15++ High risk money laundering products info

Home » about money loundering Info » 15++ High risk money laundering products infoYour High risk money laundering products images are available. High risk money laundering products are a topic that is being searched for and liked by netizens today. You can Download the High risk money laundering products files here. Get all free photos and vectors.

If you’re looking for high risk money laundering products images information connected with to the high risk money laundering products keyword, you have come to the ideal site. Our site always provides you with suggestions for downloading the maximum quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

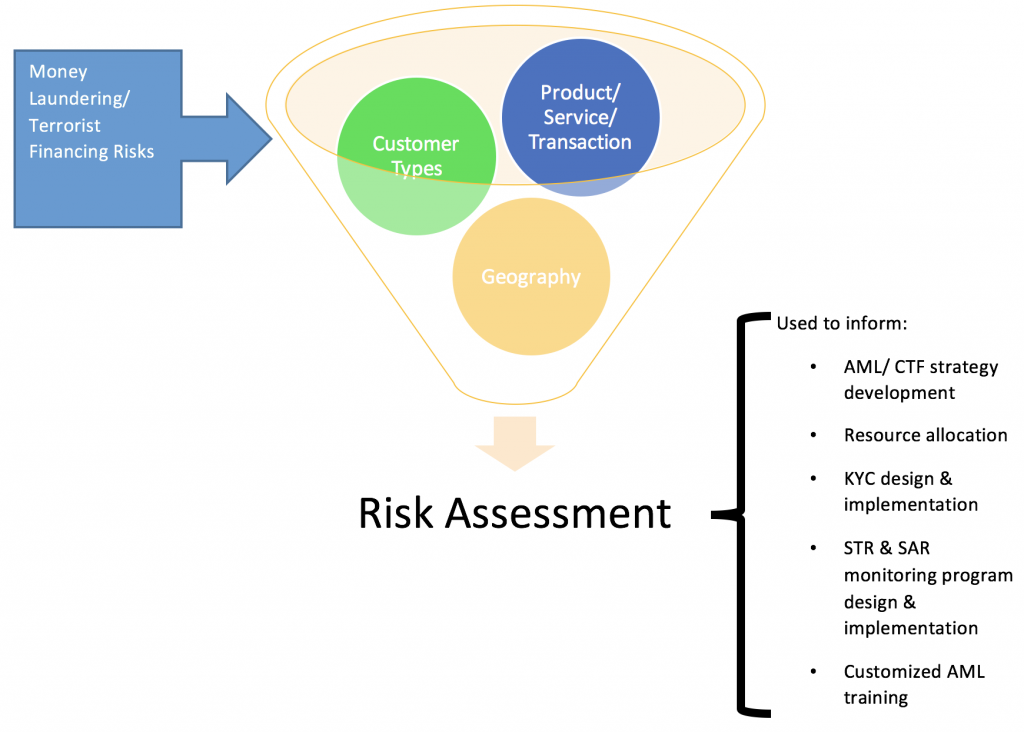

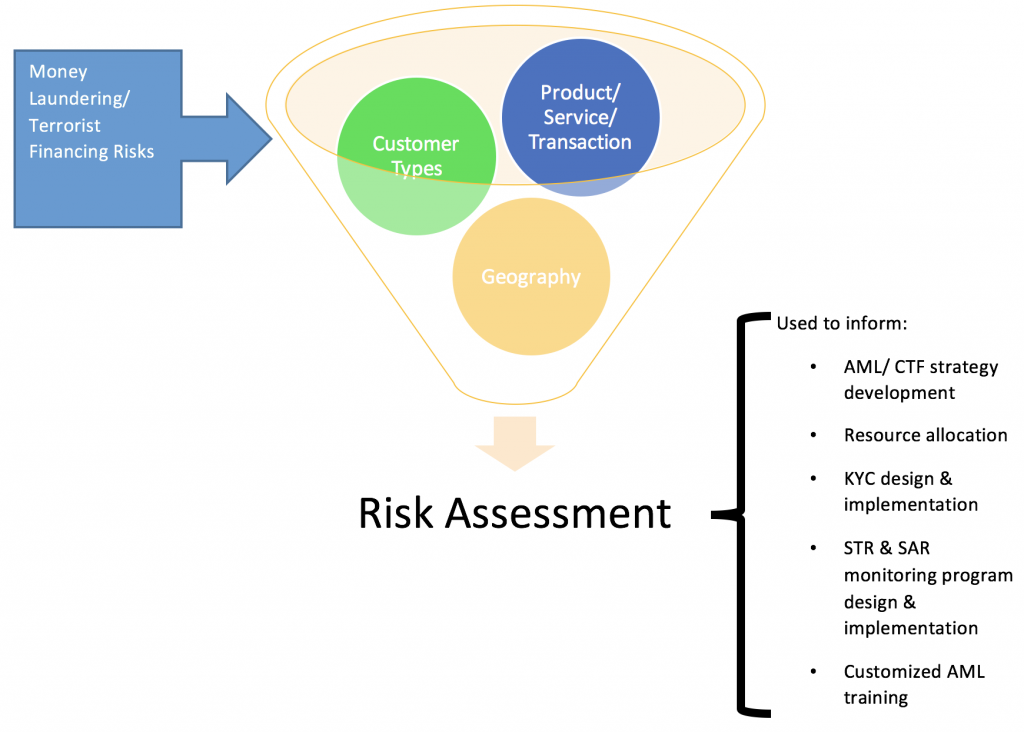

High Risk Money Laundering Products. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks. The concept of cash laundering is very important to be understood for these working within the monetary sector. Which Countries Are High Risk For Money Laundering pada tanggal Agustus 05 2021. Customers The following may suggest a high risk of money laundering or terrorist financing.

Anti Money Laundering Programmes Systems Financetrainingcourse Com From financetrainingcourse.com

Anti Money Laundering Programmes Systems Financetrainingcourse Com From financetrainingcourse.com

What are considered higher risk customer types for money laundering. Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons PEPsMore items. The concept of cash laundering is very important to be understood for these working within the monetary sector. This course helps the bankers to get insights of the high risk. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks. This report describes how banks operating in the UK are managing money-laundering risk in higher risk situations.

Activities do not pose a higher risk of money laundering.

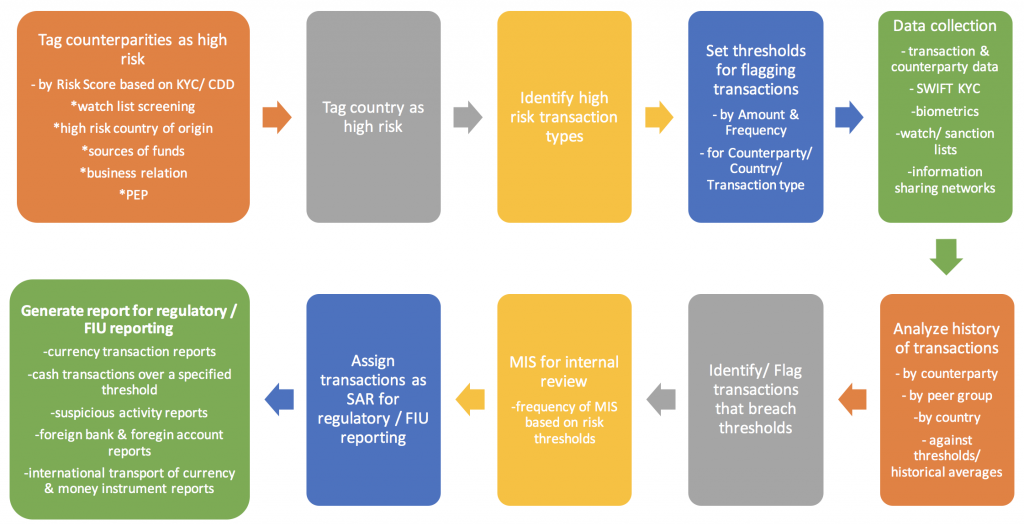

Under the UKs Money Laundering Regulations regulation 331b enhanced due diligence EDD is mandated for any business relationship with a person established in a high-risk third countryUntil the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive. There are a number of definitions of TBML including this helpful definition from FATF 2. Risk Based approach to combat money laundering requires the financial institutions and the banks to identify the high risk customers. The process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to. Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk. Which Countries Are High Risk For Money Laundering pada tanggal Agustus 05 2021.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

Financial Institutions conduct enhanced due diligence EDD and ongoing monitoring for the higher risk customers. The Joint Money Laundering Steering Group guidance for example recognises that the provision of banking and investment services to high net worth clients may carry an enhanced money laundering risk. Understanding risk within the Recommendation 12 context is important for two reasons. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks. Application of the risk variables described above plays an important part in this determination.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

Its a process by which soiled money is transformed into clean cash. Cash based businesses. Risk Based approach to combat money laundering requires the financial institutions and the banks to identify the high risk customers. Activities do not pose a higher risk of money laundering. Its a process by which soiled money is transformed into clean cash.

Source: taxguru.in

Source: taxguru.in

Risk Based approach to combat money laundering requires the financial institutions and the banks to identify the high risk customers. Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons PEPsMore items. Financial Institutions conduct enhanced due diligence EDD and ongoing monitoring for the higher risk customers. Which Countries Are High Risk For Money Laundering pada tanggal Agustus 05 2021. The sources of the cash in precise are legal and the money is invested in a method that makes it appear to be clear cash and hide the identity of the legal part of the cash earned.

It points out that complex products and services that operate internationally and within a wealth management environment may also be attractive to money launderers. Financial Institutions conduct enhanced due diligence EDD and ongoing monitoring for the higher risk customers. There is no universal consensus as to which customers pose a higher risk but the below listed characteristics of customers have been identified with potentially higher money laundering risks. Banks management of high money laundering risk situations How banks deal with high-risk customers including PEPs correspondent banking relationships and wire transfers Page 3 1. The Joint Money Laundering Steering Group guidance for example recognises that the provision of banking and investment services to high net worth clients may carry an enhanced money laundering risk.

Source: bi.go.id

Source: bi.go.id

Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons PEPsMore items. Customers The following may suggest a high risk of money laundering or terrorist financing. Inherently high risk for money laundering. There is no universal consensus as to which customers pose a higher risk but the below listed characteristics of customers have been identified with potentially higher money laundering risks. Under the UKs Money Laundering Regulations regulation 331b enhanced due diligence EDD is mandated for any business relationship with a person established in a high-risk third countryUntil the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive.

Source: complyadvantage.com

Source: complyadvantage.com

Undue client secrecy eg reluctance to provide requested information and unnecessarily complex ownership structures including nominee shareholders or bearer shares. Indiaforensic offers a video learning program on the subject of Risk Based approach to KYC. Undue client secrecy eg reluctance to provide requested information and unnecessarily complex ownership structures including nominee shareholders or bearer shares. Understanding risk within the Recommendation 12 context is important for two reasons. Classification of High Risk CustomersCustomers linked to higher-risk countriesCustomers from High Risk Business sectorsCustomers who have unnecessarily complex or opaque beneficial ownership structuresUnusual account activityLack an obvious economic or lawful purposePolitically Exposed Persons PEPsMore items.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

Application of the risk variables described above plays an important part in this determination. Financial Institutions conduct enhanced due diligence EDD and ongoing monitoring for the higher risk customers. High value products or services offer those seeking to undertake money laundering and the financing of terrorism the opportunity to move illicit funds in large amounts with. Banks management of high money laundering risk situations How banks deal with high-risk customers including PEPs correspondent banking relationships and wire transfers Page 3 1. This report describes how banks operating in the UK are managing money-laundering risk in higher risk situations.

Source: slideplayer.com

Source: slideplayer.com

Understanding risk within the Recommendation 12 context is important for two reasons. What are considered higher risk customer types for money laundering. It points out that complex products and services that operate internationally and within a wealth management environment may also be attractive to money launderers. Banks management of high money laundering risk situations How banks deal with high-risk customers including PEPs correspondent banking relationships and wire transfers Page 3 1. Understanding risk within the Recommendation 12 context is important for two reasons.

Source: slideplayer.com

Source: slideplayer.com

This report describes how banks operating in the UK are managing money-laundering risk in higher risk situations. This report describes how banks operating in the UK are managing money-laundering risk in higher risk situations. This course helps the bankers to get insights of the high risk. Cash based businesses. Banks management of high money laundering risk situations How banks deal with high-risk customers including PEPs correspondent banking relationships and wire transfers Page 3 1.

Source: bi.go.id

Source: bi.go.id

Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk. Trade-based money laundering TBML is a serious financial crime threat and money launderers will use different methods to misuse trade to move value around the world. What are considered higher risk customer types for money laundering. This course helps the bankers to get insights of the high risk. The sources of the cash in precise are legal and the money is invested in a method that makes it appear to be clear cash and hide the identity of the legal part of the cash earned.

Source: slideplayer.com

Source: slideplayer.com

Activities do not pose a higher risk of money laundering. Risk Based approach to combat money laundering requires the financial institutions and the banks to identify the high risk customers. Indiaforensic offers a video learning program on the subject of Risk Based approach to KYC. Banks management of high money laundering risk situations How banks deal with high-risk customers including PEPs correspondent banking relationships and wire transfers Page 3 1. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

This course helps the bankers to get insights of the high risk. Which Countries Are High Risk For Money Laundering pada tanggal Agustus 05 2021. Financial Institutions conduct enhanced due diligence EDD and ongoing monitoring for the higher risk customers. High value products or services offer those seeking to undertake money laundering and the financing of terrorism the opportunity to move illicit funds in large amounts with. Cash based businesses.

Source: acamstoday.org

Source: acamstoday.org

High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks. Financial Institutions conduct enhanced due diligence EDD and ongoing monitoring for the higher risk customers. High value products or services offer those seeking to undertake money laundering and the financing of terrorism the opportunity to move illicit funds in large amounts with. Indiaforensic offers a video learning program on the subject of Risk Based approach to KYC. The sources of the cash in precise are legal and the money is invested in a method that makes it appear to be clear cash and hide the identity of the legal part of the cash earned.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title high risk money laundering products by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas