13+ Hmrc money laundering risk assessment information

Home » about money loundering Info » 13+ Hmrc money laundering risk assessment informationYour Hmrc money laundering risk assessment images are available. Hmrc money laundering risk assessment are a topic that is being searched for and liked by netizens now. You can Find and Download the Hmrc money laundering risk assessment files here. Get all royalty-free images.

If you’re searching for hmrc money laundering risk assessment pictures information related to the hmrc money laundering risk assessment topic, you have come to the ideal site. Our website frequently provides you with hints for seeing the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

Hmrc Money Laundering Risk Assessment. And failure to keep adequate records. National risk assessment of money laundering and terrorist financing 2020. The types of customer you have. Money laundering supervision.

How To Write Your Aml Risk Assessment For Estate Agents Youtube From youtube.com

How To Write Your Aml Risk Assessment For Estate Agents Youtube From youtube.com

The types of customer you have. And failure to keep adequate records. Basically the risk assessment document is a some sort of form no special format that is a list of things to look out for and ranking them all together to give you an idea if the client is low to high risk for potential money laundering activity. Assessing AML risks is a mandatory requirement for those with obligations under the MLR17. When you assess the risks of money laundering that apply to your business you need to consider. The Money Laundering Risk Assessment Template is included with our AML Policy Template MLRO form.

As the supervisor for AMPs HMRC is obliged to share up-to-date information on money laundering with AMPs including information from its own risk assessment where appropriate any indicators of money laundering and details of circumstances which HMRC considers to be at high risk of money laundering.

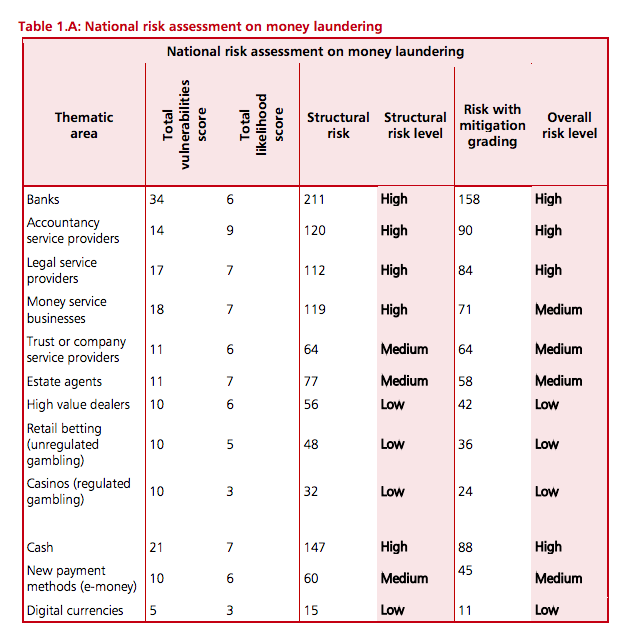

When you assess the risks of money laundering that apply to your business you need to consider. Hope the link works. The 2020 national risk assessment NRA is the third comprehensive assessment of money laundering and terrorist financing. Put in place policies controls and procedures to reduce any risks of money laundering as identified. How to carry out a risk assessment. Under Regulation 17 of the Money Laundering Regulations supervisors are required to undertake a risk assessment covering the international and domestic risks of money laundering.

Source: service.betterregulation.com

Source: service.betterregulation.com

Money laundering supervision. Assessing AML risks is a mandatory requirement for those with obligations under the MLR17. Under Regulation 17 of the Money Laundering Regulations supervisors are required to undertake a risk assessment covering the international and domestic risks of money laundering. IMAS Guidance to Assessing Money Laundering and Financing of Terrorism MLFT. You are best placed to.

Source:

The 2020 national risk assessment NRA is the third comprehensive assessment of money laundering and terrorist financing. Have you looked at the HMRC website. National risk assessment of money laundering and terrorist financing 2020. Failing to undertake adequate customer due diligence. Carry out a detailed risk assessment of.

Source: researchgate.net

Source: researchgate.net

Have you looked at the HMRC website. The types of customer you have. How to carry out a risk assessment. The supervisory authorities advise that once a firm has completed their money laundering risk assessment they will then need to. It is also compulsory for supervisory authorities to assess the risks associated with money laundering and terrorist financing.

Source: taxcalc.com

Source: taxcalc.com

Under Regulation 17 of the Money Laundering Regulations supervisors are required to undertake a risk assessment covering the international and domestic risks of money laundering. It is also compulsory for supervisory authorities to assess the risks associated with money laundering and terrorist financing. AML Risk Assessment Template AML Policy Template. The types of customer you have. The Money Laundering Risk Assessment Template is included with our AML Policy Template MLRO form.

Source: twitter.com

Source: twitter.com

Hope the link works. HMRC issued Touma a penalty of 7832155 for breaches under the Money Laundering Regulations for failing to carry out risk assessments. It is also compulsory for supervisory authorities to assess the risks associated with money laundering and terrorist financing. Not having the correct policies controls and procedures. The types of customer you have.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

Businesses need to do about identifying and assessing risk. Hope the link works. The 2020 national risk assessment NRA is the third comprehensive assessment of money laundering and terrorist financing. Under Regulation 17 of the Money Laundering Regulations supervisors are required to undertake a risk assessment covering the international and domestic risks of money laundering. The Money Laundering Risk Assessment Template is included with our AML Policy Template MLRO form.

Source: getpropertycompliant.co.uk

Source: getpropertycompliant.co.uk

Failing to adequately train staff. Businesses are also required to report suspicious transactions to the National Crime Agency NCA meet their obligations. Carry out a detailed risk assessment of. The types of customer you have. Assessing AML risks is a mandatory requirement for those with obligations under the MLR17.

Source: legislation.gov.uk

Source: legislation.gov.uk

Businesses need to do about identifying and assessing risk. The Money Laundering Regulations say about risk assessment. Make assessing risk an ongoing process at your firm. Assessing AML risks is a mandatory requirement for those with obligations under the MLR17. Businesses are also required to report suspicious transactions to the National Crime Agency NCA meet their obligations.

Source: vinciworks.com

Source: vinciworks.com

But the risk of money laundering doesnt just go away after onboarding. Not having the correct policies controls and procedures. HMRC issued Touma a penalty of 7832155 for breaches under the Money Laundering Regulations for failing to carry out risk assessments. And failure to keep adequate records. See how your anti-money laundering risk assessment policies controls and procedures work have access to all the records and paperwork relating to your procedures speak to the right people.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

Make assessing risk an ongoing process at your firm. When you assess the risks of money laundering that apply to your business you need to consider. But the risk of money laundering doesnt just go away after onboarding. Under Regulation 17 of the Money Laundering Regulations supervisors are required to undertake a risk assessment covering the international and domestic risks of money laundering. Assessing AML risks is a mandatory requirement for those with obligations under the MLR17.

Source: fcscompliance.co.uk

Source: fcscompliance.co.uk

Carry out a detailed risk assessment of. The Money Laundering Risk Assessment Template is included with our AML Policy Template MLRO form. Any accountant worth their salt and licence will complete anti-money laundering ID checks credit screens and a risk assessment for all new clients. Businesses need to do about identifying and assessing risk. Make assessing risk an ongoing process at your firm.

Source: youtube.com

Source: youtube.com

Under Regulation 17 of the Money Laundering Regulations supervisors are required to undertake a risk assessment covering the international and domestic risks of money laundering. AML Risk Assessment Template AML Policy Template. National risk assessment of money laundering and terrorist financing 2020. The Money Laundering Risk Assessment Template is included with our AML Policy Template MLRO form. Money laundering supervision.

Source: praxisifm.com

Source: praxisifm.com

It is also compulsory for supervisory authorities to assess the risks associated with money laundering and terrorist financing. National risk assessment of money laundering and terrorist financing 2020. Failing to adequately train staff. Hope the link works. It also covers many of the supervisory authority requirements for the FCA and HMRC.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hmrc money laundering risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas