14+ Funds transfer recordkeeping and travel rule ideas in 2021

Home » about money loundering Info » 14+ Funds transfer recordkeeping and travel rule ideas in 2021Your Funds transfer recordkeeping and travel rule images are ready in this website. Funds transfer recordkeeping and travel rule are a topic that is being searched for and liked by netizens today. You can Download the Funds transfer recordkeeping and travel rule files here. Download all free images.

If you’re searching for funds transfer recordkeeping and travel rule pictures information related to the funds transfer recordkeeping and travel rule interest, you have pay a visit to the right blog. Our website always provides you with hints for seeking the maximum quality video and picture content, please kindly search and find more enlightening video articles and images that fit your interests.

Funds Transfer Recordkeeping And Travel Rule. We have received a letter from the Home Loan Bankwhich states in order to comply with Travel Rule as of May 312003 the required information regarding beneficiaries of funds transfers needs to include complete addresses. This requirement is commonly referred to as the Travel Rule 110 31 CFR 1020410a is the recordkeeping rule for banks and 31 CFR 1010410e imposes similar requirements for nonbank financial institutions that engage in funds transfers. I For each payment order that it accepts as an originators. Overview of the Recordkeeping and Travel Rules The recordkeeping and travel rules in 31 CFR 10333 require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 and more.

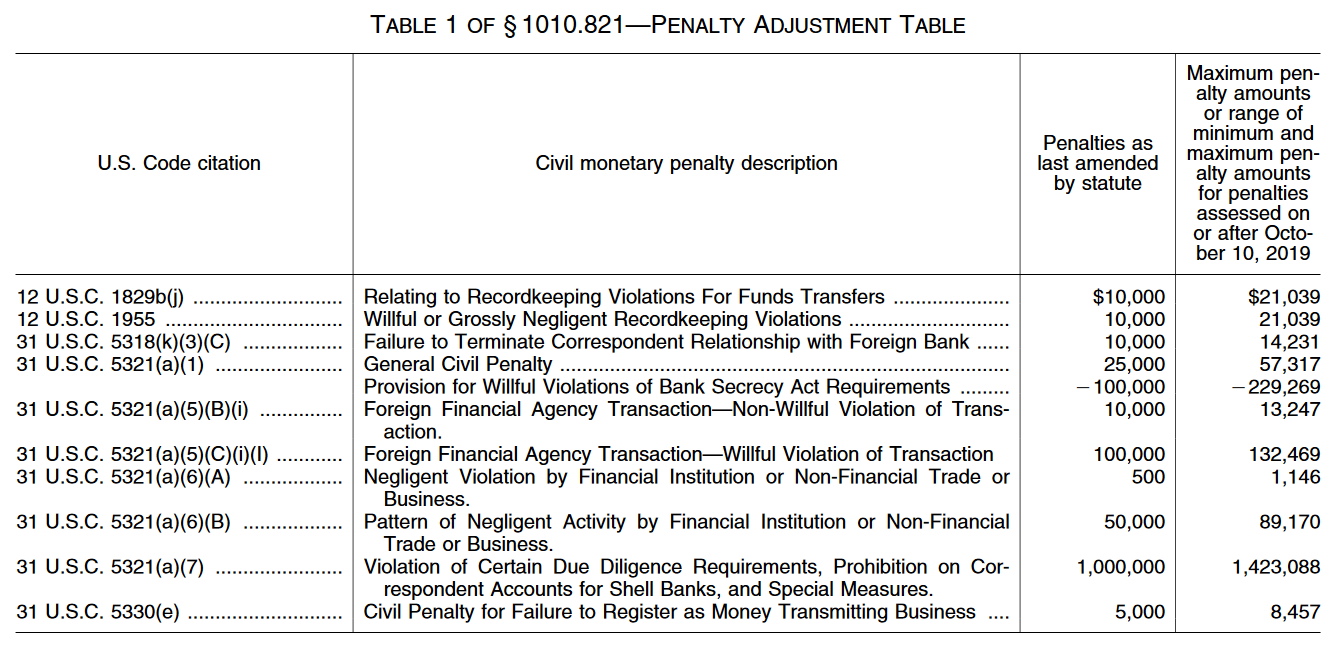

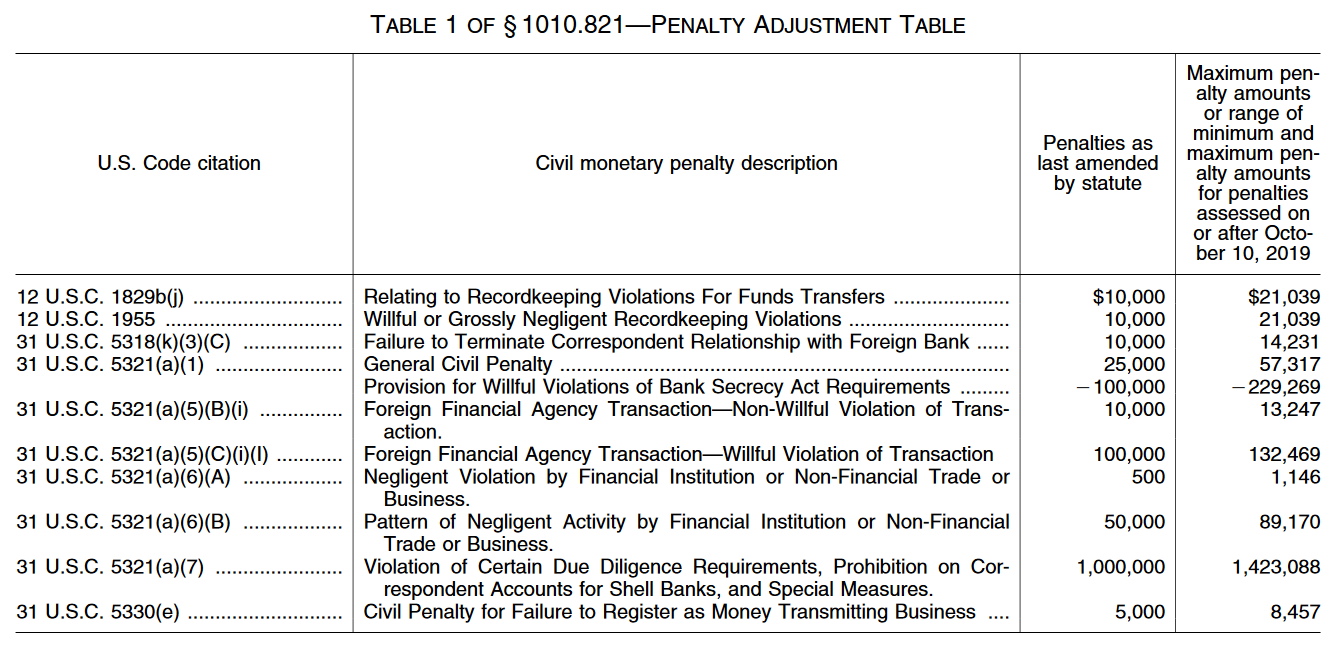

Bsa Violation Civil Penalties Increase Nafcu From nafcu.org

Bsa Violation Civil Penalties Increase Nafcu From nafcu.org

Under the current version of the recordkeeping rule banks and nonbank financial institutions are required to collect and retain information that relates to funds transfers and transmittals of funds of 3000. The procedures in this core overview section address only the rules for banks in 31 CFR 1020410a. Financial institutions are also required to verify the identity of the person making or receiving a funds. We have received a letter from the Home Loan Bankwhich states in order to comply with Travel Rule as of May 312003 the required information regarding beneficiaries of funds transfers needs to include complete addresses. Overview of the Recordkeeping and Travel Rules The recordkeeping and travel rules in 31 CFR 10333 require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 and more. Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over 3000.

Travel Rule Complete Beneficiaries Addresses.

Overview of the Recordkeeping and Travel Rules The recordkeeping and travel rules in 31 CFR 10333 require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 and more. I For each payment order that it accepts as an originators. Financial institutions are also required to verify the identity of the person making or receiving a funds. Under the current recordkeeping and travel rule regulations financial institutions must collect retain and transmit certain information related to funds transfers and transmittals of funds over. At the same time the Treasury adopted a companion rule Travel Rule or Rule that requires financial institutions to include on transmittal orders certain information that must be retained under the new record keeping requirements. Only transmittals of funds equal to or greater than 3000 or its foreign equivalent are subject to this rule regardless of whether or not currency is involved.

Source: elibrary.imf.org

Source: elibrary.imf.org

The threshold for domestic transactions remains unchanged at 3000. Financial institutions are also required to verify the identity of the person making or receiving a funds. At the same time the Treasury adopted a companion rule Travel Rule or Rule that requires financial institutions to include on transmittal orders certain information that must be retained under the new record keeping requirements. The recordkeeping rule and the travel rule apply to transmittals of funds and funds transfers. The Joint Rule requires additional record keeping related to certain funds transmittals and transfers by brokerdealers and other financial institutions.

Source: elibrary.imf.org

Source: elibrary.imf.org

The Travel rule should be examined in concert with the TreasuryÕs related recordkeeping rule concerning the transmittal of funds. Is there a change as of May 31 2003 that I missed. The term includes any transmittal order. 1 The Recordkeeping Rule currently requires that financial institutions collect and retain certain information for funds transfers of 3000 or more such as the originators name and address the amount and date of the payment order payment instructions and the identity of the beneficiarys bank. The Travel rule should be examined in concert with the TreasuryÕs related recordkeeping rule concerning the transmittal of funds.

Source:

Travel Rule Complete Beneficiaries Addresses. 1 The Recordkeeping Rule currently requires that financial institutions collect and retain certain information for funds transfers of 3000 or more such as the originators name and address the amount and date of the payment order payment instructions and the identity of the beneficiarys bank. More specifically in 2019 FinCEN issued guidance describing how the Travel Rule and Recordkeeping Rule would apply to virtual currencies. We have received a letter from the Home Loan Bankwhich states in order to comply with Travel Rule as of May 312003 the required information regarding beneficiaries of funds transfers needs to include complete addresses. Overview of the Recordkeeping and Travel Rules The recordkeeping and travel rules in 31 CFR 10333 require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 and more.

Source: pikpng.com

Source: pikpng.com

Are all transmittals of funds subject to this rule. A Each agent agency branch or office located within the United States of a bank is subject to the requirements of this paragraph a with respect to a funds transfer in the amount of 3000 or more and is required to retain either the original or a copy or reproduction of each of the following. The procedures in this core overview section address only the rules for banks in 31 CFR 1020410a. Iv Generally speaking these rules apply when two money service businesses MSBs or other financial institutions covered by the rules transfer 3000 or more in funds including virtual currencies on behalf of a client. Are all transmittals of funds subject to this rule.

Source: pinterest.com

Source: pinterest.com

This requirement is commonly referred to as the Travel Rule 110 31 CFR 1020410a is the recordkeeping rule for banks and 31 CFR 1010410e imposes similar requirements for nonbank financial institutions that engage in funds transfers. The term includes any transmittal order. 1 The Recordkeeping Rule currently requires that financial institutions collect and retain certain information for funds transfers of 3000 or more such as the originators name and address the amount and date of the payment order payment instructions and the identity of the beneficiarys bank. The Treasury and not the Board is authorized to issue regulations requiring. We have received a letter from the Home Loan Bankwhich states in order to comply with Travel Rule as of May 312003 the required information regarding beneficiaries of funds transfers needs to include complete addresses.

Source: elibrary.imf.org

Source: elibrary.imf.org

In addition transmittals of funds governed by the Electronic Funds Transfer Act Reg E or made through ATM or point-of-sale systems are not subject to this rule. I For each payment order that it accepts as an originators. Financial institutions are also required to verify the identity of the person making or receiving a funds. The procedures in this core overview section address only the rules for banks in 31 CFR 1020410a. 110 31 CFR 1020410a is the recordkeeping rule for banks and 31 CFR 1010410e imposes similar requirements for nonbank financial institutions that engage in funds transfers.

Source: nafcu.org

Source: nafcu.org

Is there a change as of May 31 2003 that I missed. 1 The Recordkeeping Rule currently requires that financial institutions collect and retain certain information for funds transfers of 3000 or more such as the originators name and address the amount and date of the payment order payment instructions and the identity of the beneficiarys bank. A Each agent agency branch or office located within the United States of a bank is subject to the requirements of this paragraph a with respect to a funds transfer in the amount of 3000 or more and is required to retain either the original or a copy or reproduction of each of the following. 110 31 CFR 1020410a is the recordkeeping rule for banks and 31 CFR 1010410e imposes similar requirements for nonbank financial institutions that engage in funds transfers. The threshold for domestic transactions remains unchanged at 3000.

Source: elibrary.imf.org

Source: elibrary.imf.org

I For each payment order that it accepts as an originators. I For each payment order that it accepts as an originators. A Each agent agency branch or office located within the United States of a bank is subject to the requirements of this paragraph a with respect to a funds transfer in the amount of 3000 or more and is required to retain either the original or a copy or reproduction of each of the following. Under the current version of the recordkeeping rule banks and nonbank financial institutions are required to collect and retain information that relates to funds transfers and transmittals of funds of 3000. Overview of the Recordkeeping and Travel Rules The recordkeeping and travel rules in 31 CFR 10333 require banks and nonbank financial institutions to collect retain and transmit information on funds transfers and transmittals of funds in amounts of 3000 and more.

Source: elibrary.imf.org

Source: elibrary.imf.org

1 The travel rule codified at 31 CFR 1010410f requires financial institutions conducting funds transferstransmittals to include certain information on the originator and recipient. Are all transmittals of funds subject to this rule. 110 31 CFR 1020410a is the recordkeeping rule for banks and 31 CFR 1010410e imposes similar requirements for nonbank financial institutions that engage in funds transfers. At the same time the Treasury adopted a companion rule Travel Rule or Rule that requires financial institutions to include on transmittal orders certain information that must be retained under the new record keeping requirements. More specifically in 2019 FinCEN issued guidance describing how the Travel Rule and Recordkeeping Rule would apply to virtual currencies.

Source: id.pinterest.com

Source: id.pinterest.com

The threshold for domestic transactions remains unchanged at 3000. Iv Generally speaking these rules apply when two money service businesses MSBs or other financial institutions covered by the rules transfer 3000 or more in funds including virtual currencies on behalf of a client. Only transmittals of funds equal to or greater than 3000 or its foreign equivalent are subject to this rule regardless of whether or not currency is involved. The Treasury and not the Board is authorized to issue regulations requiring. Travel Rule Complete Beneficiaries Addresses.

Source: elibrary.imf.org

Source: elibrary.imf.org

Only transmittals of funds equal to or greater than 3000 or its foreign equivalent are subject to this rule regardless of whether or not currency is involved. Iv Generally speaking these rules apply when two money service businesses MSBs or other financial institutions covered by the rules transfer 3000 or more in funds including virtual currencies on behalf of a client. 1 The travel rule codified at 31 CFR 1010410f requires financial institutions conducting funds transferstransmittals to include certain information on the originator and recipient. The procedures in this core overview section address only the rules for banks in 31 CFR 1020410a. The Treasury and not the Board is authorized to issue regulations requiring.

Source: elibrary.imf.org

Source: elibrary.imf.org

The term includes any transmittal order. In addition transmittals of funds governed by the Electronic Funds Transfer Act Reg E or made through ATM or point-of-sale systems are not subject to this rule. 1 The travel rule codified at 31 CFR 1010410f requires financial institutions conducting funds transferstransmittals to include certain information on the originator and recipient. The procedures in this core overview section address only the rules for banks in 31 CFR 1020410a. Under the current version of the recordkeeping rule banks and nonbank financial institutions are required to collect and retain information that relates to funds transfers and transmittals of funds of 3000.

Source: elibrary.imf.org

Source: elibrary.imf.org

The recordkeeping rule and the travel rule apply to transmittals of funds and funds transfers. Under the current version of the recordkeeping rule banks and nonbank financial institutions are required to collect and retain information that relates to funds transfers and transmittals of funds of 3000. The procedures in this core overview section address only the rules for banks in 31 CFR 1020410a. 110 31 CFR 1020410a is the recordkeeping rule for banks and 31 CFR 1010410e imposes similar requirements for nonbank financial institutions that engage in funds transfers. The Treasury and not the Board is authorized to issue regulations requiring.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title funds transfer recordkeeping and travel rule by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas