20+ Fourth aml directive ireland information

Home » about money loundering Info » 20+ Fourth aml directive ireland informationYour Fourth aml directive ireland images are ready. Fourth aml directive ireland are a topic that is being searched for and liked by netizens now. You can Find and Download the Fourth aml directive ireland files here. Download all royalty-free vectors.

If you’re looking for fourth aml directive ireland images information linked to the fourth aml directive ireland interest, you have visit the right site. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly search and find more enlightening video articles and graphics that match your interests.

Fourth Aml Directive Ireland. Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership register. The Fourth Anti-Money Laundering Directive 4 AMLD EU 2015 849 is due to be transposed by EU member states by 26 June 2017Meanwhile proposals for a Fifth Anti-Money Laundering Directive 5 AMLD which will amend 4 AMLD are at an advanced stage and are currently scheduled to be discussed by the EU Parliament on 23-26 October 2017Legislation implementing. Financial Stability Financial Services and Capital Markets Union. The Department of Justice and Equality will transpose the majority of the Directive by a Criminal Justice Amendment Act the General Scheme of which was agreed by the Cabinet on 3 January 2019.

M3cyymsfvrryhm From

M3cyymsfvrryhm From

However there are some other new provisions to be aware of which are as follows. A major part of this is the creation of a Beneficial Owners Register which we covered in a previous blog. Financial Stability Financial Services and Capital Markets Union. Ireland has been the subject of EU infringement proceedings due to the Department of Justices failure to transpose the fourth EU anti-money laundering AML directive into Irish law by June. The Fourth Money Laundering Directive has been published but is yet to be transposed into Irish law. The Act transposes European Union Law on AML and CFT the Third Money Laundering Directive 200560EC and its Implementing Directive 200670EC into Irish Law.

The Guidelines are designed to assist credit and financial institutions in understanding their obligations in relation to AML and CFT following the implementation in Ireland of the 4th EU AML Directive.

The newly adopted Directive has already been dubbed as the 6AMLD due to its paramount feature- the new criminal law provisions relating to money laundering and financing of terrorism. The newly adopted Directive has already been dubbed as the 6AMLD due to its paramount feature- the new criminal law provisions relating to money laundering and financing of terrorism. The draft Fourth EU Anti Money Laundering Directive AMLD4 is designed to update and improve the EUs Anti-Money Laundering AML and Counter. The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015. Banking and financial services. A new Directive complementing and reinforcing the Fourth and the Fifth Anti-Money Laundering Directives 4AMLD and 5AMLD was adopted on 23 October 2018.

Source: slideplayer.com

Source: slideplayer.com

The Fourth Anti-Money Laundering Directive 4 AMLD EU 2015 849 is due to be transposed by EU member states by 26 June 2017Meanwhile proposals for a Fifth Anti-Money Laundering Directive 5 AMLD which will amend 4 AMLD are at an advanced stage and are currently scheduled to be discussed by the EU Parliament on 23-26 October 2017Legislation implementing. The Fourth EU Anti-Money Laundering Directive AMLD4 was transposed into Irish law 26 June 2017. The Department of Justice and Equality will transpose the majority of the Directive by a Criminal Justice Amendment Act the General Scheme of which was agreed by the Cabinet on 3 January 2019. It will also ensure consistency in the application of such laws across all EU Member States. A major part of this is the creation of a Beneficial Owners Register which we covered in a previous blog.

Source: arthurcox.com

Source: arthurcox.com

The Department of Justice and Equality will transpose the majority of the Directive by a Criminal Justice Amendment Act the General Scheme of which was agreed by the Cabinet on 3 January 2019. A major part of this is the creation of a Beneficial Owners Register which we covered in a previous blog. A new Directive complementing and reinforcing the Fourth and the Fifth Anti-Money Laundering Directives 4AMLD and 5AMLD was adopted on 23 October 2018. A package of amendments to the 4th Anti- Money Laundering Directive known as 5AMLD was adopted on 30 May 2018 as Directive 2018843. The Guidelines are designed to assist credit and financial institutions in understanding their obligations in relation to AML and CFT following the implementation in Ireland of the 4th EU AML Directive.

Source: camsafroza.com

Source: camsafroza.com

The Fourth EU Anti-Money Laundering Directive AMLD4 was transposed into Irish law 26 June 2017. Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership register. The Department of Justice and Equality will transpose the majority of the Directive by a Criminal Justice Amendment Act the General Scheme of which was agreed by the Cabinet on 3 January 2019. The Act transposes European Union Law on AML and CFT the Third Money Laundering Directive 200560EC and its Implementing Directive 200670EC into Irish Law. Banking and financial services.

Source: slideplayer.com

Source: slideplayer.com

A major part of this is the creation of a Beneficial Owners Register which we covered in a previous blog. The Fourth Anti-Money Laundering Directive 4 AMLD EU 2015 849 is due to be transposed by EU member states by 26 June 2017Meanwhile proposals for a Fifth Anti-Money Laundering Directive 5 AMLD which will amend 4 AMLD are at an advanced stage and are currently scheduled to be discussed by the EU Parliament on 23-26 October 2017Legislation implementing. The draft Fourth EU Anti Money Laundering Directive AMLD4 is designed to update and improve the EUs Anti-Money Laundering AML and Counter. A new Directive complementing and reinforcing the Fourth and the Fifth Anti-Money Laundering Directives 4AMLD and 5AMLD was adopted on 23 October 2018. A major part of this is the creation of a Beneficial Owners Register which we covered in a previous blog.

Source: acamstoday.org

Source: acamstoday.org

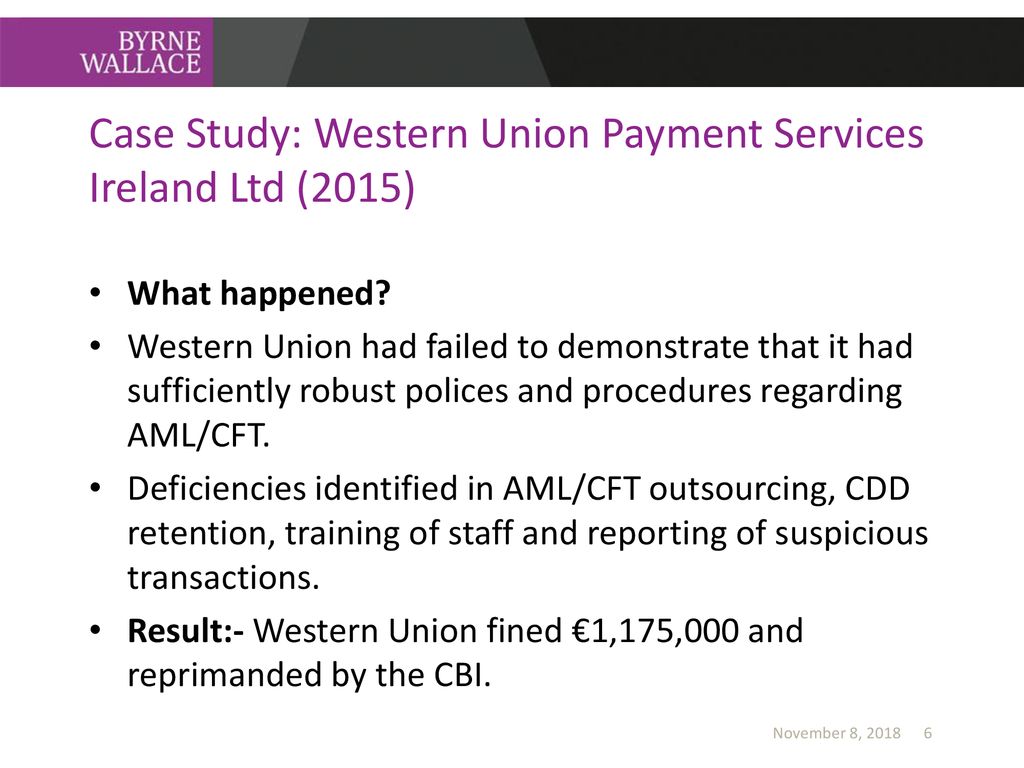

The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law. The newly adopted Directive has already been dubbed as the 6AMLD due to its paramount feature- the new criminal law provisions relating to money laundering and financing of terrorism. A package of amendments to the 4th Anti- Money Laundering Directive known as 5AMLD was adopted on 30 May 2018 as Directive 2018843. Banking and financial services. A major part of this is the creation of a Beneficial Owners Register which we covered in a previous blog.

Source: kbassociates.ie

Source: kbassociates.ie

The Fourth Money Laundering Directive has been published but is yet to be transposed into Irish law. The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law. The Guidelines are designed to assist credit and financial institutions in understanding their obligations in relation to AML and CFT following the implementation in Ireland of the 4th EU AML Directive. The draft Fourth EU Anti Money Laundering Directive AMLD4 is designed to update and improve the EUs Anti-Money Laundering AML and Counter. The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015.

Source: ireland.representation.ec.europa.eu

Source: ireland.representation.ec.europa.eu

However there are some other new provisions to be aware of which are as follows. The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015. Banking and financial services. The draft Fourth EU Anti Money Laundering Directive AMLD4 is designed to update and improve the EUs Anti-Money Laundering AML and Counter. The Fourth Anti-Money Laundering Directive 4 AMLD EU 2015 849 is due to be transposed by EU member states by 26 June 2017Meanwhile proposals for a Fifth Anti-Money Laundering Directive 5 AMLD which will amend 4 AMLD are at an advanced stage and are currently scheduled to be discussed by the EU Parliament on 23-26 October 2017Legislation implementing.

Source:

Source:

Ireland has been the subject of EU infringement proceedings due to the Department of Justices failure to transpose the fourth EU anti-money laundering AML directive into Irish law by June. Ireland has been the subject of EU infringement proceedings due to the Department of Justices failure to transpose the fourth EU anti-money laundering AML directive into Irish law by June. However there are some other new provisions to be aware of which are as follows. A major part of this is the creation of a Beneficial Owners Register which we covered in a previous blog. The Guidelines are designed to assist credit and financial institutions in understanding their obligations in relation to AML and CFT following the implementation in Ireland of the 4th EU AML Directive.

Source: companyformations.ie

Source: companyformations.ie

The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law. The Fourth Money Laundering Directive has been published but is yet to be transposed into Irish law. The Fourth EU Anti-Money Laundering Directive AMLD4 was transposed into Irish law 26 June 2017. The Fourth Anti-Money Laundering Directive 4 AMLD EU 2015 849 is due to be transposed by EU member states by 26 June 2017Meanwhile proposals for a Fifth Anti-Money Laundering Directive 5 AMLD which will amend 4 AMLD are at an advanced stage and are currently scheduled to be discussed by the EU Parliament on 23-26 October 2017Legislation implementing. The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law.

Source: slideplayer.com

Source: slideplayer.com

However there are some other new provisions to be aware of which are as follows. The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law. Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership register. The Guidelines are designed to assist credit and financial institutions in understanding their obligations in relation to AML and CFT following the implementation in Ireland of the 4th EU AML Directive. The Fourth Money Laundering Directive has been published but is yet to be transposed into Irish law.

Source: slidetodoc.com

Source: slidetodoc.com

The Fourth Money Laundering Directive has been published but is yet to be transposed into Irish law. A major part of this is the creation of a Beneficial Owners Register which we covered in a previous blog. Banking and financial services. The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015. It will also ensure consistency in the application of such laws across all EU Member States.

Source: slideplayer.com

Source: slideplayer.com

The Fourth Anti-Money Laundering Directive 4 AMLD EU 2015 849 is due to be transposed by EU member states by 26 June 2017Meanwhile proposals for a Fifth Anti-Money Laundering Directive 5 AMLD which will amend 4 AMLD are at an advanced stage and are currently scheduled to be discussed by the EU Parliament on 23-26 October 2017Legislation implementing. Banking and financial services. The Fourth Anti-Money Laundering Directive 4 AMLD EU 2015 849 is due to be transposed by EU member states by 26 June 2017Meanwhile proposals for a Fifth Anti-Money Laundering Directive 5 AMLD which will amend 4 AMLD are at an advanced stage and are currently scheduled to be discussed by the EU Parliament on 23-26 October 2017Legislation implementing. The Department of Justice and Equality will transpose the majority of the Directive by a Criminal Justice Amendment Act the General Scheme of which was agreed by the Cabinet on 3 January 2019. The Act transposes European Union Law on AML and CFT the Third Money Laundering Directive 200560EC and its Implementing Directive 200670EC into Irish Law.

Source: irishtimes.com

Source: irishtimes.com

It will also ensure consistency in the application of such laws across all EU Member States. A package of amendments to the 4th Anti- Money Laundering Directive known as 5AMLD was adopted on 30 May 2018 as Directive 2018843. A new Directive complementing and reinforcing the Fourth and the Fifth Anti-Money Laundering Directives 4AMLD and 5AMLD was adopted on 23 October 2018. The Fourth Money Laundering Directive has been published but is yet to be transposed into Irish law. The Fourth Anti-Money Laundering Directive 4 AMLD EU 2015 849 is due to be transposed by EU member states by 26 June 2017Meanwhile proposals for a Fifth Anti-Money Laundering Directive 5 AMLD which will amend 4 AMLD are at an advanced stage and are currently scheduled to be discussed by the EU Parliament on 23-26 October 2017Legislation implementing.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fourth aml directive ireland by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas