19+ First step of kyc process information

Home » about money loundering idea » 19+ First step of kyc process informationYour First step of kyc process images are ready in this website. First step of kyc process are a topic that is being searched for and liked by netizens today. You can Find and Download the First step of kyc process files here. Find and Download all royalty-free photos and vectors.

If you’re searching for first step of kyc process pictures information connected with to the first step of kyc process keyword, you have come to the ideal blog. Our site always provides you with suggestions for seeking the highest quality video and picture content, please kindly search and find more informative video content and images that fit your interests.

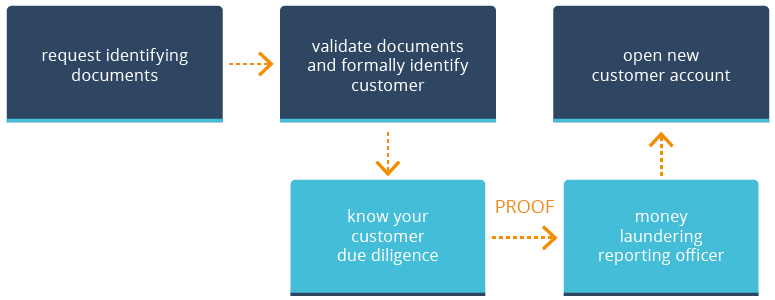

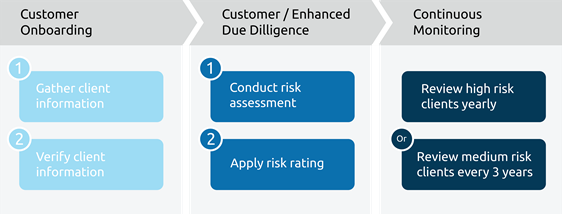

First Step Of Kyc Process. They are the same in some instances but when we combine compliances and legal requirements with ID verification the end result is KYC Know Your Customer. Your customers identity before they. These in particular can expect to benefit. The first step of the process was to triage the files against a remediation standard and conduct public source verification identifying data gaps or items in question for further review.

Kyc Verification Process 3 Steps To Know Your Customer Compliance From shuftipro.com

Kyc Verification Process 3 Steps To Know Your Customer Compliance From shuftipro.com

The first step of the process was to triage the files against a remediation standard and conduct public source verification identifying data gaps or items in question for further review. They are the same in some instances but when we combine compliances and legal requirements with ID verification the end result is KYC Know Your Customer. KYC Know Your Customer related practices are especially relevant in user and clients relationships with business. It is essential that you fully verify new and existing customers before you process transactions in order to understanding the risks they may represent. Your customers identity before they. Most of us we consider ID verification and KYC both are similar.

The agreed remediation standard covered approximately 70 percent of the key data points required by the clients KYC policy.

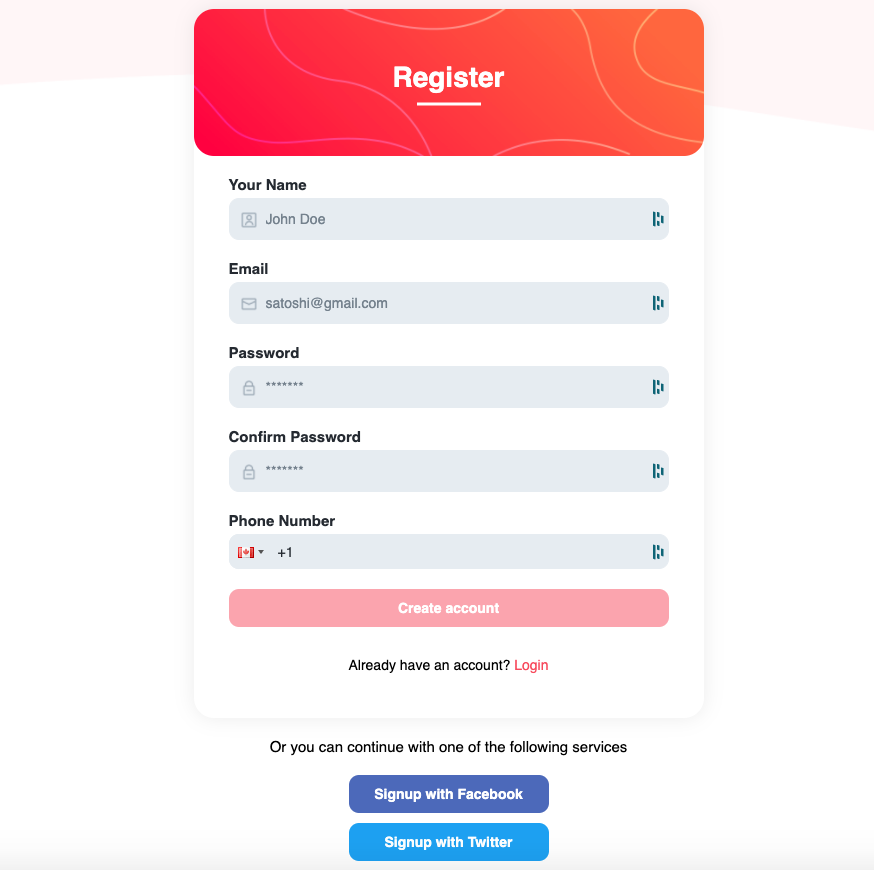

KYC Know Your Customer related practices are especially relevant in user and clients relationships with business. KYC compliance responsibility rests with the banks. It is essential that you fully verify new and existing customers before you process transactions in order to understanding the risks they may represent. The agreed remediation standard covered approximately 70 percent of the key data points required by the clients KYC policy. The very first step in the KYC procedure is to collect any personal information about the customer. The first step of the process was to triage the files against a remediation standard and conduct public source verification identifying data gaps or items in question for further review.

Source: encompasscorporation.com

Source: encompasscorporation.com

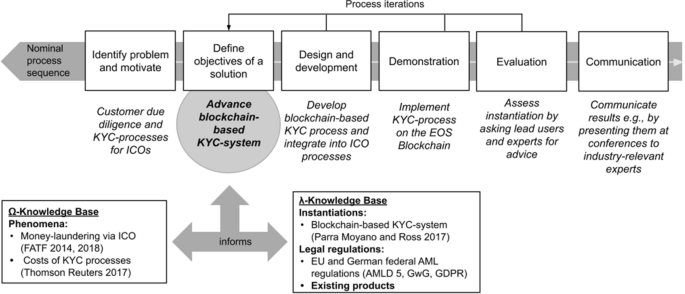

KYC after all forms an essential first step for accessing several financial services- loans banking payments etc. The user is supposed to enter all the personal details at the time of account registration. Offline KYC process steps generally involve manually filling up a form with details that include your Aadhaar card number name address proof of identity proof of address etc. The agreed remediation standard covered approximately 70 percent of the key data points required by the clients KYC policy. The very first step in the KYC procedure is to collect any personal information about the customer.

Source: link.springer.com

Source: link.springer.com

Secondly the fingerprint process happens via a biometric scanner. This process ensures compliance with the requirements of regulatory authorities that refer to your business model. The main reason to complete the KYC process is that it is absolutely vital for. The Essentia Team is excited to announce that we have started the KYCAML procedure. CIP protocols in most of the regions of the world are the same.

The first step of the process was to triage the files against a remediation standard and conduct public source verification identifying data gaps or items in question for further review. In some instances you might also have to visit a KRA to get your biometric data verified. The first step of the KYC procedure is to collect the personal data from a client. KYC process includes ID card verification face verification document verification such as utility bills as proof of address and biometric verification. Customer Identification Program CIP is the first step in the KYC compliance program.

Source: youtube.com

Source: youtube.com

It is the first step in a customer relationship with a company. This process ensures compliance with the requirements of regulatory authorities that refer to your business model. Businesses can and must learn about the KYC requirements from a regulator in their jurisdiction. The agreed remediation standard covered approximately 70 percent of the key data points required by the clients KYC policy. Your customers identity before they.

Source: shuftipro.com

Source: shuftipro.com

Businesses can and must learn about the KYC requirements from a regulator in their jurisdiction. The very first step in the KYC procedure is to collect any personal information about the customer. For small businesses MSMEs one person companies etc the lack of digitized KYC processes is a major challenge with account opening and lending processes. Its importance in relation to customer onboarding its relationship with identity fraud and AML controls as well as irs regulatory standards make Know Your Customer or. Step by Step process in eKYC Follow these steps to know about the eKYC process.

Source: shuftipro.com

Source: shuftipro.com

KYC Know Your Customer related practices are especially relevant in user and clients relationships with business. KYC compliance responsibility rests with the banks. This step is crucial if. Customer Identification Program CIP is the first step in the KYC compliance program. They are the same in some instances but when we combine compliances and legal requirements with ID verification the end result is KYC Know Your Customer.

Source: medium.com

Source: medium.com

Your customers identity before they. These in particular can expect to benefit. Most of us we consider ID verification and KYC both are similar. The first step in KYC verification involves the collection of personal information from an online user. End-User Submits Government-Issued Documents After the user has filled in the form with his or her personal information the next step is to upload their identity document for verification purposes.

Source: basisid.com

Source: basisid.com

Know Your Customer procedures are a critical function to assess and monitor customer risk. KYC refers to the steps taken by a financial institution or business to. Step by Step process in eKYC Follow these steps to know about the eKYC process. It is essential that you fully verify new and existing customers before you process transactions in order to understanding the risks they may represent. The very first step in the KYC procedure is to collect any personal information about the customer.

Source: status200.net

Source: status200.net

This step is crucial if. The first step of the process was to triage the files against a remediation standard and conduct public source verification identifying data gaps or items in question for further review. It is the first step in a customer relationship with a company. The first step involved in the KYC onboarding process is the customer identification program here personal information of the client is collected. Understanding all there about KYC is the first step to knowing its importance in everyday life.

Source: cedar-rose-news.com

Source: cedar-rose-news.com

Businesses can and must learn about the KYC requirements from a regulator in their jurisdiction. The first step of the process was to triage the files against a remediation standard and conduct public source verification identifying data gaps or items in question for further review. Offline KYC process steps generally involve manually filling up a form with details that include your Aadhaar card number name address proof of identity proof of address etc. Establish the identify of the customer Understand the nature of the customers activities primary goal is to satisfy that the source of the customers funds is legitimate. Banks must comply with KYC regulations and anti-money laundering regulations to limit fraud.

Source: researchgate.net

Source: researchgate.net

Banks must comply with KYC regulations and anti-money laundering regulations to limit fraud. The first step involved in the KYC onboarding process is the customer identification program here personal information of the client is collected. Know Your Customer procedures are a critical function to assess and monitor customer risk. May 9 2018 5 min read. For small businesses MSMEs one person companies etc the lack of digitized KYC processes is a major challenge with account opening and lending processes.

Source: businessprocessincubator.com

Source: businessprocessincubator.com

Whether this information is correct and updated will depend on the due diligence of the. The Essentia Team is excited to announce that we have started the KYCAML procedure. KYC process includes ID card verification face verification document verification such as utility bills as proof of address and biometric verification. For small businesses MSMEs one person companies etc the lack of digitized KYC processes is a major challenge with account opening and lending processes. These in particular can expect to benefit.

Source: businessprocessincubator.com

Source: businessprocessincubator.com

KYC after all forms an essential first step for accessing several financial services- loans banking payments etc. Identification is the first critical step in the KYC compliance process. It is the first step in a customer relationship with a company. Customer Identification Program CIP is the first step in the KYC compliance program. The first step of the process was to triage the files against a remediation standard and conduct public source verification identifying data gaps or items in question for further review.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title first step of kyc process by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information