13++ Funds transfer and travel rule requirements information

Home » about money loundering Info » 13++ Funds transfer and travel rule requirements informationYour Funds transfer and travel rule requirements images are ready. Funds transfer and travel rule requirements are a topic that is being searched for and liked by netizens now. You can Get the Funds transfer and travel rule requirements files here. Find and Download all royalty-free photos and vectors.

If you’re searching for funds transfer and travel rule requirements pictures information related to the funds transfer and travel rule requirements interest, you have pay a visit to the right site. Our website always gives you hints for seeking the maximum quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

Funds Transfer And Travel Rule Requirements. All transmittors financial institutions must include and send the following in the transmittal order. It explains your requirement under the Proceeds of Crime Money Laundering and Terrorist Financing Act PCMLTFA and associated Regulations to include or obtain certain information in relation to an electronic funds transfer EFT or a virtual currency VC transfer. Of funds moves from a bank to a non-bank or vice versa. Regulation EU 2015847 in respect of all transfers of funds.

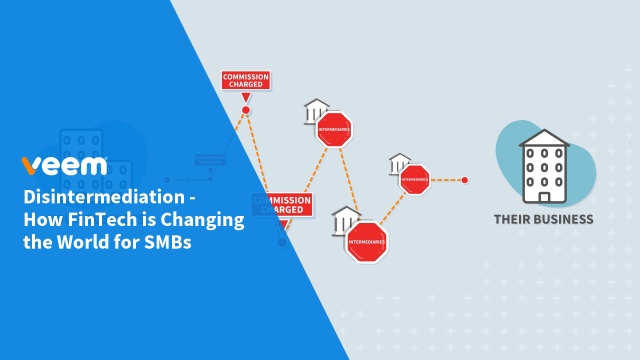

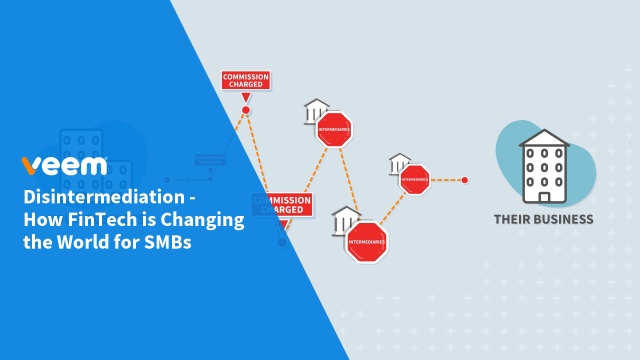

Wire Transfers Explained Outdated Overpriced Save Money With Veem From veem.com

Wire Transfers Explained Outdated Overpriced Save Money With Veem From veem.com

Of funds moves from a bank to a non-bank or vice versa. It is noted that some firms are not making use of the exemptions in the Regulations namely on transfers below the EUR 1000 threshold and the intra-EU transfers. Regulation EU 2015847 in respect of all transfers of funds. The Funds Travel Rule requires financial institutions who are sending and or receiving funds to or from other financial institutions to capture transmit and store certain information associated with each transfer of funds above a certain threshold. Only transmittals of funds equal to or greater than 3000 or its foreign equivalent are subject to this rule regardless of whether or not currency is involved. When you make or receive any transfer of funds the EU legislation states that you must have complete information about the payer and payee and send this along with the transfer of funds.

It explains your requirement under the Proceeds of Crime Money Laundering and Terrorist Financing Act PCMLTFA and associated Regulations to include or obtain certain information in relation to an electronic funds transfer EFT or a virtual currency VC transfer.

The Funds Travel Rule requires financial institutions who are sending and or receiving funds to or from other financial institutions to capture transmit and store certain information associated with each transfer of funds above a certain threshold. The Recordkeeping Rule and Travel Rule collectively require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 or more. Referencing these documents by the SEC and FinCEN. It explains your requirement under the Proceeds of Crime Money Laundering and Terrorist Financing Act PCMLTFA and associated Regulations to include or obtain certain information in relation to an electronic funds transfer EFT or a virtual currency VC transfer. Regulation EU 2015847 in respect of all transfers of funds. The Funds Travel Rule requires financial institutions who are sending and or receiving funds to or from other financial institutions to capture transmit and store certain information associated with each transfer of funds above a certain threshold.

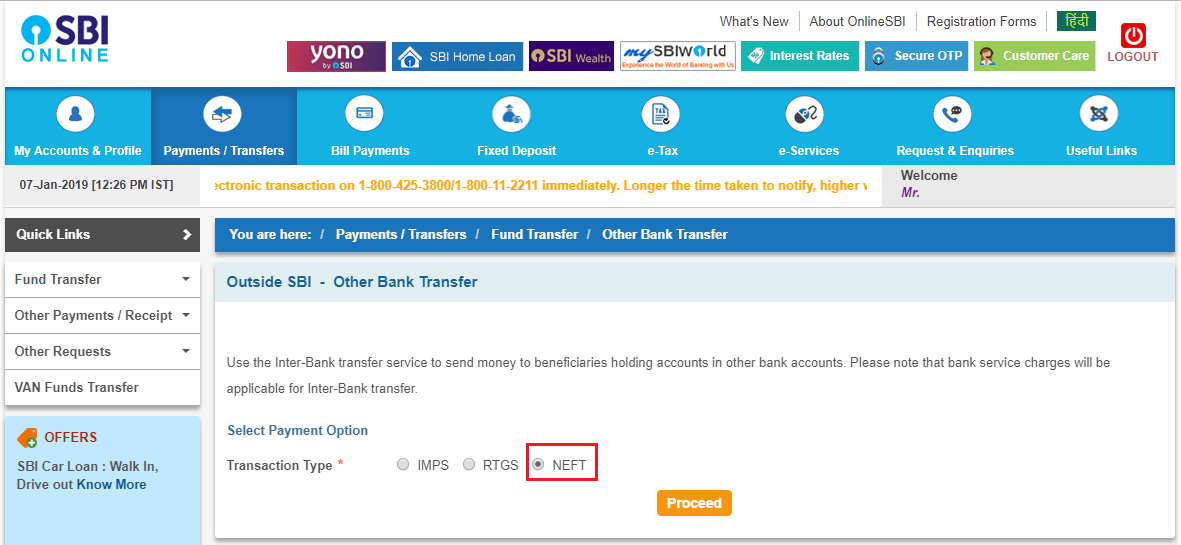

Source: earncheese.com

Source: earncheese.com

In addition transmittals of funds governed by the Electronic Funds Transfer Act Reg E or made through ATM or point-of-sale systems are not subject to this rule. What is the Funds Travel Rule. The recordkeeping and travel rules in 31 CFR 10333 require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 and more. This requirement is commonly referred to as the travel rule. It is noted that some firms are not making use of the exemptions in the Regulations namely on transfers below the EUR 1000 threshold and the intra-EU transfers.

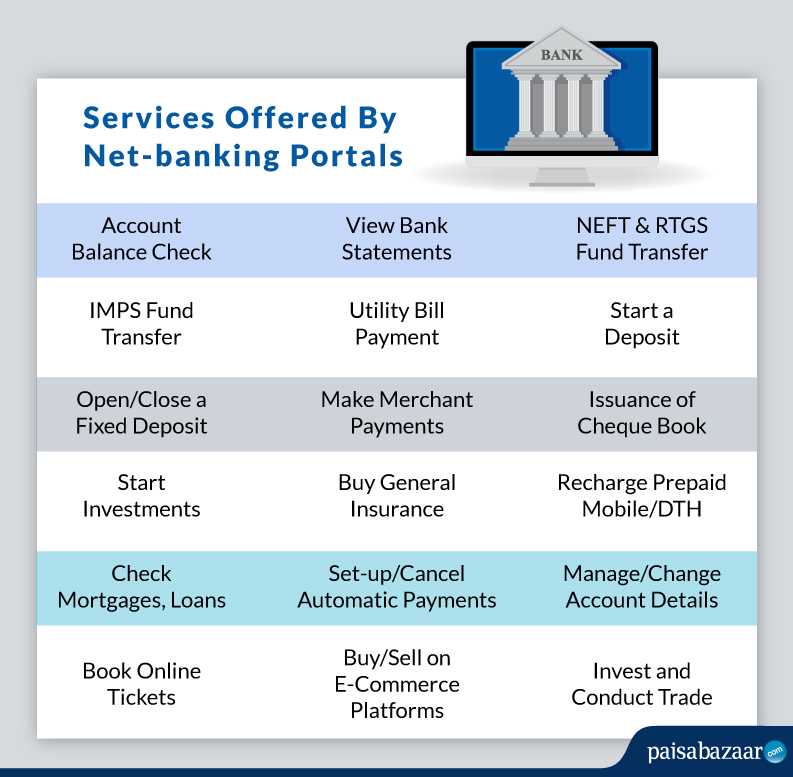

Source: paisabazaar.com

Source: paisabazaar.com

However while 31 CFR 1020220 applies only to new customers opening accounts on or after October 1 2003 and while the rule exempt funds transfers from the definition of account for banks the Travel Rule applies to all transmittals of funds of 3000 or more whether or not the transmittor is a customer for purposes of 31 CFR 1020220. What is the Funds Travel Rule. The name of the transmittor. As per the Guidelines firms that do not have in place the systems to ensure the conditions for. All transmittors financial institutions must include and send the following in the transmittal order.

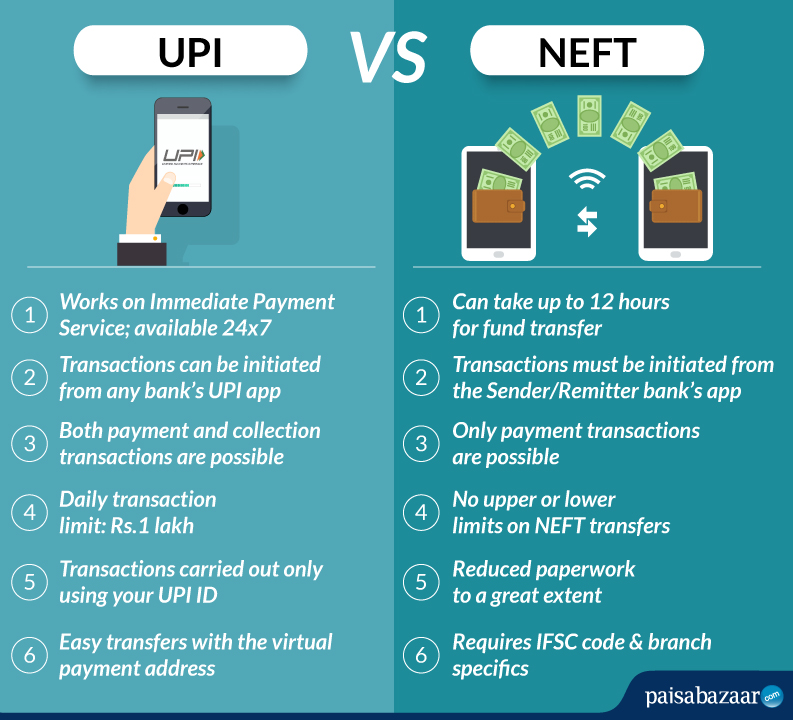

Source: paisabazaar.com

Source: paisabazaar.com

This requirement is commonly referred to as the travel rule. What is the Funds Travel Rule. In addition transmittals of funds governed by the Electronic Funds Transfer Act Reg E or made through ATM or point-of-sale systems are not subject to this rule. RBI Rules On Money Transfer Abroad Maximum limit of money that can be transferred abroad by an Indian citizen As per the Liberalized Remittance Scheme a resident individual has the facility to transfer money abroad to the limit of USD 250000 per financial year approx INR 18 crore check todays USD exchange rate in India. What are the Travel rules requirements.

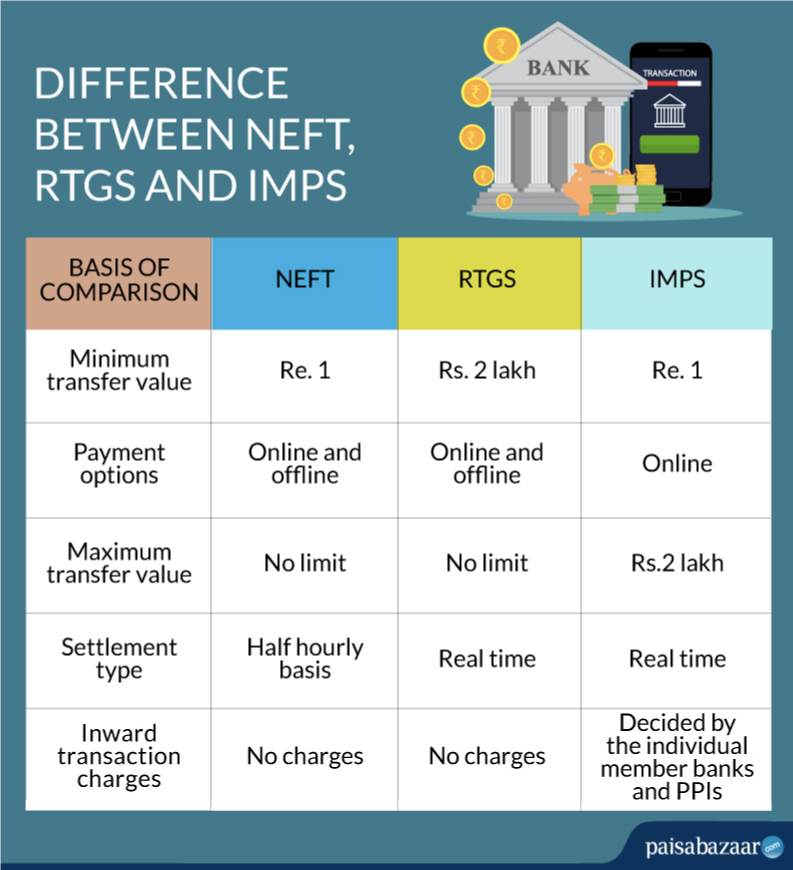

Source: paisabazaar.com

Source: paisabazaar.com

Referencing these documents by the SEC and FinCEN. The recordkeeping and travel rules in 31 CFR 10333 require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 and more. The proposed rules would further solidify the requirement that virtual asset service providers VASPs comply with the travel rule and with recordkeeping requirements related to funds transfers. The Funds Travel Rule requires financial institutions who are sending and or receiving funds to or from other financial institutions to capture transmit and store certain information associated with each transfer of funds above a certain threshold. This is important because the Travel ruleÕs requirement to pass information to the next financial institution in the chain implicitly requires financial institutions that carry out transmittals of funds to coordinate the transfer of information required by this new rule.

Source: veem.com

Source: veem.com

In addition transmittals of funds governed by the Electronic Funds Transfer Act Reg E or made through ATM or point of sale systems are not subject to this rule. This requirement is commonly referred to as the travel rule. All transmittors financial institutions must include and send the following in the transmittal order. RBI Rules On Money Transfer Abroad Maximum limit of money that can be transferred abroad by an Indian citizen As per the Liberalized Remittance Scheme a resident individual has the facility to transfer money abroad to the limit of USD 250000 per financial year approx INR 18 crore check todays USD exchange rate in India. The proposed rules would further solidify the requirement that virtual asset service providers VASPs comply with the travel rule and with recordkeeping requirements related to funds transfers.

Source: id.pinterest.com

Source: id.pinterest.com

Regulation EU 2015847 in respect of all transfers of funds. However while 31 CFR 1020220 applies only to new customers opening accounts on or after October 1 2003 and while the rule exempt funds transfers from the definition of account for banks the Travel Rule applies to all transmittals of funds of 3000 or more whether or not the transmittor is a customer for purposes of 31 CFR 1020220. Only transmittals of funds equal to or greater than 3000 or its foreign equivalent are subject to this rule regardless of whether or not currency is involved. RBI Rules On Money Transfer Abroad Maximum limit of money that can be transferred abroad by an Indian citizen As per the Liberalized Remittance Scheme a resident individual has the facility to transfer money abroad to the limit of USD 250000 per financial year approx INR 18 crore check todays USD exchange rate in India. Referencing these documents by the SEC and FinCEN.

Source: remitr.com

Source: remitr.com

The proposed rules would further solidify the requirement that virtual asset service providers VASPs comply with the travel rule and with recordkeeping requirements related to funds transfers. Regulation EU 2015847 in respect of all transfers of funds. The Recordkeeping Rule and Travel Rule collectively require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 or more. In addition transmittals of funds governed by the Electronic Funds Transfer Act Reg E or made through ATM or point-of-sale systems are not subject to this rule. On file and the address information is retrievable upon request by law.

Source: bbt.com

Source: bbt.com

The Funds Travel Rule requires financial institutions who are sending and or receiving funds to or from other financial institutions to capture transmit and store certain information associated with each transfer of funds above a certain threshold. What is the Funds Travel Rule. Regulation EU 2015847 in respect of all transfers of funds. Referencing these documents by the SEC and FinCEN. When you make or receive any transfer of funds the EU legislation states that you must have complete information about the payer and payee and send this along with the transfer of funds.

Source: pinterest.com

Source: pinterest.com

When you make or receive any transfer of funds the EU legislation states that you must have complete information about the payer and payee and send this along with the transfer of funds. Travel Rule Requirements For funds transmittals of 3000 or more the intermediary financial institution must include the following information if received from the sender in a transmittal order at the time that order is sent to a receiving financial institution 1010410f2. The recordkeeping and travel rules in 31 CFR 10333 require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 and more. On file and the address information is retrievable upon request by law. It explains your requirement under the Proceeds of Crime Money Laundering and Terrorist Financing Act PCMLTFA and associated Regulations to include or obtain certain information in relation to an electronic funds transfer EFT or a virtual currency VC transfer.

Source: bbt.com

Source: bbt.com

In addition transmittals of funds governed by the Electronic Funds Transfer Act Reg E or made through ATM or point of sale systems are not subject to this rule. When you make or receive any transfer of funds the EU legislation states that you must have complete information about the payer and payee and send this along with the transfer of funds. Only transmittals of funds equal to or greater than 3000 or its foreign equivalent are subject to this rule regardless of whether or not currency is involved. This requirement is commonly referred to as the travel rule. In addition transmittals of funds governed by the Electronic Funds Transfer Act Reg E or made through ATM or point-of-sale systems are not subject to this rule.

Source: pinterest.com

Source: pinterest.com

In addition transmittals of funds governed by the Electronic Funds Transfer Act Reg E or made through ATM or point-of-sale systems are not subject to this rule. The Recordkeeping Rule and Travel Rule collectively require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 or more. The Funds Travel Rule requires financial institutions who are sending and or receiving funds to or from other financial institutions to capture transmit and store certain information associated with each transfer of funds above a certain threshold. Only transmittals of funds equal to or greater than 3000 or its foreign equivalent are subject to this rule regardless of whether or not currency is involved. The recordkeeping and travel rules in 31 CFR 10333 require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 and more.

Source: paisabazaar.com

Source: paisabazaar.com

In addition transmittals of funds governed by the Electronic Funds Transfer Act Reg E or made through ATM or point-of-sale systems are not subject to this rule. The Funds Travel Rule requires financial institutions who are sending and or receiving funds to or from other financial institutions to capture transmit and store certain information associated with each transfer of funds above a certain threshold. Travel Rule Requirements For funds transmittals of 3000 or more the intermediary financial institution must include the following information if received from the sender in a transmittal order at the time that order is sent to a receiving financial institution 1010410f2. In addition transmittals of funds governed by the Electronic Funds Transfer Act Reg E or made through ATM or point-of-sale systems are not subject to this rule. Regulation EU 2015847 in respect of all transfers of funds.

Source: remitr.com

Source: remitr.com

This is important because the Travel ruleÕs requirement to pass information to the next financial institution in the chain implicitly requires financial institutions that carry out transmittals of funds to coordinate the transfer of information required by this new rule. It explains your requirement under the Proceeds of Crime Money Laundering and Terrorist Financing Act PCMLTFA and associated Regulations to include or obtain certain information in relation to an electronic funds transfer EFT or a virtual currency VC transfer. The Recordkeeping Rule and Travel Rule collectively require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 or more. In addition transmittals of funds governed by the Electronic Funds Transfer Act Reg E or made through ATM or point of sale systems are not subject to this rule. Of funds moves from a bank to a non-bank or vice versa.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title funds transfer and travel rule requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas