12+ How often is an employee required to complete aml training info

Home » about money loundering Info » 12+ How often is an employee required to complete aml training infoYour How often is an employee required to complete aml training images are available in this site. How often is an employee required to complete aml training are a topic that is being searched for and liked by netizens today. You can Download the How often is an employee required to complete aml training files here. Download all free vectors.

If you’re looking for how often is an employee required to complete aml training pictures information linked to the how often is an employee required to complete aml training interest, you have pay a visit to the ideal site. Our website frequently provides you with hints for seeing the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

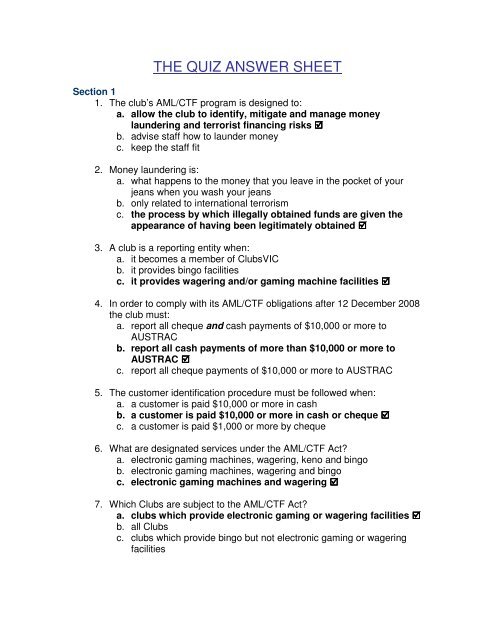

How Often Is An Employee Required To Complete Aml Training. Designated business groups DBG Suspicious transactions identified. However there are some carriers that require AML training to be completed every 12 months such as American General Foresters and Great American. This includes establishing an ongoing training program for anti-money laundering. Reg CC 12 CFR 22919fprovide each employee who performs duties subject to the requirements of this subpart with a statement of the procedures applicable to that employee 4.

The Quiz Answer Sheet From yumpu.com

The Quiz Answer Sheet From yumpu.com

For compliance officers to understand their roles and obligations an AML training program should be carried out regularly. The training program may be used to reinforce the importance that the board of directors and senior management place on the banks compliance with the BSA and that all employees understand their role in maintaining an adequate BSAAML compliance program. As mentioned above most carriers require AML training to be completed every 24 months. For example an employee may only need to complete a 30-minute module as compared to a 2-hour complete training. To secure an employee handbook that is both bespoke and up to date we offer a fixed price solution and work in consultation with you to ensure the policy not just meets legislative requirements but meets the. For other training options refer to section 3 of this document.

For compliance officers to understand their roles and obligations an AML training program should be carried out regularly.

AMLCTF risk awareness training program. But with short 5-10 minute bursts of knowledge employees can use their mobile devices to train while on their daily commute during their breaks or whenever they see fit. Producers Guide to Anti-Money Laundering As an insurance producer you are required to complete periodic anti-money laundering training. For example an employee may only need to complete a 30-minute module as compared to a 2-hour complete training. As mentioned above most carriers require AML training to be completed every 24 months. Anti-Money Laundering AML Training The Industrys Once and Done AML Program This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program.

Source: plianced.com

Source: plianced.com

For compliance officers to understand their roles and obligations an AML training program should be carried out regularly. We recommend that you take the course provided by LIMRA International Inc. Often employees find the courses too long feel bored and begin to rush through everything especially with compliance training. According to this the financial institution should provide ongoing training for appropriate personnel concerning their responsibilities under the program including training in the detection of suspicious transactions. This includes establishing an ongoing training program for anti-money laundering.

Source: vinciworks.com

Source: vinciworks.com

Anti-Money Laundering AML Training The Industrys Once and Done AML Program This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program. Anti-Money Laundering AML Training The Industrys Once and Done AML Program This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program. But with short 5-10 minute bursts of knowledge employees can use their mobile devices to train while on their daily commute during their breaks or whenever they see fit. Enhanced customer due diligence ECDD Transaction monitoring. Online anti-money laundering training WebCE delivers up-to-date anti-money laundering AML training courses to a variety of insurance and financial professionals.

Training programs should include examples of money laundering and suspicious activity monitoring and reporting that are tailored as appropriate. Ultimately training frequency depends on several factors such as an employees roles and responsibilities regulatory expectations relevant rule changes and any new organisational developments. As mentioned above most carriers require AML training to be completed every 24 months. Often employees find the courses too long feel bored and begin to rush through everything especially with compliance training. For compliance officers to understand their roles and obligations an AML training program should be carried out regularly.

Source: pinterest.com

Source: pinterest.com

Designated business groups DBG Suspicious transactions identified. Reduces the time required for training. This includes establishing an ongoing training program for anti-money laundering. AML and Compliance works with businesses to ensure that their employee handbook is kept up to date at the point of implementation and importantly remains up to date as changes are required. Enhanced customer due diligence ECDD Transaction monitoring.

Source: yumpu.com

Source: yumpu.com

Reduces the time required for training. Often employees find the courses too long feel bored and begin to rush through everything especially with compliance training. Enhanced customer due diligence ECDD Transaction monitoring. We recommend that you take the course provided by LIMRA International Inc. However there are some carriers that require AML training to be completed every 12 months such as American General Foresters and Great American.

Source: pinterest.com

Source: pinterest.com

A record of the training employees have completed should be kept as well as regular analysis to ensure training. Producers Guide to Anti-Money Laundering As an insurance producer you are required to complete periodic anti-money laundering training. Reduces the time required for training. For example an employee may only need to complete a 30-minute module as compared to a 2-hour complete training. As a minimum MLROs should ensure that the AML training is conducted once a year for all the staff.

Source: pinterest.com

Source: pinterest.com

A record of the training employees have completed should be kept as well as regular analysis to ensure training. High-risk departments those where staff comes into direct contact with clients compliance and audit teams senior management. Reg CC 12 CFR 22919fprovide each employee who performs duties subject to the requirements of this subpart with a statement of the procedures applicable to that employee 4. Training programs should include examples of money laundering and suspicious activity monitoring and reporting that are tailored as appropriate. This includes establishing an ongoing training program for anti-money laundering.

Source: in.pinterest.com

Source: in.pinterest.com

As mentioned above most carriers require AML training to be completed every 24 months. AMLCTF risk awareness training program. AML and Compliance works with businesses to ensure that their employee handbook is kept up to date at the point of implementation and importantly remains up to date as changes are required. As a minimum MLROs should ensure that the AML training is conducted once a year for all the staff. Reg CC 12 CFR 22919fprovide each employee who performs duties subject to the requirements of this subpart with a statement of the procedures applicable to that employee 4.

Source: medium.com

Source: medium.com

We recommend that you take the course provided by LIMRA International Inc. Reg CC 12 CFR 22919fprovide each employee who performs duties subject to the requirements of this subpart with a statement of the procedures applicable to that employee 4. A record of the training employees have completed should be kept as well as regular analysis to ensure training. The training program may be used to reinforce the importance that the board of directors and senior management place on the banks compliance with the BSA and that all employees understand their role in maintaining an adequate BSAAML compliance program. According to this the financial institution should provide ongoing training for appropriate personnel concerning their responsibilities under the program including training in the detection of suspicious transactions.

Source: legal.thomsonreuters.com

Source: legal.thomsonreuters.com

Producers Guide to Anti-Money Laundering As an insurance producer you are required to complete periodic anti-money laundering training. A record of the training employees have completed should be kept as well as regular analysis to ensure training. Designated business groups DBG Suspicious transactions identified. Enhanced customer due diligence ECDD Transaction monitoring. To secure an employee handbook that is both bespoke and up to date we offer a fixed price solution and work in consultation with you to ensure the policy not just meets legislative requirements but meets the.

Source: firstheartland.com

Source: firstheartland.com

For compliance officers to understand their roles and obligations an AML training program should be carried out regularly. But with short 5-10 minute bursts of knowledge employees can use their mobile devices to train while on their daily commute during their breaks or whenever they see fit. There must be a culture and environment to support training which will provide learners with the appropriate time to complete the training whether it be time away from the office to attend training coursesconferences or uninterrupted time at the employees desk to study or complete training. Customer Information Security found at IIIC2 Pursuant to the Interagency Guidelines for Safeguarding Customer Information training is required. Article written by Souzan Esmaili.

Source: pideeco.be

Source: pideeco.be

Article written by Souzan Esmaili. For example an employee may only need to complete a 30-minute module as compared to a 2-hour complete training. There must be a culture and environment to support training which will provide learners with the appropriate time to complete the training whether it be time away from the office to attend training coursesconferences or uninterrupted time at the employees desk to study or complete training. Designated business groups DBG Suspicious transactions identified. Enhanced customer due diligence ECDD Transaction monitoring.

AML and Compliance works with businesses to ensure that their employee handbook is kept up to date at the point of implementation and importantly remains up to date as changes are required. As mentioned above most carriers require AML training to be completed every 24 months. Article written by Souzan Esmaili. For compliance officers to understand their roles and obligations an AML training program should be carried out regularly. Insurance and financial professionals use AML training courses to familiarize themselves with the process of money laundering the criminal business used to disguise the true origin and ownership of illegal cash and the laws.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how often is an employee required to complete aml training by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas