12++ How often must you complete bank secrecy act training ideas in 2021

Home » about money loundering Info » 12++ How often must you complete bank secrecy act training ideas in 2021Your How often must you complete bank secrecy act training images are available. How often must you complete bank secrecy act training are a topic that is being searched for and liked by netizens now. You can Get the How often must you complete bank secrecy act training files here. Download all royalty-free photos.

If you’re searching for how often must you complete bank secrecy act training pictures information connected with to the how often must you complete bank secrecy act training interest, you have visit the ideal blog. Our website frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that match your interests.

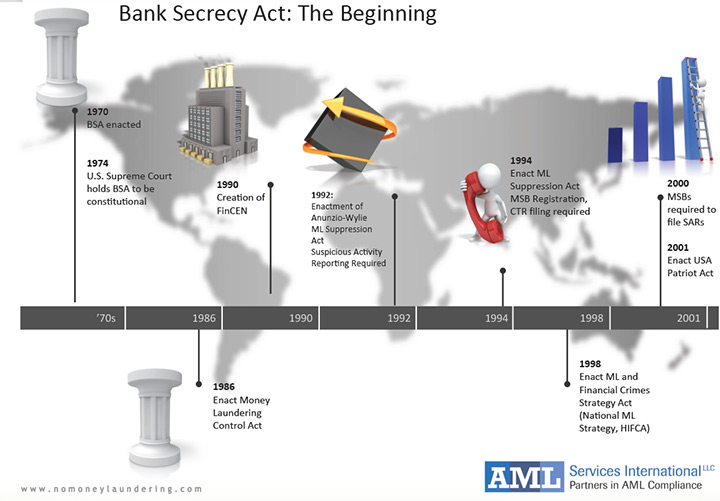

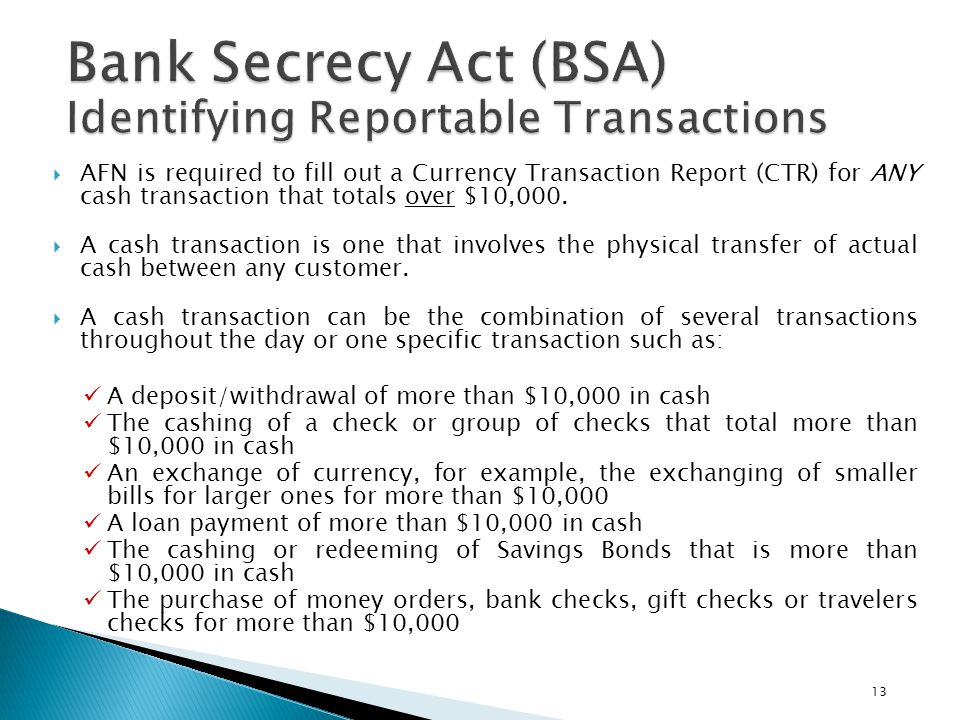

How Often Must You Complete Bank Secrecy Act Training. You do not need to verify the identity of all new members joint owners co-borrowers. As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports. The purpose of the BSA is to require United States US. Multiple transactions made on the same day must be aggregated if they are made by or on behalf of the same person or entity.

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

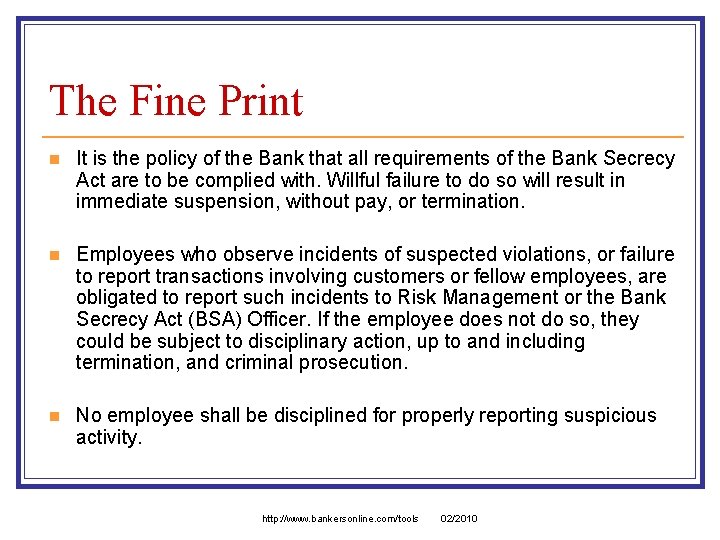

Essentially the Bank Secrecy Act BSA establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Compliance with the Bank Secrecy Act otherwise known as the BSA is a critical task for each and every credit union in the United States so all credit union employees must be familiar with BSA requirements. BSA and OFAC Compliance - Board of Directors Training. Under this act US banks are required to submit documentation for any transaction that is of 10000 or more. The Bank Secrecy Act is a piece of legislation enacted in 1970 which is meant to keep banks from being a place where criminal launder money. Whenever we feel like it.

At least every 12-18 months d.

Establish effective BSA compliance programs. As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports. Credit unions are required to obtain an acceptable form of identification for the person conducting the transaction. BSA and OFAC Compliance - Staff Training. The nature of this work can be quite complex. 5311 et seq is referred to as the Bank Secrecy Act BSA.

Source: slideplayer.com

Source: slideplayer.com

Today government regulations require financial institutions to complete annual bank secrecy training so providing quality education and training to employees on this topic has become a. NCUA Letter to Credit Unions 05-CU-09 and Enclosure The formal regulatory requirement is to provide training for appropriate personnel The FFIEC BSAAML Manual however expands upon this to indicate that training must. For example if the program requires that a particular employee or category of employee should be trained once every six months then the independent testing should determine whether the training occurred and whether the training was adequate. The BSA compliance officer should receive periodic training that is relevant and appropriate given changes to regulatory requirements as well as the activities and overall BSAAML risk profile of the bank. The nature of this work can be quite complex.

Source: acamstoday.org

Source: acamstoday.org

Multiple transactions made on the same day must be aggregated if they are made by or on behalf of the same person or entity. Essentially the Bank Secrecy Act BSA establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Welcome to CUNAs Bank Secrecy Act for Operations Staff Training on Demand course. Once you have obtained the training you need you. Every 12 months b.

Source: slideshare.net

Source: slideshare.net

Compliance with the Bank Secrecy Act otherwise known as the BSA is a critical task for each and every credit union in the United States so all credit union employees must be familiar with BSA requirements. The BSA compliance officer should receive periodic training that is relevant and appropriate given changes to regulatory requirements as well as the activities and overall BSAAML risk profile of the bank. For example if the program requires that a particular employee or category of employee should be trained once every six months then the independent testing should determine whether the training occurred and whether the training was adequate. The Bank Secrecy Act BSA was created in 1970 to assist in criminal tax and regulatory investigations. Take this quiz and look at how much you know about the Bank Secrecy Act.

Source: blog.gao.gov

Source: blog.gao.gov

Today government regulations require financial institutions to complete annual bank secrecy training so providing quality education and training to employees on this topic has become a. Financial institutions - namely banking institutions and securities broker-dealers - from establishing maintaining administering or managing a correspondent account in the United States for or on behalf of foreign shell banks eg foreign banks that do not have a physical presence in any country. Well trained staff are more proficient at spotting suspicious activity as well as completing more timely and accurate BSA report submissions. Bank Secrecy ActAnti Money Laundering 12 CFR. The Bank Secrecy Act BSA was created in 1970 to assist in criminal tax and regulatory investigations.

![]() Source: adiconsulting.com

Source: adiconsulting.com

Welcome to CUNAs Bank Secrecy Act for Operations Staff Training on Demand course. Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information. The nature of this work can be quite complex. Financial institutions - namely banking institutions and securities broker-dealers - from establishing maintaining administering or managing a correspondent account in the United States for or on behalf of foreign shell banks eg foreign banks that do not have a physical presence in any country. NCUA Letter to Credit Unions 05-CU-09 and Enclosure The formal regulatory requirement is to provide training for appropriate personnel The FFIEC BSAAML Manual however expands upon this to indicate that training must.

Source: slideserve.com

Source: slideserve.com

Every 12 months b. Individuals who want to become compliance officers must complete extensive Bank Secrecy Act training. For example if the program requires that a particular employee or category of employee should be trained once every six months then the independent testing should determine whether the training occurred and whether the training was adequate. Multiple transactions made on the same day must be aggregated if they are made by or on behalf of the same person or entity. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC.

Source: proprofs.com

Source: proprofs.com

Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must. Once you have obtained the training you need you. Knowledgeable officers can provide financial service providers with the information they need to better understand the reporting requirements they must satisfy to remain in compliance with the law. BSA and OFAC Compliance - Staff Training. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC.

Source: proprofs.com

Source: proprofs.com

Welcome to CUNAs Bank Secrecy Act for Operations Staff Training on Demand course. The BSA training program for your credit union is a vital component of your Bank Secrecy Act Compliance Program. The nature of this work can be quite complex. BSA and OFAC Compliance - Board of Directors Training. Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information.

Source: slideplayer.com

Source: slideplayer.com

To that end this course provides an overview of the Bank Secrecy Act including specific actions that you. Compliance with the Bank Secrecy Act otherwise known as the BSA is a critical task for each and every credit union in the United States so all credit union employees must be familiar with BSA requirements. Every 12 months b. The training should include information to specific business lines such as such as trust services international and private banking. 5311 et seq is referred to as the Bank Secrecy Act BSA.

Source: acamstoday.org

Source: acamstoday.org

Establish effective BSA compliance programs. To that end this course provides an overview of the Bank Secrecy Act including specific actions that you. Today government regulations require financial institutions to complete annual bank secrecy training so providing quality education and training to employees on this topic has become a. NCUA Letter to Credit Unions 05-CU-09 and Enclosure The formal regulatory requirement is to provide training for appropriate personnel The FFIEC BSAAML Manual however expands upon this to indicate that training must. The Bank Secrecy Act prohibits certain U.

Source: slidetodoc.com

Source: slidetodoc.com

To that end this course provides an overview of the Bank Secrecy Act including specific actions that you. Today government regulations require financial institutions to complete annual bank secrecy training so providing quality education and training to employees on this topic has become a. NCUA Letter to Credit Unions 05-CU-09 and Enclosure The formal regulatory requirement is to provide training for appropriate personnel The FFIEC BSAAML Manual however expands upon this to indicate that training must. Multiple transactions made on the same day must be aggregated if they are made by or on behalf of the same person or entity. A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a basis for filing a suspicious.

Source: blog.gao.gov

Source: blog.gao.gov

For example if the program requires that a particular employee or category of employee should be trained once every six months then the independent testing should determine whether the training occurred and whether the training was adequate. Credit unions are required to obtain an acceptable form of identification for the person conducting the transaction. For example if the program requires that a particular employee or category of employee should be trained once every six months then the independent testing should determine whether the training occurred and whether the training was adequate. Take this quiz and look at how much you know about the Bank Secrecy Act. Under this act US banks are required to submit documentation for any transaction that is of 10000 or more.

Source: slideplayer.com

Source: slideplayer.com

Credit unions are required to obtain an acceptable form of identification for the person conducting the transaction. The training should include information to specific business lines such as such as trust services international and private banking. At least every 12-18 months d. Financial institutions - namely banking institutions and securities broker-dealers - from establishing maintaining administering or managing a correspondent account in the United States for or on behalf of foreign shell banks eg foreign banks that do not have a physical presence in any country. Essentially the Bank Secrecy Act BSA establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how often must you complete bank secrecy act training by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas