20+ How money laundering affects the economy information

Home » about money loundering idea » 20+ How money laundering affects the economy informationYour How money laundering affects the economy images are available. How money laundering affects the economy are a topic that is being searched for and liked by netizens today. You can Get the How money laundering affects the economy files here. Find and Download all royalty-free images.

If you’re looking for how money laundering affects the economy pictures information related to the how money laundering affects the economy topic, you have pay a visit to the ideal blog. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

How Money Laundering Affects The Economy. Money launderers put money into unproductive assets to avoid detection ðAffects the integrity of the financial system. Moreover government loss revenue as tax collection becomes more complicated and confusing. People launder money by putting away their gains into multiple bank accounts with a series of complex transactions. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of the economy.

Pdf Journal Of Money Laundering Control Shadow Economy And Tax Evasion In The Eu Article Information For Authors From researchgate.net

Pdf Journal Of Money Laundering Control Shadow Economy And Tax Evasion In The Eu Article Information For Authors From researchgate.net

Due to the high integration of capital markets money laundering can also adversely affect currencies and interest rates. Individuals may turn enterprises which were initially productive into sterile ones just to launder money. What Are The Negative Effects of Money Laundering on The Economy. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of the economy. Money launderers put money into unproductive assets to avoid detection ðAffects the integrity of the financial system. What Are The Negative Effects of Money Laundering on The Economy.

Money laundering and terrorism financing are financial crimes with economic effects and act as a threat to economic and financial stability.

Money laundering has catastrophic effects on economies. Money laundering causes a diversion of resources to less productive areas of the economy which in turn depresses economic growth. Money laundering has a negative effect on the economy such as loss of control on the economical policy economic distortion and instability. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of the economy. What Are The Negative Effects of Money Laundering on The Economy. Therefore the research will help to.

Source:

Due to the high integration of capital markets money laundering can also adversely affect currencies and interest rates. Can increase the risk of macroeconomic instability. The Table 7shows the chi-square and P-value of the cases in which the P-value is greater than 005. Money laundering causes a diversion of resources to less productive areas of the economy which in turn depresses economic growth. Individuals may turn enterprises which were initially productive into sterile ones just to launder money.

Source: sciencedirect.com

Source: sciencedirect.com

Money launderings effects on the economy 1 Challenges in implementing economic policies For starters money laundering can cause massive fluctuations in the financial sector. ðReduces Revenue and Control. Money laundering and terrorism financing are financial crimes with economic effects and act as a threat to economic and financial stability. Under the affects of money laundering on business in results there is no association which means that the salary persons respondents and businessmen respondents both are unsatisfied or at neutral at the edge of money laundering affects on business. 12 The Real Sector.

Source: researchgate.net

Source: researchgate.net

Unchecked money laundering can erode the integrity of a nations financial institutions. The negative effects of money laundering on economic development are difficult to measure but it is obvious that such activity seriously damages the financial sector economy by diverting. 12 The Real Sector. The unpredictable nature of money laundering coupled with the attendant loss of policy control may make sound economic policy difficult to. Money laundering distorts the investments and depresses the productivity.

Source: ft.lk

Source: ft.lk

As a large amount of money is transferred to a bank this can artificially inflate the demand in whichever industry or economic sector the money launderers are eyeing. The possible social and political costs of money laundering if left unchecked or dealt with ineffectively are serious. People launder money by putting away their gains into multiple bank accounts with a series of complex transactions. The majority of global research focuses on two major money-laundering sectors. 13 The Real Sector.

Source: bi.go.id

Source: bi.go.id

The possible social and political costs of money laundering if left unchecked or dealt with ineffectively are serious. Money laundering causes a diversion of resources to less productive areas of the economy which in turn depresses economic growth. Money laundering and terrorism financing are financial crimes with economic effects and act as a threat to economic and financial stability. The majority of global research focuses on two major money-laundering sectors. Money laundering has a negative effect on the economy such as loss of control on the economical policy economic distortion and instability.

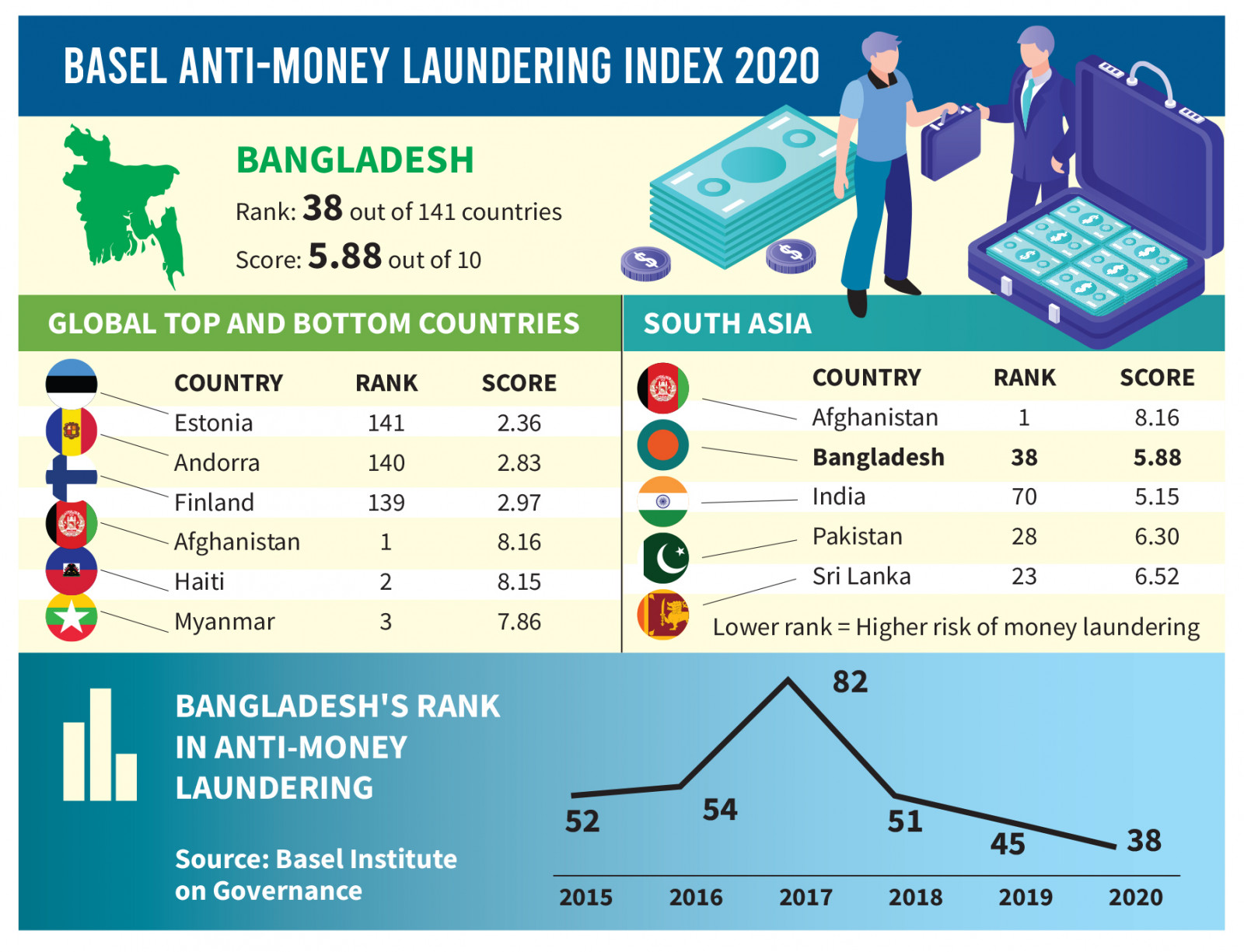

Source: tbsnews.net

Source: tbsnews.net

Must be an environment conductive to fair open reporting to prevent money laundering. Can increase the risk of macroeconomic instability. The possible social and political costs of money laundering if left unchecked or dealt with ineffectively are serious. Money laundering is one of the major issues in the world economy market. Money laundering and terrorism financing are financial crimes with economic effects and act as a threat to economic and financial stability.

Source: jagranjosh.com

Source: jagranjosh.com

We have to prevent money laundering to have a safer nation thats why I have chosen this topic. Facilitates corruption and crime at the expense of development. What Are The Negative Effects of Money Laundering on The Economy. The possible social and political costs of money laundering if left unchecked or dealt with ineffectively are serious. Financial system advancing criminal purposes undermines the function and integrity of the financial system.

Source: openknowledge.worldbank.org

Source: openknowledge.worldbank.org

It is basically illegal money. Due to the high integration of capital markets money laundering can also adversely affect currencies and interest rates. Money laundering and terrorism financing are financial crimes with economic effects and act as a threat to economic and financial stability. The possible social and political costs of money laundering if left unchecked or dealt with ineffectively are serious. Effects on the Economy Money launderers ultimately make businesses much less productive leading to lower levels of money and tax revenue for the country.

Source: engageinlearning.com

Source: engageinlearning.com

The negative effects of money laundering on economic development are difficult to measure but it is obvious that such activity seriously damages the financial sector economy by diverting. The phenomenon of money laundering amongst other economic and financial crimes have had better success in infiltrating into the economic and political structures of most developing countries therefore resulting to economic digression and political instability. Unchecked money laundering can erode the integrity of a nations financial institutions. Must be an environment conductive to fair open reporting to prevent money laundering. Money laundering has catastrophic effects on economies.

Individuals may turn enterprises which were initially productive into sterile ones just to launder money. The cost burden of anti-money-laundering policies on financial institutions must be assessed in context. Drug trafficking and terrorist. ðReduces Revenue and Control. Distorts investment and depresses productivity.

Source: pideeco.be

Source: pideeco.be

Money laundering and terrorism financing are financial crimes with economic effects and act as a threat to economic and financial stability. Money launderings effects on the economy 1 Challenges in implementing economic policies For starters money laundering can cause massive fluctuations in the financial sector. The cost burden of anti-money-laundering policies on financial institutions must be assessed in context. Due to the high integration of capital markets money laundering can also adversely affect currencies and interest rates. Money laundering distorts the investments and depresses the productivity.

Source: regtechtimes.com

Source: regtechtimes.com

Money laundering provides illegal cash money to the criminals. Effects on Economic Growth. The majority of global research focuses on two major money-laundering sectors. Money laundering distorts the investments and depresses the productivity. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of the economy.

Source: infinitysolutions.com

Source: infinitysolutions.com

As a large amount of money is transferred to a bank this can artificially inflate the demand in whichever industry or economic sector the money launderers are eyeing. Unchecked money laundering can erode the integrity of a nations financial institutions. We have to prevent money laundering to have a safer nation thats why I have chosen this topic. Money laundering provides illegal cash money to the criminals. Drug trafficking and terrorist.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how money laundering affects the economy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information