16+ Funnel accounts money laundering stage information

Home » about money loundering idea » 16+ Funnel accounts money laundering stage informationYour Funnel accounts money laundering stage images are ready. Funnel accounts money laundering stage are a topic that is being searched for and liked by netizens today. You can Find and Download the Funnel accounts money laundering stage files here. Get all royalty-free photos and vectors.

If you’re looking for funnel accounts money laundering stage images information related to the funnel accounts money laundering stage keyword, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for refferencing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

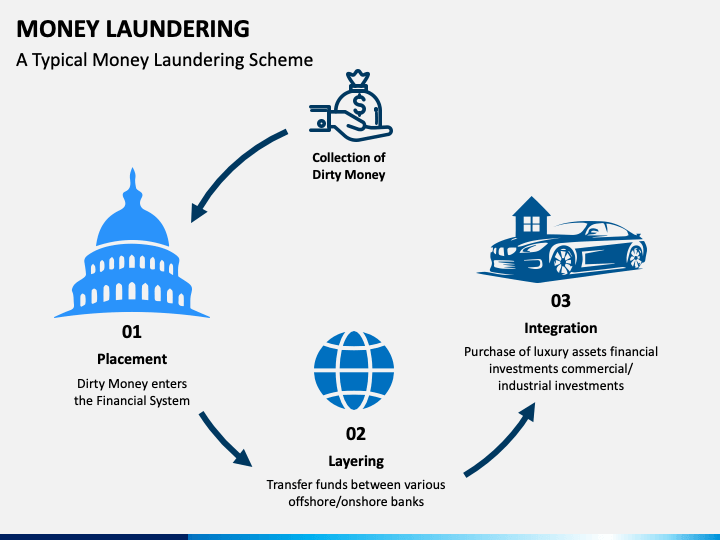

Funnel Accounts Money Laundering Stage. Since they are a convenient instrument for making dirty money look clean escrow arrangements call for careful consideration when taking part in property transactions. The US Immigration and Customs Enforcement ICE agency publish guidelines to assist in recognizing Money Laundering. Money Laundering Process Step 3 - Integration Integration is the final stage in the process. Although the specific techniques used to clean dirty money vary financial experts cite three stages of money laundering in the process.

Fatf Report Professional Money Laundering And Related Threats Money Laundering Watch Money Laundering Money Threat From pinterest.com

Fatf Report Professional Money Laundering And Related Threats Money Laundering Watch Money Laundering Money Threat From pinterest.com

The stages of money laundering include the. Accordingly the first stage of the money laundering process is known as placement. In this way launderers are presented with a practical vehicle through which they can funnel funds into the financial system making them appear legitimate. The US Immigration and Customs Enforcement ICE agency publish guidelines to assist in recognizing Money Laundering. Paul identified a money laundering organization using front companies and funnel accounts to further a scheme involving illegal pharmaceutical sales. If illegal funds make it to this level of the process it will become increasingly harder to make a case for money laundering.

2014-A005 funnel accounts are also used in conjunction with trade-based money laundering.

According to FinCEN Advisory No. Interstate funnel accounts or interstate cash ac-counts are currently one of the most efficient means for drug and human smuggling organizations to rapidly move illicit pro-. A funnel account is an individual or business account in one geographic area that receives multiple cash deposits often in amounts below the cash reporting threshold and from which the funds are withdrawn in a different geographic area with little time elapsing between the deposits. Money is integrated into the legitimate economic and financial system and is assimilated with all other assets in the system. These accounts are called funnel accounts also known as interstate funnel accounts a method used to launder money that exploits branch networks of financial institutions. Below we have listed sample set of typologies used for the detection of suspicious money laundering activity across Funnel Accounts.

Source: pinterest.com

Source: pinterest.com

Pharmaceutical fraud and money laundering facilitated through front companies HSI St. Money is integrated into the legitimate economic and financial system and is assimilated with all other assets in the system. Criminals may use several methodologies to place illegal money in the legitimate financial system including. The US Immigration and Customs Enforcement ICE agency publish guidelines to assist in recognizing Money Laundering. The term walking account was coined because the money in these accounts appears to walk away.

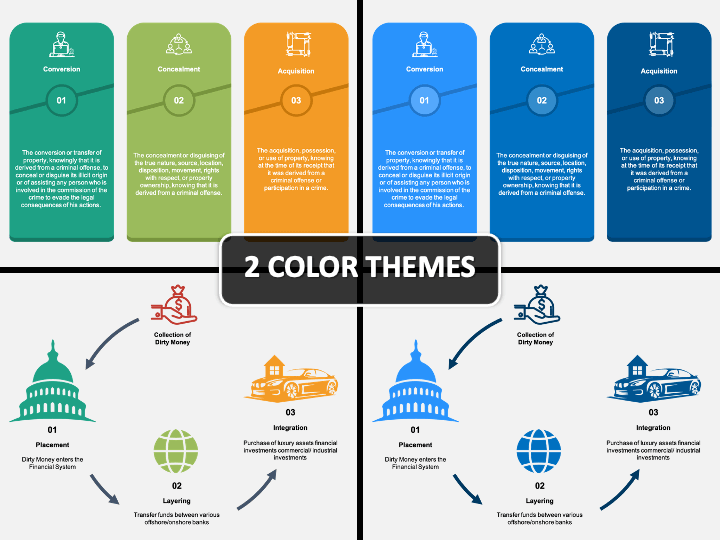

Source: sketchbubble.com

Source: sketchbubble.com

In addition to the illegal importation of. Criminals may use several methodologies to place illegal money in the legitimate financial system including. Pharmaceutical fraud and money laundering facilitated through front companies HSI St. A funnel account is an individual or business account in one geographic area that receives multiple cash deposits often in amounts below the cash reporting threshold and from which the funds are withdrawn in a different geographic area with little time elapsing between the deposits. Or foreign business owner or other individual colluding with representatives of a criminal organization opens an account at banks or credit unions whose accounts can readily receive cash deposits in multiple states through their own branches or through shared branches.

Source: sciencedirect.com

Source: sciencedirect.com

Money laundering involves three basic steps to disguise the source of illegally earned money and make it usable. Money laundering involves three basic steps to disguise the source of illegally earned money and make it usable. FinCEN recently released guidance on US currency restrictions in Mexico specifically tailored to funnel accounts and trade-based money laundering. In 2010 the Mexican Finance Ministry SHCP announced new AML regulations that prohibit banks from receiving more than 7000 USD in cash from a customer during a one month period. Flow Through of Funds.

Source: ppt-online.org

Source: ppt-online.org

Money laundering involves three basic steps to disguise the source of illegally earned money and make it usable. 1 placement 2 layering and 3 integration. In addition to the illegal importation of. However it is important to remember that money laundering is a single process. These accounts are called funnel accounts also known as interstate funnel accounts a method used to launder money that exploits branch networks of financial institutions.

Source: chaussureslouboutin-soldes.fr

Source: chaussureslouboutin-soldes.fr

However it is important to remember that money laundering is a single process. View the infographic to read about the 12 Red Flags associated with these accounts. Criminals may use several methodologies to place illegal money in the legitimate financial system including. Currency transactions in Mexico. Due to these reasons walking accounts create substantial investigation hurdles for regulators.

Source: sketchbubble.com

Source: sketchbubble.com

Money laundering involves three basic steps to disguise the source of illegally earned money and make it usable. Below we have listed sample set of typologies used for the detection of suspicious money laundering activity across Funnel Accounts. Stage 1 of Money Laundering. A funnel account is an individual or business account in one geographic area that receives multiple cash deposits often in amounts below the cash reporting threshold and from which the funds are withdrawn in a different geographic area with little time elapsing between the deposits. 2014-A005 funnel accounts are also used in conjunction with trade-based money laundering.

Source: pinterest.com

Source: pinterest.com

Or foreign business owner or other individual colluding with representatives of a criminal organization opens an account at banks or credit unions whose accounts can readily receive cash deposits in multiple states through their own branches or through shared branches. A funnel account is an individual or business account in one geographic area that receives multiple cash deposits often in amounts below the cash reporting threshold and from which the funds are withdrawn in a different geographic area with little time elapsing between the deposits. Authorities in the United States have alerted banks to the use of funnel accounts in trade-based money laundering the latest scheme in an extensive arsenal of operations employed by Mexicos drug cartels to legitimize their illicit funds. Money launderers use this layering technique because it is extremely difficult to detect and money moves very fast through accounts across the world. 1 placement 2 layering and 3 integration.

Source: ppt-online.org

Source: ppt-online.org

Money launderers use this layering technique because it is extremely difficult to detect and money moves very fast through accounts across the world. In addition to the illegal importation of. Stage 1 of Money Laundering. A funnel account is an individual or business account in one geographic area that receives multiple cash deposits often in amounts below the cash reporting threshold and from which the funds are withdrawn in a different geographic area with little time elapsing between the deposits. In this way launderers are presented with a practical vehicle through which they can funnel funds into the financial system making them appear legitimate.

Authorities in the United States have alerted banks to the use of funnel accounts in trade-based money laundering the latest scheme in an extensive arsenal of operations employed by Mexicos drug cartels to legitimize their illicit funds. In 2010 the Mexican Finance Ministry SHCP announced new AML regulations that prohibit banks from receiving more than 7000 USD in cash from a customer during a one month period. Flow Through of Funds. Or foreign business owner or other individual colluding with representatives of a criminal organization opens an account at banks or credit unions whose accounts can readily receive cash deposits in multiple states through their own branches or through shared branches. The term walking account was coined because the money in these accounts appears to walk away.

Source: ppt-online.org

Source: ppt-online.org

Interstate funnel accounts or interstate cash ac-counts are currently one of the most efficient means for drug and human smuggling organizations to rapidly move illicit pro-. The term walking account was coined because the money in these accounts appears to walk away. Money is integrated into the legitimate economic and financial system and is assimilated with all other assets in the system. Money launderers use this layering technique because it is extremely difficult to detect and money moves very fast through accounts across the world. View the infographic to read about the 12 Red Flags associated with these accounts.

Source: pinterest.com

Source: pinterest.com

View the infographic to read about the 12 Red Flags associated with these accounts. In addition to the illegal importation of. FinCEN defines a funnel account as an individual or business account. Currency transactions in Mexico. The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

Source: slideteam.net

Source: slideteam.net

One such guideline is the presence of funnel accounts where many deposits are input into an account and then dispersed to other accounts within a short period of time. Money laundering involves three basic steps to disguise the source of illegally earned money and make it usable. Below we have listed sample set of typologies used for the detection of suspicious money laundering activity across Funnel Accounts. Since they are a convenient instrument for making dirty money look clean escrow arrangements call for careful consideration when taking part in property transactions. Pharmaceutical fraud and money laundering facilitated through front companies HSI St.

Source: slideteam.net

Source: slideteam.net

The US Immigration and Customs Enforcement ICE agency publish guidelines to assist in recognizing Money Laundering. Interstate funnel accounts or interstate cash ac-counts are currently one of the most efficient means for drug and human smuggling organizations to rapidly move illicit pro-. However it is important to remember that money laundering is a single process. According to FinCEN Advisory No. 1 placement 2 layering and 3 integration.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title funnel accounts money laundering stage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information