13++ Gatekeeper definition money laundering info

Home » about money loundering idea » 13++ Gatekeeper definition money laundering infoYour Gatekeeper definition money laundering images are ready. Gatekeeper definition money laundering are a topic that is being searched for and liked by netizens today. You can Get the Gatekeeper definition money laundering files here. Get all royalty-free photos and vectors.

If you’re searching for gatekeeper definition money laundering pictures information linked to the gatekeeper definition money laundering topic, you have come to the ideal blog. Our website frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly surf and find more informative video content and images that match your interests.

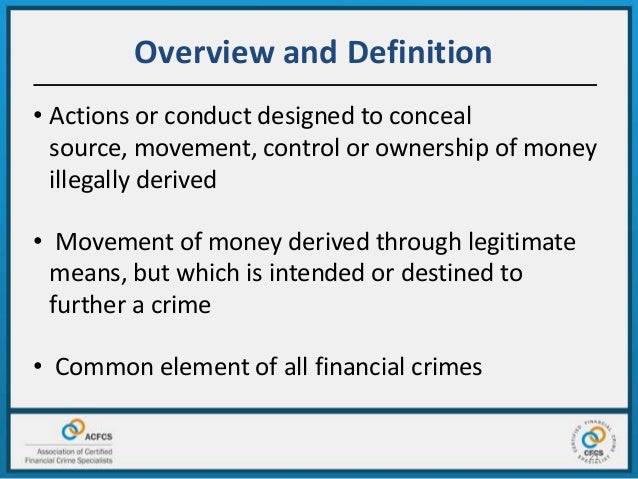

Gatekeeper Definition Money Laundering. Curb gatekeepers in assisting money laundering schemes. Gatekeepers as a money laundering structure to hinder the proceeds of crime within. Facilitates the process of money laundering and is responsible for the financial crime itself after receiving the proceeds of original crimes committed by other perpetrators. In the case of Singapore due diligence is compulsory for some transactions.

Commonalities Money Laundering Ethics International Standards Gac From slideshare.net

Commonalities Money Laundering Ethics International Standards Gac From slideshare.net

Laundering in the matter of cutting-off the nexus between the assets in money laundering and its owner and its role in preventing money laundering. After researching on the urgency and comparison in other States there are some reasons about why Indonesia should adopt gatekeeper concept. Panama Cayman Islands Belize and other small countries have become major financial centers because they provide a destination for often illegal proceeds from criminal. The task of the gatekeeper is to create conditions in which money launderers can maintain and enjoy. The FATF report on Money Laundering Typologies 2000-2001 expanded on the role of gatekeeper professionals in facilitating money laundering. However the Association opposes legislation and regulations that would impose burdensome and intrusive gatekeeper requirements on small businesses or their attorneys or that would undermine the attorney-client.

Facilitates the process of money laundering and is responsible for the financial crime itself after receiving the proceeds of original crimes committed by other perpetrators.

Commonly it is known as a gatekeeper. Transaction monitoring systems currency. Facilitates the process of money laundering and is responsible for the financial crime itself after receiving the proceeds of original crimes committed by other perpetrators. Is a gatekeeper for identifying money laundering because so much of the worlds capital must be converted into US. It has been stated in model legislation on money laundering and financing of terrorism for civil law country but not in Law Number 8 of 2010 in Indonesia. 16 The Second Money Laundering Directive passed in the wake of the events of 11th September 2001 placed a legislative imperative on EU Member States to extend the AML.

Source: researchgate.net

Source: researchgate.net

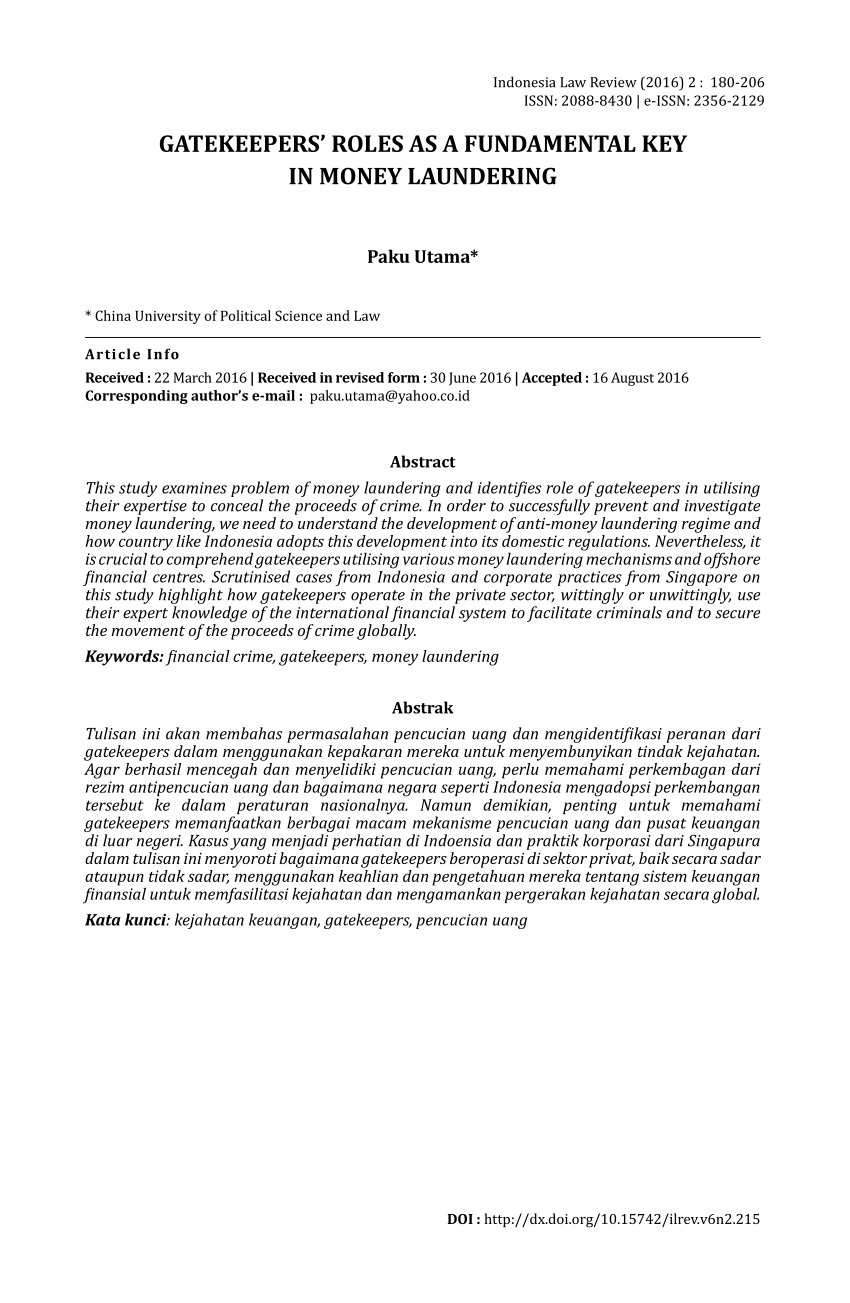

In order to successfully prevent and investigate money laundering we need to understand the development of anti-money laundering regime and how country like Indonesia adopts this development into its domestic regulations. Launder the proceeds of crime. After researching on the urgency and comparison in other States there are some reasons about why Indonesia should adopt gatekeeper concept. THE EUROPEAN UNION ENLISTS LAWYERS IN THE FIGHT AGAINST MONEY LAUNDERING AND TERRORIST FINANCING I. After researching on the urgency and comparison in other States there are some reasons about why Indonesia should adopt gatekeeper concept.

Source: slideshare.net

Source: slideshare.net

2008 Intl Bar Association – Money Laundering Gatekeeper Ethics. In the case of Singapore due diligence is compulsory for some transactions. Is a gatekeeper for identifying money laundering because so much of the worlds capital must be converted into US. Dollars from the original countrys currency. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income.

Source:

It has been stated in model legislation on money laundering and financing of terrorism for civil law country but not in Law Number 8 of 2010 in Indonesia. Commonly it is known as a gatekeeper. This study examines problem of money laundering and identifies role of gatekeepers in utilising their expertise to conceal the proceeds of crime. Dollars from the original countrys currency. Facilitates the process of money laundering and is responsible for the financial crime itself after receiving the proceeds of original crimes committed by other perpetrators.

Source: niceactimize.com

Source: niceactimize.com

Gatekeepers as a money laundering structure to hinder the proceeds of crime within. It has been stated in model legislation on money laundering and financing of terrorism for civil law country but not in Law Number 8 of 2010 in Indonesia. By definition money laundering can only arise once an underlying offence has first generated the dirty funds to be laundered. THE EUROPEAN UNION ENLISTS LAWYERS IN THE FIGHT AGAINST MONEY LAUNDERING AND TERRORIST FINANCING I. Gatekeepers as a money laundering structure to hinder the proceeds of crime within.

Source: saktiryan.wordpress.com

Source: saktiryan.wordpress.com

Commonly it is known as a gatekeeper. But also embezzlement in which money rightly belonging to the State was siphoned for personal use through a variety of means extortion in which the public official uses the threat of official power to receive money and self dealing in which the corrupt PEP has a personal financial interest in acts and. There are four basic types of software that address anti-money laundering. Transaction monitoring systems currency. THE EUROPEAN UNION ENLISTS LAWYERS IN THE FIGHT AGAINST MONEY LAUNDERING AND TERRORIST FINANCING I.

Source: slideshare.net

Source: slideshare.net

The Attorney as Gatekeeper in Anti-Money Laundering Systems International Bar. The FATF report on Money Laundering Typologies 2000-2001 expanded on the role of gatekeeper professionals in facilitating money laundering. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. Commonly it is known as a gatekeeper. Dollars from the original countrys currency.

Source: academia.edu

Source: academia.edu

By definition money laundering can only arise once an underlying offence has first generated the dirty funds to be laundered. Global Anti money Laundering Software Market Report 2018-2023 - Anti-money laundering software is software used in the finance and legal industries to meet the legal requirements for financial institutions and other regulated entities to prevent or report money laundering activities. Transaction monitoring systems currency. 2008 Intl Bar Association – Money Laundering Gatekeeper Ethics. There are four basic types of software that address anti-money laundering.

Source: slideshare.net

Source: slideshare.net

Commonly it is known as a gatekeeper. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Gatekeepers as a money laundering structure to hinder the proceeds of crime within. Global Anti money Laundering Software Market Report 2018-2023 - Anti-money laundering software is software used in the finance and legal industries to meet the legal requirements for financial institutions and other regulated entities to prevent or report money laundering activities. Panama Cayman Islands Belize and other small countries have become major financial centers because they provide a destination for often illegal proceeds from criminal.

Source: academia.edu

Source: academia.edu

Money Laundering Goal and Methods The fundamental goal of money laundering is to disconnect the proceeds of a crime from its source and the process aims to turn the proceeds of crime into assets that appear legitimate13 however this broad goal can be achieved by a variety of methods. The task of the gatekeeper is to create conditions in which money launderers can maintain and enjoy. The FATF report on Money Laundering Typologies 2000-2001 expanded on the role of gatekeeper professionals in facilitating money laundering. Curb gatekeepers in assisting money laundering schemes. Panama Cayman Islands Belize and other small countries have become major financial centers because they provide a destination for often illegal proceeds from criminal.

Source: researchgate.net

Source: researchgate.net

It has been stated in model legislation on money laundering and financing of terrorism for civil law country but not in Law Number 8 of 2010 in Indonesia. This study examines problem of money laundering and identifies role of gatekeepers in utilising their expertise to conceal the proceeds of crime. Commonly it is known as a gatekeeper. In the case of Singapore due diligence is compulsory for some transactions. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to.

Source: researchgate.net

Source: researchgate.net

16 The Second Money Laundering Directive passed in the wake of the events of 11th September 2001 placed a legislative imperative on EU Member States to extend the AML. Curb gatekeepers in assisting money laundering schemes. Commonly it is known as a gatekeeper. However the Association opposes legislation and regulations that would impose burdensome and intrusive gatekeeper requirements on small businesses or their attorneys or that would undermine the attorney-client. Here we focus on the 2020 Strategy as it relates to combating money laundering relating to real estate transactions and gatekeeper professions in general such as lawyers real estate professionals and other financial professionals including broker dealers.

Source: actec.org

Source: actec.org

The Attorney as Gatekeeper in Anti-Money Laundering Systems International Bar. After researching on the urgency and comparison in other States there are some reasons about why Indonesia should adopt gatekeeper concept. It has been stated in model legislation on money laundering and financing of terrorism for civil law country but not in Law Number 8 of 2010 in Indonesia. Curb gatekeepers in assisting money laundering schemes. Commonly it is known as a gatekeeper.

Source: yumpu.com

Source: yumpu.com

16 The Second Money Laundering Directive passed in the wake of the events of 11th September 2001 placed a legislative imperative on EU Member States to extend the AML. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. THE EUROPEAN UNION ENLISTS LAWYERS IN THE FIGHT AGAINST MONEY LAUNDERING AND TERRORIST FINANCING I. After researching on the urgency and comparison in other States there are some reasons about why Indonesia should adopt gatekeeper concept. Laundering in the matter of cutting-off the nexus between the assets in money laundering and its owner and its role in preventing money laundering.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title gatekeeper definition money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information