13+ Hmrc money laundering certificate ideas

Home » about money loundering Info » 13+ Hmrc money laundering certificate ideasYour Hmrc money laundering certificate images are available in this site. Hmrc money laundering certificate are a topic that is being searched for and liked by netizens now. You can Find and Download the Hmrc money laundering certificate files here. Download all royalty-free photos and vectors.

If you’re looking for hmrc money laundering certificate pictures information related to the hmrc money laundering certificate topic, you have come to the right site. Our website frequently provides you with hints for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Hmrc Money Laundering Certificate. Customer due diligence 5. Money laundering means exchanging money or assets that were obtained criminally for money. Once you have successfully completed this course you will gain 30 Entry Level credits towards STEP membership and be awarded the STEP Certificate in Anti-money Laundering. Hmrc money laundering regulations Your choice regarding cookies on this site To improve your experience we and third parties we work with use cookies to provide secure access to the site analyze traffic on our site access the impact of campaigns and deliver content and advertisements tailored to your interests.

Customer due diligence 5. The sources of the money in precise are criminal and the money is invested in a manner that makes it appear to be clean cash. Registering as a tax agent is not the same thing. Its a criminal offence to trade as an estate agency or letting agency business without being registered or after your registration is cancelled with HMRC for money laundering supervision. Agents or franchisees premises lso need to be registered where you control or have an overview of their transactions and are responsible for the way their business is run. HMRC Money Laundering Certificate.

Use the service to apply to register for money laundering supervision renew a registration or to manage your account.

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017692 replaced the Money Laundering Regulations 2007. Reporting suspicious activity 7. HMRC have introduced a register for Accounting Services Providers ASPs whose business is not supervised by a designated professional body. Hmrc money laundering regulations Your choice regarding cookies on this site To improve your experience we and third parties we work with use cookies to provide secure access to the site analyze traffic on our site access the impact of campaigns and deliver content and advertisements tailored to your interests. Money Transmitters - additional obligations 6. The sources of the money in precise are criminal and the money is invested in a manner that makes it appear to be clean cash.

Source: train4academy.co.uk

Source: train4academy.co.uk

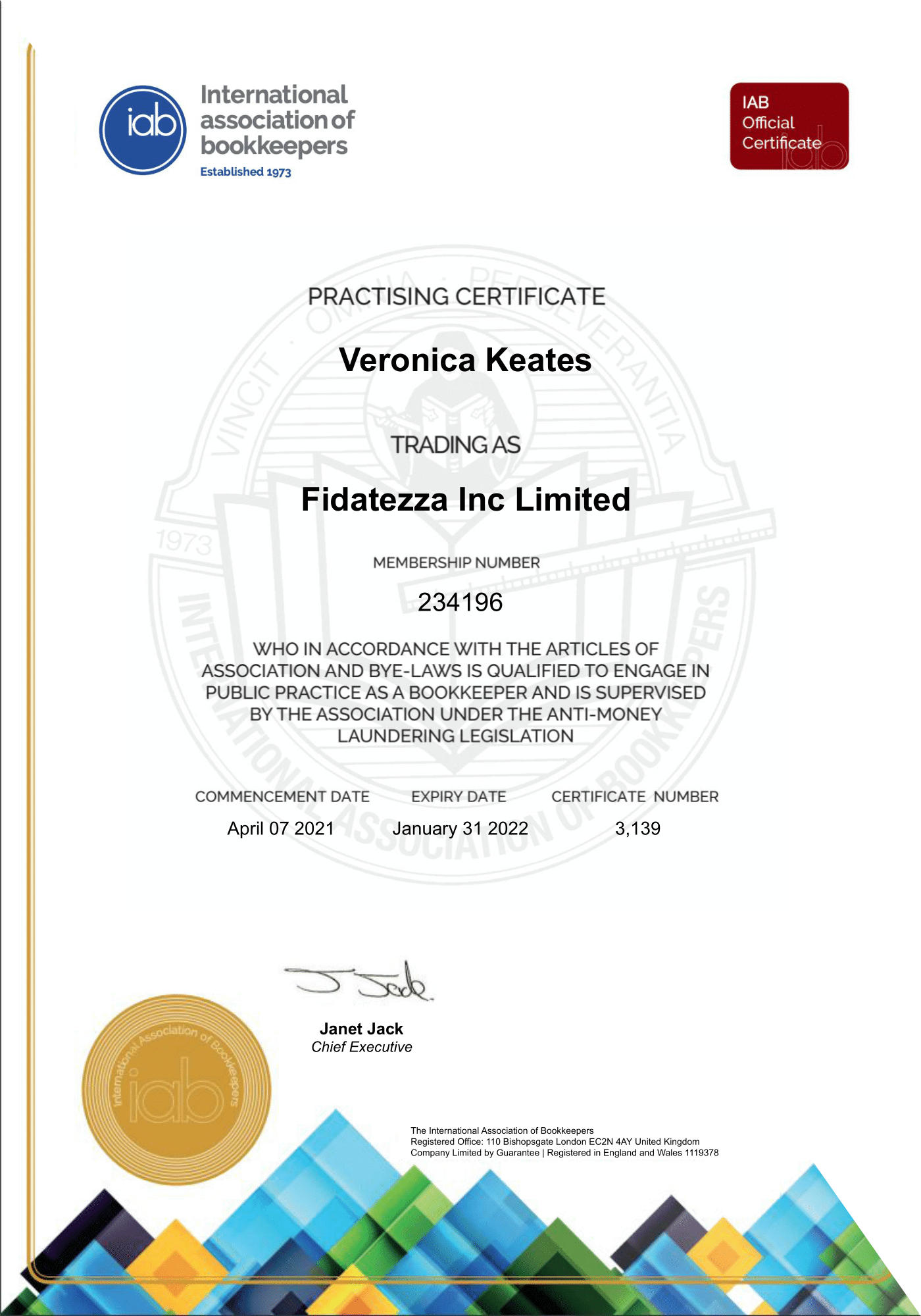

Money laundering regulations The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations. Writing Certified to be a true copy of the original seen by me on the document. I HVDs should be registered with HMRC and should have a Certificate of Registration for Money Laundering Regulations. Youll need to download the CSV. You can use the Supervised Business Register CSV 505MB to verify that a business is registered with HMRC for supervision under the Money Laundering Regulations.

Source: fidatezza.com

Source: fidatezza.com

The examination questions are drawn from across the syllabus and candidates must achieve 50 in order to pass the Certificate. But besides these responsibilities another important responsibility is to work with the FCA to investigate money laundering crimes. Youll need to download the CSV. Again I understand that from the practice and membership number HMRC can check if truly registered with the relevant professional body. You must register with HMRC for Money Laundering.

Again I understand that from the practice and membership number HMRC can check if truly registered with the relevant professional body. I HVDs should be registered with HMRC and should have a Certificate of Registration for Money Laundering Regulations. Risk assessment policies controls and procedures 4. How to certify a document Take the photocopied document and the original and ask the person to certify the copy by. Register or review your money-laundering supervision with HMRC opens in a new window.

Source: fidatezza.com

Source: fidatezza.com

A high value dealer under Money Laundering Regulations is any business or. Writing Certified to be a true copy of the original seen by me on the document. Risk assessment policies controls and procedures 4. Money Transmitters - additional obligations 6. Its a criminal offence to trade as an estate agency or letting agency business without being registered or after your registration is cancelled with HMRC for money laundering supervision.

Source: fidatezza.com

Source: fidatezza.com

How to certify a document Take the photocopied document and the original and ask the person to certify the copy by. Money laundering registration hmrc. I HVDs should be registered with HMRC and should have a Certificate of Registration for Money Laundering Regulations. Use the service to apply to register for money laundering supervision renew a registration or to manage your account. If you are unsure as to whether you are a HVD please see question below.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

Again I understand that from the practice and membership number HMRC can check if truly registered with the relevant professional body. Money Service Businesses 1. Reporting suspicious activity 7. For further assistance for HVDs please click the linked question. Writing Certified to be a true copy of the original seen by me on the document.

Use the service to apply to register for money laundering supervision renew a registration or to manage your account. Use the service to apply to register for money laundering supervision renew a registration or to manage your account. For further assistance for HVDs please click the linked question. Youll need to download the CSV. I HVDs should be registered with HMRC and should have a Certificate of Registration for Money Laundering Regulations.

Source: pinterest.com

Source: pinterest.com

But besides these responsibilities another important responsibility is to work with the FCA to investigate money laundering crimes. You can use the Supervised Business Register CSV 505MB to verify that a business is registered with HMRC for supervision under the Money Laundering Regulations. HMRC need to be informed of the premises used by the business when registering for money laundering. But besides these responsibilities another important responsibility is to work with the FCA to investigate money laundering crimes. Hmrc money laundering regulations Your choice regarding cookies on this site To improve your experience we and third parties we work with use cookies to provide secure access to the site analyze traffic on our site access the impact of campaigns and deliver content and advertisements tailored to your interests.

Source: reed.co.uk

Source: reed.co.uk

Once you have successfully completed this course you will gain 30 Entry Level credits towards STEP membership and be awarded the STEP Certificate in Anti-money Laundering. For further assistance for HVDs please click the linked question. Its a criminal offence to trade as an estate agency or letting agency business without being registered or after your registration is cancelled with HMRC for money laundering supervision. HM Revenue Customs Money Laundering Regulations Her Majestys Revenue and Customs HMRC in the UK collect taxes in general and helps families and individuals with targeted financial support. Money laundering and money service businesses 2.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

My understanding is that if registered with a professional body which HMRC accepts for AML supervision that suffices. Money Service Businesses 1. This includes offices shops call centres and other significant addresses. HMRC have introduced a register for Accounting Services Providers ASPs whose business is not supervised by a designated professional body. Use the service to apply to register for money laundering supervision renew a registration or to manage your account.

Source: theferret.scot

Source: theferret.scot

A high value dealer under Money Laundering Regulations is any business or. This guide will help you to decide if you need to register with HMRC under the regulations. Hmrc money laundering regulations Your choice regarding cookies on this site To improve your experience we and third parties we work with use cookies to provide secure access to the site analyze traffic on our site access the impact of campaigns and deliver content and advertisements tailored to your interests. Once you have successfully completed this course you will gain 30 Entry Level credits towards STEP membership and be awarded the STEP Certificate in Anti-money Laundering. Money Transmitters - additional obligations 6.

Source:

Money laundering means exchanging money or assets that were obtained criminally for money. Writing Certified to be a true copy of the original seen by me on the document. Its a criminal offence to trade as an estate agency or letting agency business without being registered or after your registration is cancelled with HMRC for money laundering supervision. Responsibilities of senior managers 3. I HVDs should be registered with HMRC and should have a Certificate of Registration for Money Laundering Regulations.

Source: smallfirmsservices.com

Source: smallfirmsservices.com

Registering as a tax agent is not the same thing. August 08 2021 The idea of cash laundering is essential to be understood for these working in the financial sector. You may have to register with HMRC if your business operates as a high value dealer. The sources of the money in precise are criminal and the money is invested in a manner that makes it appear to be clean cash. Agents or franchisees premises lso need to be registered where you control or have an overview of their transactions and are responsible for the way their business is run.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hmrc money laundering certificate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas