaken by the entities is an analysis of the client. Identifying individuals online is an essential component of KYC and AML regulations as well. KYC includes three components. Identity proofing and enrollment is the first component and it involves the collection and verification of customer data. It also increases customer confidence in the business that they are taking proper measures to protect their private data.

Source: medium.com

Source: medium.com

What is KYC verified. These modern financial tools have gained popularity among both new age investors as well as seasoned investors because they are ideal for investment planning. The first component of the set of measures and actions that need to be undertaken by the entities is an analysis of the client. At the minimum the CIP requires the following information before any individual can open a financial account. Identity proofing and enrollment is the first component and it involves the collection and verification of customer data.

What is KYC verified. Organizations can benefit from remaining compliant by having proper identity verification checks in place. The first component of Risk management is risk identification where we need to identify different risk factors that are present within the bank along with its respective components. Date of birth 3. At the minimum the CIP requires the following information before any individual can open a financial account.

Source:

Let us first look at our data. Hence it is mandatory to update the records of a customer from time to time. The customer address may be changed depending on the city in which heshe is living. This guidance will bring some major changes in the regulations for these sectors. It is same as long as the account available in the bank.

Source: exporthub.co

Source: exporthub.co

Vast mobile ownership in developing countries has produced the right conditions for innovative solutions like mobile money to be adopted by the previously financially excluded. The second component is the affirmative anti-money laundering compliance program requirements of the Bank Secrecy Act as amended by the USA PATRIOT Act. The first component is the. When performed one or. At the minimum the CIP requires the following information before any individual can open a financial account.

Source: shuftipro.com

Source: shuftipro.com

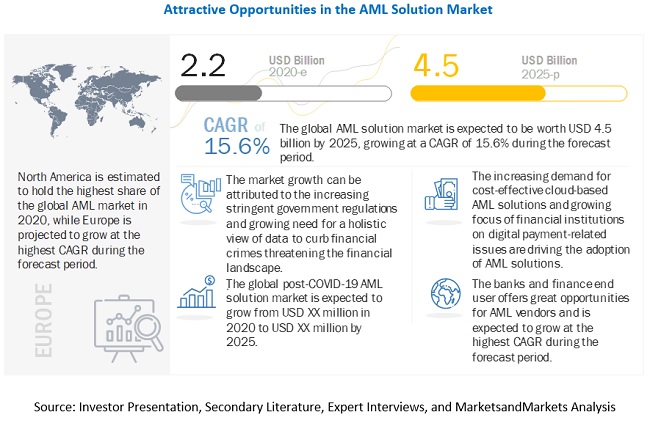

The service providers will have to make sure that their. When performed one or. These modern financial tools have gained popularity among both new age investors as well as seasoned investors because they are ideal for investment planning. Regtech and Fintech will absorb major impact as this sector produces AML and KYC screening solutions DIgital ID systems. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws.

Source: tookitaki.ai

Source: tookitaki.ai

The first component of KYC is the Customer Identification Program or CIP which entails obtaining identifying information on a companys founders and leadership team. Organizations can benefit from remaining compliant by having proper identity verification checks in place. To comply with the first component CIP a bank typically asks the customer for scores of identifying information. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. The first component is the collection and verification of the customers.

Source: marketsandmarkets.com

Source: marketsandmarkets.com

The first component mobile connectivity has served as the bedrock for much of the fintech revolution creating digital financial ecosystems in developing countries. KYC includes three components. Certified articles of incorporation. The first component is the collection and verification of the customers. At the minimum the CIP requires the following information before any individual can open a financial account.

Source: kyckr.com

Source: kyckr.com

The first component is the. The main purpose here it to discourage money laundering. The first component of the set of measures and actions that need to be undertaken by the entities is an analysis of the client. Certified articles of incorporation. Components of KYC Coming to KYC Know Your Customer it has mainly two components.

Source: link.springer.com

Source: link.springer.com

Verifying the identity of the customer through a Customer Identification Program CIP Understanding the nature of the customers transactions Performing AML screening due diligence The first component identity verification entails having the customer. Mutual funds are considered to be way better than traditional investment tools as they hold the potential. Regtech and Fintech will absorb major impact as this sector produces AML and KYC screening solutions DIgital ID systems. Let us first look at our data. When performed one or.

Source: shuftipro.com

Source: shuftipro.com

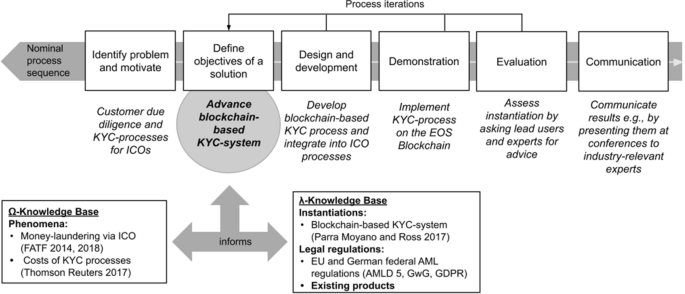

The first component of KYC is the Customer Identification Program or CIP which entails obtaining identifying information on a companys founders and leadership team. A picture is shown on the 13th page of the guidance draft and it shows the process of collection of data from the official identity document like ID card and then screening of the information to verify the identity of a customer. The main purpose here it to discourage money laundering. The first component of the set of measures and actions that need to be undertaken by the entities is an analysis of the client. Vast mobile ownership in developing countries has produced the right conditions for innovative solutions like mobile money to be adopted by the previously financially excluded.

The first component is the collection and verification of the customers. Make sure you adhere to your countrys KYC norms and integrate a suitable customer verification procedure into your exchange. August 2 Interfax - The preliminary results of a current study of combinations of the first component of the coronavirus vaccine Sputnik V with the AstraZeneca and Sinopharm vaccines in Argentina have shown no serious side-effects the Russian Direct. The CIP is the first component of the KYC process that helps ascertain the identity of an individual attempting to make financial transactions ensuring that it is safe to do business with this person. It is same as long as the account available in the bank.

Source:

The KYC Policy consists of the following four key elementsCustomer Acceptance PolicyCustomer Identification ProceduresMonitoring of TransactionsRisk Management. Let us first look at our data. The first component of the set of measures and actions that need to be undertaken by the entities is an analysis of the client. Certified articles of incorporation. KYC is the process whereby a business verifies the identity of its customers through government issued ID cards or passports.

Source: businessprocessincubator.com

Source: businessprocessincubator.com

Organizations can benefit from remaining compliant by having proper identity verification checks in place. The first component of KYC is the Customer Identification Program or CIP which entails obtaining identifying information on a companys founders and leadership team. Date of birth 3. What is KYC verified. August 2 Interfax - The preliminary results of a current study of combinations of the first component of the coronavirus vaccine Sputnik V with the AstraZeneca and Sinopharm vaccines in Argentina have shown no serious side-effects the Russian Direct.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title first component of kyc by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas