18++ Institutional money laundering risk assessment information

Home » about money loundering idea » 18++ Institutional money laundering risk assessment informationYour Institutional money laundering risk assessment images are ready in this website. Institutional money laundering risk assessment are a topic that is being searched for and liked by netizens now. You can Download the Institutional money laundering risk assessment files here. Find and Download all free photos and vectors.

If you’re looking for institutional money laundering risk assessment pictures information related to the institutional money laundering risk assessment topic, you have come to the ideal site. Our website always provides you with suggestions for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

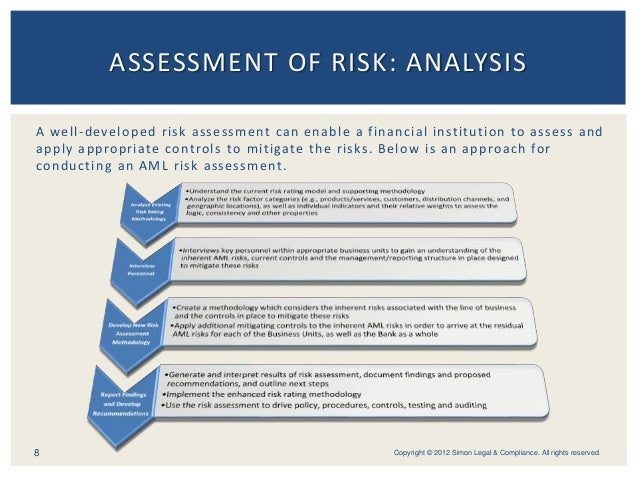

Institutional Money Laundering Risk Assessment. The specific risks of money laundering and terrorist. Institutional Risk Assessment Observations and Common Deficiencies AML Seminars Hong Kong Central Library 3rd th 5 November 2015 Maggie Wong Anti-Money Laundering and Financial Crime Risk. The conclusion should include a short narrative in support of the conclusion. ML TF risk on an enterprise-wide basis is moderate 30.

Https Www2 Deloitte Com Content Dam Deloitte In Documents Finance In Fa Strengthening The Anti Money Laundering Noexp Pdf From

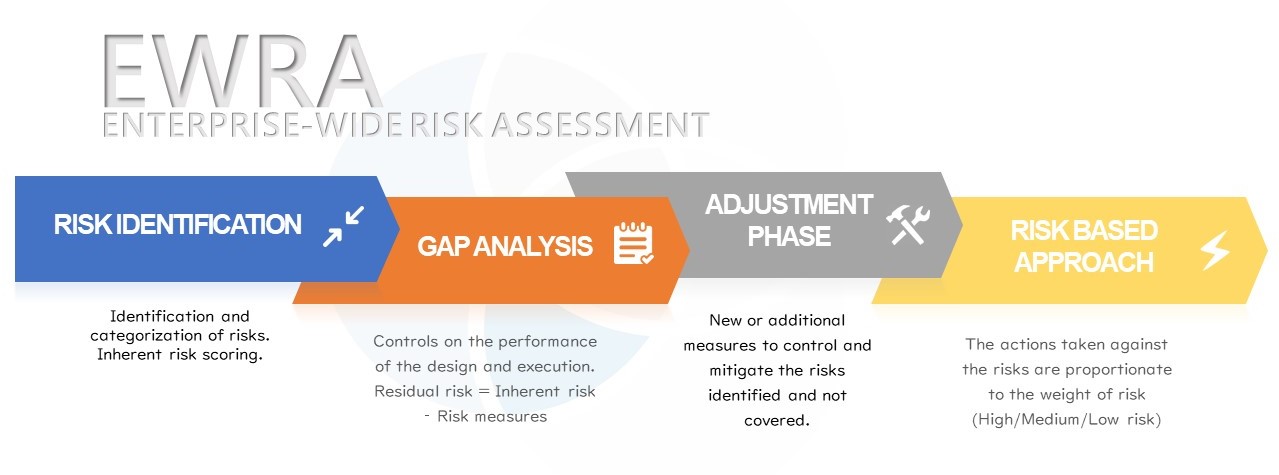

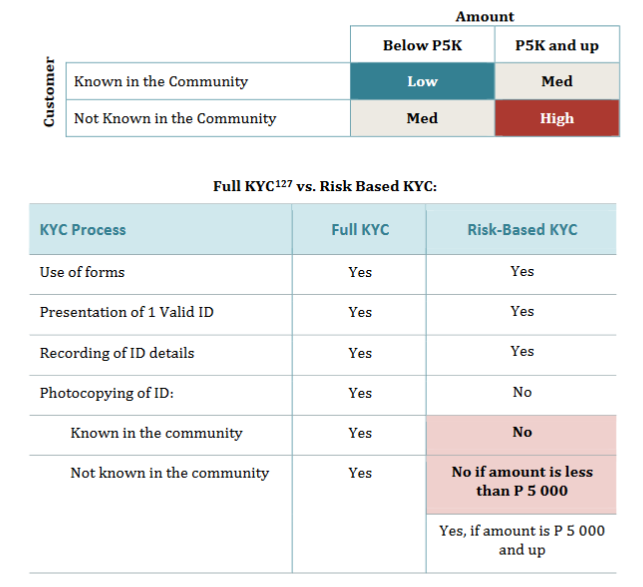

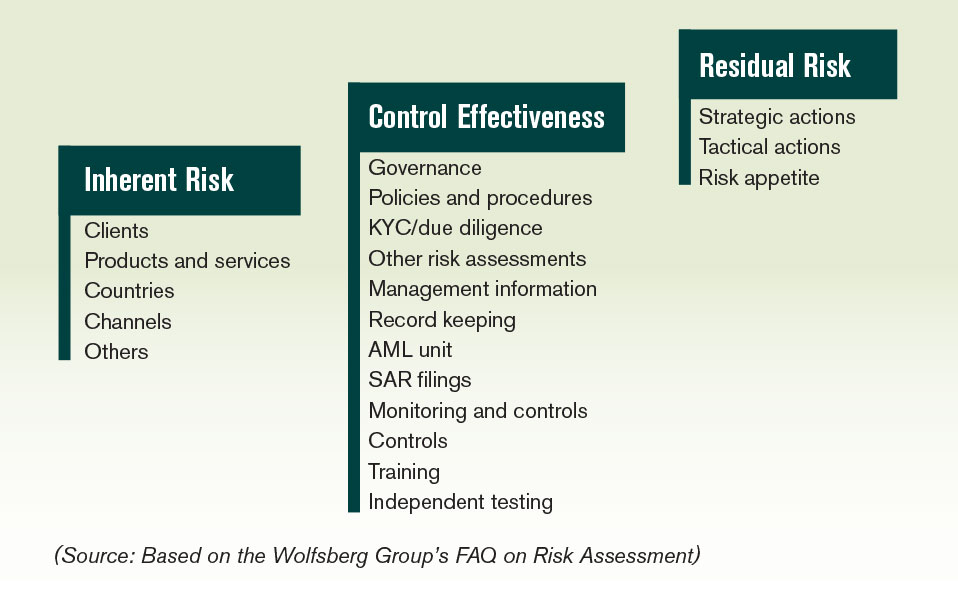

Input into the overall money laundering risk assessment. Institutional money laundering and terrorism financing risk assessment Konformitas Consulting can assist your business prepare a money laundering and terrorist financing risk assessment. ML TF risk on an enterprise-wide basis is moderate 30. Money Laundering Terrorist Financing Proliferation Financing MLTFPF risk assessment. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. Risk Assessments-Institutional risk assessment IRA A comprehensive range of MLTF risk factors analyzed in both qualitative and quantitative aspects was considered for IRA purposes Kept the IRA up-to-date by reviewing the assessment on a regular basis or when specific events occurred Did not conduct any IRA or failed to maintain.

A Risk Assessment score.

In this regard sectoral risk assessments play an important role so that Financial Institutions will be able to understand identify and measure the risks of money laundering and terrorism financing focusing on four risk. Further to this when new products and services are added the risks should be evaluated prior to implementation to ensure. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. Money Laundering Risk. A Risk Assessment score. A the likelihood that a MLTF event will occur and b the impact or consequences that the occurrence of the MLTF event can exert directly or indirectly.

Source: bi.go.id

Source: bi.go.id

Money Laundering Risk. The conclusion should include a short narrative in support of the conclusion. The specific risks of money laundering and terrorist. The risk-based approach RBA to AMLCFT is central to the effective implementation of the. Further to this when new products and services are added the risks should be evaluated prior to implementation to ensure.

Source:

Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. Input into the overall money laundering risk assessment. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. ML TF risk on an enterprise-wide basis is moderate 30. This will help ensure that your institutional risk assessment is aligned with your FIs intended risk profile.

Source: pideeco.be

Source: pideeco.be

Institutional money laundering and terrorism financing risk assessment Konformitas Consulting can assist your business prepare a money laundering and terrorist financing risk assessment. The types of customer you have. The Guidelines outline minimum requirements in respect of the institutional MLTFPF risk assessment. The view is that in order to implement effective AMLCTF systems and controls Authorized Institutions AIs should identify assess and understand the MLTF risks to which they are exposed. This is Irelands first money laundering and terrorist financing MLTF national risk assessment NRA and the aim of this process was to identify understand and assess the money laundering and terrorist financing risks faced by Ireland.

Source:

A the likelihood that a MLTF event will occur and b the impact or consequences that the occurrence of the MLTF event can exert directly or indirectly. This NRA is also intended to. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. Institutional Risk Assessment Observations and Common Deficiencies AML Seminars Hong Kong Central Library 3rd th 5 November 2015 Maggie Wong Anti-Money Laundering and Financial Crime Risk. MLTF risk on an enterprise-wide basis is low 20 30.

Source: bi.go.id

Source: bi.go.id

The specific risks of money laundering and terrorist. Money Laundering Terrorist Financing Proliferation Financing MLTFPF risk assessment. As a means and target for money laundering and terrorism financing. Institutional money laundering and terrorism financing risk assessment Konformitas Consulting can assist your business prepare a money laundering and terrorist financing risk assessment. Further to this when new products and services are added the risks should be evaluated prior to implementation to ensure.

Source:

The conclusion should include a short narrative in support of the conclusion. Objective of National Risk Assessment 11. The vulnerabilities make it possible to identify the areas systems factors and specific features of each sector or product which could result in misappropriations for purposes of money laundering or terrorist. The risk assessment should identify areas of vulnerability to money laundering identify weaknesses or gaps in the existing control environment support informed decisions on risk appetite and highlight the banks AML risk and control environment for all key stakeholders including senior management and regulators. The view is that in order to implement effective AMLCTF systems and controls Authorized Institutions AIs should identify assess and understand the MLTF risks to which they are exposed.

Source: service.betterregulation.com

Source: service.betterregulation.com

The specific risks of money laundering and terrorist. The key purpose of a money laundering risk assessment is to drive improvements in financial crime risk management through identifying the general and specific money laundering risks a FI is facing. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. Institutional money laundering and terrorism financing risk assessment Konformitas Consulting can assist your business prepare a money laundering and terrorist financing risk assessment. When you assess the risks of money laundering that apply to your business you need to consider.

Source: acamstoday.org

Source: acamstoday.org

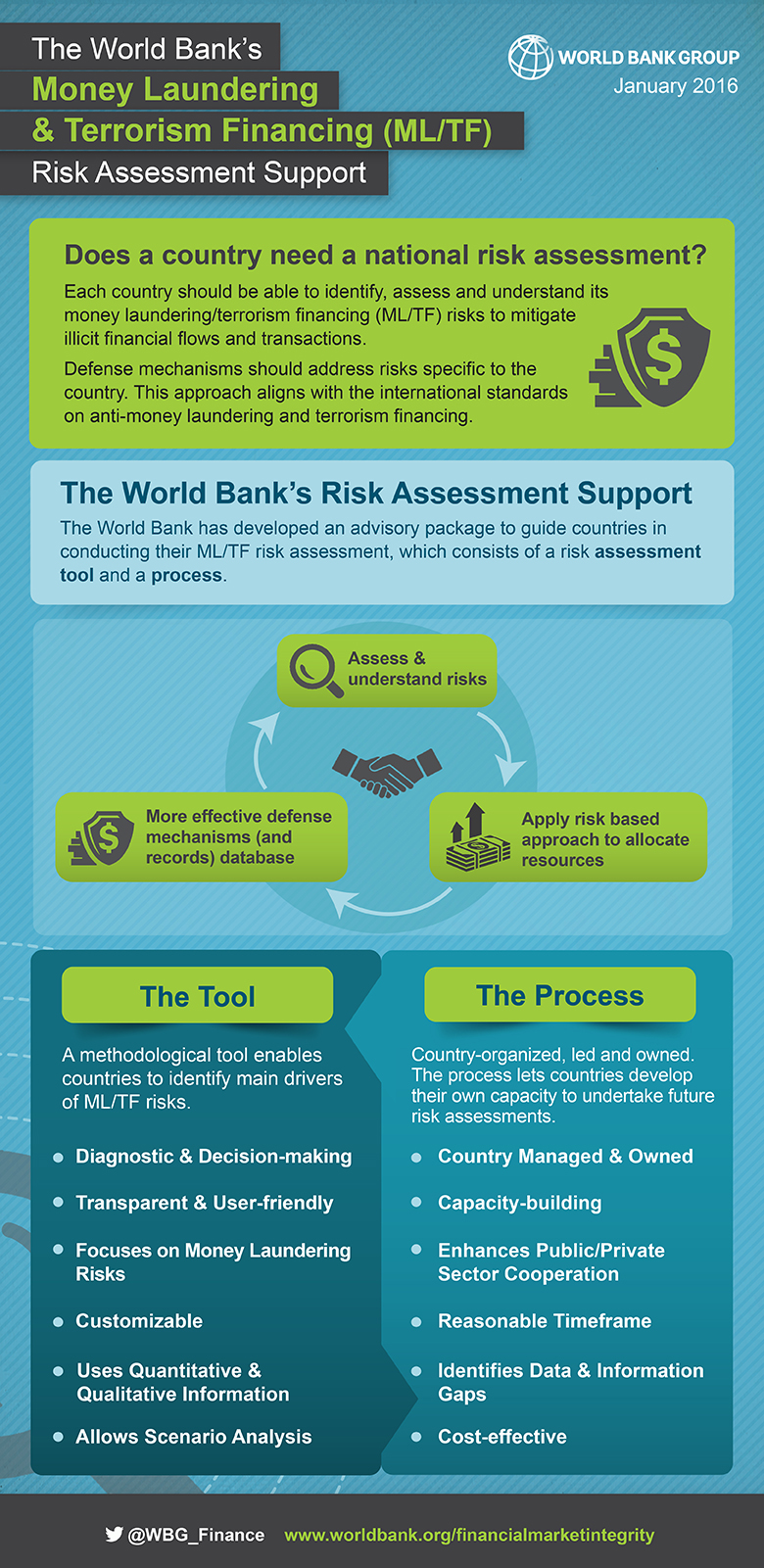

This is Irelands first money laundering and terrorist financing MLTF national risk assessment NRA and the aim of this process was to identify understand and assess the money laundering and terrorist financing risks faced by Ireland. Conceptual and Institutional Framework. The Anti-Money Laundering and Countering the Financing of Terrorism Institutional Risk Assessment Guidelines is issued by the FIU pursuant to section 57 2 of the AMLCFT Act to provide guidance to its reporting entities on how to conduct and document their AMLCFT risk assessment in line with the requirements of the AMLCFT Act. The types of customer you have. The view is that in order to implement effective AMLCTF systems and controls Authorized Institutions AIs should identify assess and understand the MLTF risks to which they are exposed.

Source: researchgate.net

Source: researchgate.net

As a means and target for money laundering and terrorism financing. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1. Conceptual and Institutional Framework. The Anti-Money Laundering and Countering the Financing of Terrorism Institutional Risk Assessment Guidelines is issued by the FIU pursuant to section 57 2 of the AMLCFT Act to provide guidance to its reporting entities on how to conduct and document their AMLCFT risk assessment in line with the requirements of the AMLCFT Act. The vulnerabilities make it possible to identify the areas systems factors and specific features of each sector or product which could result in misappropriations for purposes of money laundering or terrorist.

Source: bi.go.id

Source: bi.go.id

This will help ensure that your institutional risk assessment is aligned with your FIs intended risk profile. Conceptual and Institutional Framework. The risk-based approach RBA to AMLCFT is central to the effective implementation of the. In this regard sectoral risk assessments play an important role so that Financial Institutions will be able to understand identify and measure the risks of money laundering and terrorism financing focusing on four risk. The vulnerabilities make it possible to identify the areas systems factors and specific features of each sector or product which could result in misappropriations for purposes of money laundering or terrorist.

Source: worldbank.org

Source: worldbank.org

Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. In this regard sectoral risk assessments play an important role so that Financial Institutions will be able to understand identify and measure the risks of money laundering and terrorism financing focusing on four risk. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. The specific risks of money laundering and terrorist. When you assess the risks of money laundering that apply to your business you need to consider.

Source: slideshare.net

Source: slideshare.net

The Guidelines outline minimum requirements in respect of the institutional MLTFPF risk assessment. Each institution needs to assess based on its own criteria whether a particular customer poses a higher risk of money laundering and whether mitigating factors may lead to a determination that customers engaged in such activities do not pose a higher risk of money laundering. Input into the overall money laundering risk assessment. The Anti-Money Laundering and Countering the Financing of Terrorism Institutional Risk Assessment Guidelines is issued by the FIU pursuant to section 57 2 of the AMLCFT Act to provide guidance to its reporting entities on how to conduct and document their AMLCFT risk assessment in line with the requirements of the AMLCFT Act. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1.

Source: nbb.be

Source: nbb.be

Institutional money laundering and terrorism financing risk assessment Konformitas Consulting can assist your business prepare a money laundering and terrorist financing risk assessment. Institutional Risk Assessment Observations and Common Deficiencies AML Seminars Hong Kong Central Library 3rd th 5 November 2015 Maggie Wong Anti-Money Laundering and Financial Crime Risk. National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. The money laundering and terrorist financing threats are activities which could result in money laundering or terrorist financing offences whether on the national level or cross-border. Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title institutional money laundering risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information