18++ How does kyc process work ideas

Home » about money loundering idea » 18++ How does kyc process work ideasYour How does kyc process work images are ready. How does kyc process work are a topic that is being searched for and liked by netizens now. You can Download the How does kyc process work files here. Download all royalty-free photos.

If you’re looking for how does kyc process work images information connected with to the how does kyc process work keyword, you have visit the right blog. Our website frequently gives you hints for seeking the highest quality video and picture content, please kindly search and locate more informative video articles and images that match your interests.

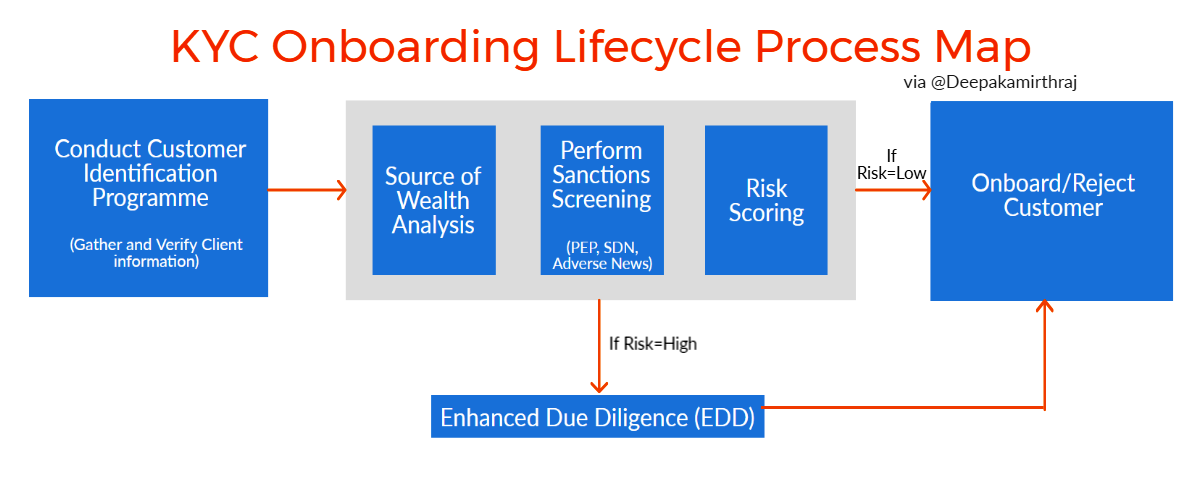

How Does Kyc Process Work. The full form of KYC is Know Your Customer It is a verification process officially mandated by the Reserve Bank of India that allows an institution to confirm and thereby verify the. They also come into play later when the customer accesses that account. This process helps to ensure that banks services are not misused. There is scrutinization of.

Blockchain Kyc An Overview With Case Studies Blockchain Consultus From blockchainconsultus.io

Blockchain Kyc An Overview With Case Studies Blockchain Consultus From blockchainconsultus.io

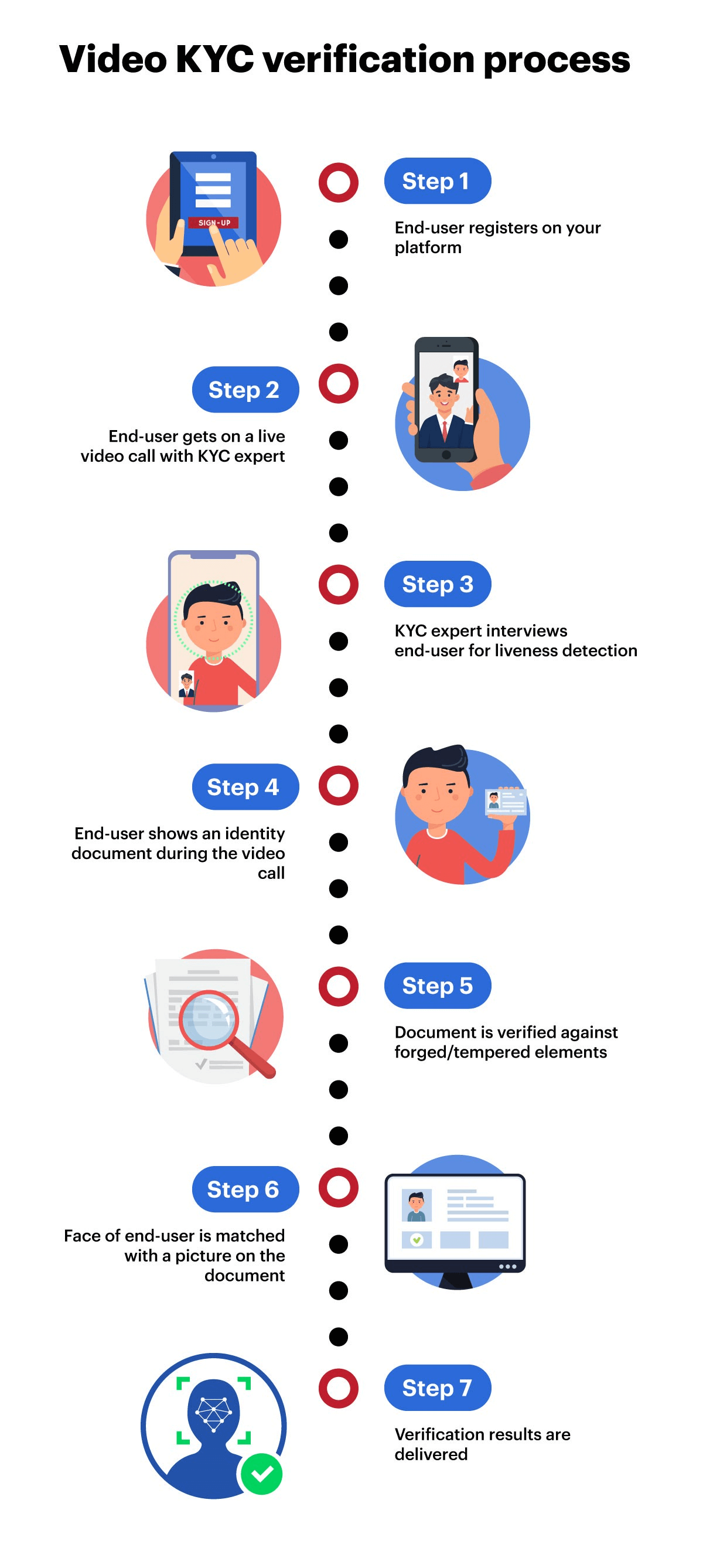

See Solutions See Solutions. The customer then applies to the bank or service provider for said services online or offline. Internet allowing you to submit from wherever you like and Aadhaar card consisting of all your necessary details. The paperless KYC process will be made possible using two important tools. This process helps to ensure that banks services are not misused. KYC means Know Your Customer.

KYC procedures defined by banks involve all the necessary actions to ensure their customers are real assess and monitor risks.

Blockpass reflects the core beliefs of IBL. A KYC process usually consists of verifying the customers identity investment suitability and due diligence on various documentation such as proof of address and income. There have already been couple of innovations in this regard e-KYC was launched last year and more recently in April 2016 ICICI Prudential Asset Management Co Ltd offers paperless biometric KYC experience. KYC AML BSA Process Initiating the AML KYC process involves a notification normally automated being sent to the AML or related KYC group alerting it to commence the AML review process per KYC requirements. KYC is the process of identification and verification of the identity of a client in which a series of controls are applied to avoid having commercial relations with people related to terrorism corruption or money laundering among others. They also come into play later when the customer accesses that account.

Source: rndpoint.com

Source: rndpoint.com

How KYC process works. First a customer requires a service such as a Sim card or to open a new bank account. KYC is the process of identification and verification of the identity of a client in which a series of controls are applied to avoid having commercial relations with people related to terrorism corruption or money laundering among others. They also come into play later when the customer accesses that account. There are several important components to achieving KYC compliance.

Source: basisid.com

Source: basisid.com

It verifies the information. EKYC Electronic Know Your Customer is the remote paperless process that minimizes the costs and traditional bureaucracy necessary in KYC processes. See how our products can help you build trust online to protect your business and customers. Falsification of identity signatures and phishing is very common. How does Know Your Customer process work.

Source: penneo.com

Source: penneo.com

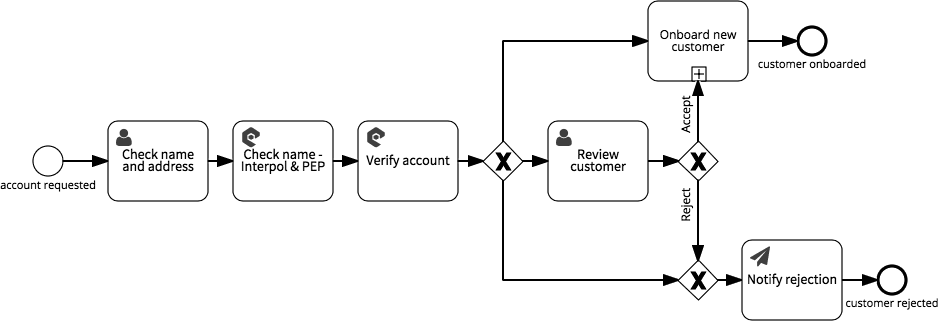

How does Know Your Customer process work. Falsification of identity signatures and phishing is very common. KYC procedures defined by banks involve all the necessary actions to ensure their customers are real assess and monitor risks. There is scrutinization of. KYC AML BSA Process Initiating the AML KYC process involves a notification normally automated being sent to the AML or related KYC group alerting it to commence the AML review process per KYC requirements.

Source: researchgate.net

Source: researchgate.net

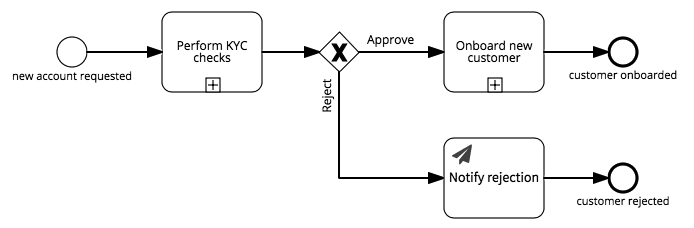

KYC Process Compliance Requirements KYC compliance begins when an account is created either in person or online or a customer starts doing business with an organization. Internet allowing you to submit from wherever you like and Aadhaar card consisting of all your necessary details. Blockpass reflects the core beliefs of IBL. There are several important components to achieving KYC compliance. This is part of what is known as the customer onboarding process.

Source: papersoft-dms.com

Source: papersoft-dms.com

In Know Your CustomerKYC the process involves the identification and verification of an individual on the basis of his identity and address. How KYC process works. It verifies the information. The full form of KYC is Know Your Customer It is a verification process officially mandated by the Reserve Bank of India that allows an institution to confirm and thereby verify the. There are several important components to achieving KYC compliance.

Source: processmaker.com

Source: processmaker.com

Internet allowing you to submit from wherever you like and Aadhaar card consisting of all your necessary details. The RD company believes the technology is best used when applied to already existing industries and processes. They also come into play later when the customer accesses that account. KYC procedures defined by banks involve all the necessary actions to ensure their customers are real assess and monitor risks. Customer Identification Program CIP Phase.

Source: papersoft-dms.com

Source: papersoft-dms.com

KYC is the process of identification and verification of the identity of a client in which a series of controls are applied to avoid having commercial relations with people related to terrorism corruption or money laundering among others. The customer then applies to the bank or service provider for said services online or offline. This process helps to ensure that banks services are not misused. The following describes the eKYC process for a customer that wants to subscribe to a good or service from an eKYC authorized body. EKYC Electronic Know Your Customer is the remote paperless process that minimizes the costs and traditional bureaucracy necessary in KYC processes.

Source: quora.com

The information is submitted to the specified KYC Registration Agencies KRAs KRA submits the data in the central database. Blockchains ability to make the process cheaper easier faster and safer only enhances the value of KYC. How does Know Your Customer process work. Know Your Customer KYC is the process of identifying an individual or corporation before entering into a business relationship. KYC means Know Your Customer.

Source: medium.com

Source: medium.com

There have already been couple of innovations in this regard e-KYC was launched last year and more recently in April 2016 ICICI Prudential Asset Management Co Ltd offers paperless biometric KYC experience. KYC procedures defined by banks involve all the necessary actions to ensure their customers are real assess and monitor risks. KYC Process Compliance Requirements KYC compliance begins when an account is created either in person or online or a customer starts doing business with an organization. What is ekyc aadhar based how it works complete step by step process requirements in verification process eKYC is called electronic know your customer. There are several important components to achieving KYC compliance.

Source: signavio.com

Source: signavio.com

Internet allowing you to submit from wherever you like and Aadhaar card consisting of all your necessary details. This is part of what is known as the customer onboarding process. A KYC process usually consists of verifying the customers identity investment suitability and due diligence on various documentation such as proof of address and income. What is ekyc aadhar based how it works complete step by step process requirements in verification process eKYC is called electronic know your customer. KYC means Know Your Customer.

Source: blockchainconsultus.io

Source: blockchainconsultus.io

A quick video to show you how the KYC process works for the verifyas tokensale starting Nov 28 whitelist and Nov 29 public. Since the passing of the Patriot Act KYC processes. Falsification of identity signatures and phishing is very common. How does Know Your Customer process work. This process helps to ensure that banks services are not misused.

Source: shuftipro.com

Source: shuftipro.com

The bank or any other financial institution collects the above-mentioned information from the applicant. The information is submitted to the specified KYC Registration Agencies KRAs KRA submits the data in the central database. It is a process by which banks obtain information about the identity and address of the customers. Blockpass reflects the core beliefs of IBL. KYC means Know Your Customer.

Source: signavio.com

Source: signavio.com

These client-onboarding processes help prevent and identify money laundering terrorism financing and other illegal corruption schemes. The bank or any other financial institution collects the above-mentioned information from the applicant. Blockpass reflects the core beliefs of IBL. KYC AML BSA Process Initiating the AML KYC process involves a notification normally automated being sent to the AML or related KYC group alerting it to commence the AML review process per KYC requirements. These client-onboarding processes help prevent and identify money laundering terrorism financing and other illegal corruption schemes.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how does kyc process work by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information