12+ Is money laundering a state or federal crime information

Home » about money loundering idea » 12+ Is money laundering a state or federal crime informationYour Is money laundering a state or federal crime images are available. Is money laundering a state or federal crime are a topic that is being searched for and liked by netizens now. You can Find and Download the Is money laundering a state or federal crime files here. Download all royalty-free photos and vectors.

If you’re looking for is money laundering a state or federal crime images information related to the is money laundering a state or federal crime interest, you have visit the ideal blog. Our website always gives you suggestions for viewing the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Is Money Laundering A State Or Federal Crime. And undercover sting money laundering. The potential consequences of federal crimes are typically more serious than state crimes. Money that has been laundered is mostly untaxed which creates disparity in the tax revenue increasing the. Texas Penal Code Chapter 34 3402 defines money laundering.

Money Laundering And Financial Risk Management In Latin America With Special Reference To Mexico From redalyc.org

Money Laundering And Financial Risk Management In Latin America With Special Reference To Mexico From redalyc.org

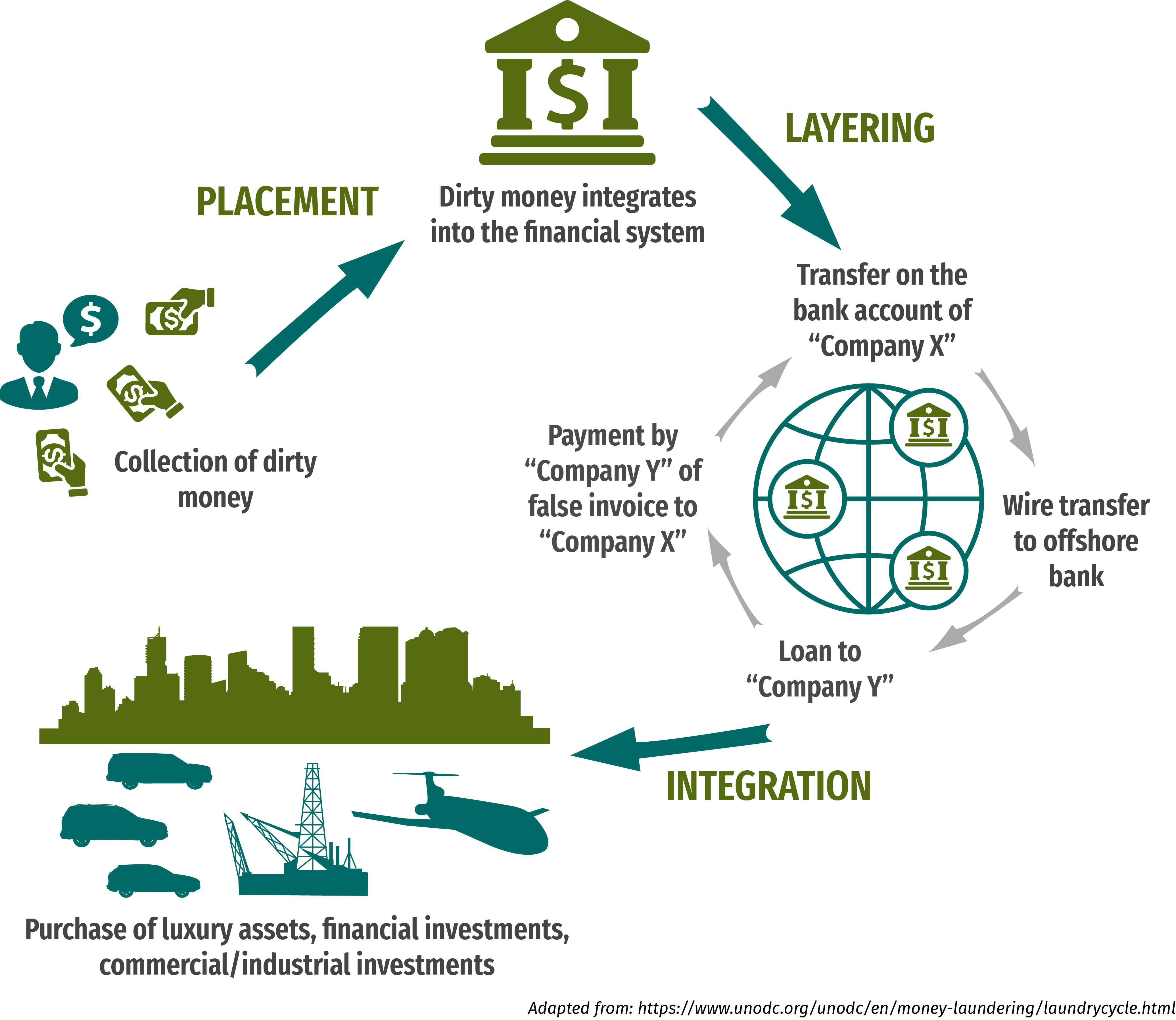

And undercover sting money laundering. Depending on the charges a conviction could result in life imprisonment or other major penalties. Dirty money appear legal ie. Placement layering and integration. It consists of two sections 18 USC. The HIFCA program is intended to concentrate law enforcement efforts at the federal state and local levels to combat money laundering in the designated high-intensity money laundering zones.

Pursuant to the Money Laundering Control Act of 1986 it is a federal crime to knowingly engage in a financial transaction with the intention of concealing the proceeds of illegal activities.

Money laundering is the process of making illegally-gained proceeds ie. The most serious illegal activities that the law singles out are those who attempt to hide the ownership control or source of the money at issue. The New RICO NY. The term knowing that the property involved in a financial transaction represents the proceeds of some form of unlawful activity means that the person knew the property involved in the transaction represented proceeds from some form though not necessarily which form of activity that constitutes a felony under State Federal or foreign law regardless of whether or not such activity is specified in paragraph 7. International money laundering transactions 1956 a 2. Money Laundering and Tax Crimes.

Source: redalyc.org

Source: redalyc.org

Federal or state law. Typically it involves three steps. Money laundering is a threat to the United States tax system in that taxable illegal source proceeds go undetected along with some taxable legal source proceeds from tax evasion schemes. Future HIFCAs will be selected from applications received from prospective areas or from candidates proposed by the Secretary of the Treasury or the. 1 1992 at 3 hereinafter Abramowitz Money Laundering.

Source: researchgate.net

Source: researchgate.net

Domestic money laundering transactions 1956 a 1. International money laundering transactions 1956 a 2. Money Laundering Overview. The New RICO NY. The potential consequences of federal crimes are typically more serious than state crimes.

Source: drkattorneys.com

Source: drkattorneys.com

Money Laundering Overview. Depending on the charges a conviction could result in life imprisonment or other major penalties. In addition to trying to make the person face additional criminal penalties the government wants to get that money. The New RICO NY. Typically it involves three steps.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

1 1992 at 3 hereinafter Abramowitz Money Laundering. It was passed in 1986. Money Laundering Overview. The individual may make one or more transactions that conceal hide or process income of some form and then clean it through a business. Depending on the charges a conviction could result in life imprisonment or other major penalties.

Source: pinterest.com

Source: pinterest.com

In addition to trying to make the person face additional criminal penalties the government wants to get that money. The New RICO NY. The individual does not need to violate any specific law to add money laundering. Future HIFCAs will be selected from applications received from prospective areas or from candidates proposed by the Secretary of the Treasury or the. Federal money laundering laws are intended to criminalize the illicit activities of large-scale criminal conspiracies that might be involved in other crimes such as counterfeiting drug trafficking and human trafficking.

Source: worldwildlife.org

Source: worldwildlife.org

In order to qualify as money laundering a person must conduct or attempt to conduct a financial transaction with the intent to. 1956 and 18 USC. At its root money laundering is the idea of taking money that was earned illegally and then cleaning or washing the money so that new money generated from ill-gotten gain is clean money and untraceable. The money may accumulate through any type of crime but this could include any felony of the state or federal laws. However your trial is your chance to set forth the strongest defense possible.

Source: shuftipro.com

Source: shuftipro.com

The money may accumulate through any type of crime but this could include any felony of the state or federal laws. Code Section 1956 is the main federal statute that defines prohibits and penalizes money laundering. One of the most common types of white collar crimes that the IRS and US Government pursue is money laundering. Money launderers may face both federal and state charges. And undercover sting money laundering.

Source: tookitaki.ai

Source: tookitaki.ai

Money laundering is a threat to the United States tax system in that taxable illegal source proceeds go undetected along with some taxable legal source proceeds from tax evasion schemes. And undercover sting money laundering. Money laundering is the process of making illegally-gained proceeds ie. Future HIFCAs will be selected from applications received from prospective areas or from candidates proposed by the Secretary of the Treasury or the. The main reason why money laundering is considered a federal crime is the adverse impact it has on the overall economy of the country.

Source: iclg.com

Source: iclg.com

The money may accumulate through any type of crime but this could include any felony of the state or federal laws. Section 1956 a defines three types of criminal conduct. Future HIFCAs will be selected from applications received from prospective areas or from candidates proposed by the Secretary of the Treasury or the. The money may accumulate through any type of crime but this could include any felony of the state or federal laws. Money Laundering and Tax Crimes.

Source: acfcs.org

Source: acfcs.org

The potential consequences of federal crimes are typically more serious than state crimes. Money Laundering and Tax Crimes. 1 1992 at 3 hereinafter Abramowitz Money Laundering. Money Laundering and Tax Crimes. The most serious illegal activities that the law singles out are those who attempt to hide the ownership control or source of the money at issue.

Source: pinterest.com

Source: pinterest.com

The main reason why money laundering is considered a federal crime is the adverse impact it has on the overall economy of the country. Federal money laundering laws are intended to criminalize the illicit activities of large-scale criminal conspiracies that might be involved in other crimes such as counterfeiting drug trafficking and human trafficking. Placement layering and integration. At its root money laundering is the idea of taking money that was earned illegally and then cleaning or washing the money so that new money generated from ill-gotten gain is clean money and untraceable. The individual does not need to violate any specific law to add money laundering.

Source: redalyc.org

Source: redalyc.org

In addition to trying to make the person face additional criminal penalties the government wants to get that money. The New RICO NY. One of the most common types of white collar crimes that the IRS and US Government pursue is money laundering. The most serious illegal activities that the law singles out are those who attempt to hide the ownership control or source of the money at issue. It consists of two sections 18 USC.

Source: shuftipro.com

Source: shuftipro.com

Money Laundering and Tax Crimes. However your trial is your chance to set forth the strongest defense possible. The individual does not need to violate any specific law to add money laundering. Dirty money appear legal ie. Money that has been laundered is mostly untaxed which creates disparity in the tax revenue increasing the.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is money laundering a state or federal crime by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information