12++ Integration aml meaning ideas

Home » about money loundering Info » 12++ Integration aml meaning ideasYour Integration aml meaning images are ready in this website. Integration aml meaning are a topic that is being searched for and liked by netizens now. You can Download the Integration aml meaning files here. Get all free photos.

If you’re looking for integration aml meaning images information linked to the integration aml meaning interest, you have visit the right blog. Our website always gives you hints for viewing the maximum quality video and image content, please kindly search and locate more enlightening video articles and images that match your interests.

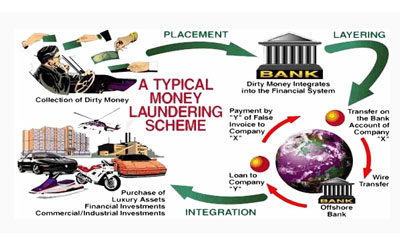

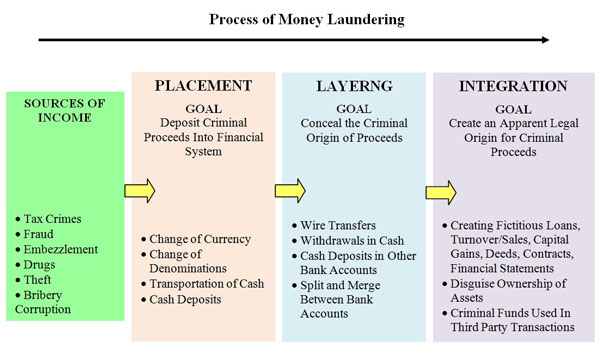

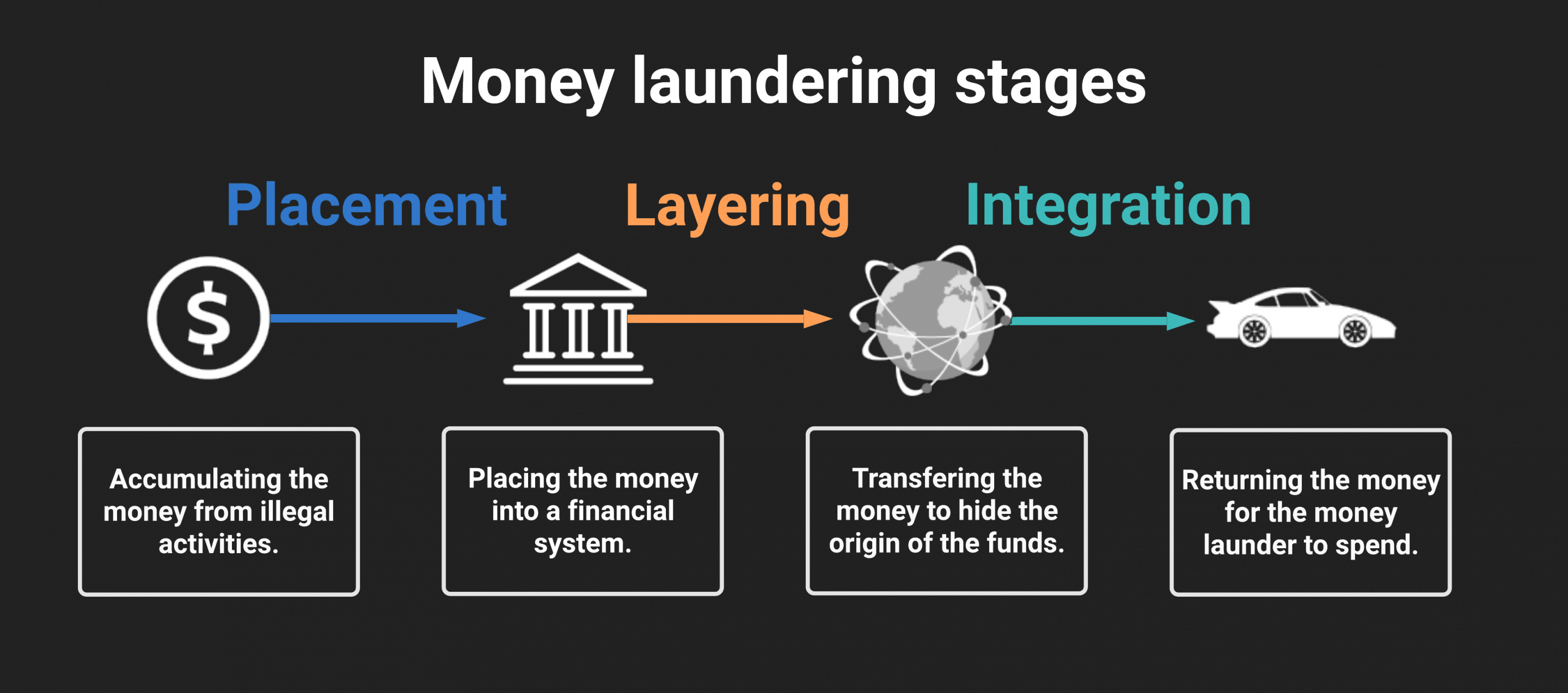

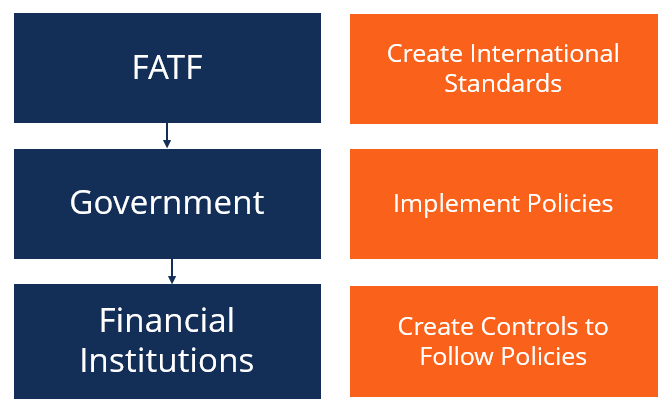

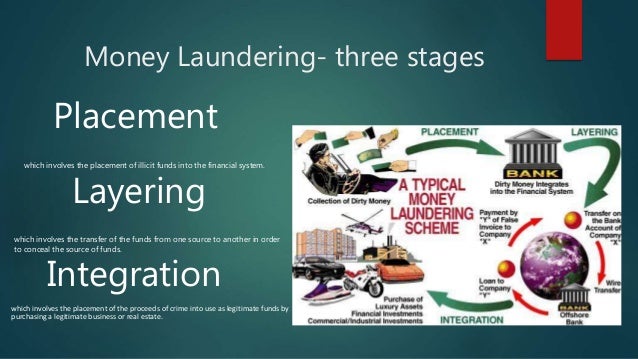

Integration Aml Meaning. And b it places the money into the legitimate financial system. Integration This is the movement of previously laundered money into the economy mainly through the banking system and thus such monies appear to be normal business earnings. Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. What is AML Anti-Money Laundering.

Money Laundering The Stages Of Layering Complyadvantage From complyadvantage.com

Money Laundering The Stages Of Layering Complyadvantage From complyadvantage.com

Anti Money Laundering AML Definition Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. Setting up or using shell companies to move illegal funds and obscure ultimate beneficial ownership and assets. Also question is what is placement layering and integration in money laundering. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. Also asked what is integration stage in money laundering. What is AML Anti-Money Laundering.

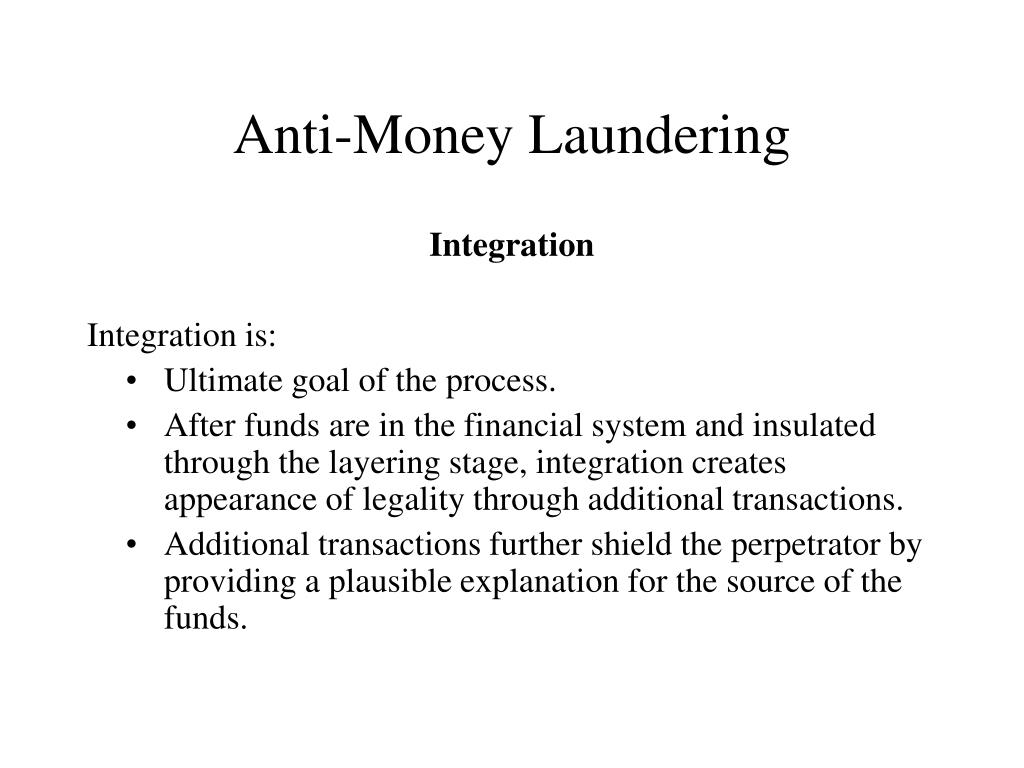

This is the final stage of the money laundering process.

Setting up or using shell companies to move illegal funds and obscure ultimate beneficial ownership and assets. Also question is what is placement layering and integration in money laundering. The final stage is where the money is returned to the criminal from what seem to be legitimate sources. And b it places the money into the legitimate financial system. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. This is the final stage of the money laundering process.

Source: pinterest.com

Source: pinterest.com

Such software allows AML analysts to manage their AMLCFT obligations no matter the size sector and geographical location of the business. Those AML obligations include the Know Your Customer KYC process however given the proximity of the terms AML and KYC and the fact that they are often used interchangeably it can be difficult to. Criminals use money laundering to conceal their crimes and the money derived from them. A it relieves the criminal of holding and guarding large amounts of bulky of cash. This is the final stage of the money laundering process.

Source: calert.info

Source: calert.info

What is AML Anti-Money Laundering. Reselling high-value goods such as artwork or any type of stored-value product such as jewelry or prepaid cards. Anti Money Laundering AML also known as anti-money laundering is the execution of transactions to eventually convert illegally obtained money into legal money. Also question is what is placement layering and integration in money laundering. Money Laundering Placement Layering Integration three stages.

Source: icas.com

Source: icas.com

AML legislation is becoming increasingly strict for financial service providers. And b it places the money into the legitimate financial system. Those AML obligations include the Know Your Customer KYC process however given the proximity of the terms AML and KYC and the fact that they are often used interchangeably it can be difficult to. The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities.

Source: calert.info

Source: calert.info

This is the final stage of the money laundering process. The AML Accelerate is a cloud-based platform from Arctic intelligence and is a good example of sophisticated software integration to AML compliance. This stage involves converting the proceeds of crime into another form and creating complex layers of financial dealing to disguise the audit trail. Click here to check out AML Accelerate. The final stage is where the money is returned to the criminal from what seem to be legitimate sources.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Anti Money Laundering AML also known as anti-money laundering is the execution of transactions to eventually convert illegally obtained money into legal money. Generally this stage serves two purposes. What is AML Anti-Money Laundering. Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. A it relieves the criminal of holding and guarding large amounts of bulky of cash.

Source: brittontime.com

Source: brittontime.com

Anti Money Laundering AML Definition Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. Also asked what is integration stage in money laundering. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. Also a process of criminal activities And obtains a large amount of money from crime and drugs people earn profit and money from illegal activities named as corruptions. Aml placement layering integration.

Source: jagranjosh.com

Source: jagranjosh.com

They are used for structuring and integration. This involves the process to get the funds back to the criminal from what seems to be a reputable source. Anti Money Laundering AML seeks to deter criminals by making it harder for them to hide ill-gotten money. A it relieves the criminal of holding and guarding large amounts of bulky of cash. Cash businesses adding the cash gained from crime to the legitimate takings.

Source: businessdatapartners.com

Source: businessdatapartners.com

There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. Stands for Anti-money Laundering AML as short forms Actually money laundering is a process or way to convert illegal money into legal is simply called money laundering. They must be prevented from financing money laundering and or terrorism. Those AML obligations include the Know Your Customer KYC process however given the proximity of the terms AML and KYC and the fact that they are often used interchangeably it can be difficult to. Also asked what is integration stage in money laundering.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. Click here to check out AML Accelerate. They must be prevented from financing money laundering and or terrorism. Stands for Anti-money Laundering AML as short forms Actually money laundering is a process or way to convert illegal money into legal is simply called money laundering.

Source: complyadvantage.com

Source: complyadvantage.com

Such software allows AML analysts to manage their AMLCFT obligations no matter the size sector and geographical location of the business. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. The Integration Stage Investment. There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering.

Source: slideshare.net

Source: slideshare.net

They are used for structuring and integration. Investing in other legitimate business interests. This is dissimilar to layering for in the integration process detection and identification of laundered funds is provided through informants. Anti Money Laundering AML Definition Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering.

Source: slideserve.com

Source: slideserve.com

This stage involves converting the proceeds of crime into another form and creating complex layers of financial dealing to disguise the audit trail. They cannot afford to wait a day or even a few hours for the compliance department to clear a prospect so they can proceed with their business activities. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. Also question is what is placement layering and integration in money laundering. The process of laundering money typically involves three steps.

Source: complyadvantage.com

Source: complyadvantage.com

Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Also a process of criminal activities And obtains a large amount of money from crime and drugs people earn profit and money from illegal activities named as corruptions. Setting up or using shell companies to move illegal funds and obscure ultimate beneficial ownership and assets.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title integration aml meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas