18+ How to improve kyc process information

Home » about money loundering Info » 18+ How to improve kyc process informationYour How to improve kyc process images are ready in this website. How to improve kyc process are a topic that is being searched for and liked by netizens now. You can Download the How to improve kyc process files here. Get all free photos and vectors.

If you’re looking for how to improve kyc process pictures information connected with to the how to improve kyc process keyword, you have come to the right blog. Our site always provides you with hints for downloading the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

How To Improve Kyc Process. The vast majority 95 of merchants are verified in real-time on submission of their information. KYC Expert - the key to simple automated KYC processes With the combination of KYC Toolbox and Expert Service backlogs are history. DPA can also help to automate other manual KYC-related processes and repetitive tasks including. Our solution can also reduce costs by at least 20 by eliminating duplication through shared services and also reduce risk via a distributed and shared ledger that acts as an immutable assure audit trail of all corporate KYC process.

Kyc Remediation Kyc Nepal From kycnepal.com.np

Kyc Remediation Kyc Nepal From kycnepal.com.np

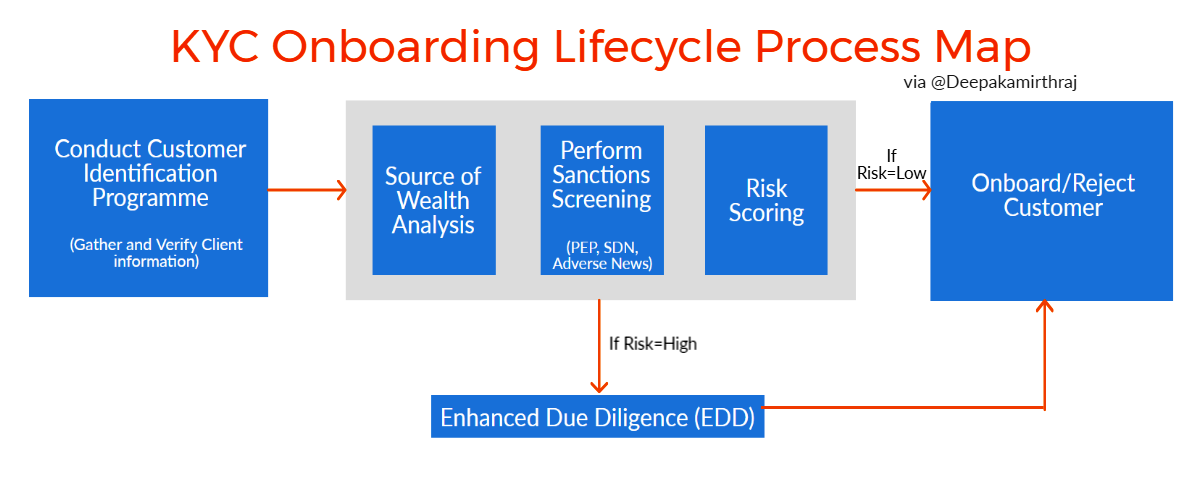

KYC Expert - the key to simple automated KYC processes With the combination of KYC Toolbox and Expert Service backlogs are history. Traditional KYC processes Financial institutions start the KYC process by asking customers to provide a range of basic information about their business operations and individuals. Advanced technologies specifically Artificial Intelligence including OCR Optical character Recognition and natural language processing NLP have been proven effective to help banks automate their KYC process reducing onboarding time while enhancing due diligence. Make sure that the image shows all. Today well give 5 easy steps you can take in order to improve your KYC process. DPA can also help to automate other manual KYC-related processes and repetitive tasks including.

A KYC process is not something thats set in stone.

Customers visits to banks for biometric scanning can be replaced by selfie validation on their mobile banking app. It is an opportunity to improve the relationship with the. Due diligence is ongoing so the KYC AML process should also be ongoing and banks and other financial entities should take measures to ensure account profiles are current and monitoring should be risk-based. DPA can also help to automate other manual KYC-related processes and repetitive tasks including. The vast majority 95 of merchants are verified in real-time on submission of their information. How e-KYC systems improve the company incorporation process Starting your business With the e-KYC system identity verification of directors and shareholders for the company incorporation process can be done without an in-person meeting.

Source: tpptechnology.com

Source: tpptechnology.com

KYC Expert - the key to simple automated KYC processes With the combination of KYC Toolbox and Expert Service backlogs are history. Using an API connection compliance-relevant data onboarding KYC checks and the required compliance forms are automatically collected according to the process defined in your compliance concept. Ascertain the identity and location of the potential customer and gain a good understanding of their business activities. How can Modex BCDB improve the KYC process. It includes the names of the companys directors business addresses national insurance or social security numbers company numbers and so on.

Source: processmaker.com

Source: processmaker.com

DPA can also help to automate other manual KYC-related processes and repetitive tasks including. Setting up customer data Uploading identifying documents into the CRM system. Some practical steps to include in your customer due diligence program include. Due diligence is ongoing so the KYC AML process should also be ongoing and banks and other financial entities should take measures to ensure account profiles are current and monitoring should be risk-based. Making use of both manual and automated checks it is time efficient and reliable.

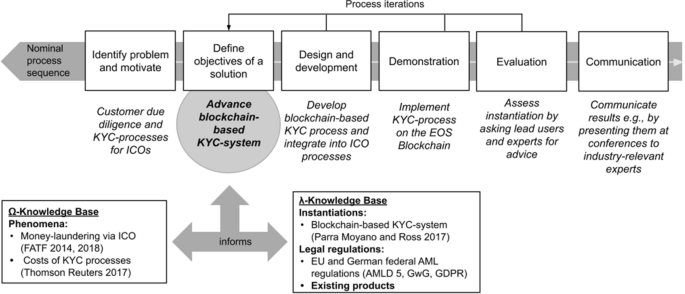

Source: researchgate.net

Source: researchgate.net

Some practical steps to include in your customer due diligence program include. You must first click on Liveness and go through that process. Application Upgrades to Include Digital KYC Financial Institutions can streamline onboarding with the help of biometric authentication like facial recognition to authenticate the applicants. Below we are outlining 5 ways on how our solution will upgrade your KYC process. Audit trails are a fairly simple concept but their value to the KYC process is.

Source: link.springer.com

Source: link.springer.com

Validating customer information both structured and unstructured collects data accesses databases and fills. How can Modex BCDB improve the KYC process. 1 One of the main challenges of emerging FinTechs will be to develop a seamless experience for their customers. It is an opportunity to improve the relationship with the. This can be as simple as locating documentation that verifies the name and address of.

Source: knowmenow.com

Source: knowmenow.com

Validating customer information both structured and unstructured collects data accesses databases and fills. Validating customer information both structured and unstructured collects data accesses databases and fills. Traditional KYC processes Financial institutions start the KYC process by asking customers to provide a range of basic information about their business operations and individuals. Customers visits to banks for biometric scanning can be replaced by selfie validation on their mobile banking app. It can increase speed from 3-4 weeks to couple of days by compressing data gathering and automating processing.

Source: taliasavchenko.com

Source: taliasavchenko.com

Traditional KYC processes Financial institutions start the KYC process by asking customers to provide a range of basic information about their business operations and individuals. Ascertain the identity and location of the potential customer and gain a good understanding of their business activities. Audit trails are a fairly simple concept but their value to the KYC process is. Using an API connection compliance-relevant data onboarding KYC checks and the required compliance forms are automatically collected according to the process defined in your compliance concept. This can be as simple as locating documentation that verifies the name and address of.

Source: papersoft-dms.com

Source: papersoft-dms.com

Customers visits to banks for biometric scanning can be replaced by selfie validation on their mobile banking app. Making client relations central to the KYC procedure is non-negotiable. Our solution can also reduce costs by at least 20 by eliminating duplication through shared services and also reduce risk via a distributed and shared ledger that acts as an immutable assure audit trail of all corporate KYC process. Using an API connection compliance-relevant data onboarding KYC checks and the required compliance forms are automatically collected according to the process defined in your compliance concept. Make sure that the image shows all.

Source: blockchainconsultus.io

Source: blockchainconsultus.io

Making use of both manual and automated checks it is time efficient and reliable. Customers visits to banks for biometric scanning can be replaced by selfie validation on their mobile banking app. Below we are outlining 5 ways on how our solution will upgrade your KYC process. DPA can also help to automate other manual KYC-related processes and repetitive tasks including. Ascertain the identity and location of the potential customer and gain a good understanding of their business activities.

Source: rndpoint.com

Source: rndpoint.com

A KYC process is not something thats set in stone. Making client relations central to the KYC procedure is non-negotiable. Ascertain the identity and location of the potential customer and gain a good understanding of their business activities. How e-KYC systems improve the company incorporation process Starting your business With the e-KYC system identity verification of directors and shareholders for the company incorporation process can be done without an in-person meeting. Due diligence is ongoing so the KYC AML process should also be ongoing and banks and other financial entities should take measures to ensure account profiles are current and monitoring should be risk-based.

Source: kycnepal.com.np

Source: kycnepal.com.np

What to do if the KYC identification procedure is unsuccessful Try again using a better quality image than before. This can be as simple as locating documentation that verifies the name and address of. It can increase speed from 3-4 weeks to couple of days by compressing data gathering and automating processing. Validating customer information both structured and unstructured collects data accesses databases and fills. Audit trails are a fairly simple concept but their value to the KYC process is.

Source: basisid.com

Source: basisid.com

Its an ever-changing always-evolving project that will always need fine-tuning and adjustments. DPA can also help to automate other manual KYC-related processes and repetitive tasks including. Customers visits to banks for biometric scanning can be replaced by selfie validation on their mobile banking app. Our solution can also reduce costs by at least 20 by eliminating duplication through shared services and also reduce risk via a distributed and shared ledger that acts as an immutable assure audit trail of all corporate KYC process. You must first click on Liveness and go through that process.

Source: processmaker.com

Source: processmaker.com

How can Modex BCDB improve the KYC process. Below we are outlining 5 ways on how our solution will upgrade your KYC process. Setting up customer data Uploading identifying documents into the CRM system. DPA can also help to automate other manual KYC-related processes and repetitive tasks including. How can Modex BCDB improve the KYC process.

Source: medium.com

Source: medium.com

You must first click on Liveness and go through that process. Due diligence is ongoing so the KYC AML process should also be ongoing and banks and other financial entities should take measures to ensure account profiles are current and monitoring should be risk-based. Make sure that the image shows all. Making use of both manual and automated checks it is time efficient and reliable. Some practical steps to include in your customer due diligence program include.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to improve kyc process by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas